Over the past couple of months we have been perusing the software as a service (“SaaS”) space to find long and short opportunities. During our analysis we compiled a list of companies (EOPN, ET, ELOQ, PRO, MKTG, DWCH and Unica an Aprimo) that provide software to help companies improve various aspects of their sales processes. This task led us to Selectica (NASDAQ:SLTC). The company:

“develops innovative software that the world’s most successful companies rely on to improve the effectiveness of their sales and contracting processes. Our guided selling, sales configuration, and contract lifecycle management solutions support the Global 2000 and growing mid-size firms in closing billions of dollars’ worth of business each year. Our patented technology, delivered through the cloud, makes it easy for customers in industries like high-tech, telecommunications, manufacturing, healthcare, financial services, and government contracting to overcome product and channel complexity, increase deal value, and accelerate time to revenue.”

The SaaS space is especially intriguing to us since the sector has rewarded shareholders with dazzling returns with certain stocks. One only has to reference the meteoric rise in the shares of Datawatch Corp (NASDAQ:DWCH), a SaaS company which saw its stock rise from around $5.50 in November 2011, to a high of $20.83 on 9/28/2012.

Furthermore, SaaS companies are ideal acquisition candidates.

- On January 1st 2011 Teradata Corporation (NYSE:TDC) completed its acquisition of 100 percent of the stock of privately held Aprimo in a deal valued at $525 million.

- On October 6, 2010 International Business Machines Corporation (NYSE:IBM) completed its acquisition of 100 percent of the stock of publicly traded Unica (the market leader at the time) for $21.00 per share in a deal valued at $480 million.

- And just on December 20, 2012, Eloqua (NASDAQ:ELOQ), a company that completed its IPO on August 2, 2012 at $7.50 was acquired by Oracle for $23.50 per share.

The first few things we noticed were that SLTS:

- Only has 2.8 million shares outstanding and a tiny float.

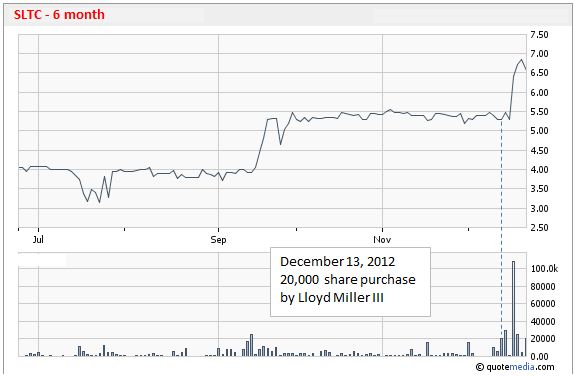

- Just attained a 52 week high.

- Had broken out of a flat line chart pattern.

These characteristics combined with a solid growth story can often lead to disruptive moves in share prices.

The second thing that caught our eye was a December 13, 2012 20,000 share purchase @ $5.27 by investor activist Lloyd Miller III.

Referencing various SEC filings, Mr. Miller showed up as a significant shareholder in a November 2007 proxy statement which disclosed that he owned 95,330 shares (adjusted for a prior 1 for 20 reverse split) or 6.7% of SLTS outstanding shares. He entered 2012 owning 557,593 shares and now owns 654,942, or about 23% of the outstanding shares.

Lloyd Miller III has invested in many public and private companies. In fact, he was an investor in Aldila (PINK:ALDA) and Ddi (NASDAQ:DDIC).

Mr. Miller joined the DDIC board in March of 2011 and owned 19.1% of DDIC’s shares before it agreed to be acquired by Viasystems Group, Inc. (NASDAQ:VIAS) on April 4, 2012 at $13.00.

Miller owned 26.5% of ALDA’s shares before it agreed to be acquired by Mitsubishi Rayon America on December 5, 2012 at $4.00.

In addition to Mr. Millers share purchase, some insiders have been nibbling at shares over the past three months.

The third thing that captured our attention is that on the surface SLTC looks cheap compared to its peers.

Referencing recent acquisition deals in the SaaS space and the valuation of publicly traded SaaS firms indicates that the market is willing to value SaaS companies similar to SLTS’s scope at a price to total bookings ratio of at least 2.5, as long as the company is able to maintain a 20%+ top line growth rate and gross margins near 70%. SLTC’s annual total bookings (revenues + deferred revenues) are tracking at $23 million. Currently, SLTC is selling at a price/bookings ratio of merely 0.85. This leaves much room for price appreciation.

In its fiscal 2013 second quarter ended September 30, the company increased its revenues 31% to $4.7 million and reported a non-GAAP loss per share of $0.08, much improved from a loss of $0.33 in the 2012 second quarter. Because SaaS companies commonly report losses or are barely profitable early in their growth stages, they are often valued on a market cap to total bookings multiple (revenues + deferred revenues).

| Sidebar – Valuing A SaaS Company Can Be A Little Tricky

A main focus of SaaS companies is to compete and capture market share to increase recurring subscription based revenue. This frequently leads to a company incurring high sales and marketing expenses and the generation of minimal net income and EBITDA. Eventually, these companies plan to earn profits as they grow and scale back on marketing expenses. So, in the short-term a measure like P/E is not a great barometer of value. Our goal is to value SaaS companies using other measures that do not rely on income data. Thus, sales multiples are often looked at as better measures of value. Still, we are cognizant that SaaS companies’ revenues consist of subscription fees that are received as cash up front, but where services pertaining to the contract are performed over time. Under GAAP, even though 100% of subscription revenue may be collected up front and shows up as cash on the balance sheet, only a portion of it is recognized on the income statement. The rest is classified as deferred revenue on the liability side of the balance sheet until it is earned. Deferred revenue is recognized on the income statement as services attached to such revenue are “earned” (the service is completed). The summation on sales and bookings is commonly referred to as total bookings. |

We surmise that SLTC is selling at such a low sales to total bookings multiple because its sales growth over the last several years has been anemic.

(Fiscal Year Ends is March)

| 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

| 13.8 | 14.5 | 15.2 | 16.4 | 16 | 14.7 |

However, the company has put together two consecutive quarters of sales growth (first and second quarter of fiscal 2013).

| Revenues (in Millions) | |||

| Qaurter | 2013 | 2012 | 2011 |

| June | $4.2 | $3.8 | $3.7 |

| September | $4.7 | $3.5 | $3.1 |

| December | TBD | $3.3 | $3.9 |

| March | TBD | $3.2 | $3.7 |

Apparently, SLTC is in the midst of revamping its business model from one based on licensing to one based on recurring revenues as a SaaS company.

From the perspective of a potential customer, a SaaS model offers advantages over a licensing model:

- Lower cost to customers because recurring subscription fees are less of a financial burden than having to pay a large one time lump sum payment.

- The burden of service is shifted from the customer to the software provider.

Some advantages of a SaaS model for the software provider include:

- Increased customer target market.

- Recurring/ predictable revenues and cash flows, which is also more attractive to investors.

We would still need to interview management to gain a clear picture on whether the third quarter revenue performance has set a new bar, enabling the company to continue to grow revenues at a greater than 20% clip and soon reach profitability.

However, management’s commentary in press releases leads us so believe that consistent near-term sales growth could now be in the cards.

“We’re entering year two of our three-year plan to transform Selectica into a software-as-a-service (SaaS) business, and I’m pleased to say that we’re on track,” said Jason Stern, Chief Executive Officer of Selectica. “Beginning with the release of our fiscal fourth quarter earnings, we have transitioned our external reporting to more clearly represent our shift to a cloud-based business model. Although this transition has resulted in what we expect to be a short-term decrease in revenue and margins, we are now seeing strong momentum in some of the key performance indicators of cloud-based businesses, including recurring revenue, deferred revenue, and billings.”

Continued Stern, “After successfully stabilizing the business and controlling cash flow in the prior fiscal year, this year we began focusing on customer and revenue growth and began increasing investment in targeted areas to meet the growing demand for our products. These investments began to yield results in fiscal 2012, as evidenced by a 13% year-over-year increase in recurring revenue, a 13% increase in year-over-year billings, and a 56% increase in year-over-year total deferred revenue.”

Sometimes You Need To Get In Early

It remains to be seen if SLTC’s operational transformation will lead to consistent revenue growth and eventual profitability. But it is encouraging that the company seems to be moving in the right direction and that it appears to be very close to profitability. SLTC has some parallels to the DWCH story. Like SLTC, DWCH was reporting revenues of around $4.0 million before its run that was buoyed by the beginning of an increase in its top line growth rate and improving bottom line prospects. Also like SLTC, DWCH’s revenues had been stagnant for several quarters before reaching new heights. Finally, we cannot ignore that a large shareholder who has a history of successfully investing in other public companies, some of which have been acquired, just increased his already large bet in SLTC.