Summary:

- SEC stepping up pace of probe into marijuana stocks. Investors should be concerned about pump campaign financed by undisclosed shareholder(s) holding larger amount of MJMD stock they intend to sell.

- Shareholder who owns(ed) 15 million shares of MJMD has been fined by SEC for unregistered stock sales in a shell company he owned that the SEC claimed was part of a pump and dump.

- Shareholder who owns 7 million shares was just fined $8 million by FNRA for “anti-money laundering failures” involving $850 million in penny stock transactions.

- Chairman of board is director of company that received 26 million shares of MJMD per an exclusive licensing agreement.

- It appears MJMD omits relationship between itself and a company that the Chairman is a director of that aims to raise capital to fund marijuana investment.

We are not alone in the opinion that Medijane will attract the attention of regulators. Here is a quote from aimhighprofits, a site that tracks pump and dump candidates:

“Besides the recent 10-for-1 stock split to ready the ticker and entry into the one sector that needs no promoting, the medical marijuana sector, connections like Carrillo, Huettel & Zouvas, LLP having been the attorney for Mokita Inc. (“MKIT”) and Irma N. Colón-Alonso having been the former sole director are enough to make MJMD stock a prime candidate to be suspended by the SEC.

Carrillo, Huettel & Zouvas, LLP was the law firm that incubated nearly all of the 30+ shells that Awesome Penny Stocks promoted when they were in the game, raising over $3 billion in the course of three years. Those familiar with their history know that the law firm and the group are no longer in existence due to a real life version of “Catch Me If You Can,” however not every one who plays the pennies knows this.

Another bad sign for MJMD which increases its odds of being a losing trade was that when Mokita Inc. was preparing to strike it rich in the oil business after buying a working interest from Buckeye Exploration Company, their CEO, Irma N. Colon-Alonso, was teaching Zumba classes in Miami. Irma was the CEO until May of last year of Dephasium Corp. (DPHS), a suspect once to be a pick of Awesome Penny Stocks, which turned out to be one of the worst front-loaded penny stocks of last year dropping from 0.61 to 0.09 before you could spell D-E-P-H-A-S-I-U-M.”

Evolution of MJMD:

- Mokita went public through an self-registered IPO in September 2010, (Symbol MKIT)

- Attempts to create a viable enterprise failed: From a mineral exploration company to a credit card processing strategy to an oil and gas company.

- On February 27, 2014, Irma N. Colon-Alonso resigned as president, chief executive officer, chief financial officer, treasurer and director of our company. Ronald Lusk was appointed as president, chief executive officer and director of the company. Mr. Lusk acting as an officer the company, agreed to issue himself 5,000,000 shares of MJMD.

- On February 28, 2014, Caduceus Industries Ltd. (“Caduceus”) acquired 30,000,000 shares of the company’s common stock from Irma Colon-Alonso for $2,000. Lusk controls Caduceus.

- On February 28, 2014, Caduceus Industries Ltd. (“Caduceus”) acquired 30,000,000 shares of the company s common stock from Irma Colon-Alonso for $2,000.

- On February 28, 2014 the company was renamed MediJane holdings

- On March 14, 2014, MediJane Holdings Inc. (the “Company”) entered into a License Agreement with Phoenix Bio Pharmaceuticals Corporation (“Phoenix Bio Pharm”). Pursuant to the License Agreement, Phoenix Bio Pharm granted to the Company an exclusive license for the territory of North America to exploit all presently owned and after-acquired intellectual property rights and know-how of Phoenix Bio Pharm related to certain medical cannabinoid products and delivery systems for the treatment and management of illnesses.

- In consideration of the acquired license, the Company issued 26,000,000 shares of its common stock to Phoenix Bio Pharm.

- On April 30, 2014, the Board of Directors authorized the issuance of 115,000 restricted common shares to an accredited investor in consideration of $97,500.

We visited Phoenix BIO Pharm’s website to get an idea of how valuable this licensing agreement could be and could not find any information about any products or Intellectual Property it currently owns. When we click on the partnership heading we are prompted to sign up and log in to view content, which takes us back in a loop to the sign up page. Furthermore, the site appears to have been established in 2014. So, obviously we are not convinced that the Pheonix Bio Pharm is a meaningfully valuable asset. It is unclear why MJMD issued 26 million shares (worth around $26 million at the time the agreement was inked) to a company that appears to be a development stage entity.

SEC Taking Decisive Action:

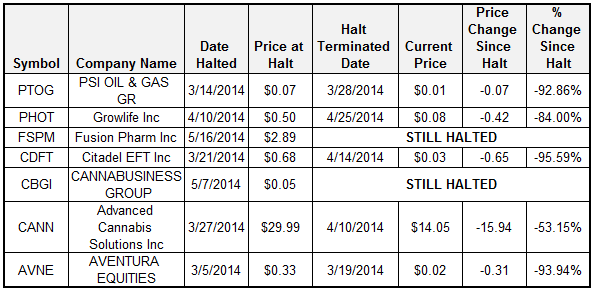

Since March 5, 2014 the SEC has halted at least seven stocks, five in the past two months, claiming to operate in the cannabis industry.

In general, common themes the SEC discusses when issuing halts have to deal with:

- disclosure issues,

- concerns over the accuracy of information in the market place,

- the existence of pump and dump campaigns and manipulative transactions in shares of stock.

The warning signs appear obvious to us that MJMD embodies these “halt themes” including the commencement of a pump campaign, large ownership ties to characters fined by regulators (SEC & FNRA), and weak disclosures.

The SEC has issued warning letters regarding investing in marijuana stocks over the last several weeks. On May 16, 2014 the SEC issued its latest warning on the sector:

“The Securities and Exchange Commission today cautioned investors about the potential for fraud in microcap companies that claim their operations relate to the marijuana industry after the agency suspended trading in the fifth such company within the past two months.”

“Recent changes in state laws concerning medical and recreational marijuana have created new opportunities for penny stock fraud,” said Elisha Frank, co-chair of the SEC Enforcement Division’s Microcap Fraud Task Force. “Wherever we see incomplete or misleading disclosures, we act quickly to protect investors.“

It amazes us that given the SEC’s recent proactive moves to halt shares of many of these names that investors are still propping up shares of many marijuana related stocks, including MJMD, that are the recipient of pump and dump campaigns.

A for profit promotional news letter from Undervalued Quarterly (UVQ) hit our email on May 13, 2014 distributed by Tobin Smith’s entity, NBT Equities Research. It referenced the performance of Fusion Pharm (PINK:FSPM) as a reason to own MJMD:

“Fusion Pharm, Inc. manufactures and sells a line of cultivation containers under the PharmPod brand name in the United States and its share price has risen from $.63 to $3.03 since January 2, 2014. That’s a 381% jump!”

Two days later it looks like this reference was misplaced and may infer that investors should be prepared for the worst since FPSM was halted by the SEC on May 16 2014. For those who are counting, the average performance of 24 stocks Tobin has promoted that we track is negative 58% with only 2 in the positive.

The contradictory language between the content in UVQ letters regarding MJMD and its disclaimer should be enough for regulators to take pause.

Here is part of the disclosure in a UVQ pump letter:

“This “advertisement” is not construed to be a recommendation by UVQ or an offer to sell or solicitation to buy or sell any security”

We think that the SEC would beg to differ that the following statement in the letter by its owner, David Katz, is not clear advice:

“Buy MJMD today at the current entry-level price.”

This MJMD letter by UVQ illustrates the same point:

“I’m writing directly to you today about a marijuana stock that’s poised to ignite a frenzy of profits. The company’s name is MediJane Holdings (MJMD) and I’m thrilled to tell you why MJMD belongs in your portfolio immediately.”

It is unclear who is funding the pump campaign, but Globalvisiion communications, LLC (GMS) based offshore in Nevis is a key player. The amount to fuel the pump campaign could be meaningful. While UVQ and its “endorser” have already received $20,000 and $1,500, respectively from GMS, GMS’s weekly advertising budget to promote the MJMD story is $400,000! And it looks like part, if not all, of the GBD budget is being financed by undisclosed shareholder(s) of the company. Furthermore, these shareholders intend to sell MJMD.

“IMPORTANT NOTICE AND DISCLAIMER: This is a paid advertisement by The Undervalued Newsletter (“UVQ”). UVQ has received $20,000 from or on behalf of Globalvision Communcations LLC (“GMS”) in compensation for this advertisement to enhance public awareness of Medijane Inc. (“Medijane” of the “Company”). UVQ endorser David Katz received a fee of $1,500. UVQ also expects to receive new subscriber revenue, the amount which is unknown at this time, as a result of this advertising effort. UVQ does not perform any due diligence on the stocks and companies discussed herein. UVQ relies on generally available public information and representations made by Medijane. UVQ does not purport to provide an analysis of any company’s financial position, operations, or prospectus. This advertisement is not to be construed as a recommendation by UVQ, or an effort to sell or solicitation to buy or sell any security. Never invest in any advertised company unless you can afford to lose your entire investment. Medijane, the Company featured in this issue, appears as paid advertising, paid by GMS to enhance public awareness for Medijane. GMS is managing an online weekly advertising budget of up to $400,000 USD in an effort to build industry and investor awareness, paid to GMS from shareholder(s) of Medijane. These shareholder(s) hold a large amount of shares in MJMD and intend to sell those shares. Their sales of MJMD common stock will affect the value of your shares (negatively). This should be considered a direct conflict of interest. The payment is to cover costs associated with creating and distributing this report online and GMS will retain any excess funds as profit. Although the information contained in this advertisement is believed to be reliable, UVQ makes no warranties as to the accuracy of any of the content herein and accepts no liability for how readers may choose to utilize it. The information contained herein is based exclusively on information generally available to the public and does not contain any material, non-public information. Readers should perform their own due-diligence before investing in any security including consulting with a qualified investment advisor or analyst. Readers should independently verify all statements made in this advertisement…”

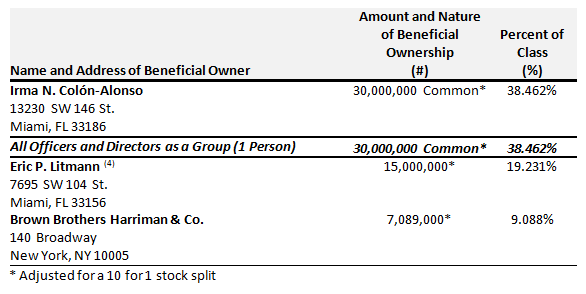

Given that two shareholders who collectively may own 22 million shares or 23% of the outstanding share count have been fined by the SEC and/or FNRA for infractions related to penny stock transactions, we don’t see how regulators can ignore the multiple facets of this story.

Our due diligence indicates that MJMD shares outstanding are around 94 million, adjusted for a 10 for 1 forward stock split executed on August 23, 2013:

- 63 million Shares outstanding pre-MJMD + 5 million issued to newly elected CEO Lusk + 26 million shares issued for licensing agreement with a company that the MJMD Chairman of the board is a director of over 115 thousand shares from financing.

The distribution of shares appears to be as follows”

- Ronlad Lusk, CEO: 35 million shares

- Phoenix Bio Pharmaceutical, Licensing partner: 26 million shares

- Eric P. Littman, fined by SEC in 2006: 15 million shares (Littman may have cancelled his shares in 2013, but we won’t know until the next 10-K is filed for the fiscal year ended February 28 , 2014)

- On August 22, 2013, a shareholder of the Company voluntarily cancelled 15,000,000 common shares.

- Brown Brothers Harriman & Co., Fined $8 million by FNRA in early 2014 for its prior involvement in penny stock transactions: 7.08 million shares.

- Undisclosed Investor from financing deal: 115 thousand restricted shares

- Other investors (less than 5% holders): 10 million shares (25 million if Littman canceled his shares).

The shares of MJMD owned by these individuals are now worth around $85 million in MJMD ($70 million if Littman cancelled his shares). Given that the UVQ disclaimer mentioned that shareholder(s) who own large amount of MJMD stock are financing the promotion, we think these players represent a good starting point to identify the shareholder(s) behind the pump campaign.

In addition to what we have already discussed, we suggest that regulators explore each of the next sections since we believe they hit on issues they are keenly interested in when considering whether or not to halt shares of companies claiming to have a cannabis angle.

Large Shareholders Have Run-Ins With Regulators

Investors may become very concerned about investing in MJMD once they delve into some of the characters involved in the story. After reading SEC filings we learned that Erick P. Littman, a person involved in the shell (Mokita) that hosted the MJMD reverse merger transaction and owned 15 million shares of the shell, was accused by the SEC of secretly selling unregistered stock of Nutraceutical Clinical Laboratories International, Inc. Also, another shareholder who owns 7 million shares of MJMD, Brown Brothers Harriman & Co, was recently fined $8 million by FNRA for executing transactions in penny stocks flagged as suspicious by FNRA.

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of June 6, 2013, by: i) each of our directors; ii) each of our named executive officers; and iii) each person or group known by us to beneficially own more than 5% of our outstanding shares of common stock.

The Littman Files

On March 29, 2011, Eric P. Littman was appointed as a member of the Mokita’s Board of Directors and was issued 1.5 million shares for “services rendered on June 20, 2011.” It was not until an 8-K was filed on September 22, 2011 that Littman amended his glowing biography disclosed in previous filings with the following additions:

“In January 2006, the SEC instituted a civil action against Mr. Littman and others in the U.S. District Court, Middle District of Florida. In a single count against Mr. Littman, the SEC alleged that in September 2000, Mr. Littman had engaged in the sale of unregistered securities. In December 2005, Mr. Littman, without admitting or denying the allegations of the SEC’s complaint, consented to a judgment enjoining him from future violations of the registration provisions of the Securities Act of 1933. Importantly, at no time did the SEC take any action against Mr. Littman as an attorney, try to prohibit him from practicing before the SEC or restrict him from being an officer or director of a public company. Presently, Mr. Littman continues to practice before the SEC as an attorney.”

However, the details within the SEC complaint are much more revealing:

“The Commission’s complaint, filed on Nov. 15, 2004, alleges that Littman made unregistered sales of the securities of St. Petersburg-based Nutraceutical Clinical Laboratories International, Inc. in violation of Sections 5a and [C] of the Securities Act. According to the complaint, in June 2000, Nutraceutical, then a private company, reverse-merged into a publicly-traded shell company named October Project II Corp. (Which then was renamed Nutraceutical). Littman controlled the shell company as its majority stockholder and its sole officer and director. As part of the merger, Littman arranged to secretly sell nearly 95% of the shell company’s outstanding shares of common stock for approximately $150,000 to nominee entities controlled by Nutraceutical insiders, including its executive officers, attorney and promoter. Based on his ownership of the shell company’s shares, Littman earned $120,000 of this $150,000 sale price. According to the complaint, Littman’s stock sales were not registered with the Commission, as required under Section 5 of the Securities Act.”

“The Commission’s complaint also charged five different individuals with securities fraud and registration violations for their participation in an alleged “pump and dump” stock manipulation scheme involving the Company.”

On February 14, 2012 Littman resigned as a director but still owned 15 million shares of the pre-MJMD stock (split adjusted) as of the most recent 10-K. Now, it’s possible that Littman may have cancelled his stock due to the following statement from the most recent 10-Q:

“On August 22, 2013, a shareholder of the Company voluntarily cancelled 15,000,000 common shares.”

If Littman has indeed cancelled his stock we are inclined to conclude he may have known that the company was headed towards a pump and dump route and did not want to get involved given past alleged infractions against him. Why else would he forgo the millions of dollars his shares would now be worth? Regardless of our findings on Littman our next piece of due diligence should continue to raise some eyebrows.

The Brown Brothers Harriman & Co Files:

We also learned that Brown Brothers Harriman & Co (“BBH”) owns 7.1 million shares of MJMD (split adjusted) according to most recent 10-K. Brown Brothers Harriman & Co.

“…is an American investment bank and securities firm, founded in 1818. It is the oldest and largest private bank in the United States.”

Don’t let BBH’s “reputation” fool you. BBH was just fined a record $8 million for “anti-money laundering failures.” This quote from stocklaw.com shows how damning this finding is.

“According to the findings, from 2009 through 2013, Brown Brothers Harriman directly executed sales or acted as a custodian in delivery of over 6 billion shares of low-priced penny stock securities, generating more than $850 million in proceeds, though just 20% were attributable to Brown Brothers Harriman as executing broker.

Because penny stocks carry higher-than-average risks because they may be “easily manipulated by fraudsters,” according to the SEC, federal law requires firms to apply heightened scrutiny and due diligence to penny stock transactions and especially those red flagged or deemed “suspicious.” FINRA’s investigation states that regardless of these warnings and alerts, Brown Brothers Harriman conducted penny stock transactions on behalf of multiple bank customers in foreign markets, including Switzerland, Guernsey and Jersey, or what FINRA deems “known bank secrecy havens.”

Moreover, the firm and Crawford as AML Compliance Officer were allegedly aware of brokerage activity-such as large volume deposits followed shortly thereafter by large block penny stock sales-that should have, according to FINRA, triggered a Suspicious Activity Report.”

Given the history of BBH we were surprised to learn that they were shareholders. Even more telling is that it appears BBH approved some of the corporate actions at MJMD, as quoted from the February 8, 2014 8-K:

“On February 28, 2014, we received written consent from our company’s board of directors and the holders of 51.47% of our company’s voting securities to change the name of our company to “MediJane Holdings Inc.”

Pursuant to Section 78.320 of the Nevada Revised Statues, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if a written consent to such action is signed by stockholders holding at least a majority of the voting power and on February 28, 2014, we received written consent from the holders of 51.47% of our company’s voting securities, for a name change to “MediJane Holdings Inc.”

At the time of this filing Lusk was the sole board member and owned around 40% of MJMD stock. Thus given that almost 100% of other shareholders approved the name change implies that BBH’s position as a large holder, could have been aware of corporate plans.

Why are the findings on Littman and BBH relevant?

- Because P&D players often employ conduits to secretly sell stock.

- Littman was accused of secretly selling unregistered stock.

- Even if Littman absolved himself of MJMD, BBH also has history of executing transactions in “known bank secrecy havens.”

Until MJMD changed its focus to a cannabis angle, the stock traded sparingly (under one million shares in 2013) making it virtually impossible for insiders to cash in shares, recent volume helped along by the promotional campaign may lead to the perfect exit opportunity. Is this why BBH may have approved the change in business? At the very least we see very little reason that BBH will want to hang on to its stock in light of the FNRA fine, and what better way to create volume to exit the position than to approve the change in business focus to one that is targeting a sexy industry? Still, 7 million shares is a substantial amount to unload when the average trading volume of MJMD was under 200,000 over the last ten days and around 100,000 since volume began coming into the stock on March 5th, 2014.

Accuracy of Claims/Incomplete Disclosures

Investors may look at MJMD press releases and be misled to think the company is more than just a development stage company, prompting them to buy MJMD stock based on misinformation. This is why we believe that the SEC stated:

“Wherever we see incomplete or misleading disclosures, we act quickly to protect investors.“

A simple look at statements made by the company should easily illustrate our point that press releases appear to be stretching the truth.

Statement One

“The sublingual delivery system is one of the most effective and convenient drug delivery systems available for patients requiring regular self-medicated doses and, in the case of Canna-mist, provides the patient with fast relief from pain and inflammation,” commented Lewis “Spike” Humer, Chairman of MediJane Holdings Inc”

This is a fairly strong statement and one we think the company needs to support.

Statement Two

“Our sales, marketing, and manufacturing team is currently finalizing the product and we expect to have the newly branded MediJane “Canna-mist” ready for distribution in targeted states across the country in just a few weeks.”

Manufacturing team? Investors should be provided more detail on its manufacturing team.

Statement Three

“MediJane Holdings Inc. is in the business of marketing and distributing products within the medical marijuana industry, including transdermal patches, capsules, sublingual sprays, and other medical delivery systems.”

As far as we can tell from the company’s website it does not market any transdermal patches and other medical delivery systems yet. We were only able to locate details about a capsule and a spray.

Statement Four from Promotional Letter

“Introducing its first breakthrough product (with many more products soon to be rolled out) that allows the health benefits of marijuana to last all day.”

More importantly, the company disclosures regarding its relations with certain companies needs to be addressed.

The company’s website discloses the following partnerships:

- National Cannabis Industry Association

- Phoenix Bio Pharmaceuticals

- River Rock

- Go Kush

But we are more interested in the “relationship” it does not disclose – Phoenix Pharms Capital.

Who is Phoenix Pharms Capital? MJMD discloses its relationship with Phoenix Bio Pharmaceutical, but not one with a company called Phoenix Pharms Capital.

We learned that a company by the name of Phoenix Pharms Capital claims to be in an alliance with MJMD. We learned of this relationship by listening to a video showcasing Phoenix Pharms Capital who claims to be a company focused on:

“…facilitating, financing and operating health and wellness centers in conjunction with the nation’s leading cannabinoid specialists.”

Phoenix Pharms Capital claims it has formed “alliances” with

- River Rock

- Holos Health

- MJMD

- Phoenix Bio Pharmaceuticals

- Phoenix Health Care Net Work

- WeedMd

According to the video clip Phoenix Pharms Capital will provide funds to MJMD to set up marijuana and cancer clinics in return for a percentage of revenue generated from these clinics. This appears to be a very relevant agreement for which investors should have more detail through MJMD disclosures.

Notice that Phoenix Pharms Capital also has a relationship with Phoenix Bio Pharm, the company MJMD just signed a licensing agreement with. How related are they? We believe the relationship between these two Phoenix companies is more than just an arm’s length one, as they share the same address and telephone number. How is Phoenix Pharms Capital going to raise capital to fund its business plan? We are curious if the MJMD/Phoenix Bio Pharm $26 million licensing deal is just a conduit to raise money for Phoenix Pharms Capital or line the pockets of individuals with ties to the Phoenix “consortium.”

Consider that MJMD Chairman, Lewis “Spike” Humer, is also is a director of Phoenix Pharms Capital and Phoenix Bio Pharmaceutical.

“Since February 2014, Mr. Humer has served as an officer and director of Phoenix Pharms Capital Corporation. Since late April 2014, Mr. Humer has served as a director of Phoenix Pharms Inc., a holding company and Phoenix Bio Pharmaceuticals Corporation, an entity engaged in the treatment of illnesses within the bio pharmaceutical and medical marijuana industry.”

So Spike is a director of what appears to be development Stage Company that is now worth $26 million from holding MJMD stock and also a director of a company (Phoenex Capital) that seeks to raise money for cannabis operators.

The company also appointed Dr. Joseph Cohen as Chief Medical Officer and to the Board of Directors. Cohen has ties to Holos Health, a company that is seeking capital through an “alliance” with Phoenix Capital.

Overall, the disclosures regarding relationships in this story are not consistent across the websites of MJMD, Phoenix Pharms Capital and Phoenix Bio Pharm.

- MJMD omits an alleged alliance with Phoenix Capital

- One of Phoenix Capital’s websites omits many of the alliances mentioned in the video clip

- Phoenix Bio Pharmaceuticals show no partnerships or product portfolio

Furthermore Phoenix Pharms Capital appears to have multiple sites with different information across some of them.

At the very least, in our opinion, the lack of organizational structure portrays inept management teams.

More on the Pump Campaign:

The icing on the cake is that as already discussed, a 3rd party promotional campaign has already commenced on MJMD, financed by shareholders through Globalvision communications, LLC (GMS). We already mentioned that UVQ and its endorser were compensated a combined $21,500. Tobin smith is also promoting MJMD by sending out UVQ letters via email. The pump and dump crowd should be familiar of Tobin Smith who seems to have a knack for being compensated for what we view as pump and dump stocks. Recall that Tobin was fired from a position as a Fox Business analyst in 2013 for taking part in a promotional campaign of a penny stock. Here is a quote from the article discussing this matter:

“There’s a reason people tend not to trust the testimony of paid experts. Why? Because they’re paid, of course. Because they’re paid, of course.

This week, we have witnessed the same kind of bias in traditionally-trusted news pundit Tobin Smith. Now an ex-business news contributor, Smith was fired from the Fox Business Network show Bulls & Bears, because he was paid $50,000 dollars to promote and aggressively sell the stock of Petrosonic Energy in his “Next Big Thing Investor Newsletter,” even though evidence suggested it may have not had such a successful future.”

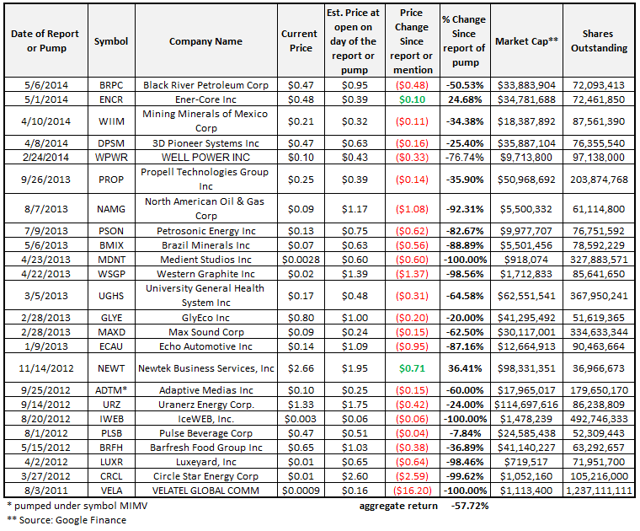

Based on the performance of the stocks that Tobin has been paid to promote, we have little confidence that he has the skillset to identify the next big idea:

The average performance on these 24 stocks is about negative 58% with only 2 in the positive.

Although we were not able to find much information on Joseph Katz of UVQ, he can be tied to the penny stock ZENO. On April 10, 2014, he wrote a promotional piece on the stock which has the same flavor as most other pump and dump advertisements we come across. ZENO, now trading around $0.45 basically immediately declined from its price of $0.75 on April 10, 2014.

Conclusion:

Like many stocks we tag as pump and dumps, it look like MJMD is attempting to portray a sense of legitimacy by beefing up its board, entering into licensing agreements and offering limited products. However, it appears that the SEC is cracking down on cannabis related companies with weak disclosures and/or misleading comments about operations. We are short MJMD believing that shares run a risk of attracting regulatory scrutiny or at the very least suddenly imploding when the impending dump occurs.