Murphy’s Law: Anything that Can Go Wrong, Will Go Wrong

One of the things that we provide for our members is portfolio protection. Portfolio protection articles of ours may not necessarily be companies that we have positions in, but rather arbitrage and information that the public may not be aware of that prevents them from potentially misjudging a situation that the majority of the market has wrong.

In today’s portfolio protection piece, we believe we see a situation we have seen numerous times in the past. A company reports a great quarter, but then issues commentary that suggests that the impressive financial results may not continue in a consistent fashion in future quarters. We have seen this numerous times and TSRI is looking like it may be offering the same conundrum to investors today.

The company reported Q2 2016 financial results before the bell last Friday. But the commentary at the bottom of the press release suggested that the earnings may not be sustainable, or at the least may be tough to predict quarter to quarter. Specifically, the last line of the press release makes it seem like these results may not be able to be relied upon in the future. Yet, it does not appear that the market is giving much weight to the commentary, only the financials reported in the quarter. TSRI released results and the stock soared upwards of 40% on the company’s financial results:

For the quarter ended May 31st, revenue increased 3.6% from the same quarter last year to $15.5 million. Net income attributable to TSR for the current quarter was $169,000 as compared to $112,000 in the prior year quarter. Additionally, net income per share for the current quarter was $0.09 compared to $0.06 per share in the prior year quarter.

For the year ended May 31st, revenue increased 6.3% from last year to $61.0 million. Net income attributable to TSR increased from $193,000 in the prior year to net income of $399,000 in the current year. Additionally, net income per share increased from $0.10 to $0.20 per share.

But the press release concluded with a statement from the CEO that seemed careful, letting investors know that these improved bottom line results may not be sustainable in the near term:

Joseph F. Hughes, CEO, stated, “Our revenue increased 3.6% for the fourth quarter reflecting continued growth resulting from the efforts of our new hires in sales and recruiting. The increase in revenue resulted from an increase in the average daily rates charged for consultants on billing with customers. The current year quarter was also affected by the average number of consultants on billing with customers increasing from approximately 347 in the quarter ended May 31, 2015 to approximately 350 in the quarter ended May 31, 2016. Although we are experiencing a gradual increase in revenue, profitability will continue to be affected until such time as our new sales and recruiting hires generate a sufficient increase in revenue.”

A History of Lumpy Results

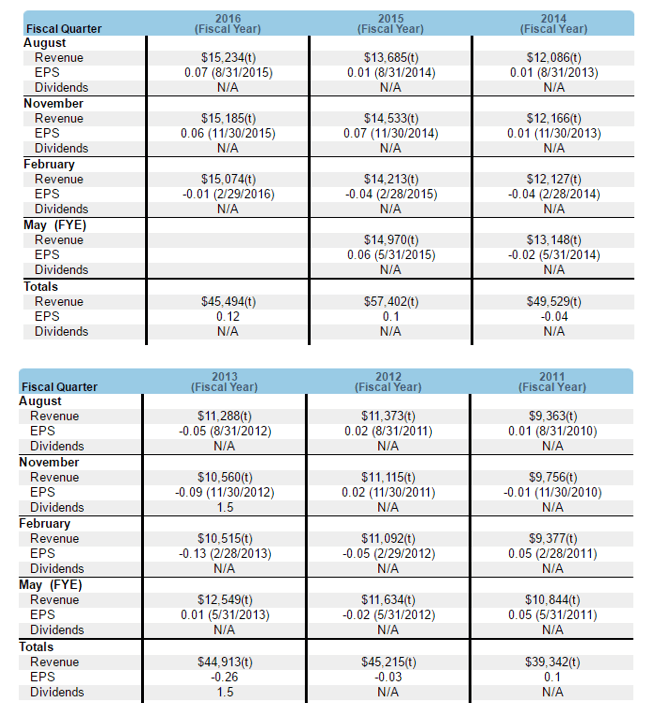

Kudos to management for being transparent, but it is important that potential investors see that TSRI has a history of reporting volatile and lumpy results, especially on the bottom line:

Our goal here is not scare investors or suggest we are going short. We just want investors to be confident in knowing they have the whole story on TSRI, not just the recent positive news.