Welcome to The GeoWire, Your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More…

If you are new or this was shared with you, you can join our email list here.

I felt it appropriate to wrap up last week with a quick Twitter thought on 2 prime characteristics a microcap might possess that serve as signs to warrant further research. First, investors might ignore quality companies with minimal revenue of under $5 million. Second, individuals on the management team may have worked with each other with great success in the past. Together, just these 2 things usually prompt us to go further down a checklist of criteria to qualify the stock as an investment to determine if management has what it takes to grow a microcap to bigcap by dramatically growing revenues and profits.

One great example that you might be aware of is Medifast Inc (NYSE:MED), a distributor of health-related and weight loss products. In 2001, stock its was trading at around $1.30, the company generated only $5 million in revenue. Today, after years of restructuring, Medifast generates nearly $1 billion dollars in revenue and the stock trades at around $200. We profiled the company for GeoInvesting Premium Members on April 24, 2009 when the company was trading at $5.25.

It’s no wonder that with the even more intense scrutiny being placed upon OTC stocks through the new hoops that these companies have to jump through, that investors are increasingly staying away from them. As a matter of fact, it might now be impossible for some retail investors to normally trade certain OTC stocks, as restrictions are being placed on a great number of them, through an amendment to SEC Rule 15c2-11, that fail to heed regulations intended to force companies to meet new disclosure standards.

If this weren’t enough, investors to a large extent had already painted smaller capitalized stocks, micro and nanocaps, with a broad brush, as the designated black sheep of the market. It didn’t, and still doesn’t, matter if the stock exhibits the traits of what we call Tier One quality.

Where have investors gone wrong? Think of a dust pile with just a few infinitesimal grains of diamond. Everything goes into the dustpan, even the diamonds. Our goal is to grab those diamonds before they get swept up with the trash. In our eyes, they are some of the most misunderstood diamonds caught up in the age of microcap misinformation and negative stereotypes.

For us, it might be best for this age to be timeless since it affords us the ability to use the sifter instead of the dustpan while everyone else leaves the auction. It’s that sifter that leads us to insightful management interviews that give us multiple attempts to build rapport with and learn about an executive’s past – his or her successes and failures, journey, goals, experience, knowledge – to start painting a picture of a potential investment. Breaking down company stories is our passion and what we do best, and what better way to do that through getting to know management?

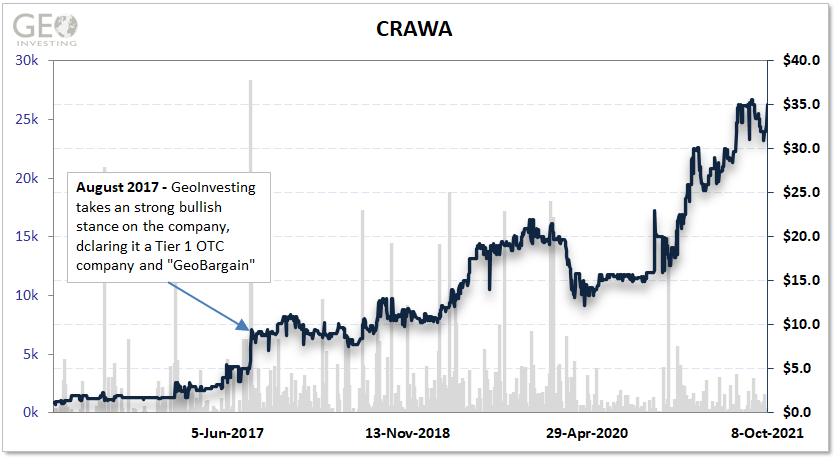

Proven management teams can grow small companies from good, or even mediocre, to great. We’ve seen it multiple times. Crawford United Corp (OTC:CRAWA) is one that comes to mind. The company is a holding company providing specialty industrial products to diverse markets, including healthcare, aerospace, education, transportation, and petrochemical. In August 2017, we built a case for the company when it was trading at a price of $7.50 under the symbol “HICKA” and company name Hickok Inc. At that time, the annual revenues were tracking at around $20 million, dramatically up from a long history of around $5 million. Today, revenues are tracking at $100 million and the stock is about to up-list to the NASDAQ.

While our initial interest arose from a few acquisitions the company made, it was really the company’s new management team that we honed in on. We were able to interview them and gleaned some much needed clarity on the earnings potential of the company, especially being that the legacy team had failed to produce a record of consistent top and bottom line growth. However, collectively at the time management owned 70% of the company’s stock, a quantitative stat that is one of ten criteria we use to essentially rank companies on their invest-ability and/or inclusion in our Model Portfolios. More importantly, we were really impressed with the background and past success of the new management team.

In the case of HICKA, we deemed it necessary to place a Tier One OTC designation on the company and added it to what we called the GeoBargains, a term synonymous with having added the stock to our Select Long Model Portfolio. We’ve since discontinued the moniker GeoBargain for the sake of taking the more standard route of Long Disclosures.

In all, the company’s:

- acquisition strategy

- strong and dedicated management

- an assumed run rate that would take earning to the next level

- the fact that it met 8 out of 10 of our strict investment criteria, and

- ironically, illiquidity in the stock that might have spooked investors (helping us to avoid the crowd)

…had us taking a bet that this “boring to beautiful” company had the potential to become a winner. The following chart pretty much sums it up.

~Maj Soueidan, Co-founder GeoInvesting

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Recommended Reading From Around The Web

On October 6, 2021, a new contributor to Seeking Alpha, DF Ventures, published a bullish article on Tapinator Inc (OTC:TAPM), Tapinator: The Best NFT Bet – Get In Before Wall Street Does. This caught our attention because we made we made our bullish viewpoint known on the company on August 27, 2021 with the article, Tapinator Inc. – A Look Under The Hood Reveals A Potential Multibagger. The stock has risen 88% since our Bullish thesis was conveyed to our Premium Members. We were happy to see a peer’s pitch on the company intersect many of the reasons why we liked the company earlier in the year. However, while the author placed a lot of focus on TAPM’s entry into the NFT marketplace, we dissected the companies core growth, which is not dependent on the company’s NFT platform.

DF Ventures writes:

Tapinator (OTCPK:TAPM) is a mobile gaming company that has been accumulating top-tier NFTs to launch an NFT art museum. Several of its pieces have skyrocketed in value (some up to 50x), but Wall Street investors have not taken notice yet. Not for long, though, as its mobile app is due to launch on the week of October 11. Current valuation is cheap at P/S ratio of 2.2x, revenue growing at approximately 30%, and with positive EPS to boot.

In my opinion, Tapinator is the best NFT stock with actual skin in the game as compared to others that may not live up to the hype.

Important Tweets

Featured Video

Having referenced Peter Halesworth’s work in the tweet above, we’d like to highlight an earlier conversation we had with him in February 2021 about a unique situation into which he and his partners put a significant amount of time and energy.

We sat down with Peter, who runs Heng Ren Investments, a concentrated special opportunities fund focused solely on microcap Chinese stocks listed in the US. Peter’s specialty is in the activist investor approach. His strategy aims to unlock the true value of the companies, many of which are viewed as outcasts of the stock market.

Peter talks about how this came to be (unsurprisingly, we played a significant role in this) and why this created opportunities for diligent investors who are not afraid to roll up their sleeves. He also shares an interesting case study of a currently halted stock that might easily jump over 100% once released. At the end of our chat, he shares a long idea which is well worth following.

On this subject, he wrote a book on called, ‘Conquering COVID – Sinovac: An Unlikely Hero‘. He believes there is immense value to be unlocked if Sinovac were to be unhalted. The book is now available.

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.