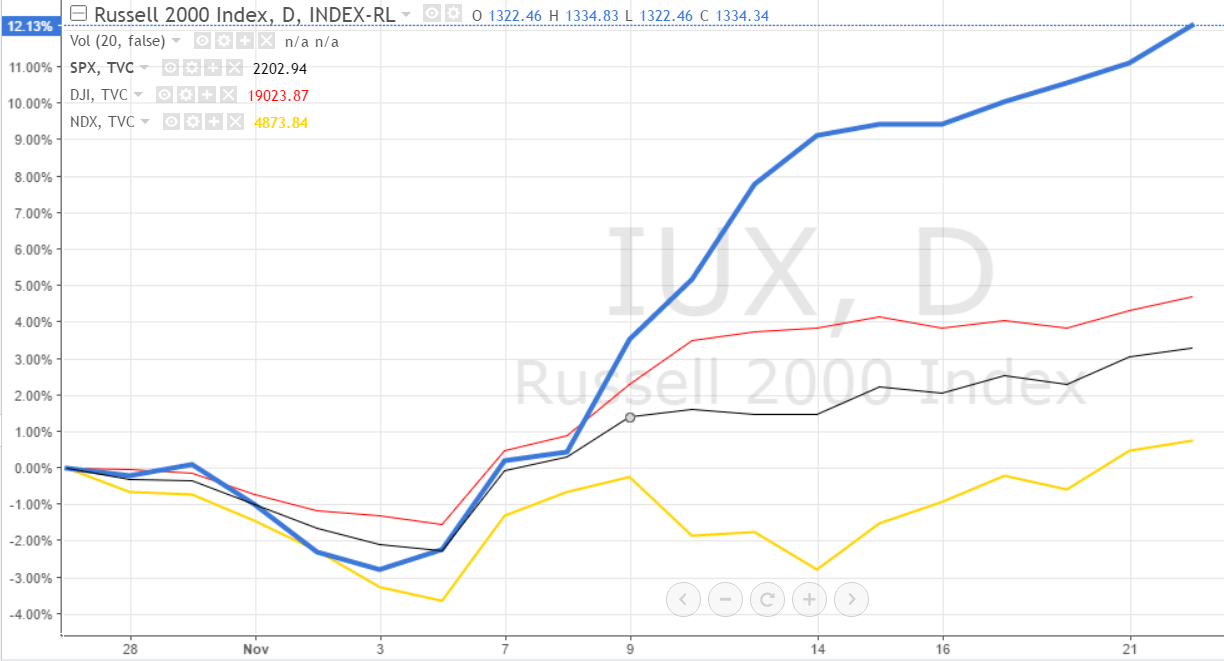

Over the last two weeks, retail and institutional investors’ appetite for microcap investing as well as smallcap stocks has been gaining steam. Using the Russel 2000 index as a gauge, this smaller capitalized group of stocks continued to rally last week, ending the week up 2.59% after posting 10.22% gains in the week prior. Since “The Donald” won the 2016 Presidential Election, these companies have outperformed their larger counterparts, the S&P, Nasdaq and DOW by 7% (DOW) to 12% (Nasdaq). The market gains are pausing today, but not before a broad multi-day rally.

I have been investing for nearly 30 years and have not seen a mad scramble to buy undervalued microcap stocks since Pre-2008. I forgot what it felt like to witness what happens when retail and institutional investors converge to buy microcap stocks all at once. After years of being ignored, the universe that I play in just experienced a long-awaited rush, but now the question remains – will the rally last?

A Microcap Revival in the Works?

Time will tell if Donald Trump will make good on his promise to inject growth stimulus into the U.S. economy to ultimately help home-grown U.S. firms. I truly believe that investors got caught with their pants down. There is a very real possibility that they are burning the midnight oil, running screens to find hidden microcap gems now that something seems to have been set in motion. You should know that our roots are in finding these gems. Since GeoInvesting was launched in 2007, we have produced research on hundreds of microcap and smallcap stocks. Of the stocks that we’ve specifically tracked, over 50 stocks were multi-baggers and over 40 were acquired.

We have been and are fully prepared for a microcap revival. Suddenly, we are getting blind-sided, on a near daily basis, by beaten up and undervalued microcap stocks priced to fail. Because we’ve been here before, we know it’s only a matter of time before the stocks are found by investors just like you.

The Writing Is On The Wall

Over the last several months, I have been demonstrative in my belief that the market environment is ripe for an unprecedented microcap investing revival.

In two interviews with The Bulldog Investor on March 4, 2015 and August 10, 2015, I expressed my take on the microcap investing space. Put simply, I believed that it was in the process of thawing, giving investors the impetus to consider diversifying their portfolios into the smaller names.

In early 2016 I stated that rising rates, volatility in currencies and the dirty protectionist games that China is playing will hurt the income statements and balance sheet of Large Cap stocks. And that this will eventually force investors to buy smaller home-grown U.S. companies.

I have spoken at five conferences this year, letting other microcap investors know that I feel their pain due to the inability to hold onto positive returns due to the lack of sustained rallies.

Market Timing With Microcap Investing

Too much emphasis on market timing can eventually paralyze investment decisions. I have and never will claim to be a market timer. Sometimes, you simply must be early to reap gains. For example, in the movie “The Big Short”, Hedge Fund managers Steve Eisman (Morgan Stanley Subsidiary) and Michael Burry (Scion Capital) were a couple of years early in their prediction that a subprime crisis would crush financial markets. But in the end, it paid off for them to the tune of over one billion dollars.

While it’s true that microcap stocks have underperformed in recent years, nothing lasts forever. I spoke about why reversion to the mean is sometimes painful, yet necessary:

“Market reversion is painful at first, but should lead to a scenario where active management and stock picking become important again. Over the last several years value had taken a back seat to hype leading to an overvaluation of ‘story stocks’ and ridiculous undervaluation of ‘boring’ stocks. At some point value will matter again.”

Inflection Points

Instead of market timing, we identify company specific inflection points that put already undervalued companies on a path to enter elevated periods of growth or improve their risk profiles. We use information arbitrage to get ahead of the discovery of positive events before the masses find them — Listen here to learn how information arbitrage, when used with microcap investing, can turn into a lucrative investing tool.

Our GeoInvesting Premium Members receive all our internal notes and proprietary analysis of undervalued stocks. We have developed a fantastic community of members and contributors that share our same passion for the microcap space. We would love to welcome you into this community and would enjoy showing you what we have to offer.

Contributed by Maj Soueidan, Co-Founder GeoInvesting. Read more about Maj here.