On December 18, 2012 we added Selectica Inc. (NASDAQ: SLTC) to our 52 week high screen @ $6.40 per share and sent our research note to members in our December 19, 2012 email. In our January 3, 2013 Seeking Alpha article, ‘Is Revamped SaaS Company Selectica Ripe for a Take Over’, we stated that:

“Over the past couple of months we have been perusing the software as a service (“SaaS”) space to find long and short opportunities. During our analysis we compiled a list of companies (EOPN, ET, ELOQ, PRO, MKTG, DWCH, Unica and Aprimo) that provide software to help companies improve various aspects of their sales process. This task led us to Selectica (NASDAQ:SLTC).”

Selectica has traded as high as $8.83 per share following our report.

Our analysis of the SAAS space also landed E2 0pen (NASDAQ:EOPN) on our plate. EOPN completed its IPO on July 26th 2012 at $15 and now trades around $18.50.

On 1/4/2013 we began sending emails to GeoInvesting premium members to tell them that

“we stumbled upon another SaaS company in EOPN ($16.00), a recent IPO that we initiated a position in since we felt it could get lift from the euphoria related to the acquisition of Eloqua (NASDAQ: ELOQ) by Oracle Corporation (NASDAQ: ORCL), announced on December 20, 2012.”

While EOPN does no directly compete with ELOQ or SLTC, it is still a SaaS company playing in a sexy industry. However, like ELOQ, it provides a product to help streamline a process. ELOQ streamlines the lead generation/marketing process, while EOPN offers a broader service to help streamline processes across several aspects of a business operation.

Coincidently, Exacttarget (NYSE:ET) is another recent SaaS IPO that looks cheap compared to ELOQ. Trading at around $22.00, ET is a direct comparable to ELOQ. In fact, ET actually mentioned ELOQ as a competitor in its IPO prospectus. Exacttarget’s shares actually traded near $30.00 in March 2012, a price on par with ELOQ’s takeout valuation multiples.

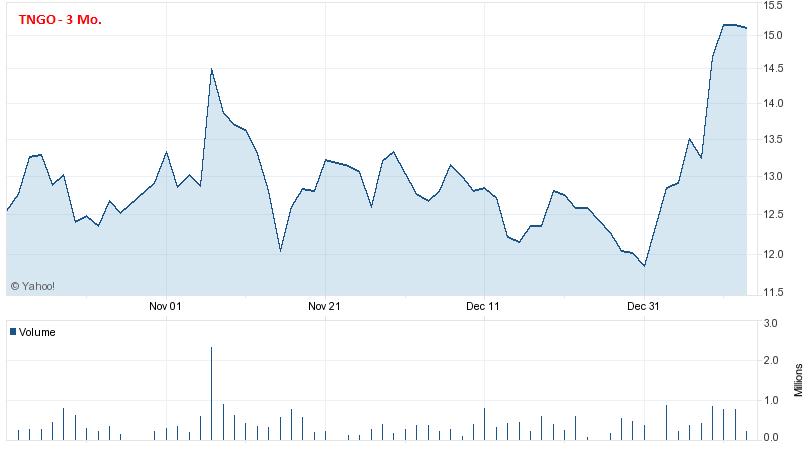

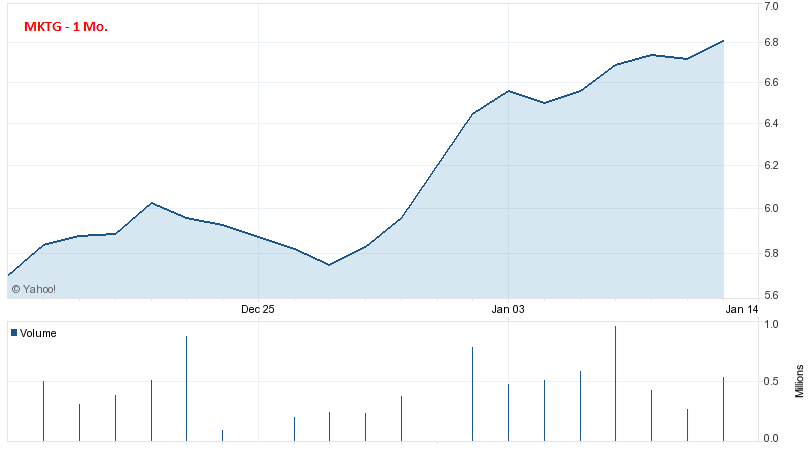

Although this article is primarily about ET and EOPN, investors may also be interested in monitoring two other SaaS companies; Responsys (NASDAQ:MKTG), which directly competes with both ELOQ and ET, and Tangoe (NASDAQ:TNGO), a recent IPO. Both are selling well below ELOQ’s EV/Sales takeout multiple. To see more details on these two companies, see our SaaS Screen. (Blog Password is GEOTEAM, all caps)

In the end, we believe that if the SaaS sector stays hot, EOPN and ET could quickly rise to as high as $24 and $30, respectively. Some major factors supporting possible bullish theses on EOPN and ET are similar to those we mentioned in our long thesis for SLTC, such as:

The Consummation of Transactions Where Well-Known Companies Have Acquired SaaS Firms

To refresh your memory, here is a summary of recent acquisition deals involving SaaS companies:

- On January 1st 2011 Teradata Corporation (NYSE:TDC) completed its acquisition of 100 percent of the stock of privately held Aprimo in a deal valued at $525 million.

- On October 6, 2010International Business Machines Corporation (NYSE:IBM) completed its acquisition of 100 percent of the stock of publicly traded Unica (the market leader at the time) for $21.00 per share in a deal valued at $480 million.

- And just on December 20, 2012, Eloqua (NASDAQ:ELOQ), a company that completed its IPO on August 2, 2012 at $7.50 was acquired by Oracle for $23.50 per share.

We failed to mention two additional acquisitions that recently took place in the cloud computing arena.

- In October 2011 Oracle acquiredRightNow Technologies, Inc. (NASDAQ: RNOW), a leading provider of cloud-based customer service, for $43.00 per share or approximately $1.5 billion net of RightNow’s cash and debt.

- In February 2012, Sap Ag (NYSE:SAP), the largest maker of business-management software, completed its acquisition of SuccessFactors Inc. (NASDAQ: SFSF) for $40.00 per share, or $3.4 billion in cash, stepping up competition with archrival Oracle Corp. in the cloud-computing market.

Since our SLTC report we have performed some more research and came across a March 2012 Forbes article that discusses the high probability that consolidation will occur in the SaaS sector. Here is an excerpt:

“In a report posted last week, Wolf and his team identified the Top 10 SaaS companies, in terms of revenue and business customers, and said many make attractive acquisition targets for some of the bigger players – like IBM, Hewlett-Packard, Oracle and SAP– who need to embrace new cloud technologies.”

“What’s the alternative for these slow moving legacy companies? If you look ahead at the business models they have of maintenance, licenses, services – that business model is changing. It’s being disrupted. They need to change accordingly,” said Wolf, who expects SaaS companies to keep outpacing traditional software makers in growth and valuation multiples in 2012.”

The acquisition of Eloqua by Oracle at a generous Enterprise value to Sales (EV/S) multiple of 8.2 is well above EV/S of both EOPN and ET and puts acquisition fever firmly in play for publicly traded SaaS companies. It also possibly raises the bar on take out valuations going forward. Overall, in the short-term, the ELOQ transaction may revive a market sector that has been attracting some skeptics.

Since the ELOQ announcement, EOPN has risen from $14.11 per share to around $18.50 or 31% and ET has risen 15% to around $22 per share. We believe investors are quickly figuring out that EOPN and ET are selling at a discount to ELOQ despite having similar or better growth profiles. Even with these recent price moves, room for further gains could be in the cards for EOPN and ET of at least 30% and 50%, respectively.

Here is an article at SaaS provider Chargebee’s blog that discusses how novice players in the SaaS space can “undervalue” related companies, creating opportunity for investors and potential suitors who begin to understand how to value them.

Depressed Valuation Multiples

A second reason we were bullish on SLTC was that it was selling well below valuation multiples compared to its competitors. We will show that EOPN and ET also appear undervalued. The question becomes, do EOPN and ET deserve premium valuations?

EOPN’s Case for Premium Valuation

- The company appears to be a formidable leader in its industry. Here is an excerpt from its going public prospectus:

“E2open is a leading provider of cloud-based, on-demand software solutions enabling enterprises to procure, manufacture, sell, and distribute products more efficiently through collaborative execution across global trading networks. We do not believe that any specific competitor offers the breadth of business network solutions and collaborative capabilities that we do.”

- EOPN Recently increased its guidance and business outlook:

“We are increasing our fiscal 2013 bookings growth guidance to 30% to 35% based on the strength of our third quarter performance, combined with a healthy pipeline of opportunities. This is greater than our expected fiscal 2013 revenue growth and represents acceleration from our fiscal 2012 bookings growth of 28%. We remain very optimistic about E2open’s long-term growth opportunity and market position.”

- Analysts expect the company to become profitable in 2013.

ET’s Case For Premium Valuation

From September 11, 2012 Prospectus:

- “Forrester placed ExactTarget in the “Leader” category in its Forrester Waveâ„¢: Email Marketing Vendors, Q1 2012, and January 20, 2012. We received the highest score possible in the Wave for our executive vision, development strategy and global strategy.”

Fom November 19, 2012 Press Releasetitled ‘Deloitte Names ExactTarget Among America’s Fastest Growing Companies’:

- “ExactTarget has earned placement on the Deloitte Technology Fast 500TM in 2011, 2010, 2009, 2007 and 2006.”

- “Founded in 2000, ExactTarget has emerged as the largest pure play marketing software as a service company in the world.”

From ExactTarget’s website:

- Increased revenuesfor 47 consecutive quarters

- Increased its 2012 guidance”With our strong revenue growth, two strategic acquisitions in October and record-setting Connections conference, our momentum continues to build, and we are pleased to raise our outlook for full-year 2012.”

- Cash flow positive

The Forbes article we mentioned earlier references factors from a Martinwolf report that separate Tier 1 and Tier 2 SaaS players, implying that EOPN and ET have Tier 1 characteristics and are deserving of premium multiples. Martinwolf goes on to say that Tier 1 SaaS companies grow revenues at an average of 27% and those that are profitable will command higher valuations.

“In simple terms, the companies that can grow the fastest and most profitably will earn higher valuations.”

Taking a look at EOPN’s most recent quarter reveals that the company’s revenue grew near 30% over the same period last year, and that analysts expect EOPN to reach profitability in 2013. ET grew revenues by 35% in its most recent quarter.

Martinwolf also poses the question:

“What is the difference between the Top 10 SaaSiest and the Second 10 SaaS companies? First and foremost, the median enterprise value based on 12 months trailing revenue of the Top 10 SaaSiest is more than 2x the second10 SaaS.”

So, let’s

- Compare EOPN and/or ET valuation multiples to those of the five SaaS acquisition deals we highlighted, and

- Determine if EOPN and /or ET are selling above or below Tier 1 valuations, referencing the Martinwolf’s valuation assumption that a Tier 1 SaaS company should sell at a trailing EV to Sales multiple of 7.4.

To refresh readers’ memories, here is an excerpt from our SLTC article on how to value a SaaS company.

| Sidebar — Valuing A SaaS Company Can Be A Little Tricky

A main focus of SaaS companies is to compete and capture market share to increase recurring subscription based revenue. This frequently leads to a company incurring high sales and marketing expenses and the generation of minimal net income and EBITDA. Eventually, these companies plan to earn profits as they grow and scale back on marketing expenses. So, in the short-term a measure like P/E is not a great barometer of value. Our goal is to value SaaS companies using other measures that do not rely on income data. Thus, sales multiples are often looked at as better measures of value. Still, we are cognizant that SaaS companies’ revenues consist of subscription fees that are received as cash up front, but where services pertaining to the contract are performed over time. Under GAAP, even though 100% of subscription revenue may be collected up front and shows up as cash on the balance sheet, only a portion of it is recognized on the income statement. The rest is classified as deferred revenue on the liability side of the balance sheet until it is earned. Deferred revenue is recognized on the income statement as services attached to such revenue are “earned” (the service is completed). The summation on sales and bookings is commonly referred to as total bookings. |

Some investors will value deferred revenue growth separately and focus on reported revenue multiples, which is what we have done in our analysis since the Martinwolf report references trailing revenues.

The following table compares several metrics between ET and EOPN to five SaaS companies that have been acquired at an average EV/S multiple of 7. (ELOQ, Rightnow, Successfactors, Aprimo,and Unica)

| EV to Trailing Sales1 | Gross Margin1,2 | Profitable?1 | Annual Revenue 2 | Revenue Growth rate3,2 | Booking (deferred revenue) Growth Run-rate1,2 | Cash flow positive1,2 | |

| EOPN | 5.7 | 69% | Yes, per 2013 analyst estimates | $89M | 22% | 30 to 35% | No |

| ET | 4.8 | 64% | Forecast to lose money in 2013 | $370M | 29% | 29% | Yes, per 2013 analyst estimates |

| ELOQ | 8.2 | 72% | Forecast to lose money in 2013 | $114M | 22% | 13% | Yes, per 2013 analyst estimates |

| Rightnow | 6.39 | 68% | Yes | $222M | 19% | 5% | Yes |

| Successfactors | 9.9 | 66% | Yes | $327M | 59% | 26% | Yes |

| Aprimo | 6.3 | 65% | Yes | $80M | n/a | n/a | Yes |

| Unica | 4 | 72% | Yes | $115M | 14% | 39% | Yes |

1For Rightnow, Successfactors, Aprimo and Unica we referenced trailing revenue, gross margins, annual revenue, revenue growth rate, bookings, cash flow and profitability at the time they were acquired.

2For EOPN, ET and ELOQ gross margins and bookings we referenced the most recent publicly available filings with the SEC.

3Analyst estimates for EOPN, ET, and ELOQ.

Some things become very obvious when we look at the above table:

- Overall takeout multiples have increased from 2010 levels.

- Profitable and non-profitable SaaS companies have been acquired. We found it interesting that ORCL paid up for ELOQ even though the company is losing money.

- EOPN, ET, MKTG and TNGO revenues are within levels at which other SaaS companies have been acquired.

- EOPN, ET MKTG and TNGO gross margins are in line with ELOQ’s, yet shares still trade well below the price inferred by ELOQ’s takeout multiple.

- EOPN, ET, MKTG and TNGO booking growth is currently well ahead of ELOQ’s.

- EOPN, ET, MKTG and TNGO are selling below the:

o Tier One 7.4 EV/Sales multiple from the Martinwolf report

o Average EV/Sales multiple of 7 for the take out companies in our table

o average EV/Sales multiple of 8.2 for the last three acquisitions

o ELOQ takeout multiple of 8.2.

ET looks particularly intriguing as a Tier 1 choice since it

- Is in a positive cash flow position

- Appears to be a clear market leader

- Is a direct competitor of ELOQ.

Given that the trend that take out valuations are increasing, we believe that the market may look to ELOQ as a proxy when valuing EOPN and ET. Using EV/Sales of 7 to 8 equates to a price target of

- $22.33 to $25.34 for EOPN (average of $23.84), or about a 30 % premium from current prices and

- $30.64 to $34.57 (average of $32.61) for ET, or about a 50% premium from current prices.

Thus, if the market starts to believe that EOPN and ET are Tier 1 SaaS players, their shares still have room to run. Keep in mind that as we head into 2013, the market may begin to value EOPN and ET on 2013 revenues, leading to higher price targets than we assume in this report if they were to be taken over.

Since EOPN and ET were recent IPOs we need to be aware of their lock up periods, typically six months from the IPO debut. To this point, EOPN has some exposure to this risk factor since its lock up period allowing certain pre IPO shareholders to sell their shares occurs at the end of January 2012. This risk factor is less of a concern with respect to ET since the lock up period from its IPO ended in late September 2012. ELOQ price action before it was acquired by Oracle highlights this risk. Its shares took a hit, falling from $24.65 to $15.71 during the weeks after it filed an S-1 on November 1, 2012 announcing that it was preparing for a secondary offering of 6 million shares held by pre-IPO shareholders (that it quickly canceled). However, investors who sold their ELOQ shares at depressed levels or became spooked by this event probably wish they would have stuck around since just within two months from this event, ELOQ agreed to be acquired by ORCL. Although, we need to be aware of the possibility of some selling pressure from EOPN weak hands, “takeover fever” could mitigate this risk.

So, in a nutshell, if you want to play in the SaaS sector, EOPN and/or ET shares may offer nice upside and limited downside for as long as the market rides the ELOQ wave. It is our opinion that ET seems like the less risky play. It is possible that the pool of quality SaaS companies will diminish as result of consolidation, so the acquisition activity may accelerate with an associated increase in takeover price tags.

Additional Notes

Here is a list of several other publicly traded SaaS companies with revenues less than $500 million.

- Aspen Technology, Inc. (NASDAQ:AZPN)

- Demandware (NYSE:DWRE)

- Guidewire Software (NYSE:GWRE)

- Intralinks Holdings (NYSE:IL)

- Netsuite Inc (NYSE:N)

- RealPage Inc (NASDAQ:RP)

- ServiceSource International Inc. (NASDAQ:SREV)

- Synchronoss Technologies, Inc. (NASDAQ:SNCR)

- Tangoe Inc (NASDAQ:TNGO)

- Responsys (NASDAQ:MKTG)

Of these choices, TNGO’s and MKTG’s recent price action seem to be responding well to the ELOQ/ORCL deal.

We will continue to track SaaS companies and provide updates to any of their stories as developments in this exciting space unfold.

Investors may also want to read a negative report published on Seeking Alpha by Kerrisdale Capital on SaaS company ServiceNow (NYSE: NOW), selling at a trailing EV to trailing sales that is well above the 7 companies we highlighted.

Caveats:

- EOPN negative cash flow

- Stock market turns south. Valuation methods like EV to Sales become less relevant in times of panic which is a risk for SaaS companies that do not report meaningful GAAP net income.

- Negative news from companies regarding failed integration of acquisitions

- Negative news from companies regarding accounting fraud in the “tricky to value” SaaS space as evident by the botched $10.3 billion acquisitionof Autonomy by Hewlett-Packard Company (NYSE:HPQ)

- The attractive SaaS space will continue to attract increased competition

- Reduction in number of potential acquisition suitors

- Determining which SaaS company will be acquired next

- Dilution due to the fact that many SaaS companies will have to raise capital if they operate at a negative cash flow position for extended periods of time. Capital to acquire new customers is a key to help curb this risk.

Disclosure: Long ET, EOPN, SLTC, MKTG; Small long position in TNGO; Due Diligence on TNGO and MKTG is not yet complete and may warrant closer looks into the companies’ business models and opportunities.