AYX fell sharply on Q2 financial results that missed estimates and weaker than expected guidance.

This article conveys that AYX could be a buying opportunity and a high conviction portfolio holding.

A Message From GeoInvesting

Arham Khan contributes to GeoInvesting periodically and has shown his diligence to be effective in rooting out undervalued stocks. Through his contributions, Arham has attained a 100% average return. We look forward to more of his research.

Contributions like this make the organic stock discovery process all the more rewarding, be it through collaboration or the sourcing of ideas from members. As a matter of fact, the returns of our contributors speak for themselves, as since 2015 and over 50 ideas generated, they have amassed an average return per stock of 150%. This includes 18 of those stocks attaining a return of over 50%, 8 of which were multi-baggers. Learn more about GeoInvesting here.

Download the PDF of this report or continue reading below.

Introduction

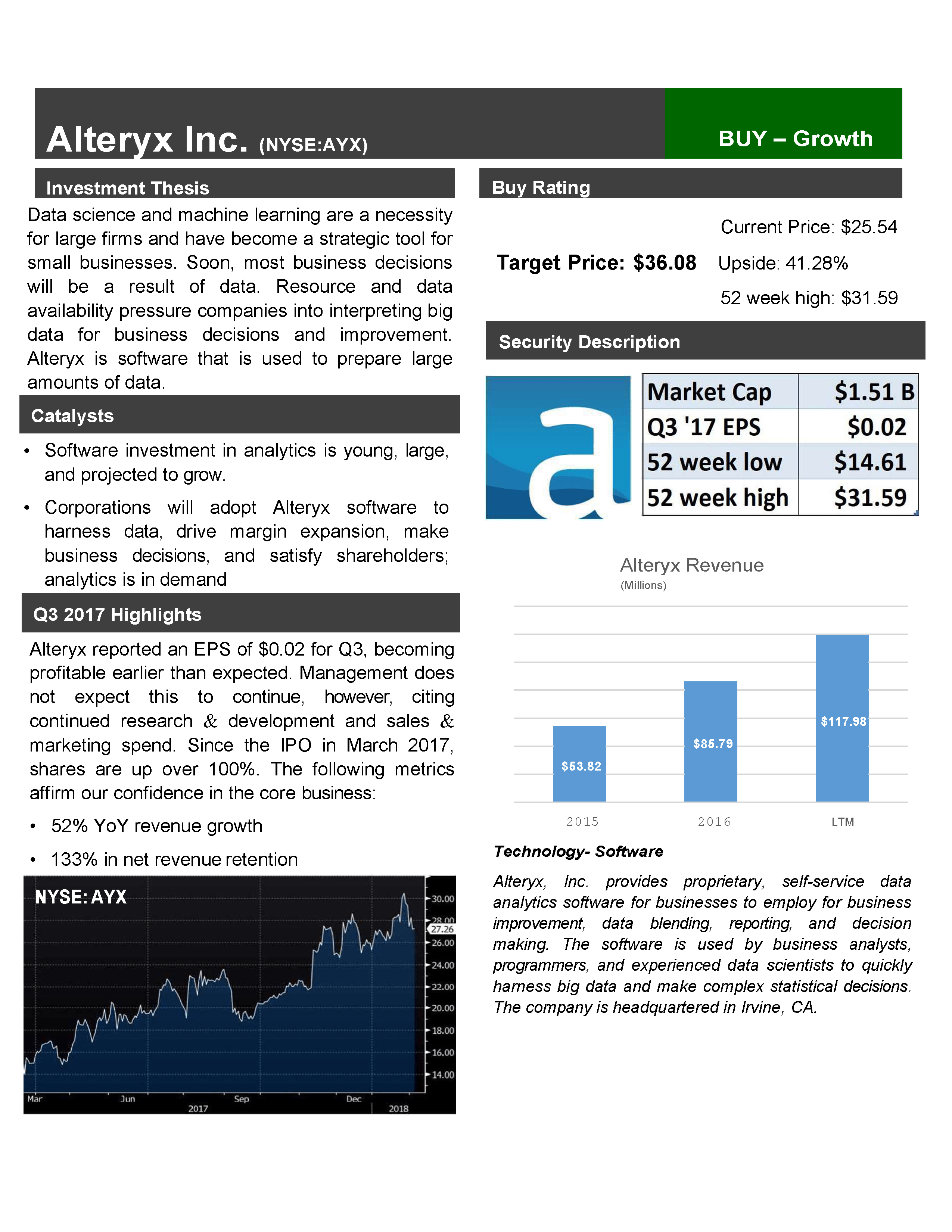

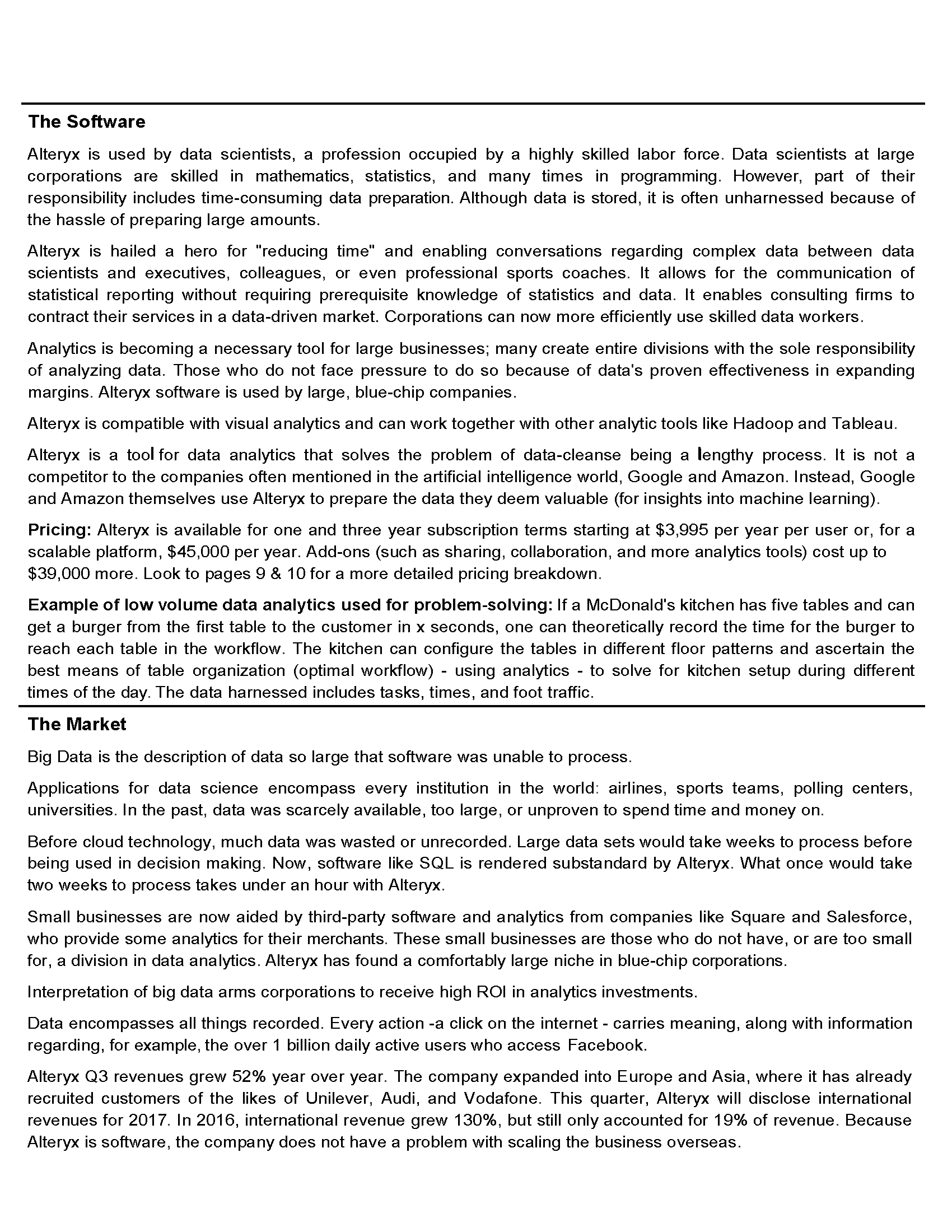

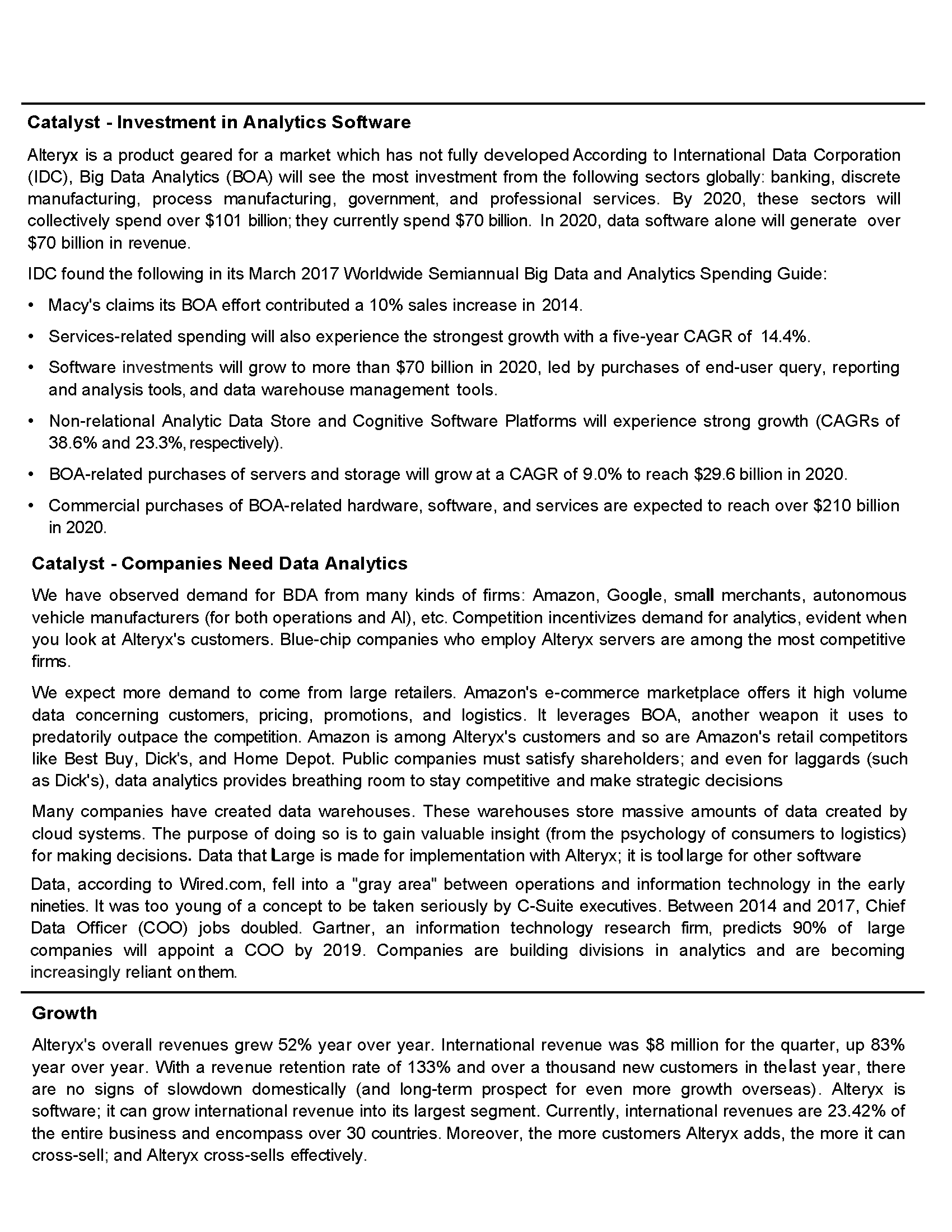

I will dissect current market dynamics and the capital markets with respect to Alteryx, Inc. (NYSE:AYX). You should know that this is one of most complicated equities to be buying, and Wall Street has a lot of this one wrong. Those of you who are considering investing in AYX, I highly recommend you read every word of this document. It is not every day I circulate unpublished research, let alone macro trends and what the capital markets do, and I especially do not reiterate companies I already published theses on. Owning this stock is not for everyone but following the company will earn you a master’s in finance. This write up is an extensive look at AYX in today’s point in time. It is not a thorough analysis of the company’s financials. Shares last closed at $121.51 on 8/7/2020, down 28.18% on the day.

For those who just want the bottom line, and do not want to read this extensive write up: AYX is a long-term winner and will be the Adobe of its class. However, current dynamics of the equity and macro-economic trends – COVID and QE – suggest we are not done with the ongoing AYX selloff. I expect AYX to trade down towards to $105. If the market is to lose its legs, AYX can and will drop to $90, dare I say $70 (not likely). Nevertheless, at prices of $105 or below, AYX becomes a bargain for the long term. Years into the future, my opinion is the stock doubles and triples again. This conclusion is ascertained from the following analyses and review. I maintain AYX is a long term buy.

Bottom Line: Start to buy slowly and add in increased weighting as the stock drops towards $115, $110, $105, $100, $95, or

$90. As the world exits COVID and new earnings are released, buy more, and watch for global corporate CAPEX rebound.

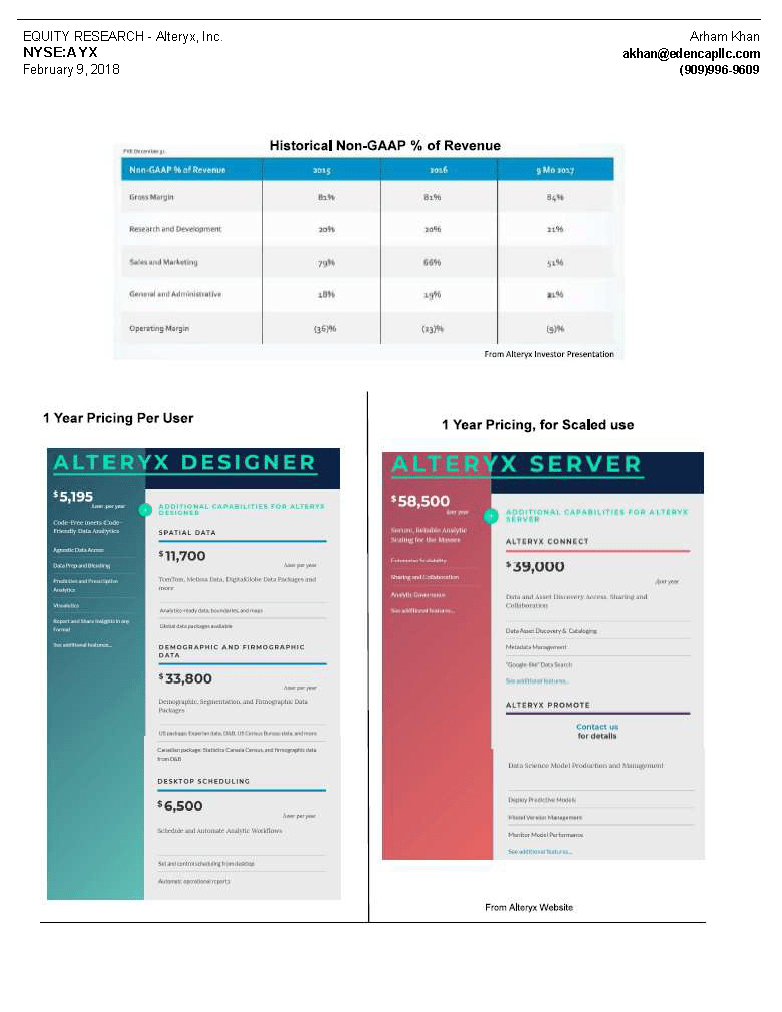

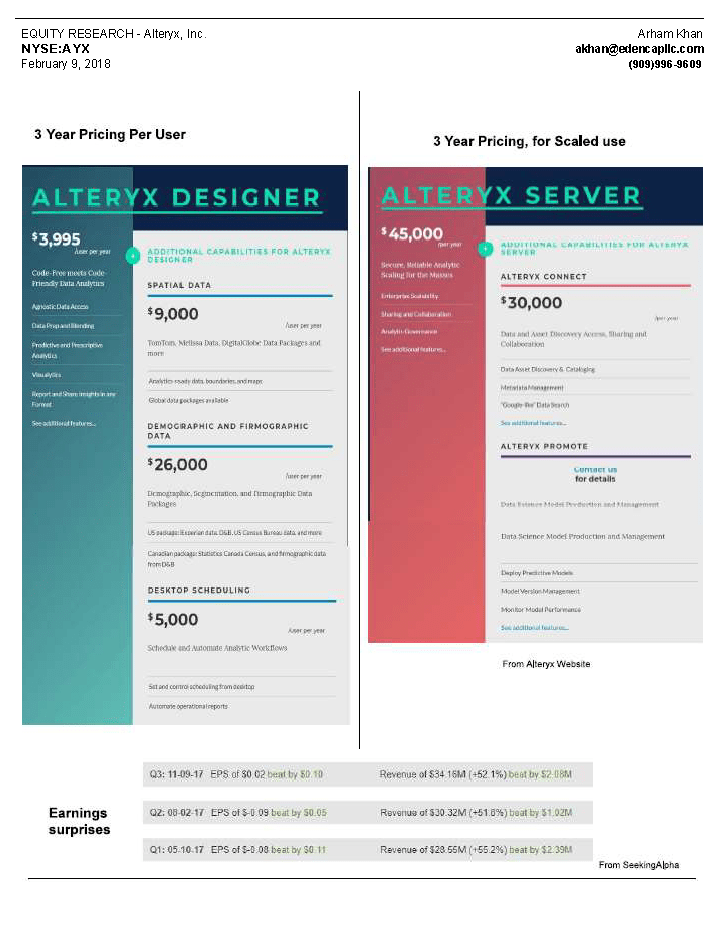

C OVID: This Alteryx recovery can take some time (we will get to this) – as opposed to previous selloffs, where recovery was relatively quick – and there is no timeline I can ascertain, as I cannot forecast COVID dissipation. Moreover, my meetings with COVID executives, doctors, management teams, consultants, and experts who develop, advise, consult, or study COVID vaccines (Tiziana Life Sciences plc – Ame (NASDAQ:TLSA), Atossa Therapeutics, Inc. (NASDAQ:ATOS), Soligenix, Inc. (NASDAQ:SNGX),$ ONCS, Fortress Biotech, Inc. (NASDAQ:FBIO)) and treatments fully anticipate us to carry COVID into and beyond early/mid 2021. Let me begin by saying that, on page 14 of this document, find my AYX equity research from February 2018. I Highly recommend you read it in its entirety before continuing this analysis (page 14 through 23 of this document). I doubt you will find another fundamental qualitative analysis like this for the company. The attached is one of the most extensive research I have done, and it is the only one of mine that you will find with nothing but words. In fact, cash flow modeling is rendered useless as the company delineates 89-92% gross margin and no profit. Read the report, AYX is an extremely misinterpreted company and the report clarifies much of what you need to know about the fundamentals of this business.

My History as an Alteryx Shareholder

I have long been a vehemently strong supporter of AYX. I have bought the stock aggressively since $24 in early 2018 after meeting the CEO and instituting AYX ownership for the California State University Endowment. I have presented the stock as a panelist at $60. Even after 150% and 275% gains, I still urged my guys to initiate positions without hesitation. Most recently, I circulated recommendations in December of 2019, at a price of around $90. For those of you who know me, I study companies of all sizes and industries to find lifelong investments. I have held as much as 60+% of my net worth in AYX multiple times, most recently up until May 2020. Yes I am batshit crazy.

Through June 2020, I reduced my position from over 60% to 3-5% of my net worth. I did not like large cap equities during unpredictable events and recession, mostly because I do not want strong-index-correlated securities in such times. I was also skeptical of COVID effecting salesmanship and adoption (adoption of AYX requires substantial CAPEX). Full disclosure, I remain 100% invested in the equity market, and over 50% in illiquid microcap securities Altigen Communications Inc (OOTC:ATGN), Crexendo, Inc. (OOTC:CXDO), NLH.V (currently).

I have gotten many of you into the stock from $24 through $90. Most recently, it hit a high of $180. This Thursday, earnings were reported, and the stock dropped 30% in one day. Many of you have reached out for my thoughts and recommendation. Some of you are in the stock, some are not.

Let me also preface my discussion by saying my father is retired from the Aramco Organizational Consulting Department, and a Tsinghua University PhD in engineering, turned PhD statistician. My family is from Pakistan. So please forgive my culturally insensitive breakdown of the following extremely complicated nature of software and data analytics with respect to the proliferation of data science, artificial intelligence, data centers, data collection, and business and organizational development and efficiency(all done in the hope of providing clarity to you). I mention engineering because statistics is done by statisticians, who are quasi-mathematicians, like engineers. And Alteryx is not exclusively used by rocket scientists, coding wizards, and autonomous driving car creators. Contemporary colleagues and cousins to the field of my father are the people who use Alteryx. For those who do not want to read the content from 2018, I have oversimplified below.

Summary of Alteryx and My Thesis, Feb. 2018

- AYX is not an artificial intelligence company.

- AYX is not like the rest of the SaaS companies.

- AYX is a quasi-crossover between Adobe Photoshop and Bloomberg Terminal for data science.

- AYX allows for the communication between different departments: OCD, coding, IT, management, etc.

Again, read the attached report starting on page 14, but allow me to oversimplify:

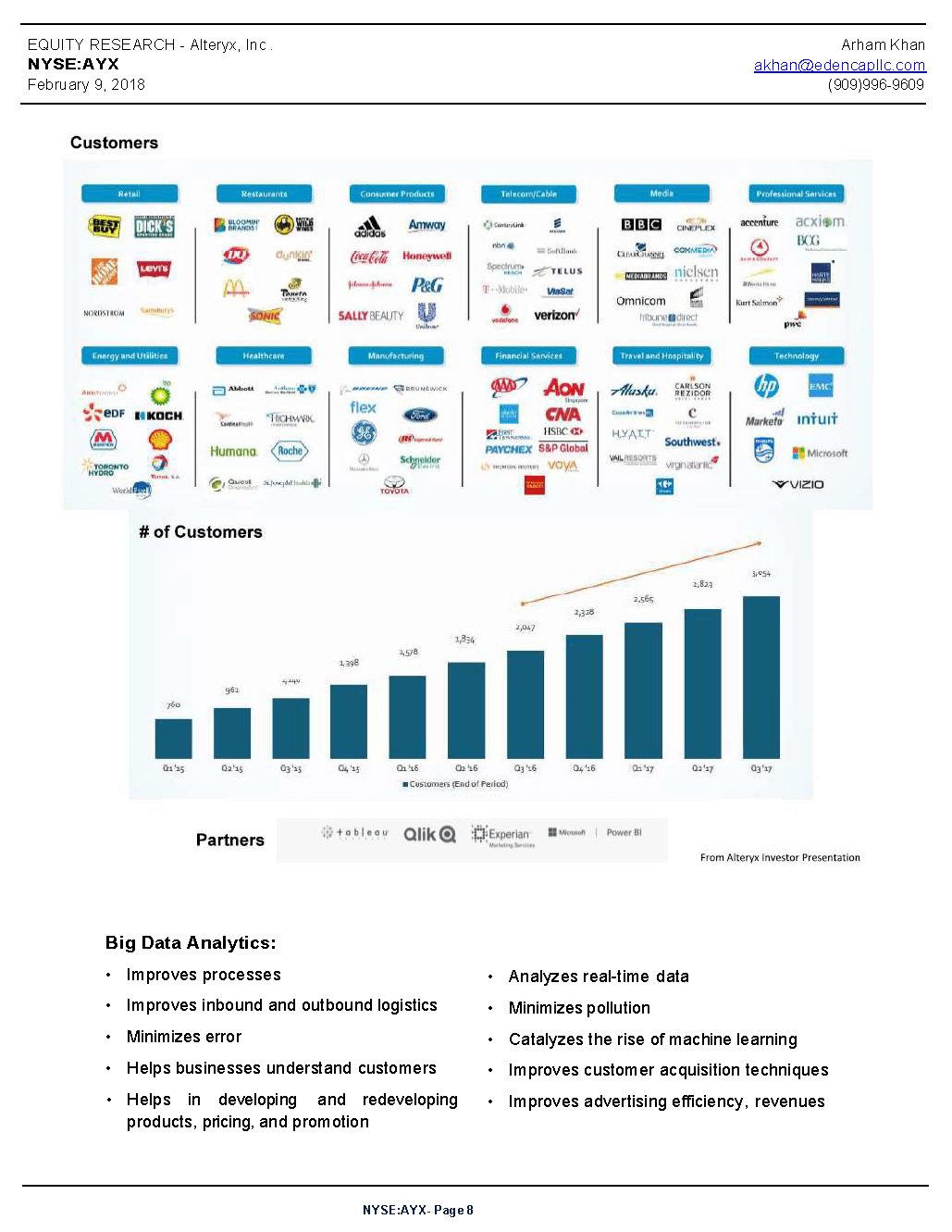

This is data analytics. If you do not understand what that is, think of the Indian or Pakistani math guy. Your statistics professor in college, your NBA team’s back office, or parts of your Democrat and Republican campaign staff. These are skilled laborers whose skill and availability are harnessed and expanded by Alteryx. They now exist in every large corporation in the world. Please see page 17 and 21 of this document to find a short list of notable corporations (Feb. 2018) who consult Alteryx.

-

- All day, statisticians and data scientists crunch regression analysis (for example). All you need to do to perform regression is collect data.

- i.e. Record how long it takes to get a burrito from the kitchen to customers hands if you have 4 people in the kitchen vs. 6 people in the kitchen.

- i.e. Record how much weight is gained if sample groups of people eat 1k calories a day vs. 2k vs 3k.

- You may find that, yes, weight gain is directly correlated to calories consumed; yet, within your samples you will find differences in how much is gained by each person in each respective group (whether it be height, gender, race/origin, etc.). These differences, if not accounted for in the data recordation process, will lead to inefficiencies (error) in your modeling.

- i.e. Record how long it takes to get a burrito from the kitchen to customers hands if you have 4 people in the kitchen vs. 6 people in the kitchen.

- Regression tells you correlation of one thing to another. You can model an event, inputs, and outputs: y=mx+b.

- In statistics, y=mx+b is too concise and perfect, it must also add variable e rror: y=mx+b+E. This can represent processes or events.

- A process is continually improved upon until error is minimized. This is done, in part, but collecting even more data.

- In our example of weight gain, the additional variables of height, weight, and race can be accounted for in a new, more concise formula with smaller ‘E’ or error.

- y=mx1+mx2+mx3+b+E

- In statistics, y=mx+b is too concise and perfect, it must also add variable e rror: y=mx+b+E. This can represent processes or events.

- Correlation of large amounts of data, and the analysis of its outputs tells you what decision to make. Who to fire, where to place the milk in the grocery store for maximum sales, how to organize the kitchen inside a McDonalds to get the burger from scratch to the customer’s hands in the fastest way possible? With this analysis, you identify bottlenecks, you identify where to place an advertisement, you identify how and where a certain demographic of people on Facebook will navigate, optimal staffing, best pricing for profitability, etc.

- Some of these are all simple processes/questions and can be solved using one Pakistani mathematician, a notebook, and paper.

- A more complex version of this is lean six sigma, where you are now utilizing data and analytics and your Pakistani math guy to optimize supply chain, for example, with extremely minimized error. Supply chain might not be a dire necessity, but minimal error is crucial for something like hospital beds and hospital staffing during COVID.

- All day, statisticians and data scientists crunch regression analysis (for example). All you need to do to perform regression is collect data.

Decision Making: you simply attribute variables to events, model the events and results, minimize error, and the math tells you what to do (or advises you what to do).

Finally, and it is worth noting, given contemporary technology:

- If you collect enough data – I am talking gigantic sums of data such as every single click made on Amazon or every single turn and movement of a vehicle (geospatial data) – you can then hire a legion of Pakistanis (it’s true trust me) to crunch your numbers and ascertain, with the help of your legion of coders and GPU manufacturers – how to create a self-driving car. It is a continuous series of collected data and new data, fed into a steroid version of y=mx+b+E, that allows for a car to drive by itself . . . and, eventually, continue to become a better driver of itself by collecting new data simultaneously and ‘minimizing error.’ This is what artificial intelligence is. Continuous ‘learning’ and minimization of error. The car is essentially thinking: when *this* happens, I respond by doing *this.*

-

- The car attributes left turn to ‘A’ and right turn to ‘B’ . . . and so on. Eventually you get a ‘ABCDEFGHIJKL’ happening in real life, and the car responds with the output ‘XYZ.’ This could happen in less than a nanosecond.

- Every click on the internet or 0.0001 degree turn of the car holds meaning in a statistical sense. Data is now produced at a pace never seen before; it will grow to paces never seen before. Companies are collecting data like never before (datacenters, inventory levels, cars, shipping logistics, transportation logistics, staffing, etc.).

- There is nothing in the world statistics does not apply to. It only took us thousands of years to find this out. Up until the late 90s, data analytics was a quasi-IT department, not understood by many. Another AYX catalyst is the proliferation of the role of a Chief Data Officer and departments dedicated to organizational development.

-

- My Father’s time with Aramco was in the Organizational Consulting Department. Saudi Aramco is so large that, when I lived there, I lived in a campus/city shut out from the rest of Saudi Arabia. Aramco has its own schools, libraries, hospitals, etc. My father found himself in a hospital one day, an oil field the next, a different office another, etc. He was no geologist; his department was brought in to improve processes.

So, the point is, with this much data, the legions of my Pakistani countrymen were reduced to ‘wasting time’ waiting for such mass amounts of data to be crunched by outdated software. There was so much data that it could not be harnessed, prepped, blended, and prepared for decision making (who to fire, what product to cut, etc.)

Let me drag out one other example of mass data, also covered in my 2018 report. Home Depot has 2000 stores, it has 200,000 SKUs, and each store will hold 100,000 SKUs. You can imagine all the combinations and permutations this yields.

Alteryx is the key to harnessing this data. It takes Home Depot 2 weeks to crunch and simply prepare data from those permutations when traditional software is used. It takes Alteryx software under one hour. It tells Home Depot exactly

which product to place on which shelf during July of a calendar year (a solution to a question with millions of possible outputs). It tells them what product to make seasonally available. It tells pro sports teams who to put on the floor in the last 2 minutes of the game. Consultants who use Alteryx for clients’ supply chain (and more) look genius. These people can walk in a client’s grocery store and tell them what to do after collecting data.

That is as far as I will go, let me reiterate that the extensive breakdown of this company is included in the attachment, page 14.

Now, For the Good Stuff

My history delineates I buy companies I want to hold forever. Here is the current reflection of my research (below, as of 7/31/2020). AYX dropped 30% on 8/7/2020; and still, I have not changed my mind. In the past, it dropped 10% and 30% multiple times, and even 50%, before fresh new highs.

I own each of these companies and I hope never to fully relinquish ownership.

For you and AYX, currently, it is a matter of identifying an entry. I maintain it is just too early and the bottom of this current selloff has not come; nevertheless, I already began buying (very small exposures) and will continue to do so as we move downwards. Again, in the past I have held as much as 63% of my net worth in the stock (I will literally have this audited). If you buy even today, I believe that you will later be handsomely rewarded. Still, my conclusion is that we are likely to drop further and that we may be able to find better points of entry.

Alteryx Since 2018: An Absolute Gem, Set Up to be Marred; Now Corrupted by The Street

AYX was a clean slate with no debt when I first invested. I bought at every single dip. Fundamentals and earnings, as time passed, got better and better. Then, two major things events that most did not pay attention to happened. You need an understanding of the business to understand some of the following, but let me quickly explain…

Institutions (Qualitative)

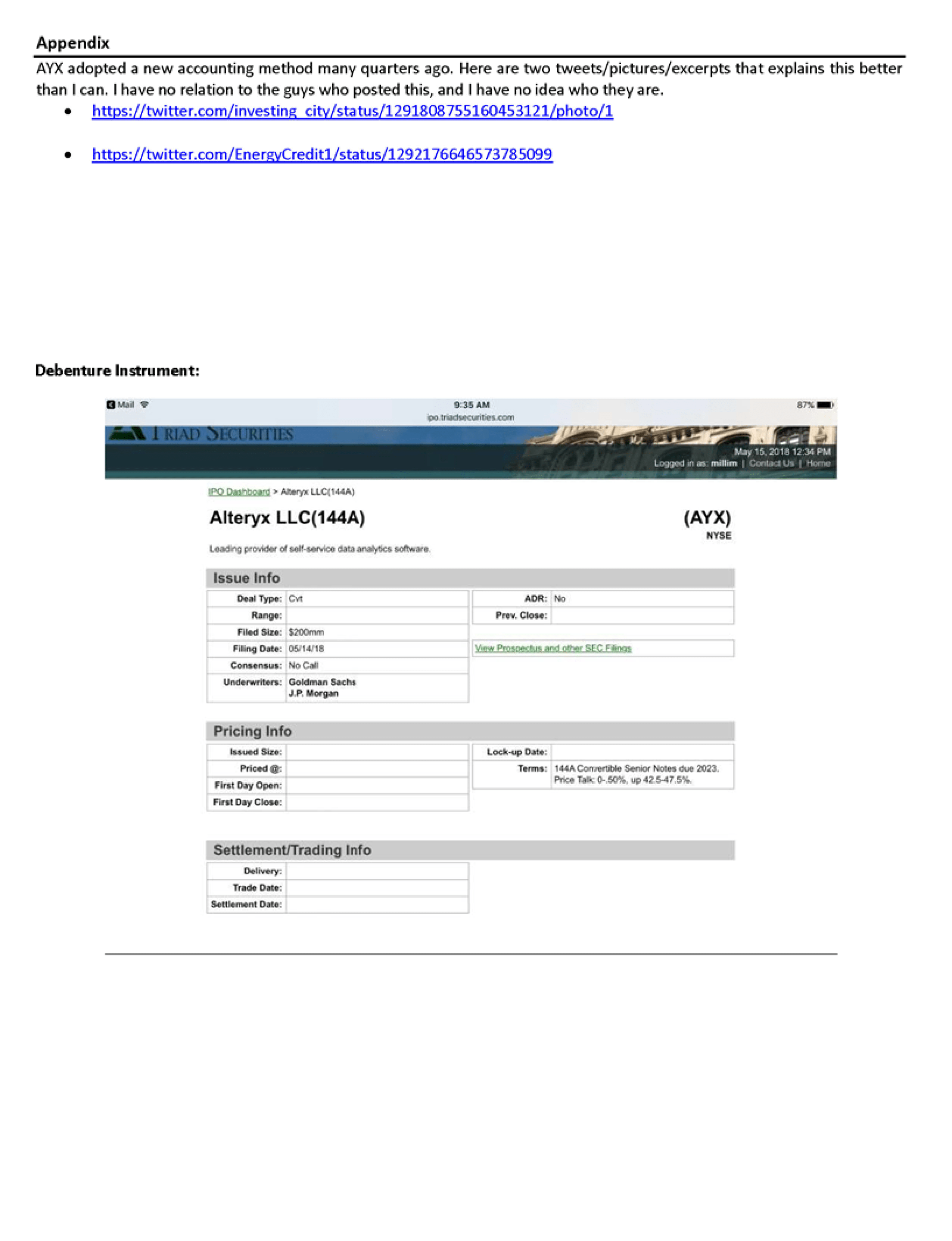

Leverage: On 5/14/2018, the already volatile Alteryx engaged Goldman Sachs and JPMorgan to help issue a convertible debenture ($200 million) on the company. There is a Bill Gross thesis on this and, in short, this catalyzes a hedge fund trading strategy: arbitrage – shorting warrants, buying stock, shorting stock, buying the bond (luckily no warrants on AYX). This increased volatility in the stock substantially and caused lag in price appreciation after positive earnings results. Without getting too detailed – this has binomial and stochastic nuances, literally rocket science – think of it simply as leverage.

If you take leverage, your up and down swings are more violent. More gains, and more losses. Simple as that. Whether it be your portfolio return using margin, or a company’s stock after an increase in debt. HOWEVER, if you add debt and all else remains equal, it is likely the value of the business increases immediately (we will get to this later in my analysis of ZIRP, but allow me to preface with the following):

If Apple adds 1% interest bearing debt tomorrow, it catalyzes the stock price up for no good reason other than that they added (cheap) debt (cost of capital considerations). If Apple started to deteriorate, the stock would obviously go down, but the move down is now more violent. This idea is relatively simple: you lose money, you lose borrowed money, you still pay back borrowed money in full plus interest, but you also absorb the loss.

With AYX through 05/2018:

- You have added convertible debt to an already high beta security.

- You have introduced more hedge funds (‘market movers’) to the stock, some who may not know or care to know a single fundamental thing about the company.

- The high beta security also happens to grow 50% a year with zero profit and 90% gross margin.

- You have introduced significant leverage on a 50% growth, software company with zero profit. Now, the company’s previous moves of up 10% or down 10% have become 20-30-40% swings. We saw just that, only a few months after the debenture was written in 05/2018. The stock rose 90% right after the debenture was issued until 09/2018 (as AYX revenue again grew 50%) and then dropped 30% in 10/2018. It then proceeded to run up 222% the next 10 months. Case in point: Leverage.

To give you my train of thought up until this point – I was horrified to see my baby, which I invested in at 0 debt levels, being polluted. Nevertheless, business was stellar, debt was supportable, and the stock appreciated grandiosely. The debenture was a huge positive for shareholders. It only meant that every dip was a buying opportunity. The fundamentals remained stellar.

-

-

- I was not concerned about the convertible; at end of July 2018, I had 53% of my brokerage account invested into AYX (I will literally have this audited in fund formation procedures).

-

-

- Important note: after all this, at this point, we observe a beta on the stock, adjusted or otherwise, nearing 2.0. That is extremely volatile to begin with . . . before what happened next . . .

-

- Please see appendix on page 13 of this document for the debenture instrument I covered above.

Institutional Coverage: The company became very successful very fast. Then came what I call the ‘kiss of death.’ My history delineates I try finding companies early, before big buyers come in. Well, here, they came in all at once. In mid-2019, at all-time highs at a range between $80 – $90, two disasters happen (which do not seem like disasters – if you do not understand the business of capital markets – because initially, this sent us to all-time highs):

- CNBC starts blasting AYX all over the place. Note, I do not watch a minute of that garbage, but my colleague told me about this, and I tuned in. Jim Cramer begins heralding AYX and thinks he found gold. He, of course, presents the company in a media frenzy, tech sense. AYX is still smashing estimates and growing 50%+. It is likely the Cramer endorsement got buying viewership, most certainly of retail investors, but that means very little now that we sit at a $9 Billion-ish market cap, have a beta of 2.0, have 50%+ growth, have convertible debentures, and have no profit. Regardless, at this level of success as a tech company, the institutions began to watch/pile in.

- At this point, the stock has been arbitrarily reduced to and grouped with other high flying, leveraged SaaS companies (I call them leveraged particles of shit) such as $DDOG, $OCTA, etc. (the same ones it is being grouped with today).

- Goldman Sachs issues a buy rating on the stock of $111 or $105 in June 2019 (something around that) when the stock was around $95. I believe this was the first substantial endorsement for the company. It also came around the same time as the Cramer endorsement (mid-2019). Remember, Goldman issued the 2018 convertible debenture (. . . cue the institutions. . . cue volatility . . .) on the sell side.

- The stock jumped 50%. Then, the stock c rashed 40% several weeks later. . . for no fundamental reason (however, the drop was also preceded by some insider selling). This was a breakdown in the stock – the leveraged particle it was reduced to – but not the company. That screams buy

- I initially reduced my position in June 2019 from 53% of my weighting to 20%. In November, I built back up to over 40% weighting. See picture:

- Then the stock jumped 70%, a run based off stellar fundamentals. Fundamentals, again, were on fire, and the company continued with no slowdown in even growth rate. Then the COVID crash came, and the stock was sent down again, aided by broad selloff.

https://geoinvesting.com/wp-content/uploads/2020/08/Messages-Arham-Sunny.png

- The COVID crash in AYX was 50%. It then rebounded 124% after the QE rebound, asset-light proliferation, and a Q1 earnings report that was too in-between the pre-COVID and post-COVID era. The Q1 report (5/6/2020) did not expose the issues Alteryx was facing. Alteryx reached an all time high in July 2020 of $185.

- I started reducing my position in April and May 2020 and continued selling through June, down to around 3% weighting. I was not comfortable with the macro environment, and had issues holding so much weight in unquestionably overextended B2B software when corporate CAPEX was bound to retract.

Mind you, amid all this gradual ‘deterioration’ by Wall Street of our asset, the broader Wall Street still has not come to grip what Alteryx is. I do not think they care; it is simple numbers and technological attributions to them. Outside of a few hedge funds, I doubt much due diligence goes into their ownership. I will explain shortly.

Alteryx is still considered – by many – artificial intelligence, simple SaaS, and another B2B tech solution. This is not how you would classify an Adobe. Photoshop is indeed tech and SaaS . . . but it is not blanketed like Alteryx due to Alteryx’s complexity. Look at the last time Adobe found a pause in fundamentals. It is a completely different story (one that I have rediscovered in ATGN and CXDO), but it catalyzed re-invigorated growth rates post-2011 after a shift to the subscription model. The stock (ADBE) returned 1700% after a -30% 2011 drawdown in the face of hardware-to-software migration.

Today for Alteryx, post Q2, we have run into a COVID problem, not a true fundamental breakdown of the company. B2B sales of software that costs a corporation $40,000 is problematic amid COVID. Some salesmanship must be done in person. My opinion is not that companies are shying away from CAPEX into analytics, it is that they shy away from CAPEX in mass amid an incredible operational interruption – COVID.

Institutions (Quantitative and More Qualitative)

Let us pause the timeline and look at the word I keep introducing to you as an omen: institutions.

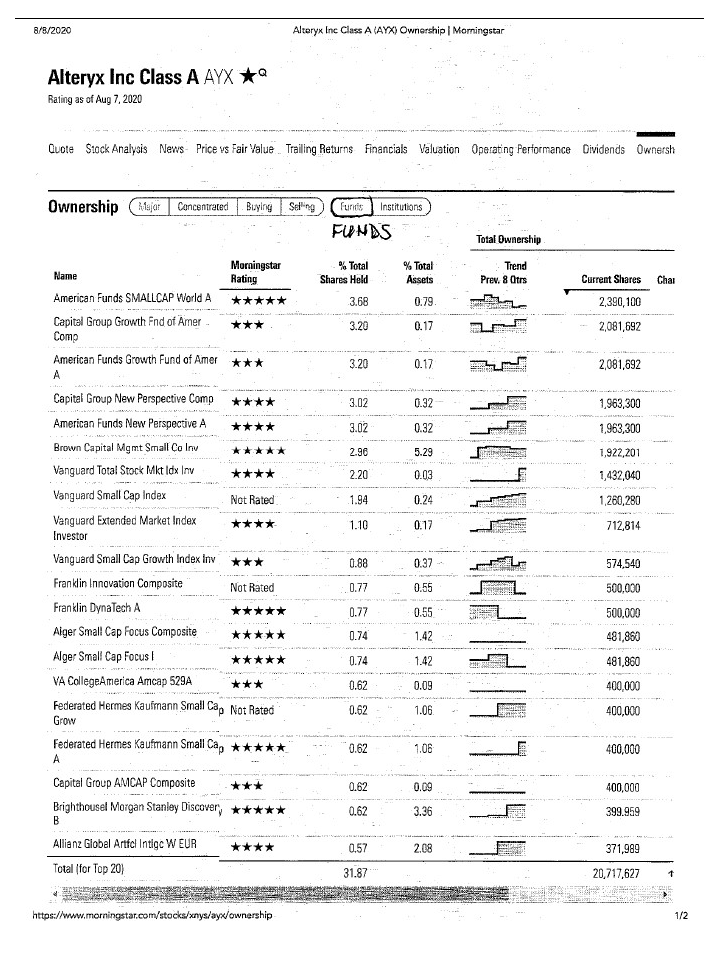

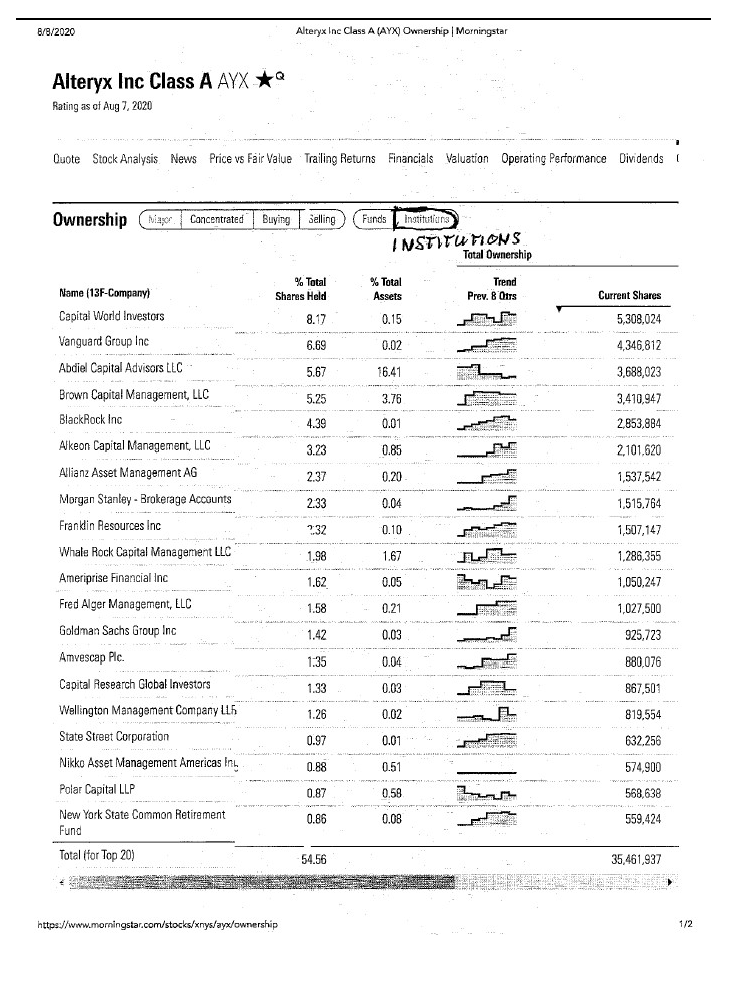

You have 2.0 beta (arbitrarily speaking and arbitrarily adjusted), convertible debentures, 50% growth pre-Q2 2020, no profit, 92% gross margin, and an absolute slew of institutions. Not only are hedge funds trading converts (which are now less) and stock, the quick success of this software company and the Goldman endorsement brought in the institutions in mass. On page 24 and 25 of this document, please find the Morningstar list of institutions who own Alteryx. What you will find is that 90% (!!!) of this company is owned by institutions and hedge funds.

Now, through my history as a shareholder, the stock had been through multiple -10% cliffs, which, after the institutions and debenture, had turned into -30% cliffs. Next came COVID. As mentioned, the COVID crash was a crash in AYX of nearly 50%. let us investigate the selling.

Let me iterate to you the absolute uselessness in society of many of these institutions (obviously I am biased here and sharing my opinion). Easily the worst people on earth (satirically speaking). The largest institutional owner of AYX – Capital World investors – owns over 8% of Alteryx. T his translates, for them, only a 0.15% weighting of their AUM. They give zero shits about this company and can move the price any day they want. FYI, they also give zero shits about generating alpha.

Here is some grey-market-but-completely-legal stuff:

- Institutions who own long stakes in equity can hedge their positions using contracts. They may hope for the contracts to expire worthless, but they will execute in a breakdown of stock. Well, if I am an institution who owns options and I know other institutions love the stock, I can predatorily:

- Sell the stock (amid already existing downward pressure such as in a broad market selloff), catalyze downward pressure, increase the value of my short exposure, execute my contracts, and allow the institutional buying at lower prices to bring the stock back up.

- Sell the stock, catalyze a slew of selling by triggering stop losses (which is accessible information), fry the hell out of retail investors, cause selling, cause institutional selling, and buy extraordinary amounts of shares at lower prices because they love the stock and want their institutional colleagues to push it back up.

Welcome to the business.

Retail gets fried. There are a few earnest looking funds on the list, but on average. . . a bunch of subpar AUM hoarding and overly diversified underperformers with no real skin in the game.

Again, these institutions and funds own 9 0% of the stock. Good luck trying to trade in and out at optimal price points. Good luck with volatility. This is another reason I emphasize AYX is a long-term position.

COVID Instigates the First Fundamental Pause in the Company

After reaching all-time highs in July 2020 of over $185, it then traded down coming into this past week of 8/3/2020. On Friday, 8/7/2020, the stock crashed 30% in one day on Q2 earnings. In total, we are down approximately 3 5% from all-time highs (in 07/2020).

- Insider selling in weeks preceding Q2 earnings was a sign and it is important to observe. I will not get into this here, but it is an important indication one should follow for all

- If you have not caught it yet, I have been underlining material and violent swings the stock observed. You can see what has happened to the magnitude of these swings over

With respect to the past, we are near, or at, the maximum historical drawdown observed in the stock. However, the all-time high of approximately $185 realized in 07/2020 would not have been possible without zero interest rate policy, quantitative easing, and the proliferation of asset-light, technology businesses amid COVID. What I can conclude from this is two things.

- The 30% one day selloff that followed the initial selloff into earnings took out close-to-a-majority-but-an-undiscovered portion of downside. I still think we have more to give up.

- The market itself is ‘levered’ (quantitative easing). This is extremely complicated and about zero people in the world are qualified to talk about this. However, it implies two things.

- The S&P 500 Index is up 50% since the COVID bottom. It is expected the Federal Reserve will not cease QE, and more importantly they will continue to maintain zero interest rate policy. While the rules of finance can imply we are due for correction (maybe -3%, -5%, -10%), QE and ZIRP instead imply we move up. Nevertheless, Alteryx has crashed 35% while the market went up. Recall that the Beta on AYX is – well, I have lost count – extremely high. The next market drop can send AYX a proportionately larger leg down (Beta and leverage), even if today’s bottom is an arbitrary resistance level.

- Also note: since early 2017, the NASDAQ is up 90% while the S&P 500 is up only 40%. Add in the nuances of what Gold has done, there is arbitrary implied volatility in markets ahead.

- The broad market bottom also happens to be the exact moment Trump’s cabinet announced re-institution of quantitative easing. This behemoth has not failed yet. You must respect it.

- Previous drawdowns in Alteryx have come while the company was firing on all cylinders and executing without pause (pre-COVID). This time, we have a first fundamental pause in AYX’s history (explained later, below). This is a substantial negative for our ‘leveraged particle’

- Combine this with institutional ownership, debentures, high beta, tech, or any incoming market correction (or even a small retraction), and you have a further catalyst for a valuation breakdown. Hence, I suggest for us to wait – in the short term – for a better entry point to maximize long term gains and to ‘grandfather in’ our cost basis. I feel we have at least another – 10% to go.

- We also observe that the sales multiple has plenty of room to re-calibrate to the downside, even after the 40% drawdown. QE sent us to new, unseen heights. I have observed a standard 20-23x run rate multiple (on 50%+ growth) before COVID and QE. However, now with a period of suppressed growth, we can expect this to retract toward 15x (our growth rates went from 50%+ to 17%) or Price target, arbitrarily backed out this way, leads me to believe we will see $100. Additionally, $90 is not out of question given a further broad market selloff. Here is when I want to begin buying, because I truly do believe we can get back to at least a prolonged period of 25-30% growth in the company. There are many nuances for this, continued from my original, attached thesis in 2018 and I will briefly mention a few.

- Each time I bring up broad market selloff, I am not talking about another 30% crash in the broad market. Anything like that, and you can throw everything in this review out the door.

- When I mention sales multiples, please see in the appendix on page 12 of this document a short discussion Alteryx’s accounting policies. Revenue recognition was changed some time ago.

- Again, these numbers are arbitrary and based off what I observe in sales, market cap, and historical multiples. I am not going to do a further analysis of the financials at this time; I spent eons doing so over the last two years. We have been rewarded 500% for it.

Please read over earnings calls, 10-Q, and probably the 10-K too, for better understanding. To summarize Q2:

- For the first time we observe a real fundamental crack in the business. Growth has slowed to 17% and guidance has lowered due to COVID.

- Institutions started selling off, we are at a 30% drawdown in the price already, one day.

- Alteryx customers are sticky, net recurring revenue is still excellent.

- Still adding customers.

- The main thing for me is that this is a COVID breakdown. That certainly does not help shareholders right now, but it gives you a sense of security over the long-term nuances for this company. Adoption of analytics will never cease. It is a must have. Again, read my attached report, but not only does a leader like Home Depot or Amazon need to consult analytics, a failing Dick’s Sporting Goods needs to as well (expand margins where possible, payroll, inventory, profitability, closures).

- Alteryx is multinational and grew 25% internationally year-over-year.

- The main fundamental issue stemming from COVID, in my opinion, is CAPEX. Corporate CAPEX must skew lower. It is difficult to deploy capital when your workforce is at home.

It is worth noting AYX seldom misses estimates. They even beat the number this time, and probably will next time; they have lowered guidance to some very achievable benchmarks. I do not outright blame management for how they have responded to 90% institutional ownership, but answers have become increasingly political. Actions, such as insider selling during overextended valuations and lowering of guidance to achievable benchmarks when they expect price stabilization seems like they play right into the hands of manipulation. Not shockingly, however, sharp falls and rebounds have followed every time.

The bottom line is this. We are down only 35% on a true fundamental (short term) pause. This thing can bleed substantially more. Let me speak again in arbitrary terms.

At the very least I expect 40% off all-time highs or 9% off the 8/7/2020 close ($110). You must further consider what my above analyses of the capital markets can catalyze . . . continuous and, later, predatory selling. Moreover, a broad market selloff alone can send the stock down another 13% off the 8/7/2020 close ($105). I think that the worst-case scenario is we see a $6 billion dollar market cap, or a price of somewhere around $95 (unless hell breaks loose again, but it very much looks like QE and stimulus will support us). At each of these price points, you can be assured I will be buying.

Recall that Beta is 2.0. Almost religiously, this stock rises 5% on a +2% SPY day (loosely speaking, but magnitude is there) and equally to the downside when the market drops. This time, the market has not dropped yet. If the market drops 10%), AYX is gone for another -17% or -25% ride. In such event, add another -5% for predatory selling. I fully expect a -40% move off the all time highs (from $185 to around $100). If you can catch the bottom, however, you will find yourself set up for a nice 20-30-40% short term gain. These bottoms are, of course, hard, and nearly impossible, to identify.

Beware that even if you mark the bottom and find it, a broad sell off can send us into no man’s land. The COVID crash low of <$80 was, at the time, absolutely ludicrous and signaled a buy, but that is what this stock has been reduced to in selloffs (leveraged particle). I bought long LEAP contracts when that happened.

The silver lining is this. I am looking to buy a large amount of AYX if I can mark a bottom. I will start to buy slowly into the $110 range and all the way down to $90 and below. Only thing that bothers me is a possible broad market selloff. I also want to come out of COVID underexposed, so that I can overexpose myself when it is over. I foresee the possibility of recreating long term moves in this stock. Long term, I must reiterate that this is a winner. The fundamentals of the product do not change. This is the next Adobe of its class. Of course, competition risk is possible in the future, but so far there is nothing that rivals Alteryx software and can take market share. Read, starting page 14, to understand why I feel this way.

Zero Interest Rate Policy (ZIRP) and 1% Payroll Protection Plan (PPP) Government Loans’ Effect on the Capital Markets and the Broad Market

When the Fed reduces interest rates to zero, the phenomenon which occurs in our business is this:

- The cost of debt capital is reduced to a minimum. Borrowing is cheap.

- Any corporation who can sustain more debt on its books finds itself in a position, or rather, an almost obligation, to take on this cheap debt. The following is a breakdown for non-valuation-literate readers but serves as the introduction to what I have to say about asset valuations in the current environment. Bottom line: yes, valuations appear stretched, but with lower costs of capital, absolutely the price of an AAPL share rises even if nothing else changes.

- If you have no debt, and your cost of capital is 100% weighted in cash. . . then let us call it 10% cost of equity for simplicity’s sake.

- If you find that you can obtain 2% debt, and operations can support as much as a 20% weight in debt, you can reduce the cost of capital from 10% to 8.48% immediately (we assume all else remains equal).

Cost of Capital = {weight in equity x cost of equity} + {weight in debt z cost of debt}*{1-tax rate)

- Assume tax rate is 20% and remains at 20%

- We went from: {100% x 10%} + {0% x 2%}*{1-0.20} = 10% Cost of Capital

- To: {80% x 10%} + {20% x 2%}*{1-0.20} = 48% Cost of Capital

Cost of Capital is an input to how we value equities. It executes a discount factor to future cash flows of the business. Think of this exactly like inflation. If inflation is 2%, your savings of $100,000 today is discounted 2%, and your real savings that sit in a bank are instead worth $98,039.22 in one year.

- Conversely, if you estimate you will earn a salary of $100,000 next year, it is, in today’s terms, worth $102,040.8. This is the equivalent of earning $100,000 next year if you had it today.

Instead of inflation, we use the cost of capital to move dollar amounts for equity valuations. If inflation dropped to 1%, your savings would not erode as much as if inflation was 2%. Immediately – all else being equal – you are worth more money.

Same thing with equities . . . immediately, our assets are worth more when the Federal Reserve drops short term rates.

Many professionals are scratching their heads at all-time highs in the NASDAQ. I disagree with their disbelief. Not only is the broad cost of capital slashed via ZIRP, the NASDAQ is a basket of asset light, high growth, and high margin corporations. Several of them, AYX included, have no profit. However, they have high gross margin, and we expect that eventually, more of this high upper line can drop tom the bottom. If they continue growing, and most of them have, the gross profit is a larger number that will further perpetuate higher net profit and future earnings potential.

- The price of any asset is the present value of its future cash flows.

Not only are future cash flows now expected to increase, the discount rate applied to these cash flows, the cost of capital, has decreased. Both are powerful expansionary forces for equity valuations.

- For simplicity’s sake, we left the tax rate in our example unchanged. However, if cost of capital did not change whatsoever, but tax increased, prices would come down. That is why asset prices rose when Trump was elected, and prices are likely to drop if the Republican Party loses this year.

- PPP loans have been injected all throughout America. This is 1% debt and it is forgivable. Cost of Capital again, slashed (many large corporations did not get any PPP loans . . . a few of my small cap holdings did).

- Jackson Square Partner’s Chairman indicated the cost of capital for large SaaS companies came down on average 100 basis points, an incredible broad decrease. A simple input that increased valuations instantly, thanks to the FED.

Now, for AYX. What we saw through July 2020 was:

- The market moved up (QE, ZIRP), and our beta is substantially high, so we moved up higher.

- AYX is still grouped with these other particles of crap, all who were expected to grow and had high margins. They all moved up.

- Cost of capital is slashed.

- The market, especially SaaS, has cost of capital slashed

- AYX still grew substantially in Q1, not delineating preliminary pauses in corporate CAPEX.

- The NASDAQ moved higher than the S&P 500 did.

When the first signs of the deterioration in growth showed, last week, we were sent down.

For the broad market, all this discussion of cost of capital applies. FAANG companies are further aided by passive investments. FAANG companies are also aided by QE, as the Federal Reserve (and institutions who follow) have injected liquidity into the market and it seems it will not cease. Asset-heavy business and service sectors struggle, so does real estate.

Gold and Commercial Real Estate Considerations With Respect to the Economy

- Real Estate has been hit hard. The first round of support, 3-month forbearance on P&I payments are soon drying. Commercial Real Estate is in the gutter. Some have said they see an interesting rebound in tenant employment, tenant payments, and landlord liquidity for P&I payments. Property prices seems stable.

- The continuous support to Americans in the form of PPP business loans, stimulus checks, and unemployment checks has led to a proliferation in Gold investors. This time around, it seems that high net worth families are actually taking in the physical metal. I spend less time on non-cash flow generating assets, but this is significant. I like to classify Gold and Real Estate investors in the same basket – high net worth yet unsophisticated. Both assets are simply a means to diversify wealth (of course, Gold is an inflation hedge and recessionary haven). It is my opinion that ZIRP is going to lag inflation more than these investors think. Gold has moved up in anticipation of inflation as well as the COVID disaster. Where was inflation for the last 10 years? Nevertheless, I have no skin in this game.

- Final point is this: Gold up, NASDAQ up, QE at levels never seen, FAANG up . . . something must give and break. It is my opinion that it must be Gold that breaks. The reason being is QE has never failed, and it is possible we begin to find novel treatments for COVID. Perhaps Gold has already run its route. Moreover, how much upside is left anyway? I make no long or short exposures based on this other than buying equities, but these are significant recent market events investors need to be aware of. Moreover, it could be that the market is the one to break, and not Gold. I disagree with this sentiment, but I digress.

Bonds

Who cares.

*In all seriousness, the inverted yield curve came two years ago. . . call me in 15 years.

APPENDIX

(Scroll right or left for slides) or download Appendix here.