Over the past several months, Maj has been increasingly engaging with industry peers about mutual commonalities in microcap investing. This has been evident in our internal productions, Maj’s Avoiding the Crowd podcast series, as well as his appearances on South Florida’s Money Talk Radio. We’ll be playing a bit of catch up as we work to get all the episodes online, but we’d like to at this time point you to the most recent GeoInvesting production you might have missed.

Last week, Maj spoke with Tyler Dupont, founder of Augury Research. Through this conversation we learned more about The Augury Investing Journal, a tool Tyler developed to track stocks he’s researching by creating standard checklists designed to help dig into investment theses for buy/sell disciplines.. We also learned about Tyler himself as he shared anecdotes about his own life and investing journey to becoming a successful investor in his own right.

You can view the talk here!

—

Biopharma Stock On Our Long Disclosures List Continues To Intrigue Us

We’d like to once again point you to a video conversation we had with the CEO of a biopharma company seemingly on the cusp of making some major FDA trial breakthroughs in the treatment of certain kinds of cancers. The interview, now archived here, was conducted live and “by invitation only” to GeoInvesting premium subscribers who attended.

We reiterate that although it is not common for us to follow biotech stocks, we felt this one in particular is intriguing enough for us to continue to follow it as it becomes more evident that its trials are producing results that we believe have not been seen before in others investigating the same disease using a similar manner to target the cancer.

Specifically, the company’s treatment is showing substantial efficacy (positive results in terms of patients experiencing benefits) in phase one FDA trials. In fact, patients are effectively going into remission in the company’s phase 1 trials. This is worth noting because phase 1 trials primarily evaluate the treatment safety, determine a safe dosage range, and identify side effects.

So, the fact that the company’s treatment is exhibiting data indicating remission (and ZERO side effects) in phase 1 is very pertinent and unusual.

More exciting is that if the stock were to trade at the valuations of its comps who we don’t think have near the positive data, shares could trade at several multiples of its current price. Oh, and by the way, the company cash balance can fund the company’s business goals for about 2 years.

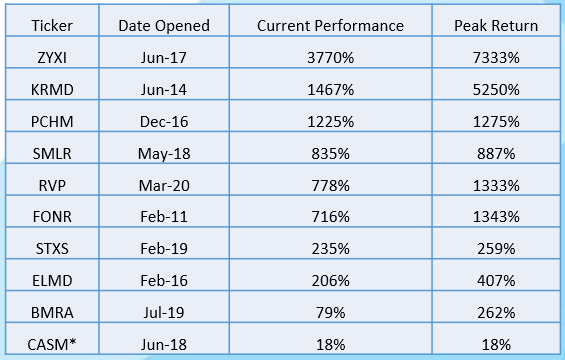

We are hoping that this biotech idea will build on the success we have had in identifying multi-bagger ideas in tier one quality medical device companies.

(data as of 3/22/2021)

We’re very excited to see how the continued testing of its lead candidate for cancer therapy progresses, being that it’s already surpassed expectations. By the CEO’s own indications, there are other much larger capitalized companies with significantly less data, opening a pathway for the company to close the gap in stock valuation should the data continue to show promise.

We brought the idea to our biotech expert, who by nature is very discriminating when it comes to his selection of the stocks he covers. He surprisingly agreed that our investment in this stock may be well worth the risk, so much so that he intends to write his next report on it for his third party service, SanaCurrents.

SanaCurrents is a premium newsletter that has been offering its Premium service to GeoInvesting Members at a special rate. SanaCurrents assigns likelihoods of favorable FDA decisions or data releases (catalysts) surrounding biotech product development initiatives. Biotech expert Bill Langbein, along with his partner Philip Greyling, apply a host of qualitative and quantitative factors to support their rankings and their purchase of shares before dates of when FDA decisions or the release of important data. To date, SanaCurrents has written 112 reports, now archived at geoinvesting.com. You can go here to learn more about SanaCurrents.

—

GeoInvesting Weekly Premium Email and Call To Action Updates (Apr 5 – Apr 9)

Weekly Wrap Up Summary…

Test drive GeoInvesting for a week to learn more about why we are so bullish on this potential cancer treatment disruptor, and to capitalize on our extended pipeline of other microcap investment ideas. Go here for your 7-day trial.

Or, log in below with your Premium Account to continue reading.