Welcome to The GeoWire, Your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

Happy New Year! With another year down the drain, we looked back at some of the things that we embarked upon in 2021, as well as some of the recurring subject matter that we tracked during each passing month. It’s likely that a good deal of coverage is going to bleed into 2022, but our pipeline of new stock ideas is always robust and on the immediate horizon, so we urge you to make sure that you read every email and update, turn on those premium Twitter push notifications if you have haven’t done so already, and be prepared for another year’s journey into the realm of microcap stocks.

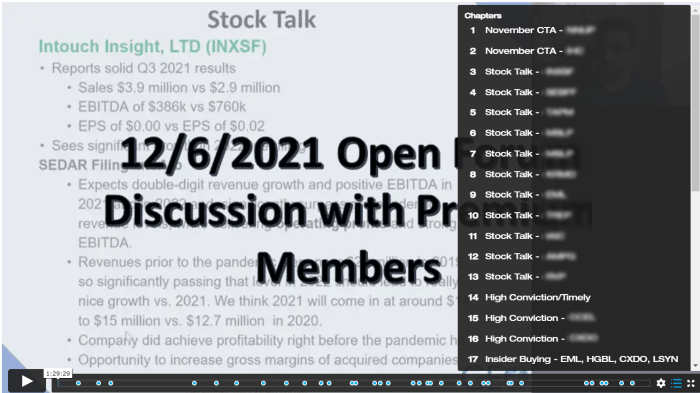

Last year saw the genesis of the Live Monthly Forum that became a mainstay. Now we use these forums to shore and tie up some loose ends on our investment theses. They include the latest Calls to Action, general commentary about stocks in our model portfolios (Stock Talk), management interviews completed and that are on deck, timely/high-conviction stock plays, contributor research, successes and failures, and premium member questions, all carefully “chapterized” to make it easy to navigate to your stocks of interest, since there are plenty of them.

If you’ve been paying close attention, you’d have noticed that some of our themes were given a bit more weight due to there being optimism proportional to the conviction of those themes. In other cases, when a larger part of our premium base had questions about one particular subject or stock, we chose to delve into those a bit more.

One instance where this is true happened to be the introduction or SEC Rule 15c2-11 (Rule 211), explained here (with more sub-references) and further elucidated upon in a PodClip here. The rule caused an upheaval in many corners of the microcap universe in that it basically would render a large chunk of OTC stocks un-tradable by the everyday microcap stock investor.

It’s quite possible that you have a few of those stocks in your portfolio now, if you have not sold them. The rule’s bottom line was that if a company was not current with its information as displayed on OTC markets, it would be in violation due to its failure to keep investors properly informed of its most recent financial records, among other company-related data and documents. In essence, it meant non-compliance with certain SEC standards. This violation would basically render a stock Dark, relegating its trading to only the most experienced and qualified brokers and institutions. Retail investors might only be able to sell shares they already own.

In 2021, we also continued coverage on US Listed China-based agriculture stock, Origin Agritech Limited (NASDAQ:SEED). SEED is a company that is on standby to receive coveted certifications from the Chinese government allowing it to market and distribute GMO seeds nationwide. We are by no means pleased with the circumstances that have resulted in a protracted storyline that at times has us on the edge of our seats given the prospect of a multi-bagger situation should SEED be selected as one of the main certificate holders. Our coverage on the saga is bar none the most comprehensive coverage that you will find anywhere on the web, as evidenced here. We’ll no doubt be addressing some of our current concerns and expectations regarding the company’s progress.

We also started toying around the idea of PodClips, short audio-based updates on our covered stocks. We were excited about the idea since it is an asset light way for us to convey some quick thoughts relevant to events that just occurred or are occurring. Since mid-2021, 31 clips were published and released, but we certainly wanted to do more given the overwhelmingly positive response from our premium audience.

If you are new to GeoInvesting or missed one of our most touted themes this year, you probably want to take a look at the presentations on what we called our “Cloud Communications Trio.” It was a small project we executed to amass research on both the cloud communications industry as well as 3 stocks that we felt, and still feel to have multi-bagger characteristics. They are companies that we believe will outperform the market for a multitude of reasons, and we encourage you to either take another look at the presentations, or a virgin look if your schedule initially got in the way.

It goes without saying that we are looking to have a successful 2022. For all of our stocks that were hit by supply chain issues, we are packing that part of 2021 away in a chest that we hope we’ll never have to open again. There has been two years’ worth of those and other stocks having to cope with Covid-related disruptions, something Maj spoke about in his latest Podcast episode of “Avoiding the Crowd.” His research analyst, Jan Svenda, Bobby Kraft, the podcast’s editor and producer, and Maj covered this and took a look back at some of the hurdles and bottlenecks posed by 2021. Please view the video here.

GeoInvesting is a living and breathing entity, and we are continuously working on a process that we believe will be most convenient for everyone. As you might imagine, it takes a lot of work and organization to keep up with every aspect of our service. Thanks for your patience as we tackle a new year that we are confident will bring as many prospective ideas to your plate as possible.

Here’s to your success and thanks for your support.

~Zou Soueidan, Senior Content Editor

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Recommended Reading From Around The Web

This week we highlight some articles from CNBC that you might find interesting. They caught our eye since in some ways, they are relevant to some of the investing themes that we covered in 2021.

China is clarifying rules for overseas IPOs. Here’s what we still don’t know

“Since the fallout over Chinese ride-hailing app Didi’s IPO in late June, authorities have increased their scrutiny of Chinese companies raising billions of dollars in U.S. public markets. A 10-year high of 34 China-based companies listed in the U.S. this year, but only three of the IPOs have occurred since July, according to Renaissance Capital.

Regulators in both countries have issued clarifications this month on what’s needed from Chinese companies to go public in the U.S. While it’s a start, many questions about implementation remain.”

–

Op-ed: The future of socially responsible investing is in female hands

“Interest in socially responsible investing skyrocketed during the Covid-19 pandemic.

To that point, environmental, social and corporate governance funds captured $51.1 billion of net new money from investors in 2020 — a record and more than double the net inflows in 2019, according to Morningstar research.

So, who is behind this massive growth in sustainable investments?

It’s women who are wealthy and socially conscious. Global wealth demographics have their part to play in this trend. Women — overall — are richer now than ever before. And they’re soon to get even richer.”

–

Meme stocks, SPAC craze and a $100 million deli: It was a wild year in the market

“This year’s activity coincided with a surge of rookie investors who joined the world of stock trading to ride the historic market rebound. Remote work, stimulus checks and higher personal savings levels, as well as social media chatrooms only accelerated the boom in retail trading.

“If there was ever a doubt about who wields power in the stock market, the U.S. retail investor stole the show in 2021,” Tony Pasquariello, global head of hedge fund coverage at Goldman Sachs, said in a note. “Following a year that saw more inflows than the prior 25 years combined, to what extent this cohort remains in the fight is a major open question for early 2022.”

Notable Tweets

In markets like these companies generating profits have extra appeal. Financing risk is much lower.

— Paul Andreola (@PaulAndreola) December 20, 2021

—

Wise words worth keeping in mind when searching for your next great investment idea. https://t.co/8fhLalPcud

— Laughing Water Capital (@LaughingH20Cap) December 2, 2021

—

Stock performance is rarely linear in microcap. Oftentimes you have to hold onto a position for a few years before it goes up 300% in 6 months.

— Ian Cassel (@iancassel) December 21, 2021

Featured Video

xxx

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.