On April 4, 2013 we alerted GeoInvesting members that we were taking a closer look at China Housing and Land Development Inc. (NASDAQ: CHLN) from a bullish point of view.

China Housing is a leading residential developer of apartments in the Peoples Republic of China. The company focuses on fast growing Tier II and Tier III cities in western China, and primarily in Xi’an City, Shaanxi province and Ankang City, Shaanxi province. CHLN aims to capitalize on opport

unities created by the demand from first-time home buyers and first-time up-graders in western China. The majority of its apartments range in size from 70 square

meters to 120 square meters; Demand for apartments of this size is considered to be more stable when compared to other residential real estate markets in western China.

Referencing SEC filings and confirmed by our investigators, the company has developed 11 projects since its establishment. As of the 2012 fourth quarter the company claims that it has sold or is currently in the process of selling apartments from the following projects:

- Junjing I, II, and III

- Puhua Phase I, Phase II, and Phase III

- Park Plaza project

- Ankang project

The company also claims that the following residential projects are in planning stages for which construction will begin between the second quarter of 2013 and third quarter of 2018.

- Puhua Phase IV

- Golden Bay

- Textile City

Through an analysis of the CHLN’s PRC filings (SAIC documents) we were able to verify that there appears to be no problems with the Company’s corporate structure.

We are still in the process of determining the appropriate modeling assumptions to use to value CHLN. However, If we compare CHLN to China Hgs Real Estate (NASDAQ:HGSH) it becomes evident that CHLN is hands down the better value proposition.

CHLN and HGSH are located in the same area, Shaanxi province, and are around 150 miles apart from one another. CHLN is located in Xi’an city which has a population of 8.5 million. HGSH is located in Hanzhong City which has a population of 3.4 million. Yet the difference in valuation metrics is staggering.

| CHLN | HGSH | |

| EV/Sales | 1.3 | 11.4 |

| EV/Adj. EBITDA | 7.4 | 32.4 |

| P/E (non-GAAP) | 4.3 | 32.8 |

| P/B | 0.5 | 5.4 |

Our motivation behind this article is to substantiate the claims that CHLN has made regarding its past and current projects and evaluate general market conditions. Our initial findings have been positive, reveal that CHLN could be more insulated than other developers from government policies aimed at preventing a real estate bubble and indicate that its 2013 first quarter results should show substantial growth. We cannot comment on the how sales will shake out on a quarterly basis past the 2013 first quarter due to the nature of how CHLN recognizes revenues, but we can confirm that the company’s potential backlog is large.

A. Initial on-the-ground due diligence reveals that the claims CHLN has made in its SEC filings appear to be accurate.

We visited the Junjing projects I, II, and III and the Puhua Phase I, Phase II, and Phase III projects. We also visited the Park Plaza project and the Ankuang project. The results of our findings are as follows:

1. Junjing projects I, II, and III

- As disclosed by CHLN, Junjing I, II, and III are next to each other.

- We confirmed that Junjing I, II, and III have been sold out.

- The sales office for Junjing I, II, and III has already been removed.

- For information about Junjing I, II, III, investors can follow this link – http://xa.focus.cn/votehouse/144.html

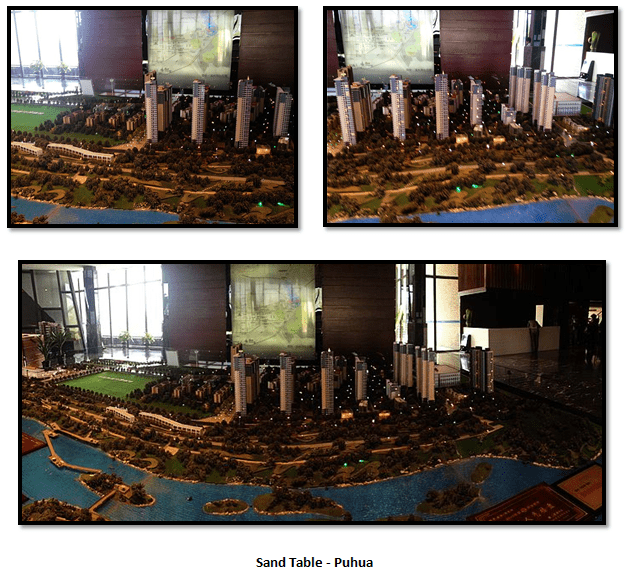

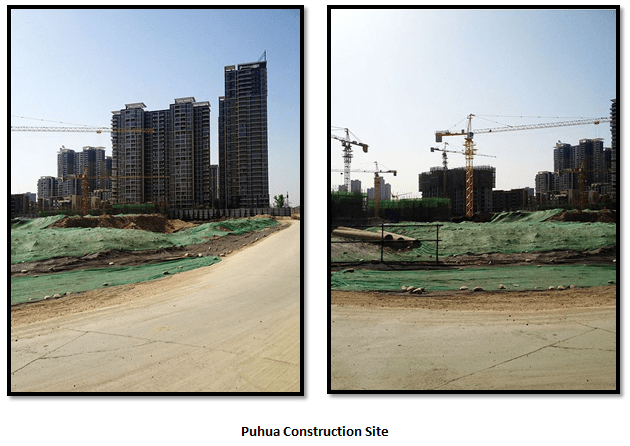

2. Puhua Phases I, II, and III

- As disclosed by CHLN, Puhua Phases I, II, and III are next to each other.

- Puhua Phase I has been sold out, while Phase II is nearly sold out. Phase III is expected to contribute to revenues in 2013.

- The selling prices and pricing trends over the past several years pertaining to Puhua I and Puhua II is approximately in line with CHLN’s disclosed sale prices and pricing trends. No price trend data on Puhua III exists because as of the 2012 fourth quarter the company had not yet recognized associated sales. http://qianshuiwanph.soufun.com/house/3610699702/fangjia.html

- The disclosed selling schedule for Puhua Phases I, II, and III is approximately in line with the disclosed revenue recognition and selling schedule found in CHLN’s SEC files. Currently, as disclosed in SEC filings, the majority of Puhua revenues will come from Puhua Phase III, since Phase I is sold out and Phase II was substantially sold out as of the 2012 fourth quarter. http://qianshuiwanph.soufun.com/house/3610699702/dongtai.htm

- We visited Puhua Phases I, II, and III. We also talked to its sales representative who confirmed the selling prices and schedules disclosed by CHLN.

3. Park Plaza

- Park Plaza is currently for sale. Its marketing information can be found at this link – http://xinqingfangxx.soufun.com/

- We visited the Park Plaza’s sales office and also talked to sales representatives who confirmed the details of the Park Plaza Project.

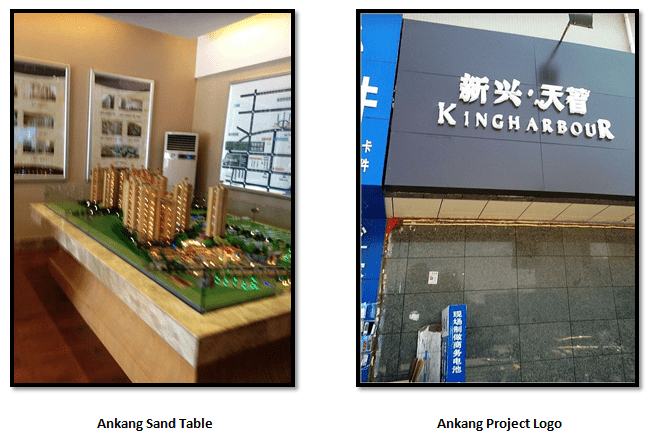

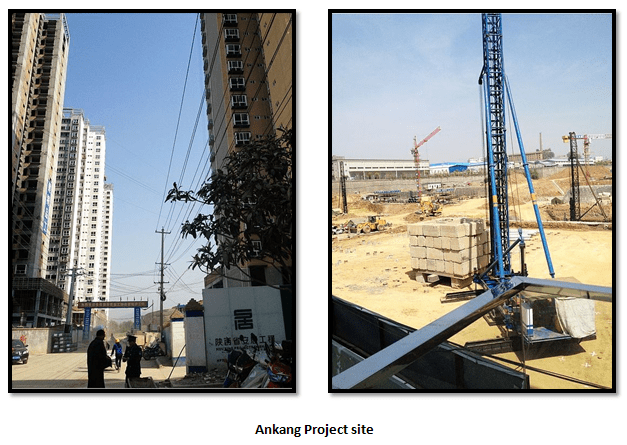

4. Ankang Project

- Pre-sales for the Ankang Project started in the fourth of 2012. Its marketing information can be found here – http://www.0915home.com/newhouse2/nh_detail.php?HID=43

- We visited the Ankang project’s sales office and also talked to its sales representative who confirmed the details of the Ankang Project.

5. We have confirmed that CHLN is in the planning stages with regards to the Puhua Phase IV, Golden Bay and Textile City projects are still in the early stages of planning.

B. Pictures

1. Puhua I, II, and III

—

2. Park Plaza

—

3. Ankang

—

C. Real estate market healthy through the 2013 first quarter: In the first quarter of 2013, the residential housing market (sales) increased more than 20% in Xi’an City, where CHLN projects are located (with the exception of its Ankang project).

Based on total sales data in Xi’an City, residential house sales in Xi’an City increased 21.9% in the 2013 first quarter, compared to the same quarter of 2012. http://www.sn.stats.gov.cn/news/sxxx/201342492404.htm

Heading into 2013, CHLN revenues and pre-sales from Xi’an City will come from Puhua Phase II, Puhua Phase III, and Park Plaza. Based upon our visit to CHLN’s sales office in April 2013 and the market trends in the first quarter of 2013, it is plausible that CHLN can achieve its first quarter revenue guidance and experience an increase in pre-sales.

“Total recognized revenue for the 2013 first quarter is expected to reach $28 million to $30 million, compared to $60.1 million in the 2012 fourth quarter and $23.5 million in the first quarter of 2012.”

D. Regulatory environment is good for CHLN

The Chinese government issued a new real estate controlling policy (GuoWuTiao) in Feb 2013 and Xi’an City implemented its own set of policies in April 2013. http://news.sz.soufun.com/2013-04-19/9938722.htm

A key factor that favors CHLN is that Xi’an City is not permitted to sell property to anyone who already owns two properties. However,

“CHLN is focusing primarily on the demand from first time home buyers and first time up-graders”. (Source: 2012 10-K)

Thus, it is feasible that CHLN’s business will be less influenced by the new real estate controlling policy compared to the real estate industry as a whole in China.

Furthermore, according to the new real estate controlling policy, a 20% income tax shall be levied on capital gains from the sale of property. This policy should reduce the amount of housing supply available from current homeowners, meaning that an increasing number of first time home buyers will purchase newly built rather than existing residential homes. This tax policy will also result in higher prices of pre-owned homes as sellers raise selling prices to adjust for the tax. Thus, new construction will be more affordable, especially to first time buyers. Following these developments, the prices of newly built housing prices in Xi’an City increased 0.52% from March 2013 to April 2013.

http://news.95191.com/detail/30852.html

Conclusion

Based upon our on-the-ground due diligence, we can begin to trust some facets of the CHLN story and conclude that the company should report strong growth in the first quarter of 2013 as the residential housing market (sales) in Xi’an City grew 21% over the same quarter in 2012.

The real estate market in Xi’an City may be influenced by the new real estate controlling policy (GuoWuTiao). However, as CHLN’s primary focus is on first-time home buyers and first time up-graders, we do not think that CHLN’s business will be adversely influenced by the government’s policy.

Disclosure: Long CHLN

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.