Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

When we added Mobivity Holdings Corp (OOTC:MFON) to our Select Long Disclosures Model Portfolio at $1.30 in November of 2020, it was shortly after Maj was a guest host for Little Grapevine’s scheduled interview to converse with MFON’s CEO, Dennis Becker, who introduced the company and answered some targeted questions on the nuts and bolts of the business. Before we go on, we’d like to remind you that our position in MFON is now closed and the stock is no longer in any of our Model Portfolios.

We once did like the company’s story, and it seemed that the niche MFON operated in was definitely in need of leaders – text message marketing platforms built to help restaurants outperform their peers. Mobivity currently boasts that 30,000 restaurants rely on its intelligent messaging platform to grow traffic and make takeout easier.

As the stock climbed, we took another stab at it, adding to our long position at a price of $1.97 in late March 2021, a short time after another appearance by Dennis on Little Grapevine as a follow up and to give more color on what appeared to be bullish indicators that the business was on the cusp of achieving some great milestones and relationships.

Looking back, the market had already swiftly recovered from the whiplash resulting in the now infamous and exaggerated index troughs created by COVID-19 in March 2020. The prevailing investor concern that the economy would be decimated by the pandemic was tempered by the emergence of the coronavirus vaccine.

While that may have been the case, the story ran a little deeper than that for the restaurant business. Things were a little more…complicated.

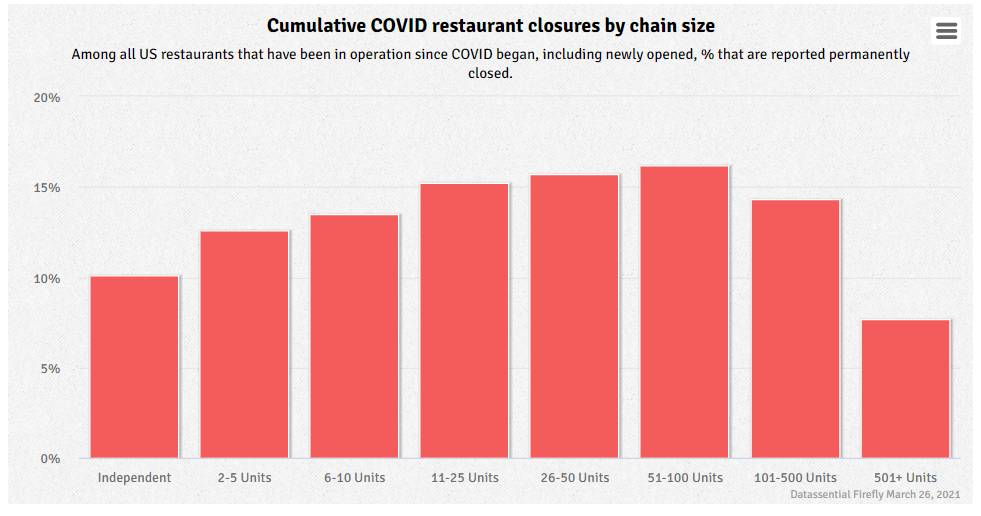

At around the time of our disclosure that we were averaging into our Select Long Disclosure position in MFON, Nation’s Restaurant News reported that 10% of restaurants in the United States closed due to COVID – permanently.

This posed a real obstacle, or maybe even an opportunity, for any entity in the hierarchical “food chain” that served to help restaurants succeed in various ways.

How it would ultimately affect MFON was not so clear, so Dennis reinforced the idea that the pandemic would dictate restaurants to become more resourceful and clever in the way that they would continue to run their operations. He posited that his company would be able to garner even more data that restaurants could use to their advantage. Explaining how his company could leverage its strength in data collection, Dennis said:

“Helping remote and digital ordering is something that has put Mobivity right into the solution-set for how these brands are trying to survive and thrive. And then also, the surprise was our receipt product. As you know, we can take over the printed receipt and put targeted advertising on the printed receipt and COVID head that Oh, no, no one’s gonna want to touch anything.

But what has happened is that a lot of these brands, and a lot of our customers’ proportion of takeout and delivery has grown tremendously, right? And guess what has to go on that bag? So it can identify whose food is whose and all of a sudden, that receipt is an essential part of the game. And, you know, our ability to customize that receipt with real time information and put targeted advertising has a lot of value. So it’s actually all played out very, very well for our products.”

Another very compelling angle to MFON’s business plan revolved around clients like Pepsico when dealing with the small to medium sized business (SMB) space:.

“We’ll lean on our Pepsi partnership for those types of customers, where most of the selling can be done outside of the Mobitivy resources. In other words, the cost of selling a one or two location restaurant is about the same for us as selling a 100 location restaurant

So, we kind of get the law of diminishing returns once you get down to the kind of mom and pop shop, independent, and small.

However, with partners like Pepsi, that allows us to get to that area of the market, and there are parts of our product that are very easily consumed at that level of the market, because it doesn’t require a lot for us to deliver our belly, digital loyalty product. I mean, it comes in a box, and it’s an iPad that you put next to your point of sale, and you’re kind of in business with loyalty. So, we have the ability to serve that independent and kind of the SMB space. It’s just how we access those markets, really through partnerships.”

But that was then, and now after a series of lackluster financial quarters, the last one being no different than the prior three in the department of disappointment, management finally let the cat out of the bag, and it turns out that Mobivity was one of those cogs in the hierarchy of entities that was truly affected by the restaurant industries’ protracted recovery and overall delayed adoption of digital solutions.

“The restaurant vertical has been impacted tremendously by the COVID pandemic, and those headwinds continue to linger. These issues have hindered the restaurant industry’s adoption of the digital transition.”

Dennis does however have his sights on other opportunities that he believes have been facilitated by what amounts to a take on big data:

“Thanks to our success winning major brands, we are uniquely positioned to monetize the intersection of millions of consumers, billions of transactions, and the digital businesses who must have efficient and effective access to customers. In just the past few months we’ve already developed new sales pipeline opportunities with digital customers including crypto, streaming video, and gaming operators where our loyalty, perfect attribution, and unique offer code solutions bring compelling value to digital acquisition and retention challenges. We’ve also seen overwhelming demand from our restaurant, CPG and C store customers who seek quick access to a highly relevant and large digital audience to drive sales.”

Now, it will be hard to grasp how MFON will overcome its overall inability to perform to investors’ expectations. The company’s stated pivot in the commentary above continues to convey bullish overtones that might actually seem fair to some, or even viewed as a silver lining due to the company’s history of collection and use of data.

One last thing that we need to think about is that given the company’s current challenges, will they need to raise money through equity offerings until they’re able to reach consistent profitability?

Because of the uncertainties, we intend to remain on the sidelines.

—

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Recommended Reading From Around The Web

xxx

Notable Tweets

Featured Video

xxx

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.