https://geoinvesting.com/wp-content/uploads/2021/10/GeoWire-Header.png

WHAT YOU MISSED FROM GEOINVESTING THIS MONTH

OCTOBER 2021, ISSUE 02 (Download here)

STUDS VS. DUDS

Stud – Usa Truck, Inc. (NASDAQ:USAK)

Congratulations to GeoInvesting research contributor Egor Romanyuk who pitched another favorite trucking company of his on August 8, 2021, which is now up 34.09%. Better yet, we chose Egor’s pitch as a GeoInvesting favorite and added it to our Selected Long Disclosure list, which is a tool our Premium Members lean on to assist them in their research. And that is a very important point we want to convey to you. We try our best to let our Premium Members know when a GEO Contributor pick connects with our investing style.

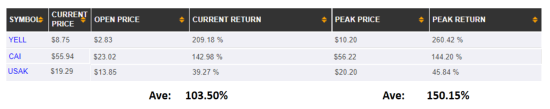

Egor’s experience and knowledge in the trucking industry has been leading him on a path to find what he feels to be some of the better transportation-focused companies. Since we began accepting pitches in 2014, to date, 60.87% of the stock pitches made by GeoInvesting research contributors have amassed positive returns. Let’s put that in perspective using baseball as an example. In baseball, a batting average of 300% is looked at as being superior. Well, Egor’s batting average at GEO is an even more impressive 1,000% – a baseball perfect score – meaning that every time Egor swings his bat he hits the ball He Sports an average return of 105.15% at the peak percent gains of his picks.

Egor Romanyuk’s most recent pitch, Usa Truck, Inc. (NASDAQ:USAK), is a truckload carrier in the United States, Mexico, and Canada. The company operates through two segments, Trucking and USAT Logistics.

In his first conversation with Maj in April 2021, Egor explained why he invests heavily in transportation companies, capitalizing on a true “buy what you know” philosophy preached by our favorite investor, Peter Lynch. We encourage you to watch that discussion too (here), perhaps after you hear his pitch on USAK.

When Maj caught up with Egor on August 6, 2021, he primed his pitch with a few small reasons why USAK is in his crosshairs:

- “So USA Truck – The reason why I like it. It’s super illiquid. When there’s good news, it moves up. I did a lot of research on it and like it for all the fundamental reasons.

- The trucking industry is very hot right now. I’m sure you’ve seen pictures of all the container ships that are stuck at LA ports, trying to get in.

- The trade deficit for the U.S., I think it’s at record levels. So there’s a lot of stuff being imported into the country.

- The retail sentiment is high right now. So there’s a lot of freight to be moved around. And trucking companies or a lot of trucking companies are capitalizing on that.”

Don’t forget to follow Egor on twitter @romanyuk_e and don’t miss out on the next pitch he brings to the GeoInvesting Community.

—

Dud – Muscle Pharm Corp (OTC:MSLP)

MusclePharm Corporation, a global provider of leading sports nutrition & lifestyle brands (such as protein powders), recently entered the energy drink market.

We love investing in turnarounds because they can often turn into multi-baggers as investors might ignore them in the early stages of turnaround initiatives. That’s why we were excited about the MSLP story when we found the company at very cheap valuations. MSLP looked to be at the very final stage of its turnaround.

The company has a great brand identity and was trying to reinvent itself under a new CEO. The stock initially rose as high as 528% after we started covering it on January 15, 2021. However, supply chain issues, escalating freight costs and inflationary pressures in whey protein unexpectedly destroyed gross margins, causing the company to take a few steps backwards in their restructuring plan.

To add salt to the wound the company announced a highly dilutive financing deal to combat liquidity issues brought about by these challenges.

On the positive side, we still think the company’s move into the functional beverage industry (energy drinks), which has been gaining healthy pre-order momentum, will be a success. The company’s hope is that it can push this new product into an established customer distribution space, where the company sees its future. But, we’re not going to lie, we believe this turn-around story has gotten a lot riskier. We’ll just have to keep an eye on it for you. See the company’s new beverage line here.

After the start of our research, EFOI had an initial run from $2.23 to $9.53, but in recent days sits in the $3 range. Had COVID-19 not arrived, we think the stock would have held its multi-bagger status. This is a great case study that shows the unpredictability of investing. Surprises and circumstances beyond your control can quickly turn a stud into a dud.

MONTHLY HIGHLIGHT

Fullnet Communications Inc (OTC:FULO) is an integrated communications provider that, through its subsidiaries, provides a range of technology services to its clients. The primary offerings include group text and voice delivery services, equipment colocation & web hosting (Data Center) and customized live help-desk outsourcing.

GeoInvesting Initiated Coverage on September 6, 2021 as well as adding the stock to both the Selected Long Disclosure Model Portfolio and Run to One Model Portfolio when the stock was trading at $0.60, FULO’s peak in October had it trading at $1.60, a 166.66% surge, and was $1.10 at the end of last month.

I prefaced that while I had yet to interview management, it was probably safe to assume that all three divisions are benefitting from the growth in mobile usage, on-line businesses, broadband usage and remote working trends. The company has spent the last several years fine tuning its business model, which included divesting non-performing assets and de-risking the balance sheet.

This has resulted in the attainment of consistent profitability for the first time since going public in around 1999, as well experiencing an uptick in revenue growth. Now, armed with a strong balance sheet, the company should be in a position to execute an acquisition strategy and be more aggressive on the marketing front.

While I was not sure if the current sales and earnings growth rate could be maintained, the stock was selling at a crazy discount to its publicly traded comps, Twilio Inc. (NYSE:TWLO) & Everbridge, Inc. (NASDAQ:EVBG) (direct comp). So, I liked the risk/reward opportunity.

Microcaps Holding Strong, or a Collective Dud?

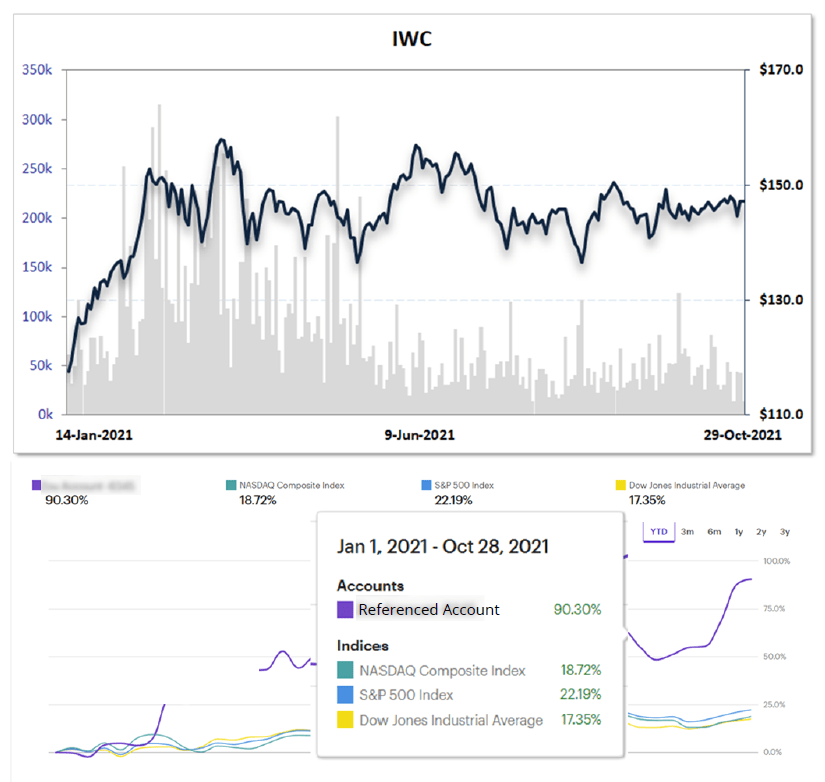

If you were to look at the microcap universe in general, you might be asking yourself when things are going to heat up again. We’ve been in this predicament in the past. While many might view the concrete wall that we’ve hit, as evidenced by iShares Micro-Cap ETF (IWC), an index that tracks the investment results of the Russell Microcap Index, as a sign of things to come (half glass half empty), it could be worse.

Below is IWC’s 1-year chart compared to the same period performance of an investor’s portfolio that contains primarily GeoInvesting stocks (name not disclosed for privacy). So, remaining steady is the key here. He told me that he did not sell any of his stocks during the 6-month flat line, and that the next leg up would put his portfolio at all time highs, going hand-in-hand to what we feel is incredible upside (glass half full) with some of the undervalued stocks in our disclosures list.

2021 RETURNS INSIDE OF GEOINVESTING

So far in 2021, we have issued 13 closing Calls to Action on companies tenured on our Select Long Disclosures List for varying periods of time.

Through the end of September 2021, the average return per closing CTA was 113.41%, a number that was significantly elevated by INTZ and CLPT.

There are 17 Calls to Action initiated and still open in 2021. While we cannot show you the premium table, our current average return per stock is 30.71%, compared to year-to-date numbers of about 12% for the DOW, 16% for the S&P and 13% for the NASDAQ.

https://geoinvesting.com/wp-content/uploads/2021/10/2021-Returns-as-of-10-1-2021.png

OTHER MARKET-WIDE STATS VS. GEOINVESTING

https://geoinvesting.com/wp-content/uploads/2021/11/Indices-vs-geo-oct-2021.png

YEAR-TO-DATE RESEARCH CONTENT

https://geoinvesting.com/wp-content/uploads/2021/11/A-few-GeoInvesting-Research-Stats.png

** All stats are cumulative YTD as of October 31, 2021

RESEARCH & IDEA PIPELINE

Cloud Communication Trio

As you can see from the FULO summary highlighted in this newsletter on page 1, you might think that we like cloud communication type stocks, and you would be correct. Last month we said we would be ready to present you our favorite Cloud Communication Trio. Unfortunately, I wanted to perform an extra layer of Due Diligence before publishing the presentations to our Premium Members. It is worth noting that one of the three stocks in the trio has already risen 194% (258% at peak). On the positive side, we have clearly communicated to our Premium Members our bullish thesis on this company and the other two companies in our Cloud Communication Trio through various model portfolios and extensive prior research. More good news is that we still think this stock has plenty more upside, and all three stocks have multibagger potential. If you choose to become a member today, you can see our current research on these stocks which includes all of our previous research, PodClips and management interviews we have compiled.