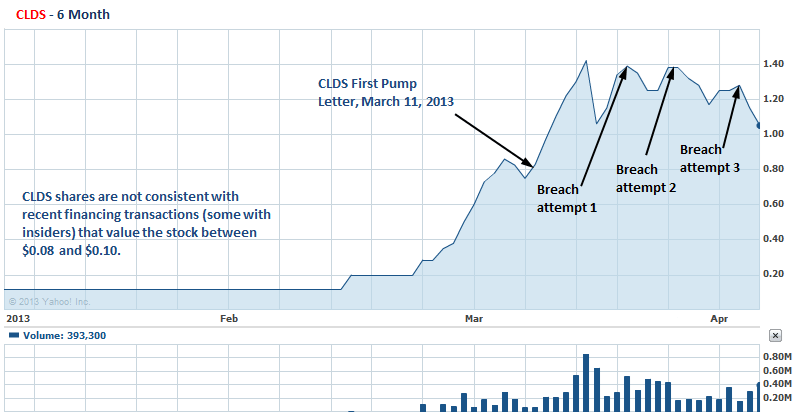

The Geo-Team has been following Cloud Star Corp (OTC:CLDS) since December 24, 2012 when we alerted our premium members of the high probability that this stock would illicit pump activity. Shares were trading around $0.12 at the time of our alert but now trade around $0.85; shares hit a high of $1.47 on March 26, 2013. The company has yet to earn any revenues, has just over $4,000 in cash with six and a half times that in current liabilities, has two employees, and has accumulated a net loss of over $200,000 since its inception. Even though CLDS shares have now fallen below $1.00, we think a further drop is on the way. This is supported by the fact that, at the current price levels, CLDS shares are not consistent with recent financing transactions (including insider transactions) that value the stock between $0.08 and $0.10.

The CLDS shares owned by 4 entities/individuals close to the company total around 62 million and were worth $91 million at CLDS’s high price.

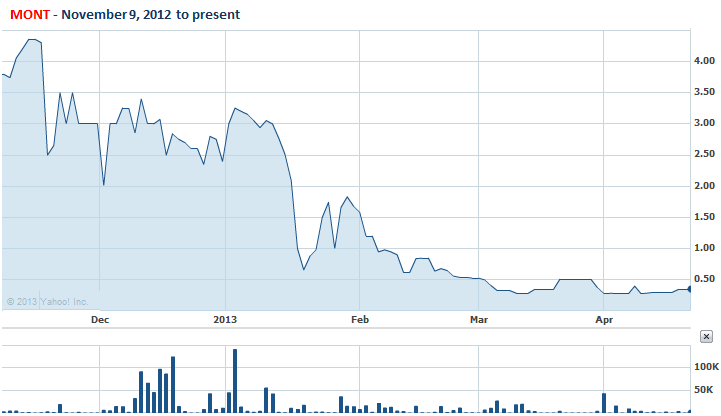

Also, consider that Scott Gerardi, current director of CLDS and former CEO of the failed company that CLDS merged into, Accend Media (old symbol ACNM), was also a director and president of the heavily promoted Monster Offers (OTC BB:MONT. Revenues in 2012 declined from $223,000 to $79,000. Concurrently, shares have also plummeted:

Here are two quotes from the web from an individual discussing his experience with MONT:

“I was contacted by Brian Kingsfield and asked to make an investment in Monster Offers. After investigating I have found that I was duped by one of the worst criminals in America. He is selling shares of the company stock that he said he received from the board. Wayne Irving II and Paul Gain are the two that I can see in the filings.”

“After googling Brian Kingsfield I see he has been ripping people off for years and is wanted by the FBI.”

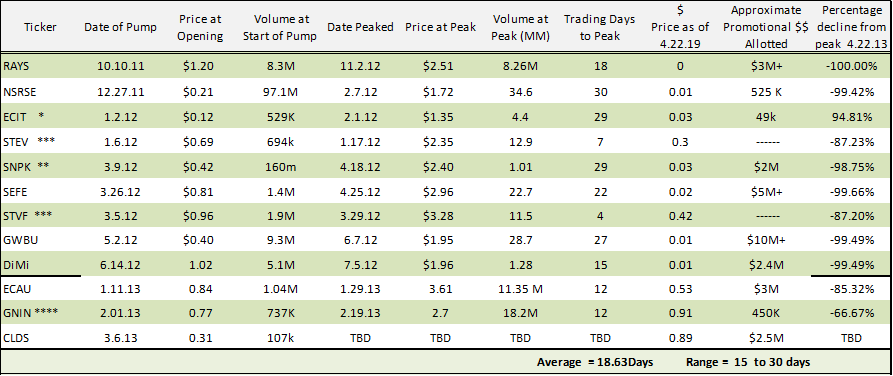

Pump and Dump Time Chart of Some of the Most Notorious P&D Stocks:

Given the parabolic move that CLDS shares have achieved, we believe that a vicious dump is in the cards – an opinion validated by our pump and dump time chart.

* ECIT Ecoland Intl. changed its symbol to NRBT.

** SNPK changed its symbol to PHRX

*** ECAU’s current IR firm, Crescendo Communications, LLC, also represented STEV and STVF. Furthermore, all three were/are being touted by a common character in the P&D world: Chuck Hughes

**** GNIN Split Adjusted

(Please note that the GeoTeam exposed the RAYS, SEFE, GWBU, DIMI, ECAU and GNIN stories).

Our pump and dump time chart has been highly successful at predicting when a pump move ends, and reveals that shares of the most prominent P&D names have been obliterated since reaching their peak trading levels. CLDS shares have been pumping for 30 Days, which is at the high end of our clock, and appear to be weakening as we speak.

In addition to the P&D time chart, a quick look at the CLDS chart confirms that shares are breaking down. After three breached attempts to eclipse the high, attained on March 26, 2013, shares look like they are about to aggressively break toward the downside.

CLDS Involvement in a Sexy Industry

“Cloud Star’s flagship product, MyComputerKeyTM is a proprietary, patent-pending technology that provides a secure multi-factor validation and authentication system for cloud-based infrastructures and protects data accessed from remote locations worldwide. The product is a custom-designed USB keycard programmed to connect via the Internet to users’ desktop or server seamlessly, which provides the user immediate access to files, personalized environments, data, programs and applications.”

The less fancy interpretation, MyComputerKeyTM, allows a user to access his or her base computer from different locations while utilizing the internet cloud through a separate computer (the “remote computer”).

True to form, a $2.5 million dollar “advertising” campaign commenced on March 11, 2013 through what we consider a promotional letter, Transformational Technology Report (TTR). TTR talks about the trillion-dollar opportunity that CLDS is pouncing on regarding the combat of cybercrime over the internet, smart phones, and other mobile mediums. This is a classic case where it looks like certain parties have seized an opportunity to capitalize on two hot, catch-phrases in one shot: the mobile nation and cloud computing.

Brief History:

CLDS completed its reverse merger on May 22, 2012 with a publicly traded company, Accend Media.

Accend became public through a self-underwritten IPO on June 15, 2011 and also had plans to capitalize on a trendy web based opportunity:

“Accend Media provides internet marketing services for its clients, who seek increased sales and customer contact through online marketing channels. The Company’s clients will include branded advertisers, direct marketers, lead aggregators, and agencies. Accend Media is powered by its own proprietary Lead Generation Software Platform. This technology platform allows the Company to process and sell real-time leads to clients across multiple verticals. The Company’s Web properties and marketing activities are designed to generate real-time response based marketing results for our clients.”

Interestingly enough Scott Gerardi, who was the CEO of Accend Media, is now a director of CLDS. So how did Accend fair in its one year tenure as a public company? Accend’s revenue grew from zero to around $80,000. Accend mentioned the following high profile companies as competitors…

- Digital River

- Unsub Central

- Optizmo.

…and it appears as though it was not able to successfully compete.

Well, CLDS also faces formidable competition.

Just like Accend, Formidable Competition Awaits CLDS

What the promotional materials fail to tell investors is that if CLDS does have a viable product, and for the sake of argument let’s assume that it does, it will have to penetrate a moat of competitors similar to what Accend had to contend with. CTXS and CHKP are two that quickly come to mind:

Citrix (NASDAQ:CTXS) is the cloud computing company that enables mobile work styles–empowering people to work and collaborate from anywhere, accessing apps and data on any of the latest devices, as easily as they would in their own office–simply and secure. Its annual revenue in 2012 was $2.59 billion.

- Check Point Software Technologies Ltd. (NASDAQ:CHKP) is the worldwide leader in securing the Internet. The company provides customers with uncompromised protection against all types of threats, reduces security complexity and lowers total cost of ownership. Its annual revenue in 2012 was $1.3 billion.

And we have all heard of GoToMyPc–a company that provides remote computer access.

Here is a list of other established cloud or SaaS companies that focus on security over the web and mobile nation:

- Symantec Corporation (NASDAQ:SYMC)

- Proofpoint (NASDAQ:PFPT)

- Imperva, Inc. (NYSE: IMPV)

- Fortinet (NASDAQ:FTNT)

Even Microsoft Corporation (NASDAQ:MSFT), Adobe Systems Incorporated (NASDAQ:ADBE), and Oracle Corporation (NASDAQ:ORCL) could be considered potential competitors.

CLDS has reported zero sales from its inception, but claims with a capital infusion of just $50,000, that it will begin generating revenues during the first half of its 2014 fiscal year end (year ends in February). As with any penny stock we deem to be a pump and dump candidate, the amount of capital needed to POTENTIALLY drive sales to levels where it could compete will likely be significant and lead to ample dilution.

Insiders Appear to Value Shares Around 90% Below Current Share Price

So what do investors who have committed to provide capital to CLDS think shares are worth? Page F7 of 2011 10K:

“We anticipate that the Company will be dependent, for the foreseeable future, on additional capital to fund further development of our infrastructure and to fund operations until such time we have sufficient revenues to meet our cost structure. Cloud Star, received $100,000 in funding through February 29, 2012, together with a commitment to receive an additional $400,000 in equity financing through the issuance of five (5) percent of the Company’s common stock after the merger. We will need additional capital as we launch our and Cloud Star’s products in the marketplace. In light of our efforts, there are no assurances that the Company will be successful in obtaining sufficient capital to continue as a going concern.”

Performing some quick math reveals the following:

- Shares to be issued in order to raise $400,000: 5% of the 97.2 million shares outstanding equals 4.86 million.

- Value of 4.86 million shares: $400,000 divided by 4.86 million shares = $0.082

Also, consider the following SEC filing passage from page 27 of the CLDS Reverse Merger 8K:

“Walter Grieves, indirectly controls 1,000,000 shares through Leeward Ventures. Mr. Grieves is the control person of Leeward Ventures, a Nevada corporation. Leeward Ventures has invested $100,000 and purchased 1,000,000 restricted shares of Accend Media from Scott Gerardi, whereby the proceeds of the sale were deposited into the Company as prepaid legal services. Leeward loaned Cloud Star $100,000 convertible into 1,000,000 shares of common stock, interest at 1% due August 2012. In connection therewith, Leeward Ventures has the right to purchase 4,000,000 additional restricted shares from two shareholders based on a subscription receivable agreement for $400,000, whereby the funds will be deposited into the Company.”

- Value of 1 million share: $100,000 divided by 1 million shares = $0.10

- Value of 4 million shares: $400,000 divided by 4 million shares = $0.10

Either of the above scenarios infers that seed shareholders financed CLDS at prices well below what the market is currently pricing shares at and that investors in CLDS/Accend were willing to let them go on the cheap. We assume these “seed” shareholders have insight into the CLDS business plan and the associated risks. In fact, Leeward Ventures caught our attention because this entity is controlled by Walter Greives, a Director of the company. Page 9 of 2012 third quarter 10Q:

“The Company received advances from, and had expenses paid on its behalf by, Leeward Ventures, a Company controlled by Walter Grieves, a director of the Company, totaling $125,596 from Inception through November 30, 2012 to fund software and website development, and provide working capital. A convertible note was initially established which provided for interest at 1%, per annum, a conversion feature into shares of issued common stock at a rate of $0.10 per share. The note was due on or about August 9, 2012. On such date, $125,000 along with accrued interest of $596 was converted through transfer of Cloud Star’s shares by an existing shareholder at $0.10 per share or 1,250,000 shares, and thus no new shares were issued.”

So, Mr. Grieves appears to have valued the company at $0.10.

One more bit of evidence that Directors of the company have valued the company at $0.10. Page 10 of 2012 third quarter 10Q:

“During the period from Inception to November 30, 2012, the Company issued 200,000 shares to a director for services rendered. The shares were fully vested on the date of issuance and stock compensation expense of $20,000 was recorded during the three months ended May 31, 2012. The compensation expense was determined based on the estimated fair value of the common stock which was deemed to be the conversion price of the convertible note payable.”

Conclusion:

Given that…

- The significant capital that CLDS we believe will have to raise and spend to compete, resulting in dilution,

- The chance that the market will begin to dissect what insiders have paid to fund operations, and

- The accuracy of our P&D time chart of predicting dumps,

…we think the probability of CLDS heading towards $0.10 is greater than the chance of the stock moving significantly higher. Accordingly, we are still short CLDS.

Disclosure: Short CLDS

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.