If you are a stock picker or have ever dabbled in the market, you may understand that there is actually a magic bullet to achieving investing success: it’s called research. You need to put in the time to find information that is misunderstood, undiscovered and improperly priced by the market. We call this information arbitrage. As you’ll read below, our process led us to find a cyber security company that we’ve invested in and will continue to track into the foreseeable future.

The GeoTeam finds the most misunderstood and most ignored investment opportunities in the microcap universe. The stock market is more efficient than it was years ago, so we need to keep looking at the most inefficient areas of the market to invest in. That is why, as time moves on, I have looked at smaller and smaller companies to invest in. Although I enjoy doing research all year long, it is during earnings season, four times a year, that I really like to step up the intensity of my research. There’s so much information available during earnings season: press releases, conference calls and SEC filings – that a few great stories always seem to go undiscovered by investors.

The Heavy Lifting

One of my favorite places to look for these information gaps is in earnings conference call transcripts. During earnings season, management normally issues a press release and may host a conference call to discuss its results in more detail. Inevitably, it often occurs that information on the conference calls is discussed in more detail than in the company’s press release. Conference calls are one of the best sources of information arbitrage available and are easy for any investor to find. The problem is that there are hundreds of these conference call transcripts to sift through every single quarter.

The nice thing about being a GeoInvesting Premium Member is that our whole team looks at these opportunities for you, so you don’t have to. We have streamlined the process so that hundreds of hours of research can be accomplished in a fraction of the time.

I love when earnings season kicks off during times of market panic.

I was particularly interested in the Q3 2018 earnings season that just ended. As you know, the markets went into a tailspin during Q3 and remain volatile. This has basically left microcaps for dead. It seems no one cares about the sector again, which happens from time to time. It also seems like no one is paying attention to bullish microcap earnings reports and related information in transcripts. It also means that this one of the few times I have seen so many under-reactions to high quality microcap earnings reports.

Conference Call Information Arbitrage

For instance, there is one profitable cyber security company we have been following for almost two years. We noticed that management would tend to expand on information contained in its earnings press releases during related conference calls. Even though the stock was moving higher, we didn’t buy it right away since we wanted to see if the company’s resurgence in operating performance was going to continue.

After listening to an earnings conference call, we started to notice that management seemed to be turning more bullish than usual and was talking about record-sized contracts it thought it was going to win. We informed GeoInvesting Premium Members about this information arbitrage and that we were finally taking a position in the stock. Last week, we alerted Members that we added to our position due to huge doses of information arbitrage on the Q3 2018 conference call. In its Q3 press release, the company reported quarterly earnings per share of 4 cents on revenues of $2.7 million. But it was a few tidbits of information on the conference call that really got us excited:

- Over the years, the company had accumulated so much data that it feels it is now able to monetize more aggressively than in the past. Apparently, the company may be the only owner of this kind of “Big Data” to allow websites to operate more securely and be less prone to cyber attacks.

- Customers have historically been heavily weighted to the U.S. Government, but commercial opportunities are now being explored.

- There is a recurring revenue component to its data business that could equate to annual revenue of ~1 million per customer that adopts a certain product platform – and the company just loaded its first customer on this program. We view this a big deal because the market tends to assign premium valuation multiples to recurring revenue models. We are excited to see what happens to the company’s valuation once more investors learn about the recurring revenue opportunity. See our special report on why we love recurring revenue business models.

- Management hinted that the new revenue run-rate for the next few quarters could reach $4.0 million, which is much higher from the $2.7 million they just reported in Q3 2018. More importantly, the company has some nice gross margins of about 65% and its overall operating expenses are staying flat, even as sales are increasing. The is called operating leverage and means that if the cost structure holds, earnings per share could increase much faster than an increase in sales, another factor that we feel could lead to higher valuation multiples.

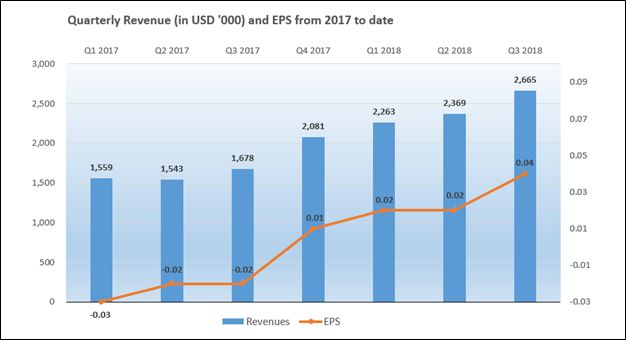

Below is a table and chart, highlighting that revenues and EPS have been growing year over year and sequentially.

| Target Company | Q1 2017 | Q2 2017 | Q3 2017 | Q4 2017 | Q1 2018 | Q2 2018 | Q3 2018 |

| Revenues ($) | 1.6M | 1.5M | 1.7M | 2.0M | 2.3M | 2.4M | 2.7M |

| EPS | -0.03 | -0.02 | -0.02 | 0.01 | 0.02 | 0.02 | 0.04 |

We calculate that if the company can reach a quarterly run-rate of $4 million, that quarterly earnings per share could approach 10 cents.

We would love to share with you our proprietary research on this name (opportunity and risk), a link to the Q3 2018 transcript, and all the microcap names that we track. We welcome you to join us for a seven-day free trial of GeoInvesting.

Log in with your premium account below to access this idea, or jump into a trial to get this and more.