We believe Tarena International’s (NMS:TEDU) business model is seriously flawed to the point that the company’s current pace of revenue growth, net income growth, and cash generation could all be unsustainable and in jeopardy. While the risks we highlight may not pose an immediate threat to TEDU’s growth profile, we think it’s prudent for longer-term bullish investors to be aware of the factors that already appear to be in motion. We feel these factors could result in TEDU being a much smaller company than it is today, operating at a loss. Likewise, those who choose to short TEDU should be aware that the company has a buyback program in place and involvement from a couple of well known institutional investors. We are short.

We believe Tarena International’s (NMS:TEDU) business model is seriously flawed to the point that the company’s current pace of revenue growth, net income growth, and cash generation could all be unsustainable and in jeopardy. While the risks we highlight may not pose an immediate threat to TEDU’s growth profile, we think it’s prudent for longer-term bullish investors to be aware of the factors that already appear to be in motion. We feel these factors could result in TEDU being a much smaller company than it is today, operating at a loss. Likewise, those who choose to short TEDU should be aware that the company has a buyback program in place and involvement from a couple of well known institutional investors. We are short.

- Tarena International has a large, accelerating accounts receivable problem that we think will continue to get worse as the company’s financing partners deteriorate in quality

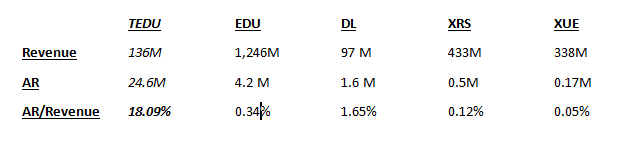

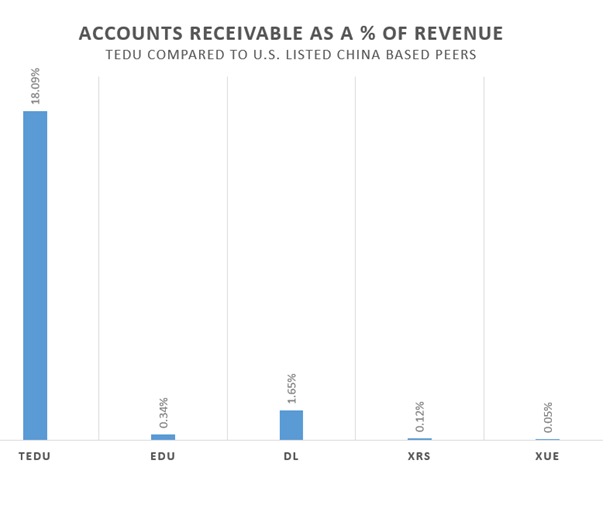

- The company’s receivables as a percentage of revenue are exponentially higher than U.S. listed China based peers, indicating TEDU has a company specific problem in collecting on tuition

- We believe that the inability of TEDU’s students to access credit has caused the quality of the TEDU’s financing partners to move from established banks to shadow banks

- TEDU students have posted reviews and complaints online from different locales throughout China; these reviews report deceptive practices and false promises

- If China begins to look at the for-profit education space through the same critical eye as the U.S., TEDU could be accelerating quickly into a hard wall

An article published in 2014 discussed the risk inherent in TEDU’s business due to the substantial amount of revenue it generates from its shadow banking relationships. The stock is down about 30% from then, potentially as investors begin to look past TEDU’s “amazing” top line growth. Or, perhaps some astute investors who combed through the fine print of TEDU’s filings noticed that TEDUs only non-shadow banking relationship expired in 2014. Or, perhaps they noticed that one of the shadow banks that TEDU had a relationship with is controlled by the chairman of TEDU — a relationship that has now been severed. Also disturbing is that the amount of revenue tied to shadow banking has increased materially, nearly overnight, as the company went public. In 2013, shadow banking contributed to about 11% of revenue — according to the latest data, it contributes 61.4% now. The clues are telling us that industry experts are viewing TEDU with a riskier profile.

If the company’s revenue (tuition collected) from questionable third party shadow banking relationships were to be put into jeopardy or to disappear altogether, the company would be left with a business that is generating 55% less revenue than reported in SEC filings. Shadow banking and uncollectable accounts are two growing problems for the company — problems that we believe could lead to investors in TEDU learning a hard lesson.

The accounts receivable issues that we will highlight are not only a manifest of the company’s high risk marketing strategy that targets low credit students, but appear to be the result of a very dissatisfied customer base.

Our due diligence has recovered media reports and reviews from TEDU students complaining about the company’s product offering, deceptive recruiting, and nightmare debt collection stories.

“TEDU’s recruitment is a bait and switch,” reads one review from Chongqing.

In order to embrace a bullish case on TEDU, investors would need to assume that the company’s shadow banking relationships will continue to generate substantial revenue growth for the company.

We have chosen to take the opposite view. We think it is illogical to assume that the accounts receivable issues taking place at TEDU we are about to highlight are not occurring at the shadow banking level. We believe that at some point, the non-collectable risk will jeopardize the company’s remaining shadow bank relationships. We don’t know what, exactly, will be the “straw that breaks the camel’s back,” but what we do know is that we believe this time is nearing.

We can boil our skepticism of Tarena down to two key points that we will explore in depth:

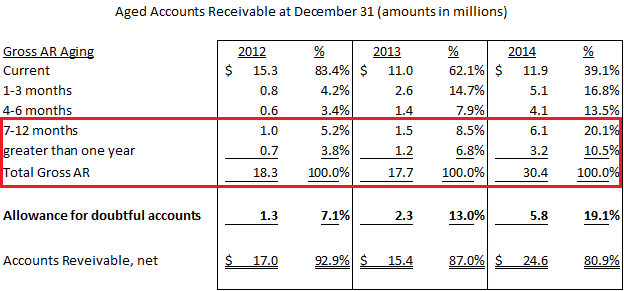

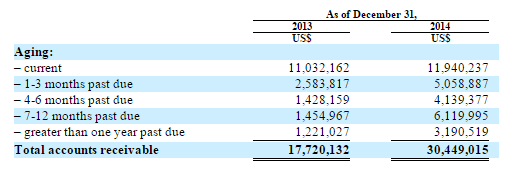

- The company’s accounts receivable are growing significantly — and growing older. Accounts receivable from 7-12 months old have increased from 5.2% of total receivables in 2012 to 20.1% of total receivables in 2014. Receivables greater than one year old have increased from 3.8% of total receivables in 2012 to 10.5% of total receivables in 2014.

- Based on our assumptions, if the negative aging account receivable trend continues, maintaining profitability will be a challenge – and that’s assuming the shadow banking relationships they have in place today are not in jeopardy.

It appears evident to our team that an aggressive marketing strategy and a poor product are beginning to rear their heads under the surface in the financials at TEDU.

Huge Receivables Telegraph a Problem Unique to Tarena

On the US markets, there are several Chinese public companies that are comparable in industry to TEDU, such as New Oriental Education (EDU), China Distance Education Holdings Limited (DL), TAL Education Group (XRS) and Xueda Education Group (XUE). We compared accounts receivable as a percentage of revenue for each of these companies in 2014 and we found that TEDU’s receivables appear to be an exponentially larger problem than its counterparts. It is worth noting, as well, that EDU and other peers use a different payment model, where students are generally asked to pay their tuition up front. TEDU’s model differs in that they allow financing as students’ progress, in anticipation of finding jobs and being able to pay back tuition in the future. This is why we think TEDU’s model is broken — should the company collect up front, there would be far less revenue, but also far less of an A/R problem.

Within this group of companies, Tarena is the only company that relies largely on third party financial service providers to finance student tuitions. As we showed in the table, TEDU’s accounts receivable to revenue percentage is 10 times, and in some cases even 100 times higher than other companies. We believe this makes TEDU an obvious risk when compared to peers. Also consider that around 55% of TEDU’s students paid their tuition fee with loans upfront in 2014 compared to 57% in 2013. Yet we will show a trend of a dramatically worsening account receivable situation which shows that quality of revenue TEDU is keeping in house has substantially deteriorated.

In these detailed assumptions, we lay out how meaningfully affected Tarena’s earnings would be if the company was to increase the allowance it held for doubtful accounts, which we think could be a reasonable occurrence in the future given the company’s growing A/R number.

The business issues we have highlighted in this report are clearly reflected in TEDU’s aged accounts receivable at December 31, 2012, 2013 and 2014. Note that at December 31, 2012, over 83% of AR was current with 9% aged seven months or more. At year-end 2014, only 39% of AR was current with over 60% past due including 31% aged more than seven months. If this trend is to continue on this path, past due receivables could be bringing the company to the tipping point. The company has progressively increased its allowance for doubtful accounts from 7.1% of gross accounts receivable at December 31, 2012, to 19.1% at the end of 2014, but that, in our opinion, is inadequate compared to the worsening AR aging picture.

It may seem that the company is making a more conservative assumption with its allowance for doubtful accounts growing, but you can see that the allowance versus accounts older than 7 months shows the gap widening significantly in 2014. In 2012, allowance of 7.1% was nearly in line with 9% of accounts being older than 7 months. In 2013, allowance of 13% was nearly in line with 14.8% of accounts being older than 7 months. In 2014, however, we see an astonishing parity where the company’s allowance of 19.1% is now far shy of its 30.6% of accounts receivable older than 7 months.

We can’t help but notice that the allowance for doubtful accounts in the prospectus for 2012 and 2013, before going public, looked relatively conservative. Since going public in 2014, however, the bad debt allowance has fallen well short of the over 7 months past due exposure. We think the 2014 allowance should be at least 30%, which would have added around $3.3 million bad debt expense to last year’s operating results, reducing net income before taxes by that amount. The company is therefore failing to provide for its increasing risk profile and likely losses embedded in AR — this despite the company’s risk profile being adversely impacted by shadow banking issues. We understand a $3.3 million allocation might seem minimal, but the key questions are:

- How much bigger can this number get?

- More importantly, if these issues are happening on the shadow banking level, could a fair amount of net income be in jeopardy?

For those 55% of students who paid their tuition fees through third party financial providers such as CreditEase, we assume based on the poor online reviews and poor performance by its students that there may also be a high percentage of default on third/ party financial provider payments. This high risk of default, in turn, may explain the main reason for Bank of Beijing Consumer Finance Company (“BOB CFC’s”) possible termination of its business with TEDU.

TEDU primarily offers two payment options for its students, including one-time full payment upon enrollment and multiple payments within two months of enrollment. Tarena also allows qualified students to pay its tuition fees within a period of time after graduation. TEDU generally charges RMB1,000 (US$161) higher in tuition fees to students electing to pay in multiple payments within two months of enrollment and charges RMB3,000 (US$483) higher in tuition fees to students qualified and electing to pay in installments post-graduation, as compared to students who elect to pay in full upfront.

As we stated earlier, for those students who elect to pay in full up-front, they may either pay directly out of pocket or pay through third party financial service providers, such as CreditEase. In 2013 and 2014, approximately 55% of TEDU students chose to pay tuition upfront with the help of one of the third party financial services. TEDU did not provide a breakdown of the number of students who pay its tuition in full, upfront, directly out of pocket.

For the purposes of our discussion, we conservatively assume that 30% of students may choose to pay their tuition fees with either multiple payments within two months of enrollment or within a period of time after graduation. As stated by TEDU in its 20-F, “accounts receivable primarily represent tuition fees due from students”. Tarena’s accounts receivable comes from those students who choose to pay their tuitions with either multiple payments within two months of enrollment, or within a period of time after graduation.

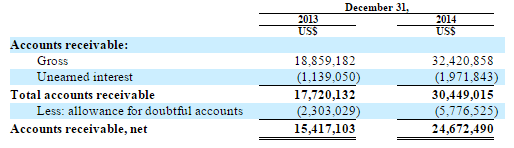

Based upon TEDU’s 20-F, as of December 31, 2014, it had booked USD 30.4 million in accounts receivable with only USD 5.7 million in allowance for doubtful accounts. From December 2013 to December 2014, TEDU’s accounts receivable increased around USD 12.7 million.

When we look through past filings and past accounts receivable numbers, we see current accounts receivables are only up from ~$11 to ~$12 million. But past due accounts receivable tripled from $6.6 million to $18.4 million from 2013 to 2014. It appears that TEDU’s accounts receivable management is getting worse with more bad debts incurred in 2014.

After we looked into TEDU’s past due accounts receivable, we saw that in 2012, TEDU only had about $3 million in past due accounts, which rapidly increased to $6.6 million in 2013 and $18.4 million in 2014, after Tarena’s aggressive marketing strategy.

Consider the fact that TEDU’s total revenue in 2014 was $136.2 million. In the event that we assume 30% of students choose the payment method that winds up increasing the company’s accounts receivable, and assuming revenue generated by each student is similar, there should be only around $40 million gross revenue added to accounts receivable in 2014. However, in 2014, past due accounts receivable increased by around $ 12 million, which is around 30% of gross revenue.

In the 2014 20-F, Tarena made following disclosure about its accounts receivable:

“Understanding the difficulty for recent college graduates to afford the high tuition fees of our courses, we offered qualified students the post-graduation tuition payment option beginning in 2006, which led to our relatively high accounts receivable. As of December 31, 2012, 2013 and 2014, our outstanding accounts receivable, net of allowance for doubtful accounts, were US$17.0 million, US$15.4 million and US$24.7 million, respectively. Although we conduct financial evaluations of our students applying to use our post-graduation tuition payment option, we do not require collateral or other security from our students.”

From this analysis, we can reasonably assume that TEDU’s growth has been a result of its aggressive marketing efforts. The obvious concern, however, is in TEDU’s growing accounts receivable number and how large that number is as a percentage of the company’s total revenue. It seems that TEDU’s training services may not be recruiting creditworthy students, but instead students who are more likely to default on their tuition payment, especially with this recent downturn in the economy.

Reports of False Promises and Predatory Collection Tactics

We believe that TEDU’s “amazing” growth story may end up being an expensive lesson for investors. TEDU’s high growth comes after strong marketing efforts that are reported to be deceptive in nature, as reviews from different parts of China seem to contradict the story that TEDU is offering investors and potential clients.

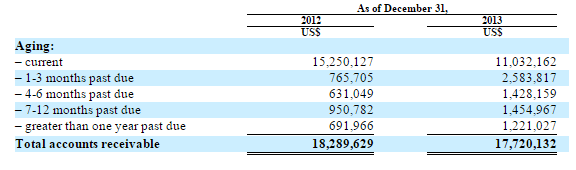

Sequential Revenue — TEDU

As you can see above, the company has reported very impressive sequential revenue numbers over the last 5-6 quarters. In the company’s 8/18/2015 press release, it stated,

“We achieved a profitable quarter with a revenue growth of 29% year-over-year. More importantly, we delivered a 43% year-over-year quarterly student enrollment growth, another record high since becoming a public company, in the second quarter. Such enrollment result is again due to the strong market demand for our high quality professional education services, as well as our continued investment in sales and marketing effort and capacity expansion.”

After noticing the growth of TEDU’s numbers, we wanted to understand its business and take a look at the quality of its training. We realized that TEDU’s aggressive sales and marketing efforts may belie the actual quality of the company’s training, which we believe to be below average. Widespread online complaints regarding TEDU, written by current and past students, are one of several red flags that we noticed in performing our diligence.

There is also this video of a CCTV news report exposing TEDU’s manipulative recruiting processes and a second video that profiles TEDU students looking to sue the company for misleading advertisements, false job prospect guarantees, and using violent/threatening tactics for loan collections.

In its student recruiting process, TEDU puts up IT-related job recruiting advertisements, but according to these videos, after potential employees begin the “job interview process,” TEDU’s career counselors try to sell them on becoming TEDU students. The videos also claim that TEDU does not have the job placement capabilities that the company uses to lure these students into their program to begin with.

Example Reviews

Qingdao

“Credit Ease called me every day to collect money. I told them TEDU did not fulfill its promise and I do not have the capability to pay back the loan, as I do not have a job. CreditEase said that job placement doesn’t have anything to do with their business, and they only wanted to collect on their loans. They even called my family members. TEDU’s job placement promise is fake. I called TEDU to ask for refund. TEDU said that I took the loan from CreditEase and TEDU wasn’t involved in the loan issue.”

宜信åˆå¤©å¤©æ‰“电è¯å‚¬æ¬¾ï¼Œæˆ‘说当åˆè¾¾å†…承诺没有åšåˆ°ï¼Œæˆ‘没工作没有能力还,宜信的说那跟他们没关系,他们åªæ˜¯å‚¬è¿˜è´·æ¬¾ï¼Œè€Œä¸”还给家人打骚扰电è¯ã€‚达内的ä¿å°± 业ä¿åº•è–ªå®Œå…¨æ˜¯å‡çš„,我给达内打电è¯ï¼Œè¦æ±‚è¾¾å†…é€€æ¬¾ï¼Œè¾¾å†…è¯´å®œä¿¡è´·æ¬¾è·Ÿå¥¹ä»¬æ²¡å…³ç³»ï¼Œæ˜¯ä½ å‘宜信贷的款,说我被公å¸è¾žé€€æ˜¯æˆ‘技术ä¸è¡Œï¼Œå¯ä»¥åŽ»è¾¾å†…从新培è®ã€‚

(Source: http://www.hebeirexian.com/html/2015/1009/121214.html)

Chongqing

“TEDU’s recruitment is a bait and switch. I am from Chongqing. In 2014, I was looking for jobs online and consulted TEDU who had posted jobs online. After that, TEDU called me every day for an interview. I wound up not finding a job, but took out a RMB 20,000 tuition loan.“

达内科技钓鱼招生,我是é‡åº†çš„å¦ç”Ÿï¼Œ2014年在网上想找工作,咨询了一下招è˜ç½‘上的达内科技,于是æ¯å¤©æŽ¥åˆ°ä¸€æ¬¡è¾¾å†…的打电è¯å«æˆ‘去应è˜ï¼Œæ²¡æƒ³åˆ°ï¼Œå·¥ä½œæ²¡æ‰¾åˆ°ï¼Œå´æ¬ 下2万元的贷款

Beijing

“After I started my studies, I realized that it was impossible for me to understand the content through the webcast. As a person without previous knowledge, it’s impossible to follow the teachers. After you ask one question, it is impossible for you to follow up on additional content.”

åŽæ¥è¿›å…¥äº†æ£å¼å¦ä¹ 天哪 æ‰çŸ¥é“ è¿™æ ¹æœ¬éƒ½æ˜¯å¦ä¸ä¼šçš„东西 è€Œä¸”æ˜¯å¤šåª’ä½“æ•™å¦ ç”µè§†åœ¨å‰é¢è®² æ²¡æœ‰åŸºç¡€çš„äººæ ¹æœ¬éƒ½è·Ÿä¸ä¸Š ä½ è¿˜æ²¡åŠžæ³•æ问题 ç‰ä½ 问完这个ä¸ä¼šçš„问题了 下é¢è®²çš„阶段都跟ä¸ä¸Šäº†(Source: http://ts.21cn.com/tousu/show/id/21611)

Hangzhou

“TEDU is the biggest pyramid selling group, using bait and switch to lure in customers!”

达内科技æ‰æ˜¯ä¸å›½æœ€å¤§çš„ä¼ é”€é›†å›¢ï¼å‘è’™æ‹éª—,钓鱼招生ï¼ï¼ï¼ï¼

Dalian

“TEDU is recruiting improperly, luring young people in with vocational training with tons of promises that result in large loan debts.”

达内利用招è˜,欺骗,诱惑刚æ¥å…¥ç¤¾ä¼šçš„é’å¹´å‚åŠ åŸ¹è®,å£å¤´æ‰¿è¯º,背负高é¢è´·æ¬¾!

(Source: http://www.wlbgt.com/408.html)

In sum, these Tarena students clearly appear to be dissatisfied with the company’s services and its inability to provide the promised job placement opportunities.

Third party financial service providers collecting on TEDU’s business could probably care less as to whether or not the company is providing the intended services – their sole interest is likely whether or not they are getting paid. These same students also claim that the interest rates used by TEDU’s third party financial service providers are extremely high and some have even speculated as to whether TEDU and its financiers could be complicit in engaging in fraud together.

Tarena Loses Traditional Banking; Now Reliant on Shadow Banking

To assist its students in paying tuition fees, TEDU formed cooperative relationships with different credit sources to provide financing services for students to make one-time, up-front tuition payments. Approximately 56.9% of TEDU’s students that enrolled in 2013 obtained financing from these third party service providers and approximately 55% of its students enrolled in 2014 obtained financing from one of the three below mentioned sources.

We took a look at all of the past and present financiers for TEDU’s students, beginning with the most reputable bank, the Bank of Beijing Consumer Finance Company, followed by banks that are known for substantially less stringent lending requirements.

TEDU launched the BOB CFC student loan program in September 2012. Approximately 61.4% of TEDU students who obtained financing for tuition fees in 2013 elected BOB CFC as the lender. However, in 2013, only 11.5% of TEDU students who obtained financing for tuition chose BOB CFC.

BOB CFC is under the umbrella of Bank of Beijing, an important national bank with a very good credit system. It appears that BOB CFC is substantially decreasing its lending service to TEDU’s students. In the company’s most recent 20-F, TEDU reported that its agreement with BOB CFC expired in Feb. 2015 and that they were in the process of renewing their agreement.

So far, TEDU has not announced whether it renewed its agreements with BOB CFC or not. While this remains up in the air, it is our opinion that TEDU has elected to take on business from some far less reputable lenders.

1. CreditEase

CreditEase is definitely a significant step lower in terms of credit quality and consumer creditworthiness than BOB CFC.

CreditEase, a credit management and microfinancing company in China, now assists Tarena students in obtaining loans to pay for their tuition. CreditEase utilizes a “person-to-person” lending method to enable qualified students to borrow unsecured loans from unrelated individuals without using a bank as an intermediary. Under this person-to-person lending method, CreditEase identifies third-party individual lenders and matches their lending needs with the loan demands of TEDU’s students. Approximately 32.7% of TEDU’s students who obtained financing for tuition fees in 2013 obtained funding sourced by CreditEase. In 2014, approximately 73.9% of Tarena’s students who obtained financing for tuition fees in 2014 obtained funding sourced by CreditEase.

2. Renrendai

In January 2015, TEDU also began to cooperate with Renrendai, a third-party person-to-person lending service provider, in arranging loans for TEDU’s students to pay for our tuition fees.

3. Chuanbang

Chuanbang is also, like Bank of Beijing, no longer doing business with TEDU.

Chuanbang utilizes a person-to-person lending method similar to the one used by CreditEase to assist students in obtaining loans to pay for their tuition. Chuanbang is owned by Mr. Shaoyan Han, Tarena’s chief executive officer. Chuangbang began to offer this service to students in 2011. Approximately 5.8% of students who obtained financing in 2013 elected funding sourced by Chuanbang. Chuanbang has ceased offering financing services to our students enrolled since January 1, 2014.

We believe that Chuangbang’s departure from working with TEDU may be the result of one or both of the following:

- The CEO was looking to end the relationship with the company due to potential related party transaction issues

- The CEO may have realized that he did not want Chuangbang to be exposed to the same type of non-creditworthy clientele that makes up TEDU’s student base

Regardless, the CEO’s shadow bank no longer has exposure to the same risk that other shadow banks that work with TEDU have.

We can clearly see that after providing loans to TEDU’s students for more than two years, Bank of Beijing — the most credit worth of the third party financiers – substantially decreased and appears to us to have recently terminated its loan services to TEDU’s students. Since Bank of Beijing (“BOB CFC”) has been fading out of TEDU’s business, TEDU has been heavily reliant on lower quality “shadow banking”, such as CreditEase and Renrendai. Bank of China (“BOC”) remains the only semi-reputable bank participating in TEDU’s financings – they provided loans to about 14% of students in 2014. It is obvious that a bank such as Bank of Beijing can generally provide lower interest rates than any of the peer to peer “shadow banks”. Obviously, given this information, we’d expect more students to be looking for the higher quality loans with lower interest rates — instead, we’re seeing just the opposite, as students are now more reliant on P2P lending to pay TEDU’s tuition. We can only think of three possible reasons that this change would logically take place:

- High student loan default rates from TEDU’s students may have forced Bank of Beijing to cease business with TEDU

- Less creditworthy students who may not have the necessary credit score to qualify for a Bank of Beijing style loan.

- TEDU may simply be getting a better deal from CreditEase on the cost of TEDU’s students

CreditEase’s loans to TEDU’s students are clearly outside of the mainstream banking system with a higher risk of default. The problems with these types of P2P “shadow banking” loans are that they’re outside of the banking system and have very little collateral requirements or due diligence associated with them.

In practice, this type of lending means that the lender assumes someone else will pick up the tab if all else fails. TEDU did not provide any details on what due diligence CreditEase performs to assure that the loans to TEDU’s students will be paid back. In China, the entire economy is slowing down and some lower quality banks are facing default loan risks, which we believe may eventually affect the relationship between TEDU and CreditEase.

Before CreditEase provided third party financial services to TEDU’s students, TEDU guaranteed the loans for the bulk of its students from Chuanbang, until April 2013. It guaranteed these loans through an arrangement with Chuanbang, which is another shadow bank similar to CreditEase, and a related party of TEDU jointly that is controlled by Shaoyan Han, TEDU’s CEO.

This guaranteed arrangement with Chuanbang has ended, raising questions of how willing external banks, such as CreditEase, will be to continue lending at the pace that Chuanbang was previously – now without the guarantee by TEDU.

To conclude, TEDU remains highly reliant on shadow banking, such as CreditEase and Renrendai to continue its business growth. Traditional banks, such as BOB CFC, leaving TEDU’s business for unknown reasons casts further clouds over the future of the business.

In the event that Chinese banking authorities intensify their regulation of shadow banking and/or shadow banks’ system risks in China, TEDU’s business may be negatively affected.

Select Caveats

- We are aware of two large institutional investors, including KKR and Areo Holdings, in the stock.

- For the story to play out in our favor, our thesis is heavily reliant on the shadow bank funding to the company falling off

- The company has approved a share repurchase program

- The agreement with Bank of Beijing, while no longer active according to the most recent 20-F filing in February 2015, may be renewed in the future. We are not positive that the company is under obligation to update its relationship with Bank of Beijing publicly. This, however, doesn’t change the fact that more students are clearly using shadow banks to finance their tuition

Our Conclusions

We think it’s just a matter of time before delinquent accounts or Chinese regulators catch up to Tarena.

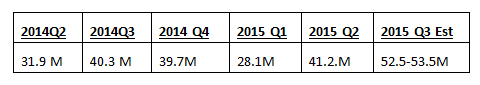

There has been a significant amount of attention in the United States on regulating the for-profit education space. Over the course of the last few years, government agencies have moved to meaningfully tighten regulation in the for-profit education field. As a result, many of the publicly traded companies that make up these for-profit education businesses in the U.S., such as ITT and Apollo Group, have been decimated.

As an example, here are the stocks of ITT Educational Services and Apollo Group, the holding company for University of Phoenix over the last 5 years. As you can see, they’re down 93% and 70%, respectively, largely as a result of increased regulation and government scrutiny.

History has proven to us that Chinese regulators often like to take their cues for action and tightening regulation from the United States. This is something that, despite our differences with Chinese securities regulators, we commend the Chinese government for. It also means that to us, it is reasonable to believe that Chinese regulators may begin to crack down on deceptive, false and misleading tactics that have been used in the vocational/for-profit education sector in China.

Why would Chinese regulators focus on for profit education now?

We have seen the new Chinese administration begin to crack down on previously poorly regulated industries and we believe for profit education/vocational companies could be next. A recent example, that we have significant experience with, is the Chinese government’s recent crackdown on unregulated lottery sales within the country. This is an industry that is vigorously regulated in the United States, and it now appears that China may be in the process of setting up a countrywide infrastructure in order to enforce the same type of regulation.

This brings us to TEDU.

- TEDU’s aggressive recruiting campaign has resulted in numerous reports of low satisfaction levels on the part of its customers. This aggressive recruiting campaign may be ruining the company’s training quality and reputation on an ongoing basis. TEDU’s lower student satisfaction levels and tarnished reputation may negatively affect operations and future growth.

- Traditional banks are leaving TEDU’s high risk business. TEDU has to rely on high risk shadow banking, such as CreditEase and Renrendai, for its business operations and growth. The dependence on high risk shadow banking may introduce regulatory and operational risk to TEDU’s future growth.

- We believe that TEDU’s accounts receivable shows that TEDU’s training services have generated a very high percentage of past due accounts, which may ultimately turn out to be bad debt. TEDU may need to take a higher bed debt allowance in the future. In the event that TEDU adopts a higher allowance, the bottom line will be affected negatively.

- The Chinese economy is rapidly slowing down. TEDU’s business performance may unavoidably be influenced by the country’s macroeconomic situation. Considering the lower student satisfaction and poor reputation, we believe that TEDU’s expansion in the future could move significantly slower — and that the business may even contract.

Valuation

We see the value of TEDU’s shares as having limited upside with more substantial downside. The upside is likely limited by the issues hanging over the company, not the least of which is that 55% of the company’s students obtain financing for their tuition fees through third party financing companies. Given the poor online reviews by students concerning the quality of TEDU’s courses and lack of job prospects after completing them, the likelihood that a significant percentage of disgruntled students will default on their loans is high. This is already evident in TEDU’s deteriorating aging of AR indicating it is very likely that third party financing companies are also facing increased default rates with TEDU’s students. If that is the case, third party financing will become much more difficult for students to obtain and/or more expensive. If the cost of loans to students becomes too great, third party lenders may find themselves exposed to government sanctions for predatory lending practices. Longer term, third party financing of tuition could simply dry up, inhibiting TEDU’s ability to attract new students. We believe this is an issue that will erode TEDU’s growth prospects and business model over time.

If the company begins to face difficulties maintaining its third party financing relationships the valuation scenario than we have presented could be very generous since cash and profitability would likely take a major hit.

The downside for TEDU’s shares could be significant, 28% or more from the recent trading price of $9.71. We see three factors that could pressure shares of TEDU.

- Valuing the shares at 10 x the average analyst estimate for 2016.

- Valuing the shares at 2 x estimated cash and time deposits per fully diluted share at December 31, 2015. The company had $182.5 million cash and short and long-term time deposits at June 30, 2015, and given recent trends that amount should reach $200 million or more by year end.

- Although assigning a value is not possible, considering the possibility that TEDU’s students are no longer able to secure third party financing to pay for tuition. That would put 55% of TEDU’s current revenue stream in jeopardy with unknown consequences as management attempts to adapt.

Given TEDU’s circumstances, we believe a short term price target of $7.00 is reasonable based on EPS estimates for 2016 and the cash and time deposits the company is likely to have on hand at year end:

- 10 X FY 2016 EPS avg. analysts’ estimates (a) : $7.10

- 2 X Cash and time deposits per fully diluted share (b) : $6.87

- Target price : $7.00

Notes:

(a)Source average analysts’ 2016 estimates per Yahoo! Finance

(b)Based on financial statements reported by TEDU @ June 30, 2015

If the company begins to face difficulties maintaining its third party financing relationships these price targets could be very generous since cash and profitability would likely take a major hit.

Miranda

I agree with your analysis, I thought the same thing! But why is its stock price still growing…