The Wingstop Inc. (NMS:WING) short thesis is easy and logical. The company is playing in a maturing segment of the restaurant industry with negative shareholder equity. We think this stock with a forward P/E of ~45 will revert to the mean. Our opinion could have been different if the company was offering a new concept, but it’s not. We believe that at some point the market will see this disconnect in the stock price and that shares will decline to a price that makes more sense.

Another “Common Sense” Short

- WING is absurdly overvalued compared to its peers and is caught up in the fast casual and dining industry that we believe is in a bubble

- A recent Seeking Alpha article calls into question numerous reasons for concern with WingStop

- We think another 30-40% downside isn’t off the table due to company-wide, sector wide and market wide risks

As we sometimes do, and as we have done in the past with our report on Davidstea Inc. (NASDAQ:DTEA), we are pointing out what we believe to be a common sense short scenario that has already been opined on at length. We want to point out some great work that’s already been done and then follow up with some of our own thoughts.

On November 23, 2015 at around $12 per share, we wrote a small article highlighting the DTEA short thesis called “David’s Tea: Far Too Optimistic in a Very Crowded Space”. In the time after our article and before we covered on January 12, 2016, DTEA lost about 12%.

Like DTEA, we have found another attractive common sense short in a similar industry. We think this one may have further downside to the tune of 30% to 40%.

Like Other New IPOs in Restaurant Industry, WingStop Will Pull Back

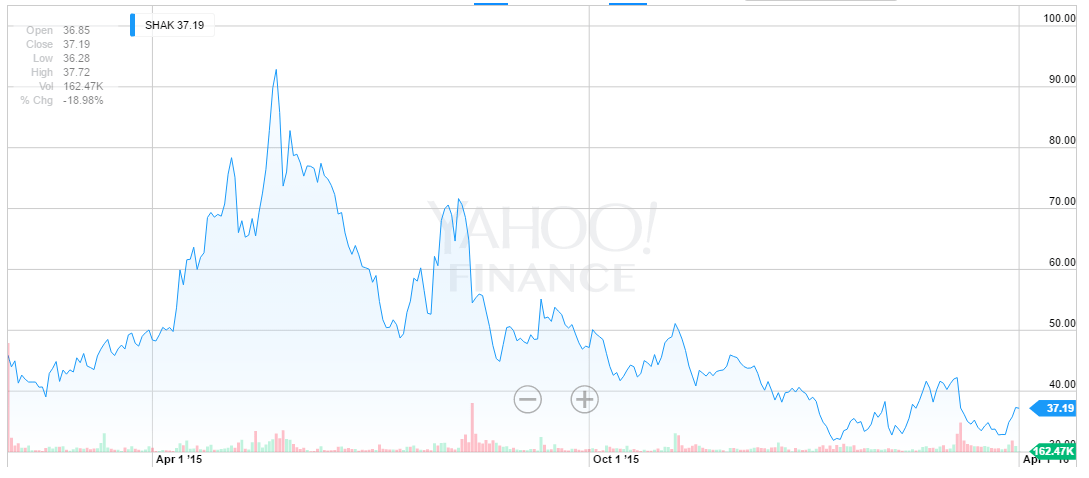

Wing Stop (WING) has come out of the gate since its IPO and — like many IPOs – has been overvalued from the start. Much like Shake Shack (SHAK), which is now down 60% percent from its IPO run up when it reached $92 per share, we believe WingStop is on the path to a similar fate and will descend 30% to 40% lower from current prices to around $ $15 before stabilizing.

While there have been many bubbles forming over the last seven years, one of the least talked about ones is the bubble in fast casual/fast food and the restaurant industry. Up-and-coming fast casual dining chains are receiving valuations that are absurdly optimistic because of the success and growth of already established companies like Panera, Chipotle and others. The market fails to notice that as this sector becomes more populous, the chances of Chipotle or Panera-style success begin to decrease dramatically.

Shown here is the incredible run up that the restaurant sector has made over the course of the last bull market. Over the last 10 years, these restaurant and beverage ETFs are up almost 100% to 150% each.

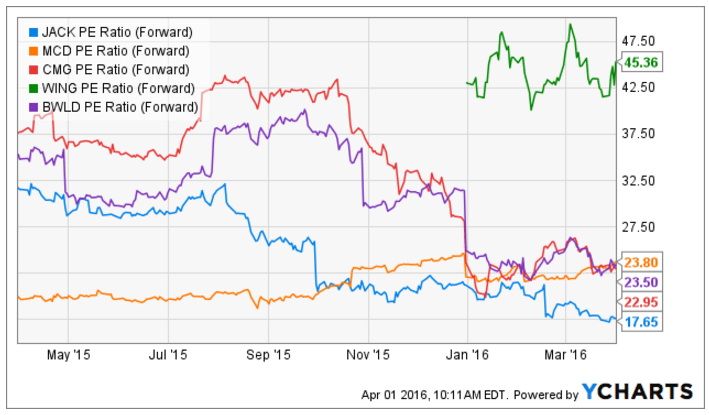

With this, the advent of the fast casual chain like Panera and Shake Shack has come to dominate the industry. Even companies like Mcdonald’s (NYSE:MCD), who are traditionally just fast food names have started to tweak their strategy to look and act more like fast casual chains. In the process, fast food and fast casual stocks were all assigned absolutely ridiculous valuations. WingStop, we believe, is not worthy of a 30x to 40x multiple and we believe it will come down to reality relatively soon.

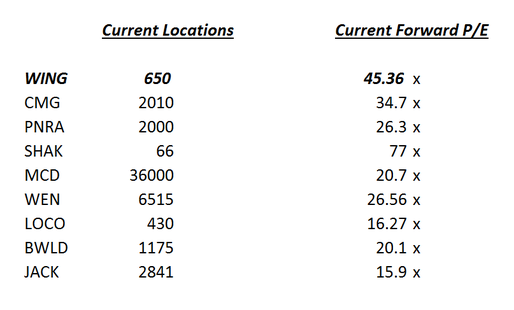

Late entries to the fast casual trend and this sector include El Pollo Loco, Shake Shack and WingStop. SHAK’s valuation of 77x estimates is at least acceptable as they haven’t even begun to grow — they have less than 100 locations, so investors assume the valuation gap will fill.

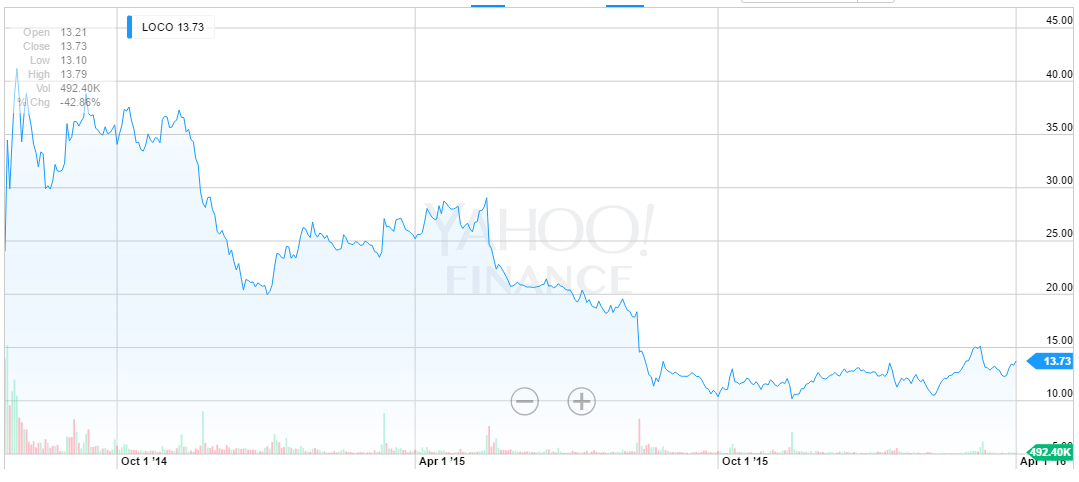

El Pollo Loco has already been brought down to about 16.2x forward earnings; a valuation that would put WING’s share price at around $11.

In WING’s case, the company is already operating about a third of the stores as veterans CMG and PNRA are, yet the multiple is the highest of almost all other fast causal chains, no matter what portion of their growth cycle they are in.

WingStop has fallen into this category and we believe shares are overvalued by as much as 30% to 40% while the company enters a more mature section of its growth phase. WING has 650 stores open now. In terms of comparison, here’s how that stacks up:

Here’s how WING’s forward P/E stacks up against some industry veterans:

We have seen a trend of fast casual chains go public and then have their multiples adjusted much lower immediately afterwards. This has already happened with SHAK:

It has also happened with El Pollo Loco (NMS:LOCO), whose chart since IPO shows that almost no one has made money as an investor in the company thus far:

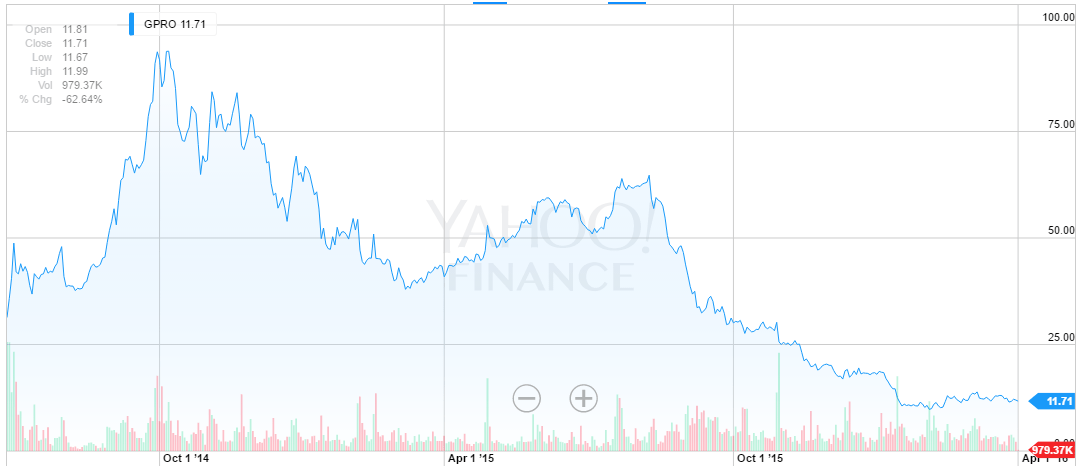

We think this is all part of a bigger mispricing problem that IPOs see out of the gate. Until the market gets a chance to see these companies run for several years in a row, it’s tough to not be perpetually adjusting the price of these equities from their position out of the starting gate. GoPro (GPRO), though not in the restaurant industry, was another great example of this:

The question then becomes whether or not WING has a product that is going to set them apart and give them the edge over these other companies where they would command a higher valuation. We think just the opposite is the case. WING’s primary draw — hot wings – already has major competition in Buffalo Wild Wings (BWLD). BWLD has almost double the amount of stores open and trades at almost half the multiple.

BWLD was clipped hard in late October 2015 when the company — like most companies with growing estimates will do — eventually couldn’t keep up with optimistic estimates and posted a poor quarter while guiding below expectations. This caused the multiple to come in from over 30x forward earnings to today’s more modest 20x multiple.

We believe we could easily see a similar move in shares of WING on the first sign that the company isn’t growing perfectly in line with Wall Street’s expectations.

In addition to these, almost all other restaurants and fast casual chains offer wings as part of their menu. The competition is almost as big as it is with burgers and definitely is far less of a niche than companies like Chipotle (Mexican) and Panera (Bread) have. Wings are everywhere:

More Red Flags, We’re Short Expecting 30% to 40% Downside

WingStop is simply a debt laden company that has been plundered by its largest shareholders (who forced them to part with precious liquidity and issue dividends while in their beginning growth stages). The company has a negative book value of ($0.50) per share.

Of the company’s $121 million in assets, $95 million are goodwill and intangibles, giving the company a disturbing net tangible asset value of negative $105.7 million — or ($3.70) per share.

Insiders are beginning to cash out, the IPO hype is at a peak (with Goldman Sachs issuing a positive note just last Friday to give WING a bump) and the only thing left for us to do is wait for reality to set in and the market to adjust WING downward.

In addition, a recent Seeking Alpha article our just days ago pointed out several more red flags. This article spawned our interest in WING and we recommend that readers of this article peruse it if they are interested in WING as a short. The key points of this Seeking Alpha article were:

- WING’s largest shareholder has been reducing their stake in an accelerated manner.

- The company is extremely overvalued relative to peers in the same industry with better growth profiles.

- WING’s incremental profit per new franchisee has been falling dramatically due to a combination of lower revenue and higher SG&A costs per new franchisee.

- Same-store sales have been falling rapidly excluding a major boost in 2014 from a reduction in bone-in chicken wing commodity prices.

- WING’s mature-state math does not make sense as the company will likely fail to grow into its current valuation. Given multiple risk factors, WING is a strong sell.

Based on WING’s absurd valuation, the bubble that the restaurant industry is in, broader market risks and the company’s poor foundation in its balance sheet, we have taken an initial speculative short position around $23.50, based on the company’s need to fill out its valuation in a market that we believe is going to pull back.