GeoWire Monthly, Vol. 4, Issue No. 10, October 2024 Review

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 4, Issue No. 10, October 2024 Review

In This Month’s GeoWire

- Introducing a New Initiative - "You Make The Call" - For Investors Who Value Getting a Solid Look at Speculative Microcaps Out To Prove Themselves.

- Another Full Complimentary Video - Dan Schum on Balancing a Broad Portfolio with Opportunistic Investing.

- Must-Read Stock Pitch: Inside This MedTech Company’s Turnaround: We See 100% Short-Term Upside.

- Monthly newsletter archives.

- Best microcap performers in October 2024.

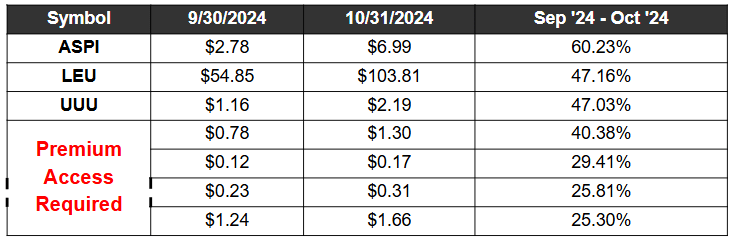

- Buy On Pullback Portfolio #12 Continues to Perform, Now Producing 11% Alpha Over S&P since launch 8 weeks ago..

- Forum Focus Model Portfolio End of Month Performance Update.

- GeoInvesting research progress to date.

A brief message from Maj

This past week, we introduced a new theme within the world of GeoInvesting Skull Sessions: “You Make The Call.”

In our November 4, 2024 morning email, when we introduced the concept and explained our motivation for this new endeavor. In case you missed that email, here’s what these events are all about:

This event format is on an experimental basis, but we thought it’d be a good idea to bring in management teams from speculatively-viewed companies eager to present their business plans to us. While we recognize that the success rate for these kinds of ventures will not be high, we believe it would be valuable to hear potentially innovative ideas that may have a chance to bear fruit for investors.

These sessions, should they continue to exist moving forward, will aim to broaden our awareness of emerging trends across industries and help us explore new business ideas that could be worth watching. And let’s not forget, it will only take one huge multi-bagger to make this endeavor worth it in the end. Time will tell.

The biggest hurdle for early-stage growth companies, from an investment perspective, isn’t simply determining whether they have a good business model. It’s assessing whether they can grow that business without destroying their capital structure by continually raising dilutive equity to cover losses on the path to (potential) profitability.

Highlights

- New GeoInvesting Theme: Launch of “You Make The Call” series to evaluate emerging, speculative growth companies.

- Featured Industry: Initial focus on a company offering innovative tech solutions in the retail and shopping sector.

- Concept Inspiration: Modeled after NFL’s engaging “You Make the Call” segment, inviting investors to make their own evaluations.

- Investment Challenge: Emphasis on assessing growth potential without significant equity dilution risks.

- Interview Insights: Insights from company leadership on unique approaches to specific challenges and competitive advantages within the retail tech space.

- Call for Feedback: We encourage your feedback on the “You Make The Call” initiative!!

—

Read More on our Latest ‘You Make The Call” Initiative in our latest Weekly wrap up

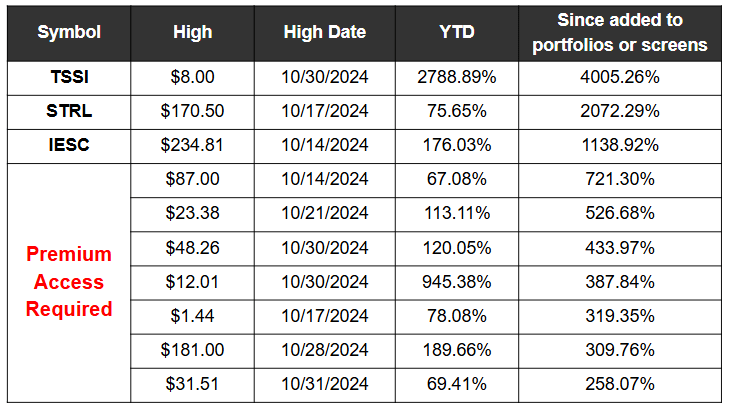

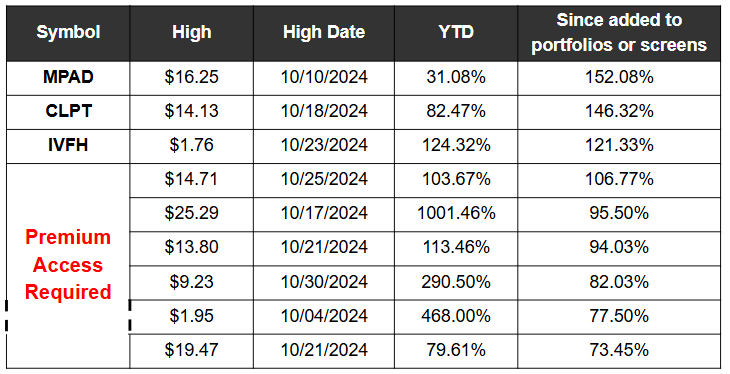

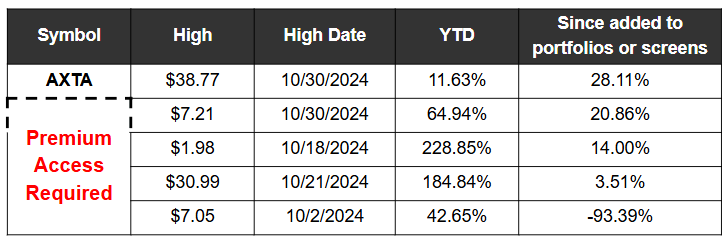

200+ Multibaggers And Counting

Must-Read MedTech Company Stock Pitch

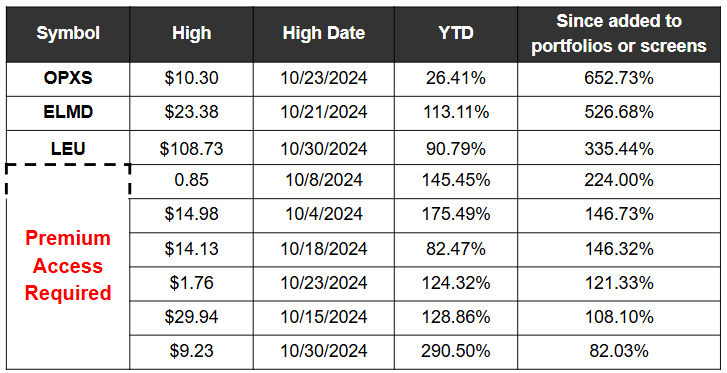

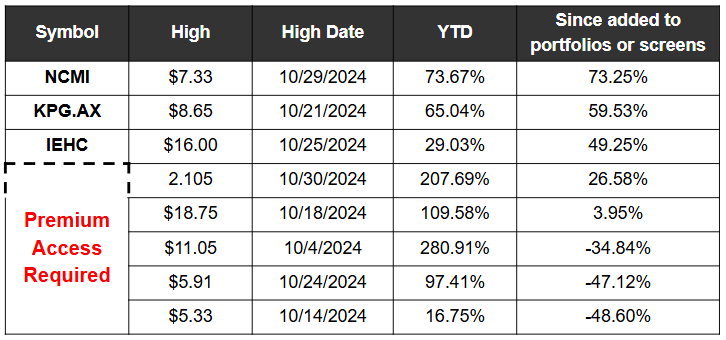

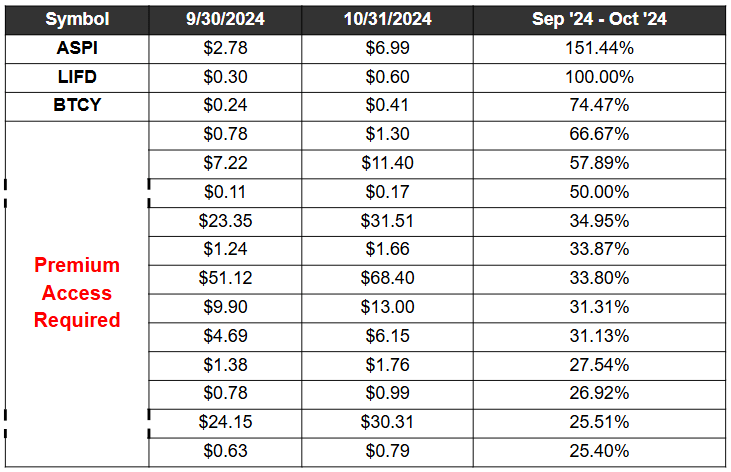

Buy On Pullback #12 & Forum Focus Model Portfolio Return Stats as of end of October 2024

Buy on Pullback Model Portfolios are aimed at swiftly capitalizing on mispriced opportunities in the market, identifying stocks experiencing negative or muted reactions to positive news or downside overreactions to negative news that we see as temporary.

Misunderstood company developments, emotions, or negative market sentiment can often be at the core of the mispricing, so the pullbacks often stem from investor overreactions and may not necessarily reflect the underlying fundamentals of the business.

High-conviction Open Forum Picks arise from analysis of an already bullish basket of stocks in our coverage universe. One timely stock per month is highlighted in our Live Monthly Forum Virtual Events and added to the Focus Model Portfolio, with expectations that a short-term 50% to 100% upside is possible. All Open Forums are archived on our premium portal. upside is possible.

Another Complimentary Video: Dan Schum on Balancing a Broad Portfolio with Opportunistic Investing

In this segment, Dan Schum delves into his unique approach to stock selection and portfolio diversification, explaining why he holds around 50-60 stocks. His strategy is built on two main pillars: managing risk through diversification and capturing opportunities in the small-cap and OTC markets. Unlike a traditional investor who might go deep into individual stocks, Schum makes decisions after brief analyses, sometimes spending as little as 30 minutes evaluating a stock before buying. His focus is on stocks that are overlooked, undervalued, or simply out of favor—often aiming at the bottom of the market rather than riding momentum.

Schum describes how he gravitates toward “ugly” stocks that others might find unappealing, and he actively seeks out companies that have faced challenges or been forgotten by most investors. His experience is supplemented by his blog network, where conversations with other investors generate new ideas.

He attributes much of his style to a mentor, a seasoned investor in tiny OTC stocks, who taught him the value of searching in small, illiquid spaces.

Schum’s strategy has allowed him to capture significant gains from high-potential stocks while reducing the risk that comes with market volatility. By diversifying and staying nimble, he leverages a broad exposure to growth potential while avoiding over-reliance on any single stock or sector.

What are Skull Session?

They are a series of in-depth interviews and discussions designed to provide GeoInvesting subscribers with “first mover advantage” insights to capture multibagger returns. We do this by interviewing the best microcap investors, CEOs from companies that have multibagger potential, and industry experts.

If you Are Not a Premium Member, You can Subscribe Here for full access to all our video events

Premium Morning and Weekly Emails You May Have Missed in October 2024

Weekly Recaps, October 2024

About The Weekly Wrap Up

This is a comprehensive weekly premium email newsletter that encapsulates all the significant updates and insights from the week, just in case you were not unable to catch up with our coverage from daily Morning Emails during the week, as well research content we save for the weekend. Each issue begins with a topical introduction, followed by a recap of our mail summaries.

- New research coverage on our research pipeline.

- Reaffirming commentary on our high conviction stocks.

- Microcap stock education

- Case studies.

- Featured videos.

Morning Emails

About Our Daily Premium Emails

These emails provide you with essential updates to start your day, relating to our over 1,500 microcap company coverage universe. Updates include:

- Calls To Actions, letting you know what stocks we are adding or removing from our Model Portfolios that our premium subscribers can choose to mimic.

- Tables and analysis of the best microcap earnings reports.

- Top Stock Pitches from investors we respect.

- GeoInvesting special event notifications.

Monthly Newsletter Archive

Stat Summarizations

Top Performance Across All GeoInvesting Model Portfolios and Screens (In October 2024)

Research Progress, October 2024

Please also note that year to date, we’ve published 228 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

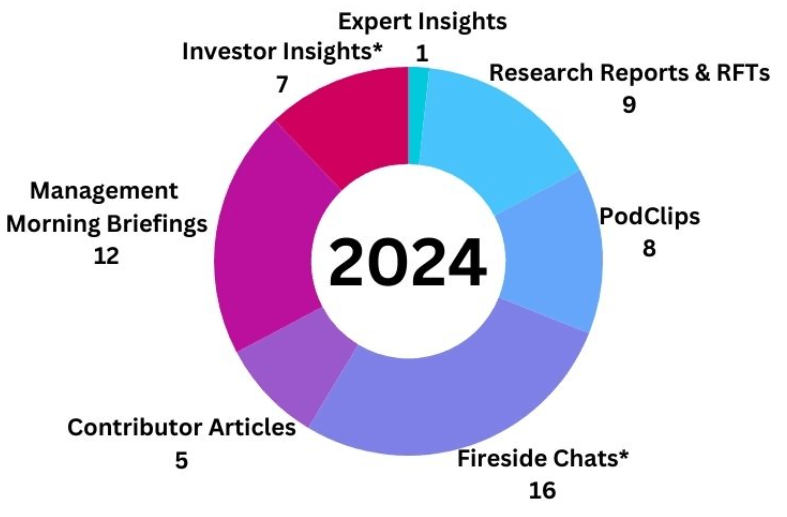

So far in 2024,apart from daily emails and weekly GeoWire Content, we have published a combined 286 pieces of Premium content (including video clips) across the segments detailed in the appendix.

As a reminder, in 2023 we published a combined 329 pieces of Premium content across GeoInvesting’s platform.

To see more details on 2023 and 2024 year to date earnings, please go here.

Earnings Processed, YTD to October 2024

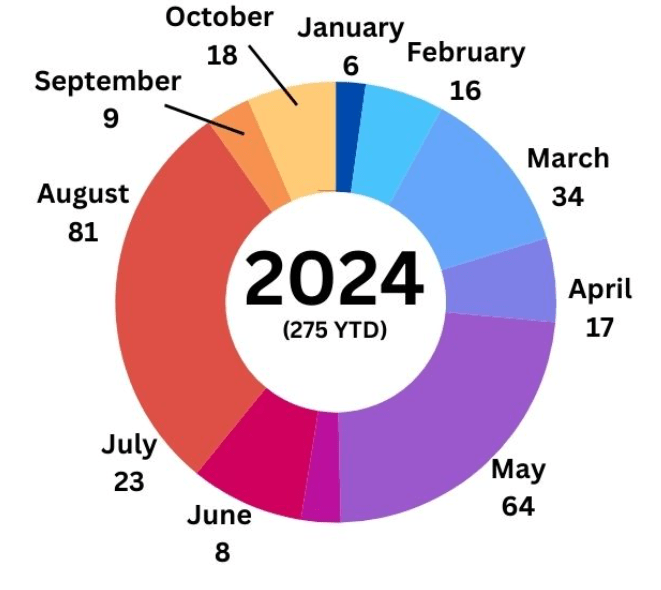

Earnings season picked up a bit in October as we began preparing for Q3 reports. We processed 18 reports in October 2024, bringing our full year total to 275.

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- Stock picks from our analyst team, backed by in-depth research

- Model portfolios curated by the GeoInvesting that include timely microcap stocks in “Buy on Pullback” and other themed portfolios and screened lists.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails.

- 16 Years of archived research on over 1500 microcap stocks and counting.

- Stock pitches from our Premium subscriber investor network.

- Live and Archived Video Events:

– CEO Fireside Chats and Briefings.

– Microcap Expert Interviews.

– Monthly Coverage Universe Review. - Week In Review Newsletter, just in case you missed our updates and alerts.

- Multibagger case studies and Investment Process Education.

Appendix

Content Distribution Key

Written

5 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

5 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

7 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

2 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

7 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

5 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

3 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

104 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)

![NoName, 30% CAGR: Dan Schum’s Journey Through the Lonely World of Microcap Investing [GeoWire Weekly No. 157]](https://geoinvesting.com/wp-content/uploads/2024/10/Dan-Schum-Nonamestocks-Thumb2-300x195.png)