By GeoContributor Zack Buckley

Asure Software is a micro-cap software business trading at ~10x 2012 earnings and 5.7x guidance for 2013 earnings. They have 80% gross margins, ~80% recurring revenue, and 90% retention rates, giving investor’s substantial visibility and predictability in their business model.

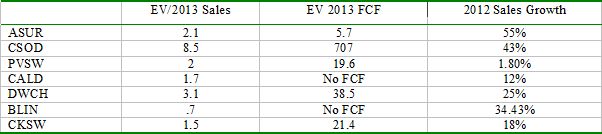

Software Equity Group released a report that median mergers and acquisitions multiples in the Software as a Service (SaaS) space are 4x EV/Revenue. Based on 2013 numbers, which implies $17.30/share for Asure versus today’s $6.95 share price, giving us reason to believe there is plenty of downside protection here.

BACKGROUND

Asure was formerly a mismanaged software company with two main products:

Netsimplicity, a meeting room manager product, and iEmployee, a workforce time management product. Asure’s biggest problem was its bloated cost structure under prior management. In 2009, David Sandberg of Red Oak Partners, Asure’s largest shareholder, kicked out Asure’s prior board of directors and management team, replacing them with his own team. Since then, the company has fixed the cost structure and performed extremely well. Revenues in 2012 should grow nearly 100%, and 2012 will be the first year that Asure shows substantial free cash flow since it has been public.

Headquartered in Austin, Texas, Asure made a string of acquisitions in the past year and today has two business lines: AsureSpace (Meeting Room Manager) and AsureForce (Time & Labor Management, which subsumed iEmployee). AsureSpace helps clients schedule various meeting room space in their offices, request equipment, order food, and send invitations for a meeting. AsureForce products help their clients manage workplace time and labor logistics, such as scheduling, time clocks, and paid time off. Under these two business lines, they serve ~11,000 clients. Asure’s management believes they have an addressable market of $310 million for AsureSpace and a $250 million addressable market for AsureForce. Given Asure’s current revenues, they comprise only a fraction of those current markets, leaving room for huge growth potential.

FROM THE CUSTOMERS’ PERSPECTIVE

We sought to speak with customers in order to learn a few key questions:

What is the customer’s incentive to buy this product? What would the customer do if they were without this product? In the case of AsureSpace, no other SaaS product exists. The alternative to this product is simply pen and paper or countless emails back and forth in attempts to schedule meetings, events, and all the details thereof. I spoke with a law school that has twenty distinct rooms, facilities, and rotundas to schedule, each with various functions and certain restrictions for use (e.g. party size, setup times, catering, necessary clearances, etc.). Other customers have even more complicated situations, like one company I spoke with had thousands of room scheduling requests daily, and seven full time staff solely dedicated to meeting room scheduling. Calling this a logistical nightmare is an understatement. Clearly, the incentive for the purchaser lies in the significant time and cost savings that can be achieved with software like AsureSpace.

As for AsureForce, the time and labor management SaaS product described above, the alternatives to this software are primarily paper (e.g. timecards) and hardware (e.g. punch clocks), which are outdated, cumbersome, and time-consuming (and thus, expensive). On-premise software is the electronic substitute for SaaS, but it cannot even come close to the benefits provided by SaaS products, including unlimited IT support (without troubling in-house IT employees), no licensure worries, free upgrades, and so on.

We wanted to better understand why customers would pay for Asure. Software like AsureForce focuses on helping businesses save labor costs. For example, if a company with $10 million in labor costs can save just 1% of that by using AsureForce to ensure that an employee is clocking out at precisely the time they leave (4:53 instead of 5:00), AsureForce will save them $100,000 per year. This is just cost savings, and does not take into account the amount of time Asureforce will save them by reducing the hours necessary to deal with time and attendance issues. By helping companies save considerable time and money, AsureForce is a highly attractive product. Although AsureForce is in the same competitive field as larger companies such as ADP and Kronos, they rarely compete directly, because AsureForce fills a niche in the small and medium business market. This niche market has an incentive to choose AsureForce over the larger companies, because it offers a smaller price tag for similar functionality.

We were also interested in determining to what extent Asure’s customers are price sensitive, because the answer gives us a sense of the ability of the business to raise prices over time. Perhaps surprisingly, the majority of Asure customers with whom we spoke did not even know how much their software actually cost. The first takeaway from this information is that the typical Asure customer is insensitive to price, leading us to believe that Asure can raise prices consistently over time, which is terrific for shareholders.

The second takeaway from Asure customers’ lack of price awareness indicates a certain level of satisfaction with Asure’s products. When customers are looking to switch products, they must be aware of the price of their current product in order to compare to other options. If Asure’s customers are not price aware and not looking for substitute products, we can infer that Asure has a sticky customer base. Our conclusion here is bolstered both by Asure’s own numbers and the numerous conversations I had with Asure customers about their level of satisfaction. Once customers make the initial infrastructure investment and train their employees, they are naturally reluctant to switch again, and retention rates for AsureSpace and AsureForce are around 93% and 88%, respectively. Asure’s retention rates reflect high customer satisfaction, which I personally verified. I spoke with ten different Asure customers, and every customer I engaged was very positive on both Asure’s products and their customer service.

Looking at Asure from the customer’s point of view was a great way to undertake in-depth research of the company and understand it from the perspective that matters most–those who generate the sales.

AN INSIDE VIEW

Equally valuable to understanding Asure was the research I performed of those who make those all-important sales happen, maintain contracts, create customer satisfaction, and guide the company: the employees. I used Linkedin as a way to research Asure’s employees, from salespeople to the management team, to gain a sense of their experience and quality.

Several people from the management team, including the CEO, left the high-growth software business Ceridian to join Asure. Asure has also attracted many of its employees from Cornerstone on Demand, a company growing at a higher than 50% annualized growth rate and currently trades at ~14.4x trailing sales with a break-even cash flow. If Asure is enticing remarkably talented employees to leave these high quality, high performing enterprise software and SaaS businesses for Asure, then Asure must be doing something right. I spoke with AsureSpace’s Head of Sales who expressed what seems to be a common theme–he uprooted his family’s life to move from California to Texas because of the significant opportunity for growth in Asure. It appears he also convinced his brother to leave a very successful software company and move to Asure. It would not seem like he would ask his brother to move unless he was highly confident in the business.

I spoke with another sales team member at Asure, who felt that Asure had only scratched the surface with their product and believes they have incredible growth ahead of them. He personally owned stock and thought the company had very bright prospects. His statements are supported by the recent insider buys by several different members of management. Most recently, Red Oak Partners and CEO Pat Goepel purchased $140,980 and $59,360 worth of stock respectively.

PROSPECTS FOR GROWTH

Once we have established an understanding of the business and its customers, as well as an idea of the company’s value, as investors, we must address whether and how quickly we can expect the business to grow. Growth is the key to Asure’s ultimate valuation.

The room for Asure’s growth is enormous, because the industries in which Asure operates are switching over en masse to SaaS solutions. As CEO Goepel pointed out, “Asure’s in a big market, and the cloud SaaS is growing 5x in the next seven years.” With such a new trend and Asure’s recent transition to entirely SaaS based products, Asure claims that their markets are still substantially underpenetrated. Goepel believes Asure has “room and markets to go 50% more into than what Asure’s going into, easily.” One sales team member I spoke with told me that they “have a huge sales opportunity and have such a large addressable market that they can’t begin to address all of it with their current sales team.” The average sales employee can generate about $500,000$ 600,000 in revenue per year. If Asure increases its sales workforce as it says it needs to do and adds at least ten additional sales employees per year, the company should be able to grow by 20%. Given the fact that Goepel said Asure had ten sales employees two years ago and now they have thirty, hiring at least ten sales employees per year, if not more, is entirely realistic.

In conjunction with the point above, as the demand for SaaS products, the average sized SaaS deal should grow substantially in 2013. Even if Asure’s absolute number of sales stagnated, Asure will still see revenues from the same amount of customer wins increase as a result of higher ASP’s. For reference, in 2011, the average SaaS deal was $3,500, and in 2012 it was $9,800. While I cannot predict the average price in 2013, there is no reason to suspect it would decrease. In fact, I think it will continue to grow as a result of Asure’s addition of more professional services and hardware sales as a part of its deals.

Additionally, Asure is well positioned against its competition. Dean Evans’ company, a competitor with a less competitive, on-premise software product, has grown revenues rapidly for a long period of time. While I had difficulty finding exact data on the company because it is private, a sales team employee I spoke with indicated that the company has been growing at 20-30% for a long period of time. I also found an exemployee’s LinkedIn profile asserting 170% growth from 2004-2008, indicating a 22% annualized growth rate in the business, which substantiates the current sales team member’s claim. This company has performed well even though it is in many ways inferior to Asure’s offerings (having on-premise software versus Asure’s cloud product). At this time, AsureSpace is the only SaaS option for meeting room scheduling, and AsureForce is the best low cost option for time and attendance SaaS. AsureSpace focuses on two distinct markets: the small and medium business market and enterprise sales. AsureForce focuses on small and medium businesses. Goepel emphasized that Asure “can absolutely win against the competitors in the mid-market all day long. Asure wins conversations based on SaaS and mobile, which Asure’s customers cannot offer.”

The evidence from my research supports a very high likelihood that it will be able to grow rapidly, and even if it does not, Asure is still worth substantially more than what today’s prices reflect, as described above.

RECENT UPDATE

Although 2013 guidance was decreased in the most recent earnings release, this reduction actually has no effect on Asure’s long-term business model, nor does it reflect a decline in the quality of the business. In fact, the reduced guidance simply reflects a change in Asure’s strategy. Originally an on-premise software sales business, Asure has transitioned entirely into selling software as a service (SaaS), which causes a change in how the books look. On-premise software sales lead to higher initial revenue, because the sales’ revenue is recognized immediately; whereas, revenue from SaaS contracts is recognized over the life of each contract. Now entirely focused on obtaining and maintaining SaaS contracts, Asure’s revenues moving forward will be lower in the short term (hence the reduced 2013 guidance) but higher in the long term because the contracts are of higher value and produce recurring revenue.

VALUATION

As mentioned above, Asure reduced its 2013 guidance because of a change in strategy. If Asure is only able to achieve the low end of its 2013 guidance, that would mean $25 million in sales, generating $5 million of free cash flow to pay off $5 million of their debt, leaving them with $12 million of debt. Even a low quality, slow-growing SaaS business typically sells for an absolute minimum of 2x sales. This implies–at the least– a $50 million enterprise value and a $38 million market cap, or $7.30 per share which is approximately 20% upside from our average costs. So even if Asure does not grow (which is a possibility), the downside is very limited at today’s prices.

The main risks are negative comps in sales or significant competition entering the field, such as Microsoft creating a meeting room management software within outlook.

In our base case, Asure management guided for approximately $1.20/share in free cash flow, at 12x 2013e free cash flow, Asure would be worth $14.40/share. On the upside, if Asure reaches its goal growing sales by 20% over the next three to five years, doubling sales to $50 million, it will have generated approximately $30 million in cash over that time frame. Since many high-growth SaaS businesses are being bought out between 810x sales, Asure could easily sell for a 5x sales multiple with that consistency and growth rate. This would imply an approximate $260 million market cap, or $50 per share, which is more than 7x our current price. Although this is certainly the bull case, we view this situation as highly asymmetric, considering we see a high probability for Asure’s rapid growth, which I will describe below. In any case, Asure should have a market cap/free cash flow yield of 18% on 2013 numbers. These numbers factor in Asure’s federal NOL balance of $119 million as of their most recent 10-k, I estimate the present value of their NOL balance to be in the $20-30 million range.

Some may be quick to point out that 5x sales implies approximately 20x EBIT, which is not a typical value investor’s multiple. I agree with this assessment and would most likely sell before owning Asure anywhere near 20x EBIT. However, Asure can trade at these multiples because of the synergies it provides. An acquirer is not only obtaining Asure’s earnings, it is also getting the product technology and the sticky customer relationships.

For example, if ADP acquired Asure, it would gain a long list of new customers to whom it could cross sell its payroll products. For these reasons, SaaS companies usually trade off of sales multiples, since a larger acquirer can strip out many of the costs of the acquired business. This space sees a lot of M&A activity, and as Pat Goepel, CEO of Asure, summarized, “[Asure’s] a fixed cost business and we’re almost in an oligopoly market. Someone will either buy you or you’ll be worth a whole boatload of money.”

Catalyst

If Asure reaches its 2013 free cash flow guidance, free cash flow will almost double in 2013, we believe this combined with substantial revenue growth in 2013 will be the primary catalyst for the stock.

Disclaimer:

GeoInvesting has no affiliation with Buckley Capital Partners in any way, nor has it vetted this information in any way. The GeoTeam does not attest to the accuracy of the information contained in this report and always urges investors to conduct their own due diligence. The GeoTeam has received no compensation for the dissemination of this report.