In recent weeks, as we approach September 28, 2021, the date that SEC Rule 15c2-11 (Rule 211) goes into effect, we’ve been discussing how the rule will impact dark stocks on the OTC market, as well as investor appetite for microcap stocks in general:

- February 21, 2021 – Working Your Way Into The Dark – Don’t Be Afraid of OTC Stocks

- August 1, 2021 – OTC Stock Regulation’s Silver Lining,

- September 17, 2021 – Rule 2-11 Drop Dead Date Quickly Approaching

This past Friday, Maj put out a PodClip in response to several member questions who expressed concerns about stocks in Geo’s select longs. We encourage you to listen to it or read the transcript.

Companies on the OTC not in compliance with certain financial filing requirements by September 28, 2021 will no longer be permitted to have their prices quoted by brokerage firms.

More importantly, if you own any dark stocks, it is our understanding that brokerage firms will not force you to sell the stock. However, at most brokerage firms, you will not be able to purchase any dark stocks moving forward and will only be able to sell positions.

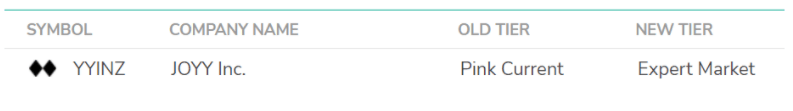

Stocks that trade on the Expert Market Tier, denoted by a side-by-side black double diamond like this…

…can only be traded by firms or qualified investors. As warned on otcmarkets.com:

“The Expert Market is a private market to serve broker-dealer pricing and best execution needs in securities that are restricted from public quoting or trading. Restrictions can be based on issuer requirements, security attributes, investor accreditation and/or suitability risks.”

Some more clarifications that address certain questions investors might have about Rule 211 were succinctly presented by Jason Paltrowitz, Executive Vice President of Corporate Services at OTC Markets and Dan Zinn, his Chief General Counsel.

“…a number of companies are already compliant, if you are reporting current information on a regular basis…so, a member of our OTCQX or OTCQB markets…or a company that’s tagged as “Pink Current Information”, those companies are already complying with the rule.”

Those of you that frequent otcmarkets.com may be also familiar with the stop and yield signs present at some of the stocks’ profiles, which may be cause for concern.

The stop sign means the company is dark and typically provides no information to investors. A yield sign means a company provides limited information to investors, and in certain circumstances are compliant with the new rule.

We have contacted OTC Markets to get some more clarity on the yield sign designation since there are stocks in our Selected Long Disclosure Model Portfolio that show the designation.

- Ccom Group Inc (OTC:CCOM)

- Firstime Design Limited (OTC:FTDL)

- Pharmchem Inc (OTC:PCHM)

- Spanish Broadcasting Systems In (OTC:SBSAA)

While our discussion with OTC Markets management is taking place tomorrow, they have given us something to chew on in preparation for our call with them. Please see their 15c2-11 Resource Center here that offers a comprehensive overview of the rule, including webinar replays, Q&As for companies and investors, and documentation that explains disclosure standards and market tiers.

Since CCOM and FTDL have been filing all necessary quarterly and annual reports and PCHM has been filing semiannual reports, we believe they are all compliant with rule 211. With the filing of its 2020 annual report and management commentary in press releases, it seems that SBSAA is working to become compliant with the filing standards.

We also wanted to alert you that one of our selected disclosed long stocks, Treecon Resources Inc (OTC:TCOR), appears to be the only stock that currently does not adhere to the rule and that our due diligence indicates that the company appears to not have a desire to become compliant. Regardless, at this time, we will continue to include TCOR in our Selected Long Disclosure Model Portfolio. You can see our past coverage on TCOR here.

Finally, a skull and crossbones symbol denotes a ‘Caveat Emptor’ status. While, like a yield, the company may provide limited information, otcmarkets.com takes the warning one step further to suggest that the stock might be engaging in promotional campaigns (as well as those by third parties), be the subject of investigations of fraud or other criminal activities, is suspended or halted, has undisclosed corporate actions, unusual or unexplained trading activity, and spam or disruptive corporate actions, even when adequate current information is available.

As GeoInvesting is extensively keeping up with rule 211 (and for good reason), you’ll be sure to get another update from us soon on this subject matter. If you have questions, we strongly encourage you to ask them in the comments section below. This holds true for all our posts on this subject.

Thanks!

GeoInvesting Weekly Premium Email and Call To Action Updates (Sept 20 – Sept 24)

Weekly Wrap Up Summary…

Email Highlights

- Millennium Inv & Acquisition Co (OTC:MILC) – Replay of full fireside chat as well as more educational material

Notable Updates

- Origin Agritech Limited (NASDAQ:SEED) – Enters collaboration agreement with China Agricultural University

- Crexendo, Inc. (NASDAQ:CXDO) – Now has 2 million end users

Premium Emails Sent During the Week

09/20/2021

MILC Fireside Chat Follow Up and Full Video

Stocks : MILC

Millennium Investment & Acquisition Company Inc. (OTC:MILC) ($6.59, $72.2M market cap), a company whose main focus will be on operating cannabis cultivation facilities through lease agreements on land owned by Power REIT (MD) (NYSE AMEX:PW). MILC has also been operating as a non-diversified, closed-end investment company. However, the company is in the process of terminating this designation. We sat down with Jared Schrader, President of MILC for a live virtual…see more.

More Notable Updates

Stocks Partially discussed or not highlighted during the week

Origin Agritech Limited (NASDAQ:SEED) (Agricultural Technology) announced that it has entered into a collaboration agreement with China Agricultural University for the research of molecular design in corn.

“This collaboration with China Agricultural University will enable Origin to accelerate its technological leadership in molecular design of corn and allow us to play a key role in China’s drive to strengthen its agricultural industry through technological advancements.”

CREXENDO INC (NASDAQ:CXDO), a provider of cloud communications, UCaaS (Unified Communications as a Service) and other cloud business services announced its solutions now support over two million end users globally.

“This is a major milestone for Crexendo. When we acquired NetSapiens we did so because we were convinced that it was the best communication platform that was available anywhere. The continued acceptance of the platform by end users confirms our belief. The steady growth is a testament to the hard work done every day by our team and the commitment of our community. We are continuing to make investments and improvement in the platform that will benefit both the NetSapiens community and Crexendo telecom customers. One of the primary advantages of joining with NetSapiens team was to allow Crexendo to offer the VIP platform which is an all-in-one cloud business communications solution with a 100% uptime guarantee offering Video Collaboration, Interactions, and Business Phone communications for customers of all sizes. We provide world class collaboration tools at a price that is better than our competitors. In addition, the VIP Platform features advanced customer experience and call center capabilities to help companies deliver an excellent customer experience. Our combined efforts will continue to make a better company, provide better products and services and to increase shareholder value.”

About the Author: GeoTeam

GeoInvesting was founded in 2007 to bring Tier One Quality Microcap research and actionable stock ideas to its Premium Subscribers. Information is distributed to subscribers through a platform featuring a robust catalogue of research. Model portfolios, research updates and idea generation complement one another to build a full picture of companies in GeoInvesting’s coverage universe. GeoInvesting has also built a high-quality investor network of research contributors that generate ideas and pitches for subscribers. GeoInvesting research is conducted through intense due diligence, live management interviews, a deep analysis of SEC filings, press releases and conference calls. The company has also played a big part in helping investors understand risk and portfolio protection.