Simply put, Mer Telemanagement (NASDAQ:MTSL) sells call accounting software and tools to help its end users manage internal communication activities as well as external billing and invoice needs.

At first glance, MTSL’s history did not leave us overly excited to make a long investment into its shares. Since its IPO in 1997 and through 2009, MTSL had a difficult time growing its top line and maintaining profitability.

Here is a look at the annual revenues (millions)

| 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | |

| Revenues | $11.4 | $8.8 | $9.3 | $10.5 | $11.6 | $9.4 | $9.2 | $9.8 | $10.7 | $11.1 | $12.8 |

We became somewhat intrigued by MTSL when it announced 2012 second quarter financial results on 8/16/2012:

- Revenues for the second quarter of 2012 were $3.3 million, compared with $3.0 million during the same quarter last year and $3.0 million in the first quarter of 2012.

- Net income for the second quarter was $460,000 or $0.10 per diluted share, compared with $229,000 or $0.05 per diluted share in the second quarter of 2011 and $310,000 or $0.07 per diluted share in the first quarter of 2012.

Surprisingly, after years of reporting losses the company returned to the black in 2010 and 2011, reporting non-GAAP EPS of $0.04 and $0.21 respectively. Furthermore, the company has now grown quarterly non-GAAP EPS for 11 straight quarters. 2012 nine months non-GAAP EPS now stands at $0.32, nearly 3 times greater than last year’s comparable period.

Here is a look at recent quarterly non-GAAP EPS trends: In 2011 MTSL incurred a $640,000 charge related to legal expenses and settlement costs. Although, we are not certain of the exact breakdown of the charge per quarter, it seems that the majority was incurred in the fourth quarter of 2011.

| 2012 | 2011 (see note) | 2010 | |

| March | |||

| Revenue (in millions)

EPS |

$3.0

$0.07 |

$2.8

$0.01 |

$2.9

$0.00 |

| June | |||

| Revenue

EPS |

$3.3

$0.10 |

$3.0

$0.05 |

$3.1

$0.01 |

| September | |||

| Revenue

EPS |

$3.4

$0.15 |

$3.0

$0.05 |

$2.7

$0.00 |

| December | |||

| Revenue

EPS |

TBD

TBD |

$3.2

$0.10 |

$3.0

$0.03 |

| Totals | |||

| Revenue

EPS |

TBD

TBD |

$12.0

$0.21 |

$11.7

$0.04 |

Note: In 2011 MTSL incurred a 640k charge related to legal expenses and settlement costs. Although, we are not certain of the exact breakdown of the charge per quarter, it seems the majority was incurred in the fourth quarter of 2011.

Finally, although absolute revenues have not seen a substantial uptick over the past four years, EPS is doing quite the opposite. For example, the company reported non-GAAP EPS of $0.15 for its third quarter of 2012, easily exceeding any prior quarter in its history. This positive EPS trend quietly began in the fourth quarter of 2010. It is promising that the company has been able to set new income records amid mediocre revenue performances, which tells us that margins are expanding. Pre-tax margins are running at 20% compared to around 9% in 2012.

Here is a look at the quarterly pre-tax margin performance since the fourth quarter of 2011.

| 3rd quarter 2012 | 2nd quarter 2012 | 1st quarter 2012 | 4th quarter 2011 | |

| Pretax Margins | 20.6% | 14.1% | 10.5% | 16.4% |

Later we will discuss why investors who decide to avoid this stock because of sub-par sales levels could be making a big error in judgment.

We initially decided to establish a short-term trading position in the stock ahead of our August 29, 2012 interview with management. We subsequently bought more shares and now, after further research, view the company as more than just a trade as it aims to target a new growth market that is no longer solely playing in the shadows of a mature and anemically-growing sector of the industry it serves.

A Little Bit of History

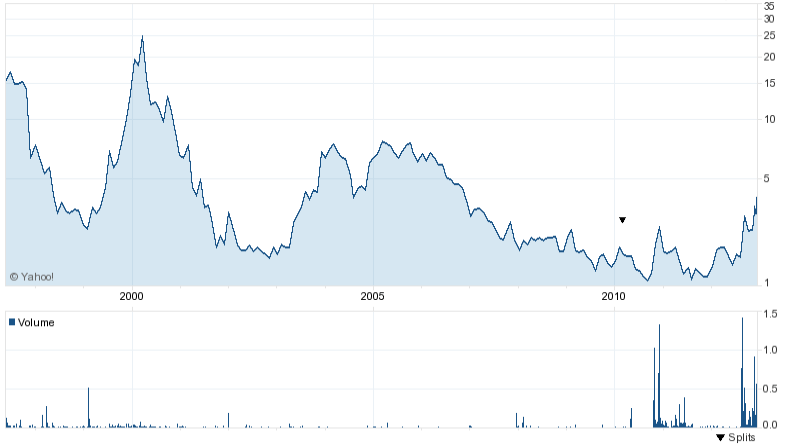

Mer Telemanagment came public via an IPO in 1997. The following chart references the stocks historical performance (adjusted for a 1 for 2 reverse split)

Despite reporting lackluster financials, the stock was able to stage a couple of rallies, but were short-lived as the company failed to deliver superior financial results.

As it turned out, the market that MTSL was serving was not in growth mode. Historically, the company’s legacy software was geared towards monitoring and managing activity across communication systems used internally within an organization; activities such as employee usage of phones, customer service talk time, performance stats, or separate billing for departments.

“Call accounting products, a fundamental management tool, record, retrieve and process data received from a PBX or other telephone switching system, providing a telecommunications manager with information on telephone usage. This information enables managers to optimize an enterprise’s telecommunications resources and reduce communication expenses, typically the second or third highest administrative expense of a business, through cost-tracking and management awareness.”

Two trends impacted MTSL’s past growth prospects and muted demand for MTSL products:

- Over time, wireless services began to grow and competition in traditional phone service markets intensified. This led to a considerable reduction in the cost of land line services that companies employ, meaning that the cost benefit of paying a hefty fee to manage internal communication systems has become less of a need.

- MTSL was selling its product through licensing arrangements. The customer would then use the software to generate reports and independently monitor communication activity. Software as a service (SAAS), where companies pay subscriptions fees instead of a lump sum licensing fee, has gained popularity. A SaaS model places the burden of maintenance away from the customer to the provider of the software.

Basically, MTSL was operating in a mature market that was shrinking. MTSL spent several years dealing with these trends. Under new management, the company’s attempt to respond to its challenges occurred in 2004 when it:

- Invested in people by doubling its workforce,

- Increased its R&D spending (the company had only offered one product since 1985),

- Aggressively pursued new customer relationships with telecom provider, and

- Made acquisitions.

Post-restructuring, the company also:

- Beefed up its SaaS application (the cloud) which allowed it to expand its services and offer a more modern platform, and

- Expanded its service to telecom customers to manage communication of the internal framework, mainly billing needs (billing/collection/ invoices).

MTSL’s entry into the telecom market was largely geared towards targeting competitive local exchange carriers (“CLEC”). CLECs purchase, for re-sale, landline capacity from local carriers. MTSL was also doing the same in the wireless telecom market for mobile virtual network operators (“MVNO”).

Although sales saw a short-term pop to $11.6 million in 2005, losses continued through 2009 and sales actually breached the $9 million level in 2008 before rebounding to the $11.4 million in 2009.

Unfortunately, many CLECs and MVNOs did not survive due to fierce competition and the high cost of capital to jump-start their businesses. The original model required resellers to spend a good deal of capital to build out their own infrastructures in order to provide services. This had an effect of leaving a reduced amount of money to spend on MTSL outsourcing services. Furthermore, telecom providers were not overly warm to the reseller idea due to a perception that doing so would create competition.

The Dilemma

Overall, this was a tough story for us to accept since it appeared that the company was not able to execute a growth plan since going public. But we tried to find a silver lining. First, we were somewhat curious why that at the very least, the company was able to maintain sales between $9 and $11 million since its IPO as it navigated through its challenges. This shows us that despite margin erosion, the company still had a respected standing in its market. But more importantly, we learned that the company has been able use its experience in the call accounting/billing industry and tap into a repackaged MVNO industry that no longer requires a high initial capital investment.

The new MVNO uses the infrastructure of the host telecom company, leaving sufficient capital that can be allocated to outsourcing services.

“MVNO incurs no significant capital expenditure on spectrum and infrastructure and does not have the time-consuming task of building out extensive radio infrastructure.”

A favorable regulatory environment and the increased desire for wireless operators to make use of idle capacity have also opened the door for this market. The result is an explosion of MVNOs into the market. According to a research report from Vision Gain, the global MVNO market will be worth $40.55 billion by 2016, with subscriptions doubling from 2011 levels to $186 million by 2015.

But MVNOs still need to manage their billing systems with services, such as those that MTSL offers:

“The MTS solution is a market leading MVNE service that provides new MVNOs with a quick time to market, flexible personalization, and rapid integration into their existing operations. This allows new MVNOs to focus their efforts on sales and marketing rather than back office technology and complex MNO integrations. MVNOs can rapidly gain a competitive advantage in the marketplace with MTS’s MVNE cradle to grave solution that is specifically designed for MVNOs, regardless of their size, service offerings or localization requirements.”

Not only has MTSL’s potential customer base increased, but this story has went from one of a company treading in a mature market to one that is now playing in a new growth market with a sexy SaaS angle with better margins.

The company now has two MVNO’s under contract and hopes to gain one to two per year.

Turn Around Has Begun

MTSL secured its first MVNO customer, Simple Mobile, and returned to profitability in 2010. We believe this trend can continue in 2013 since it just renewed its contract with Simple Mobile for a minimum of $3.6 million, which is 44% higher than the value of the previous one year contract with this company and much higher than its first contract totaling around $400,000.

Now, from casual observation of the earlier tables we presented, it can be seen that sales growth has been anemic since 2010. But this is only because the company’s legacy business has been on the decline. So really, the MVNO business, from just one customer, has been able to compensate for this loss while allowing the company to report healthy profits. To get a an idea of how profitable the MVNO business is, consider that it was only about 16% of 2011 revenues, yet enabled the company to quintuple its profits for 2011. This also shows that Simple Mobile spent more than its stated 2011-2012 contract value of $2.4 million. We believe this multiplier effect will continue into the future.

Challenges being addressed

Two challenges were present heading into the close of 2012. First, it was unclear if Simple Mobile would renew its contract with MTSL. Second was MTSL’s reliance on just one MVNO customer. The recent renewal of the Simple Mobile contract takes the near-term uncertainty off the table. And the company’s recent announcement of a new MVNO using its product offering gives us hope that the company is on its way to diversifying its customer base.

So in a nutshell, we think MTSL could be a home run as long as the new MVNO focus continues to gain traction, which seems reasonable to assume for at least 2013. We think the third quarter numbers may very well be a new high water mark that can at least be maintained for the next few quarters.

Tax Issue:

One thing that is holding shares back is uncertainty regarding the amount of a past due Israeli tax liability that the company had been waiting for the courts to make a decision on. From the 2011 20F:

“In April 2000, the tax authorities in Israel issued to us a demand for a tax payment in the amount of approximately NIS 6.0 million (approximately $1.57 million) for the 1997 to 1999 period. We have appealed to the Israeli district court in respect of this tax demand. We believe that certain defenses can be raised against the demand of the tax authorities. We have made a provision in our financial statements for this tax demand for the amount deemed probable, based on the current evidence, which we believe is adequate.”

Well, the provision that the company had made was not much and on October 24, 2012 it announced that:

“The Tel-Aviv District Court rendered its decision relating to the Company’s appeal of a tax ruling of the Israeli tax authorities that was issued with respect to the 1997 to 1999 period. According to the decision, the Company’s claims were partly accepted and partly rejected, which will require MTS to increase the provision already made in its financial statements for this tax exposure. The Company has not as yet received an assessment from the tax authorities as to the amount they believe is due. Accordingly, the Company and its tax counsel are working to determine the financial impact of the ruling, which will be included in the Company’s third quarter financial statements.”

The company eventually decided to take a one-time non-recurring charge of $450 thousand during its 2012 third quarter to put this issue to rest. But investors are likely waiting for confirmation of what the final penalty to the company will be before going all in. Needless to say, we are betting that the company can handle a greater exposure to this liability if it needs to. We would actually welcome an overreaction to the tax issue as it would only be a one-time event. In fact, the stock bounced back nicely from the initial drop that occurred after the October 24, 2012 announcement.

If by chance MTSL shares get hit when the company announces its final decision regarding its past tax liability, we will likely aggressively add shares to our position.

Here is a summary of catalysts to move MTSL higher:

- Addition of new customers and meaningful contribution from the newest MVNO.

- Multiplier effect of Simple Mobile contract, since the $3.6 million value is a minimum.

- Healthy sales growth with revenues breaking out of a the low $3 million range as the MVNO business begins to meaningfully offset drop in legacy business.

- Official resolution of tax liability.

Valuation:

MTSL’s trailing non-GAAP EPS is $0.44, or $0.28 fully tax adjusted. Applying a P/E of 25 to the trailing tax adjusted non-GAAP EPS of $0.28 gives us a price target of$ 7.00. (.28 x 25 = 7.0)

We would like to see one more quarters’ financial performance before formulating a target on future earnings, but given the facts we think that MTSL can soon exceed its 2012 third quarterly EPS run rate leading to a target well above $7.00.

Since MTSL operations have a SaaS component, we can also value shares using a EV/Sales multiple. If we apply a 4 EV/Sales multiple, which is about half of what tier one SaaS companies trade at, we would derive a price target of around $7.60. To learn more about how we derive our EV/Sales valuation assumptions on SaaS companies please see our article on Exacttarget (NYSE:ET)and E2 0pen (NASDAQ:EOPN) “Exacttarget and E2 0pen: Two Intriguing SaaS Plays”.

Risk Factors:

- Although the low barrier to entry increases potential customers for MTSL, this can also lead to fierce competition among MVNOs leading to an eventual elimination of many players in the mid to long term. One only has to reference what happened to the CLECs starting in the late 1990s, heading into the telecom bubble (2001-2002). (Still, investors who timed the CLEC “revolution” correctly made a good deal of money).

- More outsource providers are sure to enter the market to serve MVNOs and compete with MTSL.

- MVNOs may decide not to outsource billing needs.

- MTSL contract duration with Simple Mobile only covers one year.

- Quarterly sales run rate has not been able to break out of low the $3 million threshold due to decline in legacy business.

- Regulation of the MVNO market.

Disclosure: Long MTSL

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities. GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.