A Stock Peter Lynch Would Love

A Stock Peter Lynch Would Love

As a preacher of “invest in what you know”, Peter Lynch would love this pet products company engaged in developing, manufacturing and marketing products for the retail pet business. We think the company is one of those stories that just makes sense and will be easy for investors to understand. The value proposition is easily apparent from one side of the coin in that the financial and valuation ratios are favorable.

The company focuses on selling non-food pet products in high growth categories.

From the company’s recent presentation:

Not yet apparent to the market is the imminent ramp up in growth and profitability due to a sharpening of management focus and a strong pet care industry where U.S. sales are projected to reach $96 billion by 2020, equating to a respectable compounded annual growth rate of over 4%.

Over the next few quarters, we are banking that investors will assign a valuation more commensurate with new growth prospects and new comps. We see the stock rising at least 84% rather quickly.

At An Inflection Point

After tracking the company for a while, we finally got around to interviewing the management team. Strong Q4 2016 earnings combined with a favorable valuation and exposure to a steadily growing industry that is recession resistant motivated our request for an interview.

The company was founded by a father and son team. The father has a history of personally funding more than a half dozen high-tech product companies since 1976 including a blow molding business. His pet company was essentially born from the technical background in “molding” of both founders.

Its Pet Products

Initially, the company sold its products primarily through catalogs, and eventually went public on the OTC Bulletin Board, today selling over 1000 products under 12 brands through a variety of channels, 2 of which you would most likely recognize if you are a dog or cat owner.

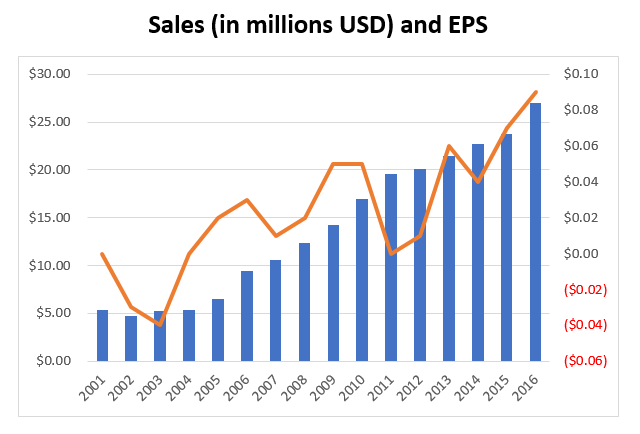

While the company had been growing sales at a somewhat respectable clip since going public, management began formulating a plan to address some issues that were beginning to challenge long-term growth starting at the end of 2011. Here is a look at the company’s annual financial picture since it went public (EPS excludes unusual items).

Sales (in millions USD) and EPS

We are betting a near-term growth inflection point that could lead to the company reaching higher EPS levels and an expansion of valuation multiples.

Favorable industry trends, management’s move to better define its products, and efforts to establish closer relationships with its sales channels are some of the key factors that we think will help the company sustain and accelerate growth. The stock trades at a low valuation (P/E of 13x over the ttm period). For this, we say thank you, Mr. Market!

Our first hint that the company is at a growth inflection point comes right from the company’s website where it communicates its goals: