I think it is safe to say that the microcap universe has been in a bit of a bearish trend for the last 3 months and seems to be getting worse.

We think this is partly due to Rule 2-11 and investor uncertainty.

On top of that, misinterpretations surrounding the rule certainly aren’t helping.

In two recent weekly emails, we discussed how SEC Rule 15c2-11 will be impacting dark stocks on the OTC market as well as investor appetite for microcap stocks in general….

We are now 10 days away from Rule 2-11 going into effect, which basically means that companies on the OTC not in compliance with certain financial filing requirements will no longer be permitted to have their prices quoted by brokerage firms.

However, brokerages are already compiling lists of dark stocks and restricting trading in these securities, only allowing investors to sell their positions.

As we have opined, although we largely disagree with the reasons behind Rule 2-11 and its implementation, we’ve stated that we think it’s going to create opportunity for savvy investors who are willing to accept a high level of risk.

For example, thanks to Robert Mulcahy and his bullish Spanish Broadcasting Systems In (OTC:SBSAA) research article published on GeoInvesting’s Premium Portal on June 22, 2021, we added the stock to one of our Model Portfolios at $4.25. Even though SBSAA has been dark, we believe that the company would take actions to comply with Rule 2-11, due to narrative by management and related press releases.

In the meantime, the stock found its way to the restricted list of many brokerage firms, possibly a big reason it fell to as low as $2.51. Now, it looks like investors who were willing to accept some “dark risk” may be on their way to being rewarded.

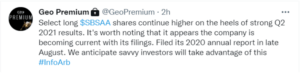

As pointed out in a Premium GeoInvesting Tweet, it appears that the company is “coming out of the dark”:

The stock is now trading at a new 52 week high and up ~37% from Robert’s bullish call.

I dove into the dark stock discussion with one of my analysts, Jan Svenda and Robert Kraft of SSN news, on my last Avoiding the Crowd episode. The discussion on dark stocks begins at the 4:08 mark and runs through the 19:47 mark, but I’d like to point you to a clip from that section that is relevant to this discussion.

However, I also urge you to listen to the entire dark stock discussion, which includes dark stock strategy buckets that Jan and I are creating:

- Stocks that are totally dark that we believe will come out of the dark

- Stocks that are partially dark and in the process of coming out of the dark

- Stocks that are compliant with rule 2-11 but are being unfairly punished due to confusion surrounding the implementation of the rule.

GeoInvesting Weekly Premium Email and Call To Action Updates (Sept 13 – Sept 17)

Weekly Wrap Up Summary…

Log in below with your Premium Account to continue reading.