GeoWire Monthly, Vol. 4, Issue No. 8, August 2024 Review

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 4, Issue No. 8, August 2024 Review

In This Month’s GeoWire

- Hindenburg’s Short Report on SMCI Short: What Their Findings Can Mean For TSSI.

- Hot on Trail of New Data Center Play, More in the Pipeline

- Discussion with another Microcap CEO Further Reinforces Bull Case for His Company With New Focus On Data Center Market. [45% to 155% Upside]

- Complimentary Video Clip: LAKE at the 4th Annual Semco Capital Networking Event

- Must-Read Stock Pitch on U.S. Listed China Based Stock, But Please Don't Shoot the Messenger!!

- Monthly newsletter archives

- Best microcap performers in August

- Buy On Pullback Portfolios End of Month Performance Update

- GeoInvesting research progress to date.

A brief message from Maj

We’ve been hot on the trail of data center-themed stocks, especially after one of our Top 5 Faves, Tss, Inc. (OTCQB:TSSI), showboated its way from $0.27 at the beginning of the year to a recent high of $5.67, or over 1,900%.

With each week that goes by, more investors are understanding that TSSI may be the main rack integration partner for DELL. This information discovery process will take a little longer on the over-the-counter market, where TSSI trades.

This multibagger move was helped along by a series of circumstances that all fed into the stock’s momentum, from an obvious data center branding strategy showcasing itself as a major contender in the data center services space (with DELL as its largest customer), to a better than expected Q2 earnings report, to last week’s Hindenburg Research short report on Super Micro Computer, Inc. (NASDAQ:SMCI).

The Hindenburg report put TSSI in the spotlight as investors digested the information and scrambled to understand how the company may be a beneficiary of the bad press on SMCI. This gave TSSI a little shove upward before the stock settled below $5.00 on Friday.

Hindenburg accused SMCI of fraud, accounting irregularities, and significant quality control issues. The report highlighted high server failure rates (up to 17.5%), firmware problems, and poor after-sales service. This is significant as SMCI competes in areas similar to TSSI, including data center integration and server solutions.

TSSI, which partners with Dell, may stand to benefit from SMCI’s challenges, if they already aren’t. Dell, praised for its quality and reliability, was identified by Hindenburg as a key competitor. The report suggests that SMCI is losing business to more reliable competitors like Dell, which could create new opportunities for TSSI.

200+ Multibaggers And Counting

The fact of the matter is, our Artificial Intelligence Screen, which now includes 17 stocks, helps us to stay primed to quickly deploy research resources on stocks on this list that we think are timely and undervalued. This already worked with one stock on the screen that we swiftly added to our Buy on Pullback Model Portfolio #12 at depressed prices. It ended up rising over 60% in 2 weeks, and we still think it has a near term upside of between 45% to 155%.

In a recent quarterly update, this company indeed revealed its strategic push into the data center market, securing long-term agreements for its power-related products that serve this sector. The increasing global demand for data center power solutions positions the company favorably.

Moreover, a review of the company’s website confirmed its focused strategy on the data center market, further validating our positive outlook on their direction.

Regulatory filings highlighted the company’s prioritization of the rapidly growing data center sector, with efforts to enhance manufacturing capacity to meet the rising demand for its critical infrastructure products.

Our research indicated that despite recent revenue declines due to the company exiting low-margin areas, this strategic shift enables a focus on higher-margin opportunities. Coupled with debt reduction and a refined business model, the company appears poised for accelerated earnings growth as sales begin to recover.

Last week, we spoke with the CEO of the company, and he will soon be joining us for a live discussion which all Premium Members can attend.

So, if this wasn’t exciting enough, our pipeline of AI-centric and data center-themed stocks contains a few more dark horses that no one is talking about and that we think could be great candidates should their turn come up due to unjustly beaten down stock prices. You never know when that will happen, but better to be ready to pounce than asleep at the wheel.

Continue Reading Rest of Commentary Here.

Complimentary Video Clip

On August 15, 2024, at the The 4th Annual CEO Networking Event in Chicago, Illinois, Jim Jenkins (CEO) and Roger Shannon (CFO) of Lakeland Industries, Inc. (NASDAQ:LAKE) participated in a fireside chat.

Maj Soueidan, the co-founder of GeoInvesting, conducted interviews with both executives, where they discussed the company’s recent developments, including its acquisition strategy. Jenkins highlighted the company’s transition from a traditional personal protective equipment (PPE) provider to a more aggressive growth-oriented firm, partly inspired by his previous success at Transcat, Inc. (NASDAQ:TRNS). They focused on their “small, strategic, and quick” acquisition approach, emphasizing recent deals like the LHD acquisition, which has expanded their fire fighting turnout product line and market presence in key regions like Australia and Germany. The discussion also covered their goal to boost EBITDA margins, the importance of recurring revenue from new services like laundry and software for firefighting gear, and the ongoing efforts to optimize operations in Europe and Asia. The conversation concluded with an optimistic outlook on achieving their long-term revenue and margin targets, despite the challenges ahead.

This Chicago Networking Event was designed to give the opportunity for microcap management teams handpicked by Geoinvesting Subscriber Scott Weis of Semco Capital to present their stories to about 30 investors, allowing the companies to showcase their business models and growth strategies.

The gathering is a significant opportunity for investors to engage directly with management teams, gaining insights that might not be accessible through regular market channels.

This event, organized by Scott Weis of Semco Capital, continues to be an important forum for microcap companies to connect with microcap investors. This is Scott’s 4th Chicago microcap conference event.

If you Are Not a Premium Member, You can Subscribe Here for full access to all our video events

Must-Read Stock Pitch

Premium Morning and Weekly Emails You May Have Missed in August 2024

Weekly Recaps, August 2024

Morning Emails

Monthly Newsletter Archive

Stat Summarizations

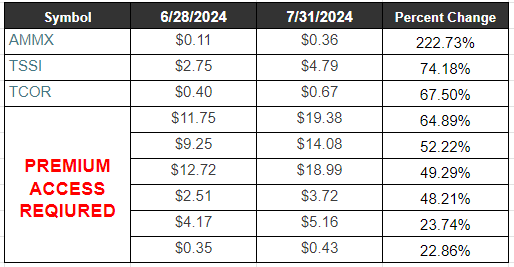

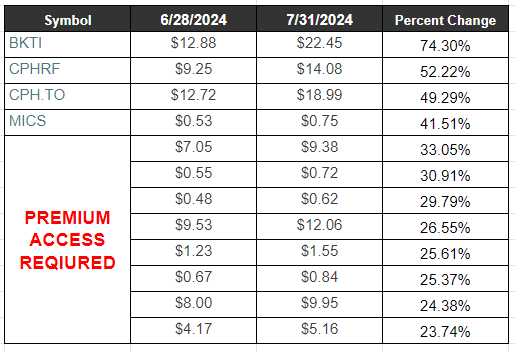

Top Performance Across All GeoInvesting Model Portfolios and Screens (In August 2024)

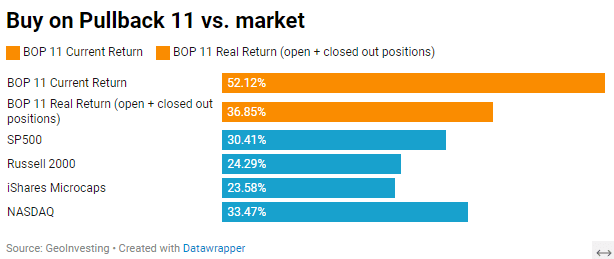

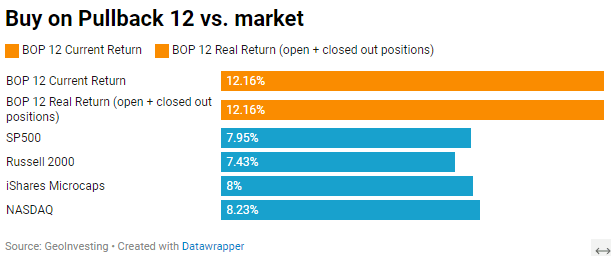

Buy On Pullback Model Portfolios 11 & 12 Return Stats as of end of August 2024

Buy on Pullback Model Portfolios are aimed at swiftly capitalizing on mispriced opportunities in the market, identifying stocks experiencing negative or muted reactions to positive news or downside overreactions to negative news that we see as temporary.

Misunderstood company developments, emotions, or negative market sentiment can often be at the core of the mispricing, so the pullbacks often stem from investor overreactions and may not necessarily reflect the underlying fundamentals of the business.

Research Progress, August 2024

*Please also note that year to date, we’ve published 184 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

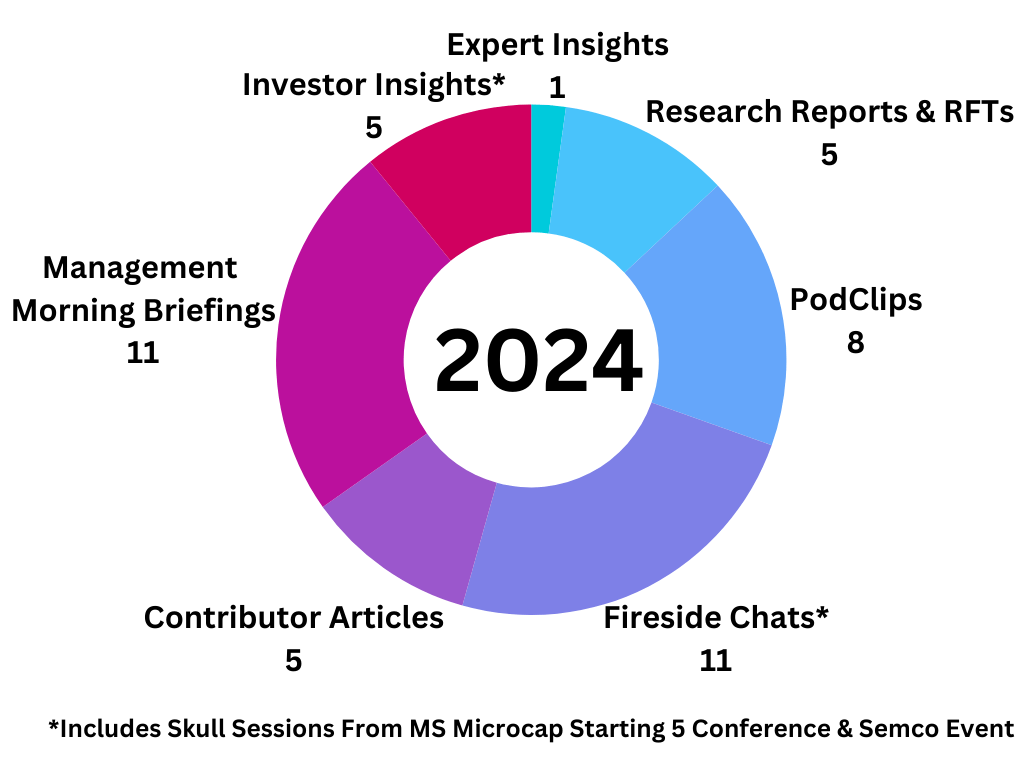

So far in 2024,apart from daily emails and weekly GeoWire Content, we have published a combined 230 pieces of Premium content (including video clips) across the segments detailed in the appendix.

As a reminder, in 2023 we published a combined 329 pieces of Premium content across GeoInvesting’s platform.

To see more details on 2023 and 2024 year to date earnings, please go here.

Earnings Processed, August 2024

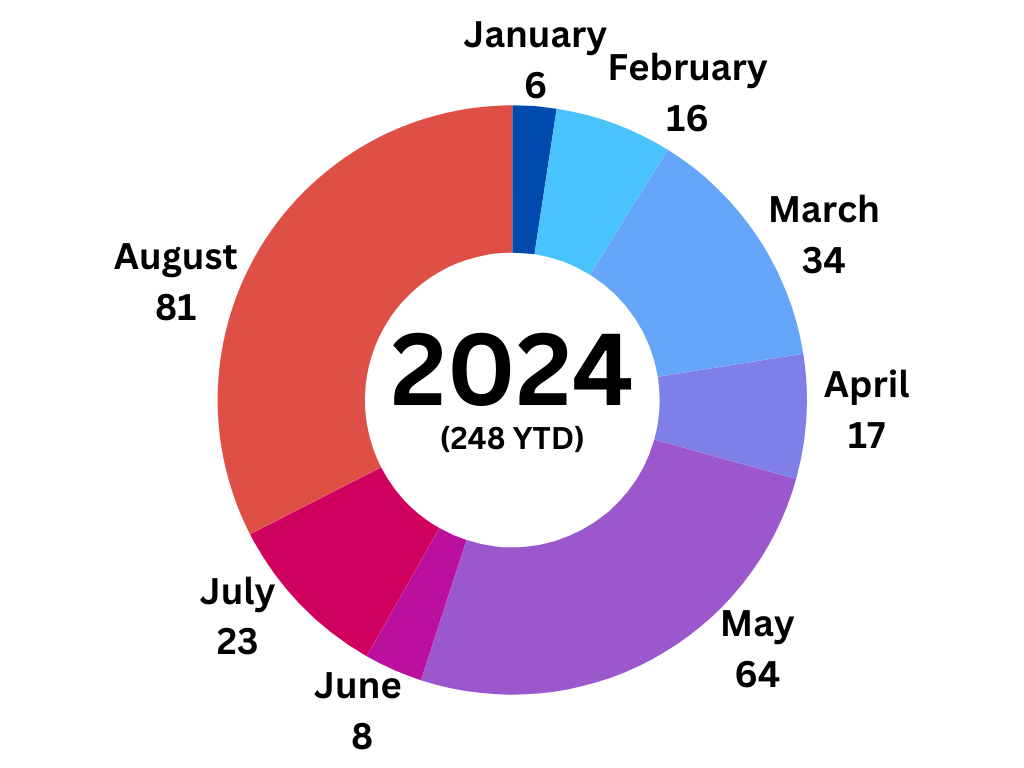

Earnings season was in full swing this month as Q2 reports rolled in. We processed 81 reports in August 2024, bringing our full year total to 248.

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- Stock picks from our analyst team, backed by in-depth research

- Model portfolios curated by the GeoInvesting that include timely microcap stocks in “Buy on Pullback” and other themed portfolios and screened lists.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails.

- 16 Years of archived research on over 1500 microcap stocks and counting.

- Stock pitches from our Premium subscriber investor network.

- Live and Archived Video Events:

– CEO Fireside Chats and Briefings.

– Microcap Expert Interviews.

– Monthly Coverage Universe Review. - Week In Review Newsletter, just in case you missed our updates and alerts.

- Multibagger case studies and Investment Process Education.

Appendix

Content Distribution Key

Written

5 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

5 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

7 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

2 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

7 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

5 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

3 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

104 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.