Just like we have stated in other Pump and Dump (“P&D”) investigations, we are comfortable with stating that American Heritage International (AHII) shares are worth no more than they would fetch as a shell company, or in this case $0.002.

- AHII trades at a market cap of around $200 million even though it appears that its e-cigarette assets were valued at only $25,000 at the time of its reverse merger in August 2013.

- Investors assume that AHII has 99 million shares outstanding, but in actuality the true fully diluted share count is around 250 million. We are betting that investors will react negatively to this reality once they fully digest the company’s 2013 10-K (just filed) where this finding is not readily apparent.

- The CEO is involved with another public company that is receiving “third party” promotional activity.

- We believe that the competitive and regulatory environment almost ensures that AHII’s business plan fails. We believe it to be absurd that AHII is of the opinion that its competitors are undercapitalized. Vapor Corp Common (VPCO) just raised $10 million. Lorillard (LO) subsidiary Blue eCigs controls 40% of the US e-cigarette market.

- Regulatory risk, right from the company:”On August 23, 2013, the Wall Street Journal reported that the FDA is considering a ban on online sales of electronic cigarettes, although the FDA clarified that any such intention would be part of the agency’s rule-making procedures. If the FDA implements such a ban, our financial results would be materially adversely affected, as approximately 50% of our revenue is derived from online sales.” Our response to this statement? Fifty percent of what revenue?!

Since we started writing articles on pump and dump scenarios we have highlighted 8 stocks, calling for the shares to fall sharply – and we have been 100% correct with these predictions. We began tracking AHII for premium GeoInvesting members on December 13, 2013 when the stock was trading at $0.55, postulating that it might be an ideal pump and dump. Promotional activity began on March 12, 2014. On March 25, 2014 we informed our premium GeoInvesting members we were going short AHII at around $1.00 as we continued our due diligence investigation into the company.

We agree with a March 25, 2014 Seeking Alpha article by Penny Stock Realist (“PSR”) and most of its pump and dump due diligence findings on AHII. We share the author’s short sentiment. But there is much more to discuss. The PSR article expresses an opinion that a pump campaign has been targeted towards AHII by a third party promoter. It also talked about other pump campaigns this promoter has initiated on stocks that now trade for pennies. In the case of AHII, the motivation for a pump is easy for us to see.

AHII entered the e-cigarette industry through a reverse merger in August 2013. Prior to the reverse merger, AHII traded under the name Cumberland Hills (former symbol CHLL). Cumberland Hills went public when its S-1 filing became effective on September 20, 2012. Cumberland’s attempt to monetize its development stage paper recycling business as a public company apparently came to an end in August 2013 when it completed a reverse merger with American Heritage. Despite all the talk about having great products in a billion dollar industry the e-cigarette assets were apparently valued at only $25,000:

“Under the Purchase Agreement, we acquired certain intellectual property related to the electronic cigarette business in exchange for 15,300 shares of our newly created Series “A” Convertible Preferred Stock valued at $25,000 in total.” Q3 2014 page F-4

Often, the details surrounding reverse merger transactions offer clues to possible motivations for a pump. PSR’s report commented that AHII’s market value at a price of around $1.50 was $153 million. However, we conclude that the motivation for the pump is much greater since the number of shares to substantiate this value has been significantly underestimated. PSR based its market value assumption on 99 million shares outstanding. The website OTC Markets (otcmarkets.com) also assumes that AHII has 99 million shares outstanding.

PSR likely used the following share count calculation (145.6 million shares minus 46.5 million):

[Shares outstanding pre-reverse merger: 145.5 million] minus [46.5 million , or 56% of shares held by sole director of Cumberland (Joseph Isaacs) that were cancelled as part of reverse merger] (Leaving Joseph with 36 million shares)

However, this calculation fails to take into account convertible preferred shares given to the owners of the e-cig “assets” purchased in the reverse merger transaction:

“In furtherance of our new business direction, on August 28, 2013, we entered into an Asset Purchase Agreement (the “Purchase Agreement”) with American Heritage LLC and its principals Anthony Sarvucci, Vincent Bonifatto and Anderson Levine LLC. Under the Purchase Agreement, we acquired certain assets and intellectual property related to the electronic cigarette business in exchange for 15,300 shares of our newly created Series A Convertible Preferred Stock.”

The 15,300 shares of preferred stock (all to Sarvucci and Bonifatto) are convertible into common shares at a rate of 10,000 to 1, equating to 153 million more common shares at a cost basis of less than a penny ($25,000 divided by 153 million). In fact, Bonifatto (now CFO of AHII) and Sarvucci, CEO, both filed 13Ds on February 13 & February 14, 2014, respectively, that not only confirm this finding, but reveal that they each own another 18,000,000 shares (36 million total) of common stock in AHII. A little more digging and we found that Isaacs gave his shares to the CEO and CFO for $36,000, or a cost basis of $0.001:

“On August 28, 2013, Joseph Isaacs agreed to transfer 36,000,000 of his shares of common stock to Anthony Sarvucci, Vincent Bonifatto and Anderson Levine LLC for a total purchase price of $36,000. The source of the consideration paid to Joseph Isaacs was the existing funds of these new shareholders.” Item 5.02 of 8-K/A

So, in actuality, AHII’s fully converted share count stands at 252 million (99 million plus 152 million), about 2.5 times more than what most investors may assume. Sarvucci and Bonifatto collectively own 189 million shares of the outstanding share count, or 75%. Just on a revaluation basis, using a higher share count, the stock should minimally drop over 50% to $0.39; and we use the inference of “value” loosely.

The two directors of minimally revenue producing American Heritage with an asset initially valued at just $25,000 were collectively worth $300 million at AHII’s peak of $1.62 on March 20, 2014. Even with the stock’s recent drop these three shareholders are still worth around $150 million.

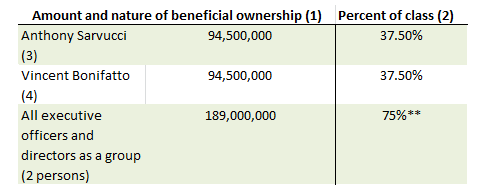

Summary of ownership (189 million shares):

- Vincent Bonifatto- 94.5 million shares (75.5 million shares from convertible + 18,000,000 from stock transfer)

- Anthony Sarvucci- 94.5 million shares (75.5 million shares from convertible + 18,000,000 stock transfer).

This table from the 2013 10-K confirms our calculations:

** Infers that fully diluted share count is 252 million (189M divided by 0.75)

(2) The percent of class is based on 252,000,000 voting shares as of March 31, 2014, comprised of 99,000,000 shares of our common stock, and 15,300 shares of Series A Convertible Preferred Stock that may be voted on the basis of 10,000 shares of common stock for every 1 share of Series A Convertible Preferred Stock held.

The Characters

We were not able to garner much on past public company involvements of Joseph Isaacs, Anthony Sarvucci and Vincent Bonifatto from SEC filings. It is unclear to our team why Isaacs would transfer all his stock, worth $34 million on January 10, 2014, for virtually nothing. But we are curious if there is more than an arm’s length relationship between him and Sarvucci, who was a director of the company when it was Cumberland:

“Mr. Sarvucci is the current President and Chief Executive Officer and has served in those positions since August 28, 2013. Mr. Sarvucci has also been a director of the Company since September 17, 2012.”10-K 2013

We came across a September 3, 2013 article that monitors stocks that may be the recipient of promotional activity. The article insinuates that Bonifatto and Sarvucci are not new to the reverse merger arena. Specifically, Sarvucci is President of Pacific Oil Company (POIL). POIL can be tied to promotional emails starting on February 11, 2014.

On a side note, some of the biggest P&D scenarios we have examined contained SEC reporting inconsistencies or incorrect info in filings, such as missing signatures or contradictory numbers. We believe AHII is no exception. The February 2014 13Ds list Bonifatto and Sarvucci as President and CEO:

- Anthony Sarvucci is currently the Chief Executive Officer, President and Director of American Heritage International Inc.

- Vincent Bonifatto is currently the Chief Executive Officer, President and Director of American Heritage International Inc.

Valuation

Just like we have sated in other P&D reports, we are comfortable with stating that AHII shares are worth no more than what we think they would fetch as a shell company or $0.002 ($500,000/252 million). Even if we liked AHII as a company, which we do not, we believe its valuation is well ahead of financials. Luckily Vapor Corp Common can serve as a proxy to value AHII. Here are some of VPCO’s stats.

- 2013 non-GAAP pre-tax margin was about 3.0%

- TTM Revenue $26 million

- TTM P/E 106

- TTM P/S 4.22

Furthermore, the e-cig space places a price to sales multiple of 2 to 3 on legitimate revenue generating companies.

We can use this data to determine what type of sales AHII would have to generate to justify its current price of around $0.80. Performing this exercise using a fully diluted share count yields required revenues of $70 million (considering the midpoint price to sales multiple of 2 to 4.22), more than what an established leader that just raised $10 million is already generating. At $0.80 margins of 3% and a P/E of 106 AHII would have to report annual revenues of around $60 million. Remember, as of the 2013 10-K AHII is generating essentially zero revenue from its e-cig operation.

AHII’s Days Appear Numbered

There is no doubt in our minds that AHII is nowhere near being a dominant e-cig player.

For those investors that are hanging on to fundamental reasons to like this company, we think it’s worth noting that the regulatory e-cigarette environment has a good chance of pushing small players with no market presence out of the market.

This “push out” process could be expedited by the entrance of blue chip competitors that will feel more comfortable entering the e-cigarette space once the regulatory landscape becomes more defined. And that time could be fast approaching.

Competition from the big boys

Investors may want to take note of AHII’s opinion that competition in the near future should not be a major concern and compare it to what market participants are saying.

Management Opinion on Competition from its August 2013 reverse merger 8-K:

“The largest direct competitors in the electronic cigarette market are currently shipping 30,000 to 40,000 startup units per month.

We believe that these competitors are undercapitalized and lack the resources to successfully find funding in a timely and cost effective manner. Additionally, we believe that these competitors each suffer from missing a critical component to success, whether it be capital, management experience, the ability to scale, marketing knowledge, distribution contacts, or general business experience.”

In its 2013 10-K released March 31, 2014, the company’s language is more cautionary and infers that competition is in a position to scale:

“The Internet marketplace for electronic cigarettes is very competitive with many brands being offered.

However, both filings essentially contain the following verbiage:

“It is a reasonable assumption, and more of an expectation, that an industry leader such as Phillip Morris or RJ Reynolds will eventually enter the electronic cigarette industry. We have seen no indication that this is on the immediate horizon, and we believe that they are waiting until the industry matures. We believe that the tobacco conglomerates will enter the electronic cigarette market sometime in the next five years.”

Really? Later in the 10-K AHII states that it sees intense competition from Big Tobacco:

“We face intense competition from direct and indirect competitors, including “big pharma”, “big tobacco”,and other known and established or yet to be formed electronic cigarette companies, each of whom pose a competitive threat to our current business and future prospects. We expect competition to intensify in the future. Certain of these companies are either currently competing with us or are focusing significant resources on providing products that will compete with our disposable electronic cigarette product offerings in the future.”

Make up your mind AHII management.

Maybe AHII missed the Memo from Phillip Morris in June 2013 (prior to the filing that contained the above quote):

“Tobacco company Altria Group Inc., is launching its first electronic cigarette under the MarkTen brand in Indiana starting in August and expanding its smokeless product offerings. The owner of the nation’s biggest cigarette maker, Philip Morris USA, announced the details of its NuMark subsidiary’s foray into the fast-growing business Tuesday.”

Or how did they miss the news regarding R.J. Reynolds? Here is a review of R.J’s product published on November 27, 2013:

It only makes sense that Big Tobacco would jump in on the e-cigarette market. From R.J. Reynolds comes Vuse Digital Vapor Cigarettes. I reviewed the solo original flavor. Apparently, traditional cigarette makers know their stuff when it comes to smoking, either analogs or digitals, because Vuse tastes good, has the highest nicotine “hit” of any pre-packaged e-cig I’ve tested, and is a cool-looking gadget, too.”

In its reverse merger filing, the company also lists its direct competitors in the electronic cigarette market

- NJoy e-cigarette

- Cigirex

- South Beach Smoke

- Smoke Stick

- Direct e-cig

- Blu Cig

- Xhale02

- Red Puff

- Green Smoke

- Gamucci America

- e-cig Technologies

We think AHII needs to perform a better comparative analysis. Apparently they missed publicly traded VPCO .

- Vapor Corp Common: Annual Revenue of $26 million

- Green Smoke: Annual Revenue of $40 million. Altria Group Inc. is buying electronic Green Smoke Inc. for about $110 million.

- Lorillard subsidiary Blue eCigs : Annual Revenue of $250 million and controls 40% of the US e-cigarette market

Better yet, in its 2013 10k AHII omits Green Smoke after saying:

“The largest direct competitors in the electronic cigarette market are…”

Green Smoke is one of the top e-cig players!

Good luck AHII. We view AHII’s statement that “competitors are undercapitalized and lack the resources” to be ridiculous. VPCO just raised $10 million, while Blue Chip companies Altria Group and LO are far from under-resourced. Victory Electronic Cigarettes Corp (ECIG) has raised around $30 million. Sure, some of the smaller comps may be undercapitalized, but that is not who AHII has to worry about. In any event, we hold the opinion that it is AHII who is undercapitalized. It looks like AHII has only raised $500,000 and needs $1.5 million just to stay afloat in 2014.

“In addition to the cash on hand as at December 31, 2013 of $15,746 and the $470,750 we raised subsequently we will require a cash injection of an additional $1,500,000 during the remainder of fiscal 2014 to achieve our 2014 operating plan.” (2013 10-K)

Even if AHII raises $1.5 million, this does not seem anywhere near enough to go up against comps that have raised tens of millions of dollars. Consider that ECIG needs to spend $30 million in 2014:

“We estimate our operating expenses for the next 12 months will be $30,000,000, consisting primarily of headcount and infrastructure costs, sales and marketing expenditures, research and development, and general and administrative costs.”

And here is the famous going concern comment tied to many P&Ds:

“We have begun operations but have not generated revenue to date. These conditions give rise to doubt about our ability to continue as a going concern.” (Q3 2013 filing)

Media Opinion on Competitive Landscape

One of our Geo team subscribers brought a research excerpt from Mergermarket to our attention, postulating that the big boys will be more aggressively entering the e-cig market soon. Here are some quotes:

“Big tobaccoseeks to capture customer migration; some buying their way in Possible FDA banprompting mainly small online e-cig playersto consider selling Larger targets could include Victory, Vapor, NJOY, LOGIC, V2, BallantyneSmaller online electronic cigarette companies facing significant competitive pressureare starting to sell out to big tobacco to expand their retail presence, as well as to arm themselves against potential governmentmeasures that could effectively cause their businesses to go up in smokesaid several industry sources.

Additionally, all the big US tobacco companies have acquired and/or have plans to introduce their own lines of e-cigarettes by the end of this year,the sources noted.”

For those who think that this story implies that AHII could be an acquisition target, note that the Mergermarket article states:

Multiples in the space are averaging around 2x-3x revenue.”

As we mentioned earlier, an AHII share price of $0.80 implies a sales run rate of between $60 million and $70 millionwhich the company is nowhere near. Of course, this analysis only matters if one does not share our opinion that AHII is just another pump and dump story.

Regulation may be coming sooner than AHII had anticipated

Unfortunately for AHII, the clock is ticking and the FDA is expected to issue some guidance soon on how it intends to regulate the e-cig industry. The FDA missed its first deadline in April 2013 to impose regulation on e-cigarette players. But regulation is still on the plate. These statements are right from the FDA’s website:

- As the safety and efficacy of e-cigs have not been fully studied, consumers of e-cigarette products currently have no way of knowing whether e-cigarettes are safe for their intended use, how much nicotine or other potentially harmful chemicals are being inhaled during use, or if there are any benefits associated with using these products.

- Currently, e-cigarettes that are marketed for therapeutic purposes are regulated by the FDA Center for Drug Evaluation and Research (“CDER”). The FDA Center for Tobacco Products (“CTP”) . . . intends to regulate other nicotine-containing products, including electronic cigarette products that do not make a therapeutic claim, in the future.

Furthermore, Government figureheads and State legislators are increasing their pressure, calling for regulation. A New York Times article published on March 23, 2014 discusses why regulation is needed:

These “e-liquids,” the key ingredients in e-cigarettes, are powerful neurotoxins. Tiny amounts, whether ingested or absorbed through the skin, can cause vomiting and seizures and even be lethal. A teaspoon of even highly diluted e-liquid can kill a small child.

But, like e-cigarettes, e-liquids are not regulated by federal authorities. They are mixed on factory floors and in the back rooms of shops, and sold legally in stores and online in small bottles that are kept casually around the house for regular refilling of e-cigarettes.

Nationwide, the number of cases linked to e-liquids jumped to 1,351 in 2013, a 300 percent increase from 2012, and the number is on pace to double this year, according to information from the National Poison Data System. Of the cases in 2013, 365 were referred to hospitals, triple the previous year’s number.”

Now, AHII does at least acknowledge that the risky regulatory landscape in its August 2013 reverse merger filing:

“We cannot predict the scope of such regulations or the impact they may have on our company specifically or the electronic cigarette industry generally, though if enacted, they could have a material adverse effect on our business, results of operations and financial condition.

In this regard, total compliance and related costs are not possible to predict and depend substantially on the future requirements imposed by the FDA under the Tobacco Control Act. Costs, however, could be substantial.”

We also found these risk factor excerpts to be intriguing:

“At present, neither the Prevent All Cigarette Trafficking Act (which prohibits the use of the U.S. Postal Service to mail most tobacco products and which amends the Jenkins Act, which would require individuals and businesses that make interstate sales of cigarettes or smokeless tobacco to comply with state tax laws) nor the Federal Cigarette Labeling and Advertising Act (which governs how cigarettes can be advertised and marketed) apply to electronic cigarettes. The application of either or both of these federal laws to electronic cigarettes would have a material adverse effect on our business, results of operations and financial condition. (10-K 2013)

On August 23, 2013, the Wall Street Journal reported that the FDA is considering a ban on online sales of electronic cigarettes, although the FDA clarified that any such intention would be part of the agency’s rule making procedures. If the FDA implements such a ban, our financial results would be materially adversely affected, as approximately 50% of our revenue is derived from online sales.“

Holding shares of AHII at a time when regulation could be right around the corner is too risky, even for our blood.

Conclusion: Just a Dream

We have always stated the key to a good pump campaign can be fueled by sprinkles of legitimacy. This can also help shield companies from regulators. Some investors will probably hang on to hopes that AHII has a high probability of success since it issues press releases regarding distribution and marketing agreements. But just because AHII may find a way into a distributor’s network does not mean the distributor will place the product in meaningful quantities, especially one from a company that does not seem to be in a position to produce significant volume. Just like AHII, previous companies that we found to be P&D’s used small capital-raises to portray a sense of legitimacy.

This story reminds us of Pharmagen, Inc. (PHRX) (previous name: Sunpeak Ventures) a company that pumped hard from $0.42 on 3/8/2012 to $2.40 on 4/18/2012 , amid “third party” promotional campaigns and news releases touting a distribution arrangement with Walgreens to market its vitamins. The stock now trades for less than a penny, where we think AHII is headed.