Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

In September of 2020, we started to track Video Display Corp (OTC:VIDE), a company that manufactures and distributes a wide range of display devices, encompassing, among others, industrial, military, medical, and simulation display solutions globally.

We felt a “Reasons For Tracking” (RFT) piece was warranted based on our assessment that the company was in the process of executing a turnaround and started to realize revenue growth that was stymied by economic conditions brought on by Covid-19. You can find that note here.

There was a good amount of optimism within the company’s 2021 10-K and 2021 Q1 communications about the prospects of a post-pandemic normalization, which led to our favorable take on the valuation on what we thought was a reasonably valued stock with some upside if certain things played out:

“VIDE is trading at 0.7x TTM price to sales multiple which we believe is not that unreasonable if the company can reach consistent profitability, considering the positive growth outlook management has communicated for the remainder of its 2021 fiscal year. We also like management’s shift to focus on cyber security which could also be a reason to assume that shares could eventually trade at a price to sales multiple well in excess of 4x.”

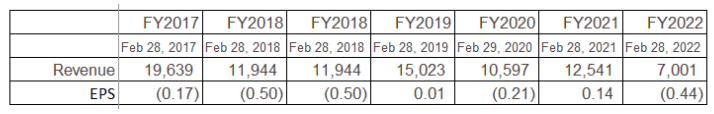

Long term price appreciation never materialized, but to be fair, as seen below, the company’s fiscal 2021 results did actually come in at an aggregate year over year increase, sending the stock to a brief high of $3.10. You could say, if just for a short moment, that the results supported the company’s outlook. However, investor conviction in the stock waned almost immediately, with the price settling back to its pre-financials levels.

Unfortunately for the company, its messaging may have been a bit too early, since its fiscal 2022 results failed to continue to show growth on both the top and bottom lines.

In actuality, it’s quite possible that VIDE’s restructuring efforts were starting to bear fruit, but you could say that it was of no fault to them that things got a bit delayed. Many companies experienced prolonged hurdles posed by a decaying economy, such as inflation, supply chain issues, and in VIDE’s case:

“Financial results for fiscal 2021 were impacted by COVID-19 due to delayed orders and/or the fulfillment of the related orders. However, the Company currently does not expect any material impact on our financial results for fiscal 2022.”

While they made the statement above in their 2021 10K, it appears that the expectation that Covid would not affect the fiscal 2022 results was inaccurate, since in the fiscal 2022 10K, there was an admission that 2022 was indeed affected:

“Financial results for fiscal 2022 were impacted by COVID-19 due to delayed orders and/or the fulfillment of the related orders. However, the Company currently does not expect any material impact on our financial results for fiscal 2023.”

It will be interesting to see if statements like these are made in the next 10K with respect to fiscal 2023/2024, so we are very much looking forward to VIDE’s next annual report.

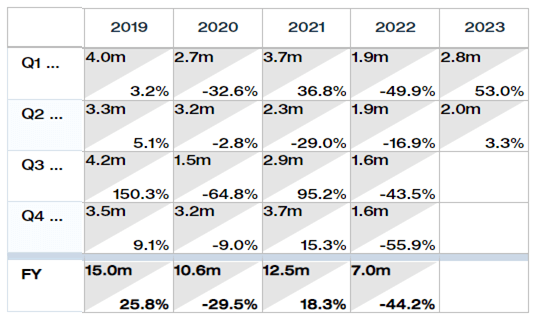

Now, the company is half way through its fiscal 2023, and for the six months ended August 2022 the company has reported:

- Sales of $4.8 million vs $3.7 million in the prior year

- Loss of $0.04 vs loss of $0.10

What has brought the Company back in focus this week were two contract announcements:

- November 14, 2022 – Awarded $2.2 million follow on contract (deliveries throughout 2023)

- November 16, 2022 – Awarded $3.2 million for its next generation MMD Rugged Display Wall (deliveries scheduled for 2023 and 2024)

With a roughly $2 to $3 million quarterly revenue run rate, these contracts will add a nice boost to the top line over the next couple of years.

Actually, statements in recent quarterly filings convey an attempt by the company to drive more revenue from additional restructuring initiatives:

“The Company has increased marketing efforts in its ruggedized displays, TEMPEST products and services and small specialty displays in an effort to increase revenue. New products in the ruggedized and TEMPEST areas have been developed and are now being evaluated by potential customers. In addition, the Company has continued to streamline its operations and is focusing on increasing revenues by executing initiatives such as upgrading its sales and marketing efforts including targeting efforts towards repeatable business, the hiring of an experienced Rugged Display Business Development Manager, increased customer visits, trade shows and e-mail blasts to market all the product lines it sells. The Company was able to increase its fiscal revenue over the prior fiscal year and has been implementing a plan to increase revenues at all the divisions,”

Should our curiosity become piqued enough, we will take a deeper look into the industry and the markets the company is focusing on right now.

For now, we will continue to track this development as it is unclear which existing contracts or recurring revenue will end and put pressure on VIDE to close more contracts like the ones announced this week.

Furthermore, the company’s quarterly revenue run rate is still below historical highs. But we definitely want to see if more new contracts will come from some of the restructuring initiatives highlighted in the recent quarterly filings.

Investors should note that there is an InfoArb aspect to the contracts as they are only listed on the Company’s website and not in the news flow section at Otcmarkets.com. This is actually part of the reason we want to monitor the website more closely for any other awards, knowing that there is a chance it will just go unnoticed.

–

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.