Once again, the GeoTeam has found an information arbitrage opportunity from China. This time, it involves a non-binding go-private offer that has reportedly been made to China Finance Online (NMS:JRJC).

Once again, the GeoTeam has found an information arbitrage opportunity from China. This time, it involves a non-binding go-private offer that has reportedly been made to China Finance Online (NMS:JRJC).

The company has not filed an 8-K or put out a press release acknowledging this offer and it has not been confirmed that the company has been in receipt of this letter.

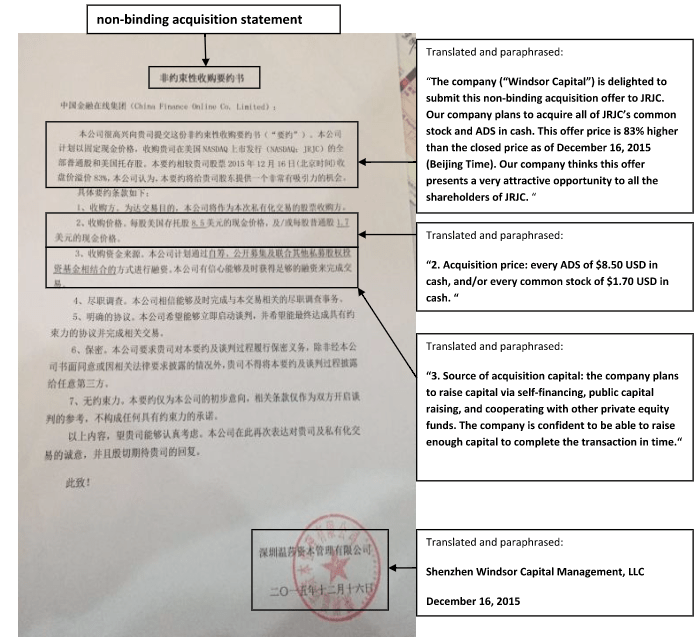

As part of news released in China that we touched upon early on December 16, 2015 for our Premium members, the image below of the reported proposal has been circulated.

News in China Reports Involvement of Windsor Capital In Potential China Finance Online Go-Private Proposal

According to a news report from China, Windsor Capital has sent the non-binding offer to acquire all outstanding shares of JRJC at a price of $8.50 per ADS. Windsor Capital stated last Friday that this non-binding offer has been sent out and because it was sent from Shenzhen, the company may not have received it yet. The company estimated that this non-binding offer would arrive at JRJC’s Board of Directors by today (December 21, 2015) at the latest.

Below is the reported copy, time stamped as of December 16, 2015, of the non-binding acquisition offer shown the news report, with its paraphrased translation regarding some terms of the offer.

Note: We have not verified the authenticity of this document and are providing this image as only a conveyance of our findings and observations.

From our point of view, as long as China Finance Online management or the Board of Directors has received this non-binding acquisition offer, they should be obliged to put out a press release in order to inform their shareholders.

The proposed non-binding acquisition offer price of $8.50 is about a 35% premium compared to JRJC’s current stock price. Although we don’t think the stock of China Finance Online would go as high as $8.50 after an announcement of this proposal, it is possible that it could appreciate from its current levels.

We are still waiting to see when and if JRJC announces receipt of this non-binding offer. Since management together only owns 31.7% of the company (including about 28.5% owned by Zhiwei Zhao, Chairman and CEO, based on the 2014 20F) and they were not in this buyer group, it is possible that if the deal went through that management could be replaced or may need to find the means to maintain control via a counteroffer.

Thus, in order to maintain the control of the company, management may need to cooperate with other funds to try and outbid this offer, or management may ask for a higher takeover price if they decide they want to give up the company.

Original Note to GeoInvesting Members

We had originally sent the following note to our Premium members, on December 16, 2015:

According to the news in China, a private investment institution has proposed a non-binding go private offer to acquire all the outstanding shares of China Finance Online. Below is the text and the translation:

16æ—¥ç§å‹Ÿæœºæž„温莎资本é€éœ²ï¼Œç›®å‰å·²æ£å¼å¯¹ä¸æ¦‚股:金èžç•Œ(4.56, 0.25, 5.80%)æ出éžçº¦æŸæ€§æ”¶è´é‚€çº¦ã€‚温莎资本计划收è´é‡‘èžç•Œå…¨éƒ¨å·²å‘行普通股和美国å˜æ‰˜è‚¡(æ¯è‚¡å˜æ‰˜è‚¡ç›¸å½“于5股普通股),æ出以8.5美元æ¯è‚¡ç¾Žå›½å˜æ‰˜è‚¡çš„å›ºå®šçŽ°é‡‘ä»·æ ¼æ”¶è´ã€‚

当å‰é‡‘èžç•Œè¿˜æ²¡æœ‰å°±æ”¶è´é‚€çº¦ç»™å‡ºæœ€åŽå›žå¤ã€‚按照å议,éžçº¦æŸæ€§é‚€çº¦å¯éšæ—¶æ’¤å›žã€‚但市场人士分æžï¼Œæ¤ä¸¾æˆ–是金èžç•Œå€Ÿè·¯ç§æœ‰åŒ–,温莎资本承担ç§æœ‰åŒ–接盘者身份。目å‰é‡‘èžç•Œå¸‚值仅1亿美金,其账é¢çŽ°é‡‘将近市值一åŠã€‚在A股,其åŒè¡Œä¸šå…¬å¸ä¸œæ–¹è´¢å¯Œç›®å‰å¸‚值接近åƒäº¿äººæ°‘å¸ã€‚

公开信æ¯æ˜¾ç¤ºï¼Œæœ¬æ¬¡é‚€çº¦æ”¶è´å‘起方温莎资本是国内最早投资海外的资产管ç†å…¬å¸ä¹‹ä¸€ï¼Œä¸»è¦åˆä¼™äººåŒ…括ä¸æ¦‚股投资领域著å的基金ç»ç†ç®€æ¯…。æ®æ‚‰ï¼Œæ¤æ¬¡é‚€çº¦æ”¶è´é‡‘èžç•Œä¸ä»…有温莎资本å‚与,还有其他大型PE(ç§å‹Ÿè‚¡æƒæŠ•èµ„)在身åŽä¸€èµ·å‚与这项投资。

一ä½åˆ¸å•†èµ„管人士分æžï¼Œé‡‘èžç•Œä½œä¸ºå›½å†…最早IPOçš„è´¢ç»åž‚直类互è”网上市公å¸ï¼Œç›®å‰è¢«ä¸œæ–¹è´¢å¯Œã€åŒèŠ±é¡ºã€å¤§æ™ºæ…§ç”©åœ¨èº«åŽï¼Œä¸€ç›´è®©è¡Œä¸šäººå£«å”嘘。“A股市场对互è”网金èžæ ‡çš„估值更高,ä¼ä¸šèƒ½å¾—到更多资本支æŒå¯¹é‡‘èžç±»ä¼ä¸šè‡³å…³é‡è¦ï¼Œé‡‘èžè¡—ç§æœ‰åŒ–回A股市场,相比目å‰å¸‚值有æå‡ç©ºé—´ã€‚”

Translation, as paraphrased:

“On [December] 16, [2015], private investment institution Windsor Capital said that, [it] has officially proposed a non-binding acquisition offer to JRJC. Windsor Capital plans to acquire all of the outstanding common shares and ADS (every ADS equals 5 common shares), proposing to acquire at price of $8.50 per ADS in cash.

Currently JRJC hasn’t given final response to this acquisition offer. According to the terms, non-binding offer can be withdrawn anytime. But based on the analysis from the market participant, this [endeavor] is perhaps JRJC wants to go private, and Windsor Capital will be the taker of this go private transaction. Right now the market capital of JRJC is only $100 million, and its cash balance is almost half of it. In China A share, the comparable company East Money Information Co.,ltd. (SHE: 300059)’s market cap is close to RMB 100 Billion (~USD 15.4 billion).

Public information shows that the proposer of this offer, Windsor Capital, is one of earliest overseas investing asset management companies, and [its] main partner includes famous fund manager in China-based US listed companies area, Yi Jian. It is known that Windsor Capital is not the only participant, but there are some other private equity firms behind to involve in this investment.

One person in the brokerage & asset management industry analyzes that, as the earliest IPO-ed vertical financial internet company, JRJC falls behind East Money information (SHE: 300059), Hithink RoyalFlush Information Network Co.,Ltd. (SHE:300033), Shanghai DZH Limited (SHA: 601519). “China A share market is valuing internet financial companies at a higher multiple, and companies will be able to get more capital to support the financial-like companies. [If] JRJC goes private and comes back to China A share market, its valuation will have room to grow.”

——-

To be the first to receive arbitrage like this, consider subscribing to our Premium services. Just one idea can make a difference.