GeoWire Monthly, Vol. 4, Issue No. 12, December 2024 Review

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 4, Issue No. 12, December 2024 Review

In This Month’s GeoWire

- Will 2025 be as exciting as 2024? We think so.

- Drones: A theme we believe is worth looking into as there will only be a handful of standouts.

- AtmosInvest Founder Kevin Schoovaerts on Concentration vs. Diversification.

- Monthly newsletter archives.

- Best microcap performers in December 2024.

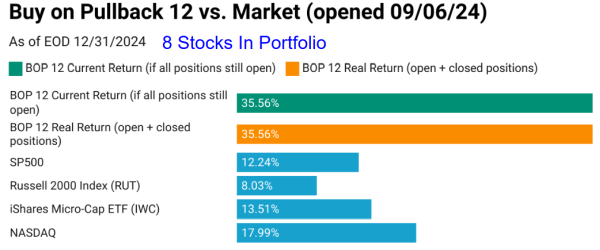

- Buy On Pullback Portfolio #12 Performance Update: ~23.3% Alpha Over S&P

- Forum Focus Model Portfolio Performance Update:: ~23.2% Alpha Over S&P

- GeoInvesting research progress to date.

A message from Maj

2024 In The Rear-view Mirror, But Not to be Forgotten as 2025 Signals Similar bullish Trends

Fresh off our Live Open Forum reviewing December 2024, we are welcoming 2025 with continued optimism that microcaps will continue to perform well, especially in certain industries. While we didn’t do a full year review as part of the forum, a few days earlier I was able able to sit down with Bobby Kraft of the Plant Microcap Podcast for a focused MicroCap Year-End Review in which we dissected key developments in the microcap space over the past year.

By the way, at one point during my conversation with Bobby, I talked about the differences and similarities between Geoinvesting and the Microcap Investing Cliff Note Substack. I get a lot of questions on that subject, so I thought the year-end review would be a great time to touch on it.

My goal was to review the performance of microcap indexes and spotlight specific stocks where detailed research and information arbitrage gave us an edge in the market.

It also included an analysis of our growing interest in misunderstood stocks trading below $1 and how we are going all in in Information Arbitrage research to identify the companies that the market is unjustly ignoring.

—

Read More at Our 1/5/2025 GeoWire Issue Here

200+ Multibaggers And Counting

Whittling Down our Microcap List of Potential Drone Trend Beneficiaries [Pitch Included]

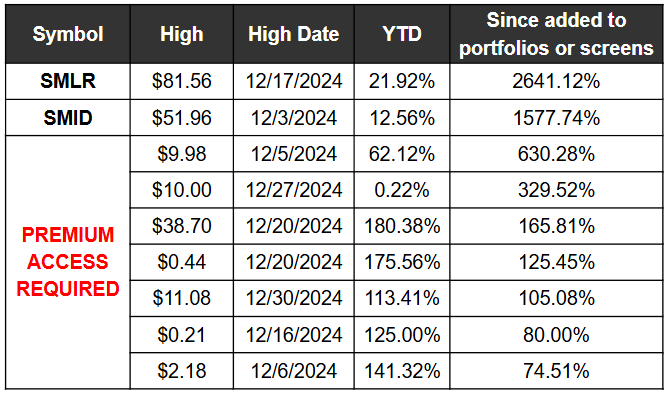

Buy On Pullback #12 & Forum Focus Model Portfolio Return Stats as of end of December 2024

About The Buy on Pullback Model Portfolios

Buy on Pullback Model Portfolios are aimed at swiftly capitalizing on mispriced opportunities in the market, identifying stocks experiencing negative or muted reactions to positive news or downside overreactions to negative news that we see as temporary.

Misunderstood company developments, emotions, or negative market sentiment can often be at the core of the mispricing, so the pullbacks often stem from investor overreactions and may not necessarily reflect the underlying fundamentals of the business.

High-conviction Open Forum Picks

High-conviction Open Forum Picks arise from analysis of an already bullish basket of stocks in our coverage universe. One timely stock per month is highlighted in our Live Monthly Forum Virtual Events and added to the Focus Model Portfolio, with expectations that a short-term 50% to 100% upside is possible. All Open Forums are archived on our premium portal. upside is possible.

Click Here To Gain Access To Our Buy on Pullback Model Portfolio #12 And Open Forum Focus Stocks.

Another Complimentary Video: Kevin Schoovaerts on Concentration vs. Diversification: Striking a Balance

On December 13, 2024, we held an Investor Insights Skull Session with Kevin Schoovaerts, founder of AtmosInvest. In this clip, Kevin delves into the debate of concentration versus diversification, sharing his own philosophy and experiences.

Concentration

He explains that he runs a concentrated portfolio of about 12-15 holdings, with his top three positions making up 40% of his portfolio. This approach allows him to go deep into his research while maintaining conviction in his best ideas, but he acknowledges that concentration requires a high tolerance for volatility and a clear understanding of one’s investment process.

True Diversification

Kevin points out that true diversification is not just owning many stocks, but ensuring that a portfolio covers varied business lines, geographies, and client bases.

He contrasts his strategy with more diversified approaches, such as Maj Soueidan’s MicroCap Quality Index, which includes over 100 positions to minimize risk while still capturing upside from multi-bagger opportunities.

Kevin stresses the importance of self-awareness in choosing a strategy, explaining that concentration suits his part-time investor schedule of 20 hours per week.

Initial Smaller Positions

He also highlights the role of initial smaller positions as a way to test ideas before scaling up, avoiding the pitfalls of overly broad portfolios that dilute potential gains. This candid discussion provides valuable insights for investors navigating the trade-offs between risk, reward, and personal preferences.

What is The Starting Five?

The ‘Starting Five Virtual Conference’ is an event series hosted by MS Microcaps, featuring presentations and stock pitches from various investors and industry experts. These conferences provide a platform for sharing investment strategies and insights into specific stock opportunities.

If you Are Not a Premium Member, You can Subscribe Here for full access to all our video events

Premium Morning and Weekly Emails You May Have Missed in December 2024

Weekly Recaps, December 2024

About The Weekly Wrap Up

This is a comprehensive weekly premium email newsletter that encapsulates all the significant updates and insights from the week, just in case you were not unable to catch up with our coverage from daily Morning Emails during the week, as well research content we save for the weekend. Each issue begins with a topical introduction, followed by a recap of our mail summaries.

- New research coverage on our research pipeline.

- Reaffirming commentary on our high conviction stocks.

- Microcap stock education

- Case studies.

- Featured videos.

Morning Emails

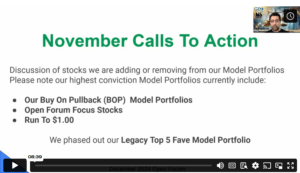

About Our Daily Premium Emails

These emails provide you with essential updates to start your day, relating to our over 1,500 microcap company coverage universe. Updates include:

- Calls To Actions, letting you know what stocks we are adding or removing from our Model Portfolios that our premium subscribers can choose to mimic.

- Tables and analysis of the best microcap earnings reports.

- Top Stock Pitches from investors we respect.

- GeoInvesting special event notifications.

Monthly Newsletter Archive

Stat Summarizations

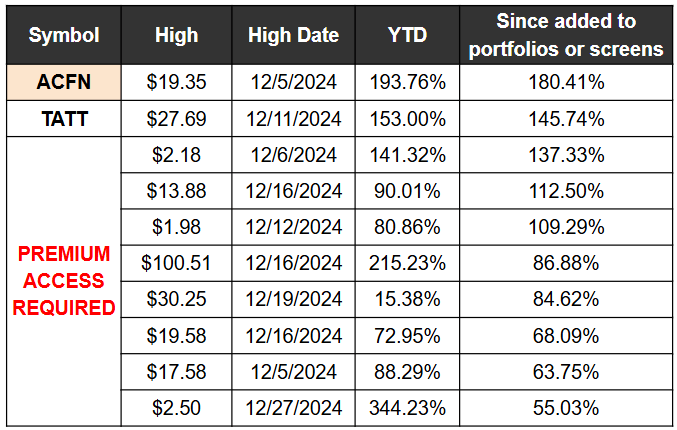

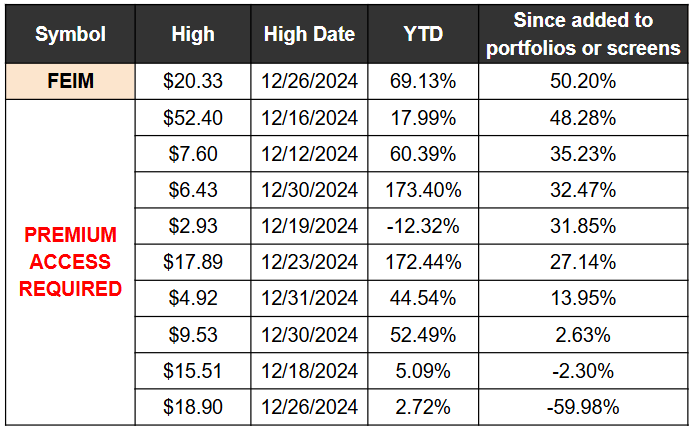

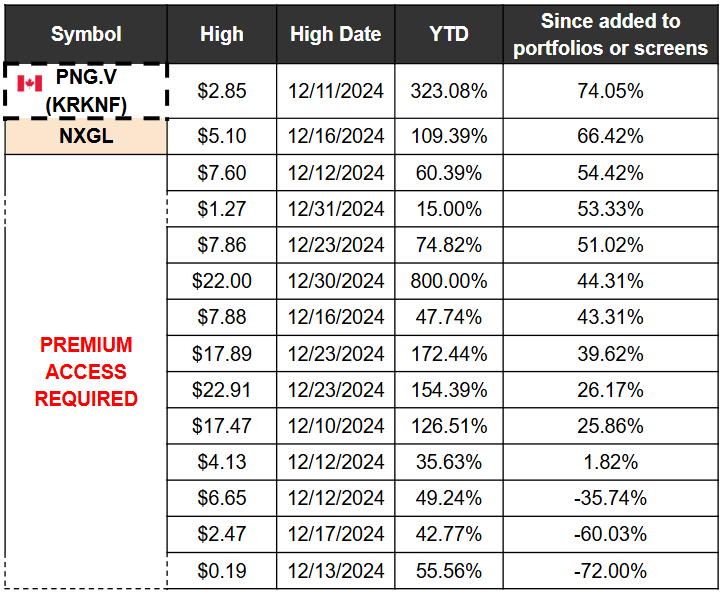

Top Performance Across All GeoInvesting Model Portfolios and Screens (In December 2024)

New Highs Across All GeoInvesting Model Portfolios/Screens

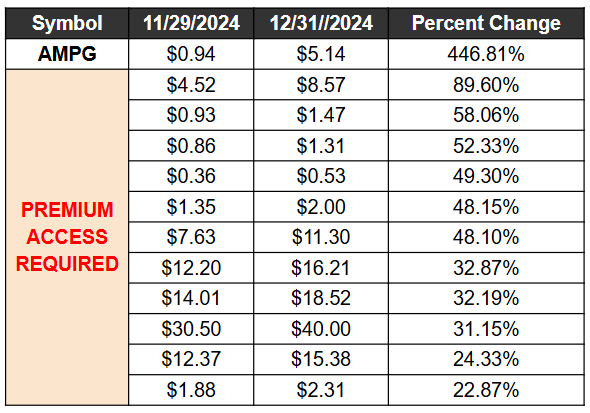

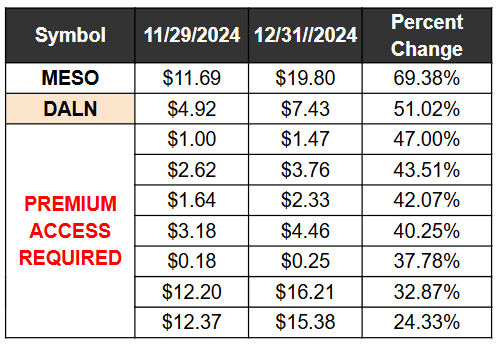

>20% Gainers Across All GeoInvesting Model Portfolios/Screens

>20% Gainers Across Contributor Index

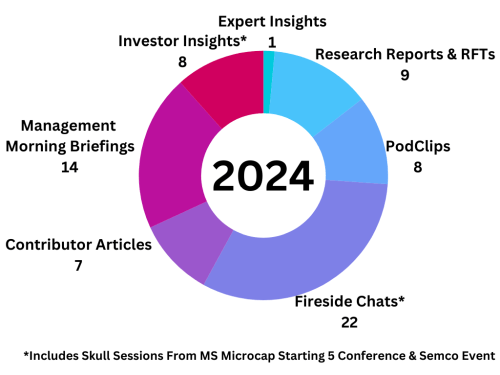

Research Progress, December 2024

Please also note that year to date, we’ve published 263 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2024, apart from daily emails and weekly GeoWire Content, we have published a combined 335 pieces of Premium content (including video clips) across the segments detailed in the appendix, versus 329 pieces of Premium content in 2023

To see more details on 2023 and 2024 year to date earnings, please go here.

Earnings Processed, YTD to December 2024

Earnings season picked up a bit in December as we began preparing for Q3 reports. We processed 8 reports in December 2024, bringing our full year total to 334.

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- Stock picks from our analyst team, backed by in-depth research

- Model portfolios curated by the GeoInvesting that include timely microcap stocks in “Buy on Pullback” and other themed portfolios and screened lists.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails.

- 16 Years of archived research on over 1500 microcap stocks and counting.

- Stock pitches from our Premium subscriber investor network.

- Live and Archived Video Events:

– CEO Fireside Chats and Briefings.

– Microcap Expert Interviews.

– Monthly Coverage Universe Review. - Week In Review Newsletter, just in case you missed our updates and alerts.

- Multibagger case studies and Investment Process Education.

Appendix

Content Distribution Key

Written

9 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

5 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

8 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

1 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

22 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

13 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

7 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

258 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)