Summary

- We believe Stellar Biotechnologies’ (SBOTF) share price to be a product of a well timed promotional campaign.

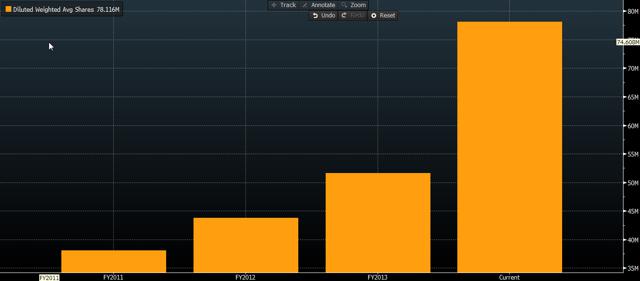

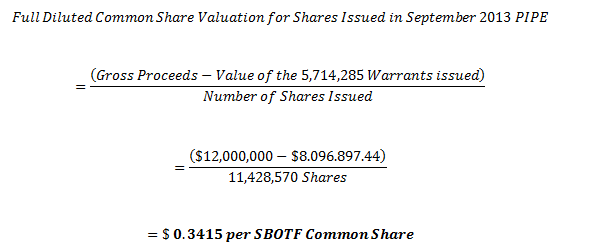

- SBOTF’s share count has risen 88.2% in three short years and the September 2013 PIPE was done at a fully diluted share price of $0.3415/share. (sourced below).

- The company appears to be operating far below its capacity and has reported net losses of ($14.8M), ($5.1M), and ($3.5M) for the past three years. (source 3).

- Promotions have touted the company’s former agreement with Sigma Aldrich, but we’ve found that this agreement had expired in 2013.

- SBOTF’s biggest competitor, BioSyn established in 1984, claims to be able to produce far more than 1,500 grams/year. (SBOTF’s current capacity).

Stellar Biotechnologies (OTCQB:SBOTF) – Intriguing Story

Stellar Biotechnologies (OTCQB:SBOTF) has been an intriguing story these last two months.

We’ve found three things about Stellar Biotechnologies to be concerned with right off the bat . These items, combined with the results of further due diligence, lead us to believe that Stellar will make its way back to $0.70 and resume its descent downward from there.

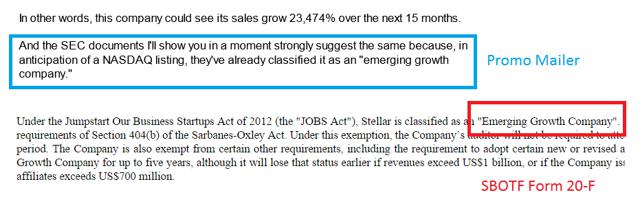

First, we’ve found a promotional campaign that we believe to be the cause of the company’s stock price moving up in rapid fashion without material news or fundamentals to back it up. We’ve found third parties that have issued questionable campaigns that are touting SBOTF, and these promotions have made some robust claims that we believe they can’t back up – including at one point commenting that SBOTF would list on the NASDAQ “as soon as August 31, 2014.”

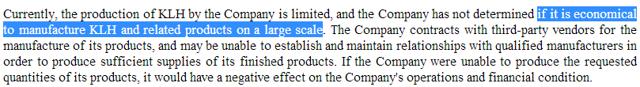

Second, we will shine light on exaggerations made by these promotions about future operational expansion, which we view as unnecessary and a non-issue due to Stellar’s already anemic history of production (sourced below). In addition, the company themselves admit that they do not know if it is economically feasible to expand at this stage in their growth. We question why the company would think about expanding when we believe them to be operating far under capacity and production appears to be falling. Our conversations with BioSyn, a 30+ year veteran in the Keyhole Limpet Hemocyanin (“KLH”) niche, confirm to us that Stellar’s capabilities are nowhere near as robust as this competitor. Stellar’s own 20-F from 2013 states that they produced under 50g of KLH for 2013, representing less than 4% of the company’s 1,500g capacity. Stellar’s V.P. of Corporate Development & Communications, Mark McPartland, confirmed that the company was operating at far less than capacity and had never operated over 10% capacity.

Finally, we question the validity of promotions tied to the company’s former agreement with Sigma Aldrich. When SBOTF’s CEO was questioned about production during the 2014 Rodman & Renshaw conference, he commented on the record that Stellar currently supplies KLH to Sigma Aldrich (NASDAQ:SIAL) via a publicly disclosed agreement between the two companies. His comments implied that this supply agreement was active and ongoing, yet we can’t find any mention of it in either companys’ recent filings. SBOTF VP Mark McPartland told us that the company doesn’t comment on who they sell to and that the agreement was a “rolling agreement”.

Furthermore, posing as a buyer, GeoInvesting tried to purchase KLH from Sigma Aldrich, who told us it was manufactured in-house by their operation in Israel.

To further back this up, we found that according to Stellar’s Form 20-F filed on December 31, 2013, their contract with Sigma Aldrich had expired in June 2013 without being extended.

They call themselves the “world leader in sustainable manufacture of Keyhole Limpet Hemocyanin (KLH) (source 28),” but from what we’ve found, this is probably not the case. BioSyn, a U.S./German company is acknowledged as Stellar’s main competition. We called BioSyn to discuss Stellar’s production capabilities of 1,500 grams/year and BioSyn’s President, Shammana Muddukrishna said, “We already produce much more than that.”

In addition, the company states in its own filings that it doesn’t know “if it is economical to manufacture KLH and related products on a large scale” (source 3).

After a steady walk down from the $1.60 levels in March of this year, SBOTF found itself trading around $0.70 to end the month of July – less than a month and a half ago.

Beginning on August 11th, and seemingly without rhyme or reason, the stock began a rocket-like ascent from those $0.70 levels to near $2.30/share on no news and record volume – all in less than one month’s time.

What major material news could have occurred in such a short time that would cause this struggling, money-losing company to mysteriously triple its value? According to a company issued press release, nothing(source 8). According to what we believe, this is the product of a comprehensive and well-timed promotional campaign about a company that is in no way as exclusive as the promotions they are making it out to be.

In this piece, we’re going to show:

- The promotion that we believe caused a rapid ascent in SBOTF’s share price to current levels.

- That a partnership agreement used to tout the company by promotershas been expired and has not been extended since June 2013.

- Why we think SBOTF’s stock crashed just days after spiking – and why we expect another decline.

- That SBOTF’s own paid research firm only has a $1.14 price target on the stock (sourced below) – representing about 33% downside to current trading levels around $1.70.

- The company appears to be operating far below its capacity.

and has reported net losses of ($14.8M), ($5.1M), and ($3.5M) for the past three years (source 3).

- The company does not have a monopoly on KLH as newsletters claim, nor do we believe it to be the leader in its industry; in fact, their biggest competitor, BioSyn, claims to be able to produce far more than 1,500 grams/year (SBOTF’s current capacity) and also claims to have supplied the KLH to “almost 90% of the clinical trials that have taken place to date and the ones that are continuing now.”

- SBOTF and some “lucky” investors valued shares at around $0.34/share during the company’s September 2013 private placement. (sourced below)

- Why we think there’s significant more downside to SBOTF at current levels and well below the $1.14 price target set by the company’s paid analyst report.

The Promotions Begin

Stellar Biotechnologies drew our attention due to its bizarre trading.

When we began to dig and look for information as to what could have caused the stock to move the way that it did on such short notice, we turned up some interesting information.

First, we obtained the following e-mail, which appears to have been issued on August 18, 2014. (source 1)

The enclosed link to “our most exciting initiative ever ” has been taken down recently, and we are instead given the following message when we try to follow the link:

Using Google Cache, we were able to locate a copy of the report, which appears to first have been issued in July 2014 (source 2).

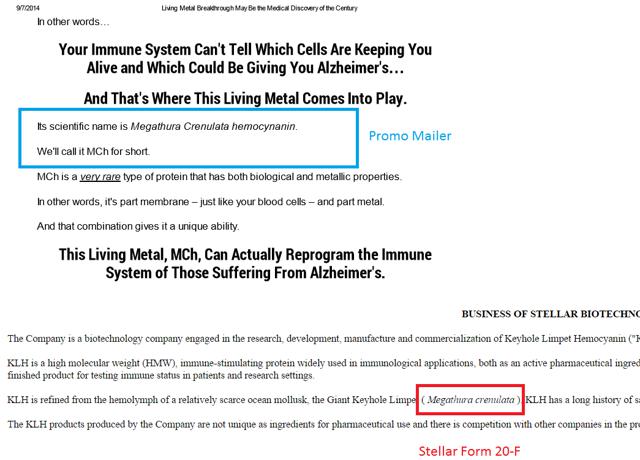

The name “Stellar” or ticker symbol “SBOTF” do not appear in the report itself, but the similarities between this report and SBOTF are uncanny. The newsletter also fails to mention any other public companies, prompting potential investors to reach out to Michael A. Robinson, the name signed on the report, for “the goods.”

The newsletter is clearly a lead in to a promotion of Stellar, as you can see from a few examples showcasing the similarities between the data points in the newsletter compared to SBOTF SEC filings (source 3).

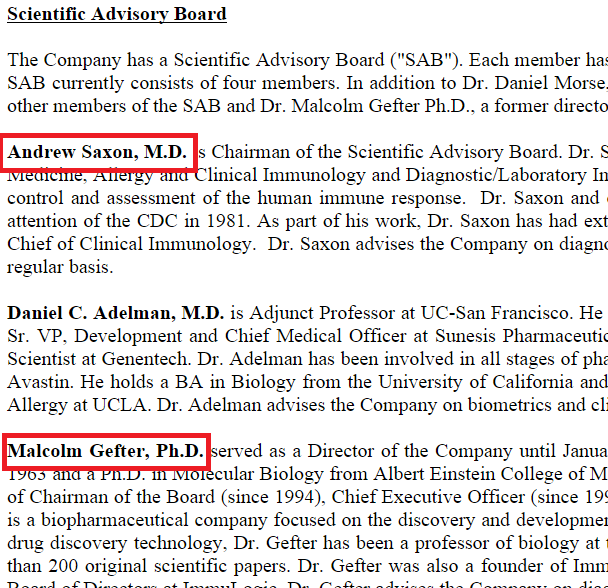

Things like the “Scientific Board” that is touted in the newsletter fit Stellar to a tee. Here is an excerpt from the newsletter:

The above statement from the newsletter runs commensurate with the “scientific board” in SBOTF’s 20-F filings:

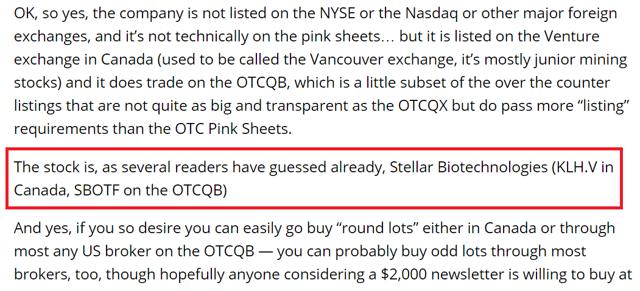

A post at Stock Gumshoe (source 4) also believes that the newsletter was, in fact, touting Stellar:

If you want to read into this particular newsletter a bit more, you can log onto the Stock Gumshoe site and read the comments to this piece. A lot of them seem to be of the consensus that this was a well-timed and well placed promotion.

This was taking place from the July date on the newsletter through August 11th, 2014 , when the stock began its run. Sources that we have spoken to have told us that they received a copy of this newsletter for the first time on August 18th, 2014 , well after the stock had begun its ascent upward.

Here are some other similarities:

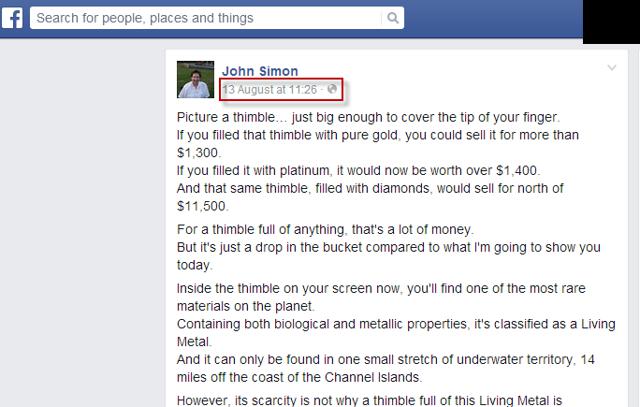

We even found promos using the exact same text as the newsletter on Facebook (source 5):

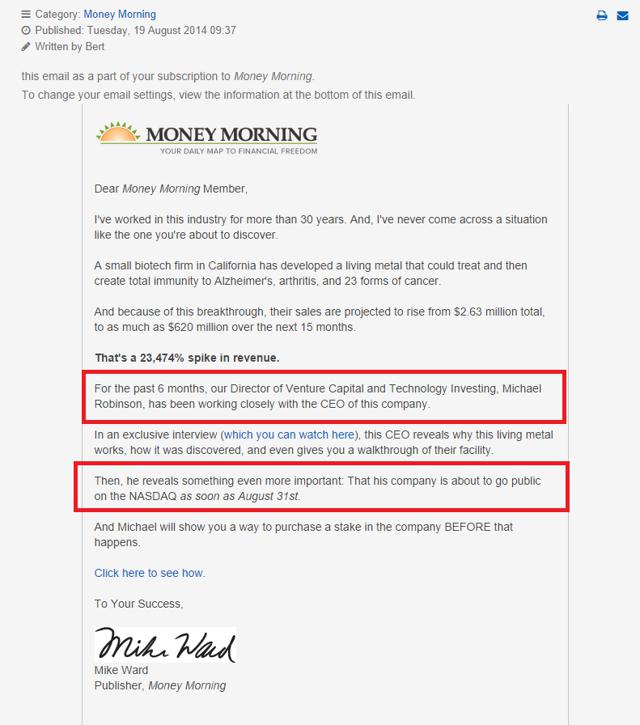

Also, we found a couple of interesting statements that were made in an e-mail blast that we believed to have gone out around August 19th, 2014 (source 6). This e-mail from Money Morning also has Michael Robinson’s name in it:

After speaking with the company, we take Stellar at their word when they say that these promotions did not operate in conjunction with the company, nor do we believe that Money Morning actually got this uplist date directly from Stellar’s management. However, when we spoke with Stellar’s VP Mark McPartland, he told us he was aware of these promotions.

Regardless of whether or not the company had anything to do with it, the statement about uplisting is irresponsible. We find such a forward looking claim to be a red flag, regardless of whether or not it was the CEO or simply the newsletter that put it out in the first place.

Stellar’s corporate video (source 25) seems to be the source for many of the images that were included in the newsletter. Here are two example images used in the newsletter and in Stellar’s corporate video:

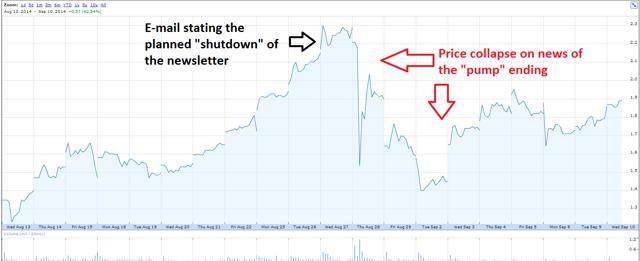

On August 25th, word went out that the newsletter that was touting SBOTF was going to have to “shut down the most extraordinary venture [they’ve] ever developed (source 7).”

In either event, in terms of the uplist, it is worth noting that we are well beyond August 31st and SBOTF continues to trade on the OTCQB.

“Coincidentally,” during the first hours of trading on August 28th, the company lost over 29% of its value. From August 27th to September 2nd, the price dropped from over $2.20/share to as low as $1.40/share, an astounding 36% drop in just three short trading days. Those that were buying on the hopes and dreams issued by this newsletter had taken significant losses.

On August 29th, the company issued a press release (source 8) that stated they were “not aware of any material change in the Company’s operations that would merit such trading activity.” We find it interesting that SBOTF (or their securities lawyers) felt prompted to put this press release out after the drop in the stock price, but not while the stock was rocketing upwards without “material changes” occurring. After Stellar made us aware that they knew of these promotions, we were taken back by how the company has seemingly failed to control this dissemination of false and misleading information.

With the company admitting no material changes had taken place, we strongly believe the drastic swing in the stock’s price was nothing more than a result of this newsletter going out.

Again, it comes as no surprise to us that this company is still listed on the OTCQB in the U.S. and the TSX Venture Exchange in Canada at the time of this article being prepared on September 16, 2014 (source 29).

Supplemental Findings

We’ve also noted that Stellar’s stock seems to be associated with MissionIR and DreamTeam – two names that give us pause due to their questionable track records. While we don’t believe the company has directly hired these promoters, we find it noteworthy that these names are involved in touting how great of an investment SBOTF is.

For a little background, we know that MissionIR is a brand that’s affiliated with DreamTeamGroup (source 9).

To familiarize yourself a bit more with DreamTeam, you can read Richard Pearson’s write-up entitled “Behind the Scenes with Dream Team, CytRx, and Galena” on Seeking Alpha (source 10). Put simply, in this piece he claims that DreamTeam disguised themselves under different pseudonyms to promote CytRx. As a result, the article notes that over 100 DreamTeam articles had been removed from various sites across the web.

A follow up article was published by ValueWalk (source 11).

Again, we are not implying that SBOTF hired the DreamTeam or any of its affiliates, but simply pointing out that we think it’s a red flag that an affiliate of the Dream Team is promoting SBOTF online.

We also believe these promotional touts for SBOTF contain false and misleading information.

MissionIR seems to have been posting about SBOTF for some time now (on various websites). Here are a couple of the posts that we’ve found:

- On February 14, 2014, there was an article written on Seeking Alpha by MissionIR (source 13). The article had this vague disclaimer at the bottom of it.

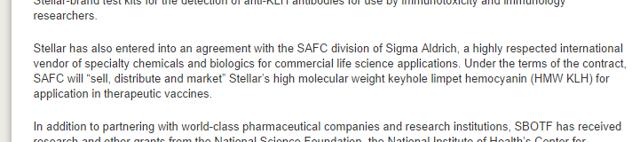

- On August 14, 2014, there was a post made by MissionIR about SBOTF on Investor’s Hub (source 14). The post has the “Compensated Awareness Post” banner at the top of it, leading one to that assume that MissionIR may have been compensated by the company. (click to enlarge)

The MissionIR post claims that:

“Stellar has also entered into an agreement with the SAFC division of Sigma Aldrich, a highly respected international vendor of specialty chemicals and biologics for commercial life science applications. Under the terms of the contract, SAFC will “sell, distribute and market” Stellar’s high molecular weight keyhole limpet hemocyanin (HMW KLH) for application in therapeutic vaccines.”

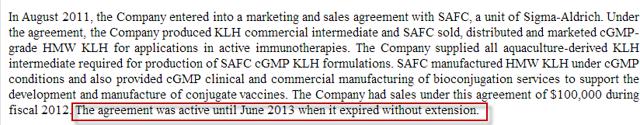

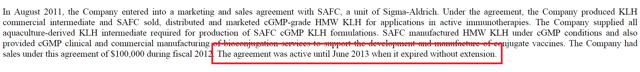

We find it interesting that in 2013, it appears that SAFC allowed the “Marketing and Sales Agreement” with SBOTF to expire. This is what the company’s Form 20-F reads from more than a year ago (source 3).

If this is true, MissionIR is promoting the company with a deal that isn’t even in place any longer. Here are two more examples that we believe to be extremely misleading.

MissionIR seems to have published this article in as many venues as they could. Aside from Investor’s Hub and Seeking Alpha, you can find it on MissionIR’s Website (source 15), Small Cap Network (source 16), DreamTeam Network (source 17), and Twitter (source 18).

The Latest Promotion

It was surprising to us on when we saw SBOTF up 5% at the open September 5th.

Once we checked, we saw the following headline (source 19):

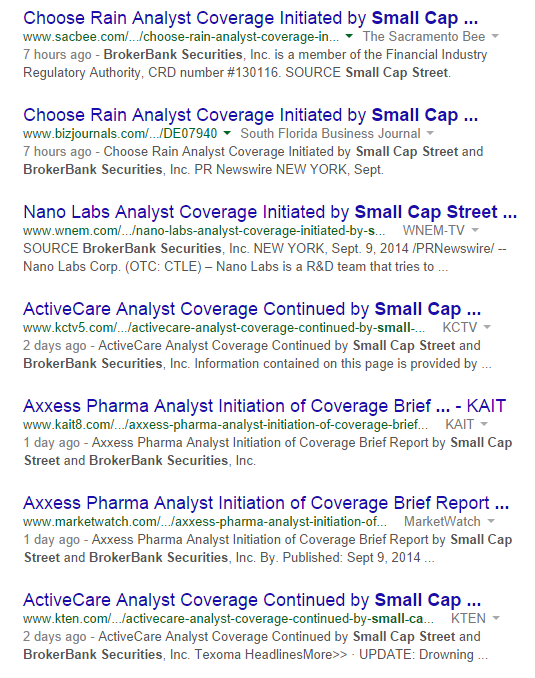

Despite the fact that it’s unusual for a company to issue a press releaseannouncing an analyst report, we found that this BrokerBank Securities, Inc. link to this particular report led us to a website called smallcapstreet.com. You can view this by following the link that’s listed at the end of the press release.

A simple Google search of both BrokerBank Securities, Inc. and Small Cap Street, LLC leads us to numerous results – most of which seem to be the same style of analyst reports.

From the same search, we found disclosures like this one, which tie the two names together:

“Apr 9, 2014 – No liability is accepted by Small Cap Street, LLC and BrokerBank Securities, Inc. whatsoever for any direct, indirect or consequential loss”

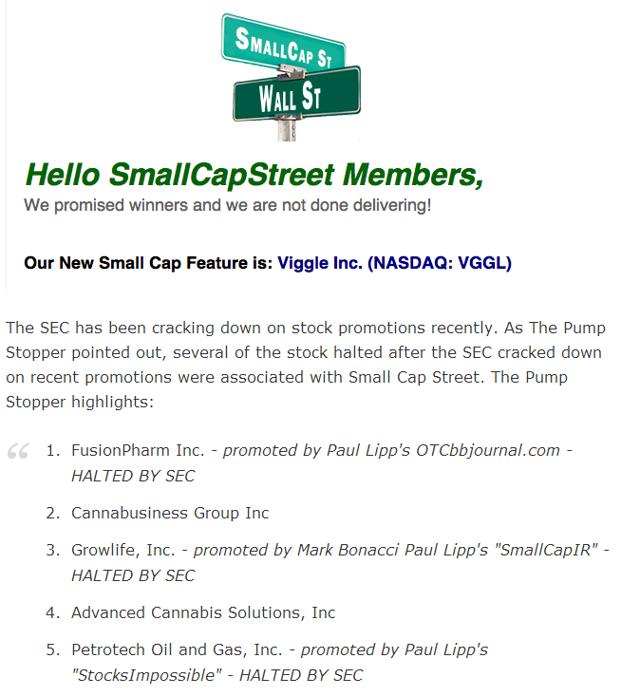

We also recall that “Small Cap Street” seems to have had a history of promotions, as they’re noted in a critical article about Provectus (source 20):

“Recently PVCT stock has gone parabolic on a promotion campaign involving smallcapstreet.com where they pumped the stock and set a price target of $62. Just a week ago, PVCT traded around $3.75, the stock now trades around $2: a crushing -46% plunge in the stock” — May 2014. (Now it trades at $1.05)

In addition, Bleecker Street Research also released an article (source 21) about VGGL where they are critical about Small Cap Street’s involvement in potentially promoting it. The stock has gone from $5.73 near June 3rd (when this piece was put out) to $3.44, what it is trading at today. This represents downside of nearly 40%.

In 2014, Promoters Are Touting an Agreement that Expired in 2013

We should note that with regards to Stellar’s 2011 “Marketing and Sales Agreement” with SAFC, a Sigma-Aldrich subsidiary. This announcement of a “strategic agreement” was announced in a press release on 8/03/11. When it was released, Stellar’s CEO Frank Oakes stated:

“The agreement solidifies our position as the only source for a scalable supply of cGMP-grade HMW-KLH for the vaccine business. We have put Stellar’s aquaculture KLH supply front and center in combination with what we believe is the most important manufacturer and marketer of cGMP biologics in the world, Sigma-Aldrich’s SAFC business unit. This exciting development will allow us to move aggressively forward on our diagnostic programs, knowing that the state-of-the-art quality assurance and production capabilities of SAFC will be providing the backbone for companies seeking the highest quality HMW-KLH available for vaccine developers anywhere in the world. We look forward to continuing growth in this relationship and will begin manufacture of SAFC’s initial order as soon as possible.”

After an initial purchase order, for which a press release was issued in September of 2011 (source 22), there doesn’t seem to be any tangible traction resulting from the 2011 partnership. The last note that we see about this relationship appears in Stellar’s Form 20-F for 2013. The Form 20-F notes that the “agreement was active until June 2013 when it expired without extension.”

Sigma Aldrich or SAFC does not appear on Stellar’s website under partners, nor does it appear in any subsequent filing after this information was disclosed in the 2013 Form 20-F. There is also no mention of this partnership in the company’s most recent corporate presentation, published in June of 2014 (source 23).

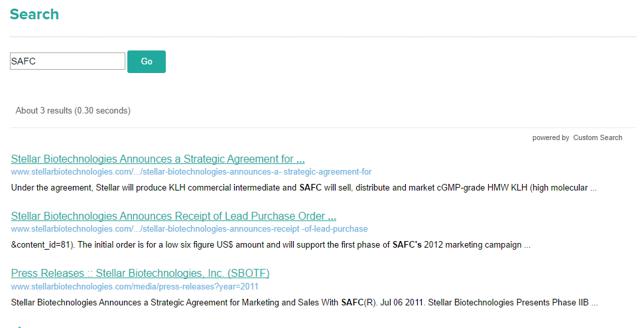

A search on Stellar’s website for “SAFC” yields only the original release and the initial purchase order:

When we asked Stellar about whether or not this deal was active, VP Mark McPartland told us it was a “rolling agreement”, but would not tell us if the company had made any sales to Sigma Aldrich this year.

When we asked Sigma Aldrich’s IR if there was any continued business going on between the two, he stated,

“To be honest, I’m not aware of anything and we don’t tend to comment on agreements other than what we put out in our SEC filings; so I can’t really give you much comment beyond that. I don’t believe we’ve said anything in our filings.”

Just to double check, we went back through Sigma-Aldrich’s filings through when the deal expired, and we don’t see Stellar, or KLH for that matter, in any of them.

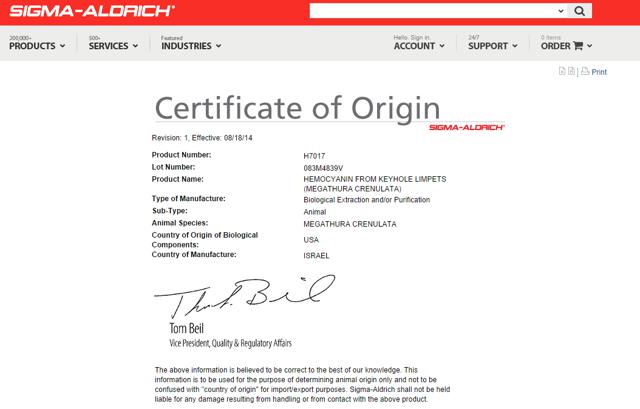

To triple check, we called Sigma-Aldrich sales and a nice gentleman was happy to walk us through the procedure to distinguish what the origin of their KLH product is.

He gave us the lot number of the KLH they were selling, and that led us to this:

Once we pulled up the certificate of origin, the gentleman confirmed over the phone that since the KLH was manufactured in Israel, that it was indeed Sigma’s own product (not manufactured from an outside source).

We also watched CEO Frank Oakes’ presentation at the Rodman & Renshaw conference just days ago. We’ve obtained the video and audio from this presentation and have posted them so that everyone can see here.

We note that at 18:29, when asked about the competitive landscape, the CEO responds:

“Stellar supplies KLH through a publicly announced agreement with Sigma Aldrich, a major global reagent supplier, we produce the KLH intermediate from our aquiculture program – they purify it into a proprietary formulation that they supply to drug companies”

We question if the company is still, in fact, supplying Sigma Aldrich and if they are, in what capacity given their limited production.

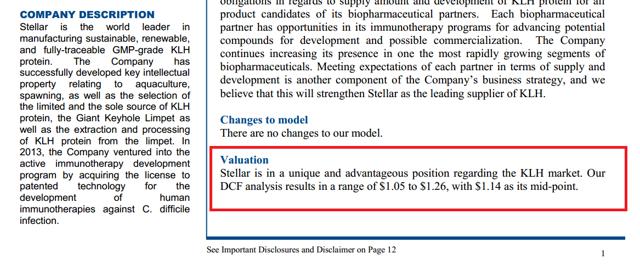

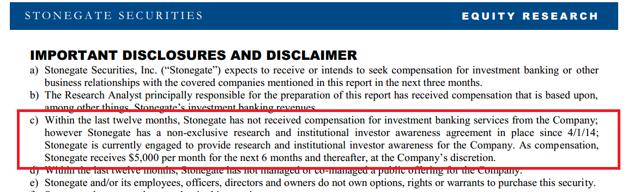

We also obtained a research report by Stonegate Securities that went out on July 15, 2014 on SBOTF. Stellar VP Mark McPartland confirmed that Stonegate was compensated by Stellar, and in this report, they only give SBOTF a valuation of $1.14/share:

We also noted the disclaimer at the bottom of the report says flat out that Stonegate is receiving compensation from Stellar.

If company-paid analysts think SBOTF is only worth $1.14, what do non-company paid analysts think?

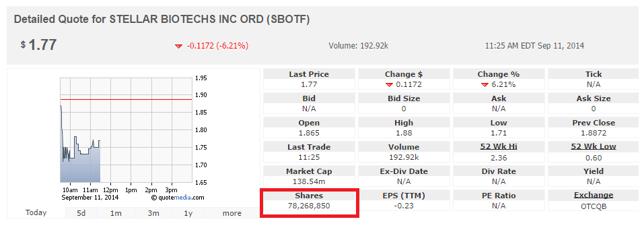

The Share Count Has Risen 88.2% in Three Short Years and the Company Placed a Valuation of Just $27M on Itself As Recently as Last Year

We note that the number of outstanding shares in SBOTF has increased dramatically over the last 3 years. According to the company’s 2013 Form 20-F, the number of shares has risen from 41.6 million in 2011, to 78.3 million as of today. That’s an increase of 88.2% in just three short years.

If they keep adding shares at this percentage rate, the company will have 147 million shares outstanding three years from now.

In the past, shares have been issued at alarming discounts.

If you reference the September 2013 private placement, you’d see that each unit was issued for $1.05 and included a half share warrant to purchase at $1.35.

“The Company issued 11,428,570 units for total gross proceeds of $12,000,000. Each unit consisted of one common share and one-half of a share purchase warrant, with each full warrant exercisable into one additional common share at a price of $1.35 for a period of three years from the issuance date of the warrants.”

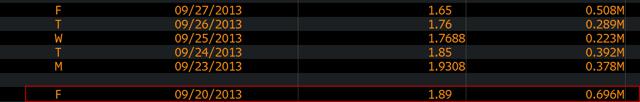

SBOTF, on the day prior to the Announcement, closed at $1.89 per share.

How can we look to see how much SBOTF values its own shares in this particular placement?

We can do this in an easy three step exercise:

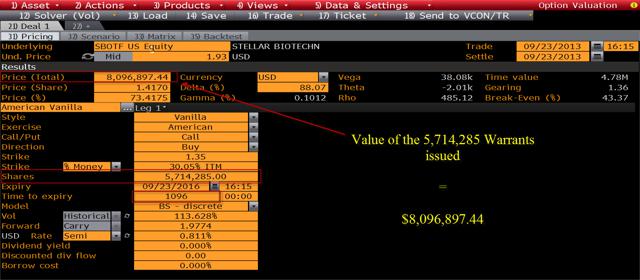

1. First, we can compute the value of the 5,714,285 three yearlong warrants issued during the PIPE using the Black-Scholes model.

2. Then, we subtract the value of the warrants from the gross proceeds raised by the company during the placement ($12,000,000 – $8,096,897.44). This gives us a figure of $3,903,102.56

3. We take the result of step two and divide by 11,428,570 (number of common Shares issued), which gives us the alarming result of $0.34/share. The work looks like this:

From this, we can derive two more alarming figures:

- The company offered shares on September 23, 2013 at a 81.93% discount to the pre-announcement trading price of $1.89.

- This deal only values the company at around $27M vs. Their current market cap of over $130M, despite any material developments at the company. We found this by taking $0.3415 times the 78,865,031 shares outstanding at 12/31/2013 (source 3).

That leads us to ask: why should shareholders and investors value this company at about FIVE TIMES what the company values itself- especially given the inability of the company to generate profit?

The Company is Operating Far Under Capacity and Is Not the Leader in KLH

In addition to the share count increasing, the company has constantly been talking about increasing production. However, filings show that the company is by far consistently operating under their current allocated production. The company has disclosed that for both the fiscal year 2012 and fiscal year 2013 (source 3), that they have a production capacity of 1,500 grams of KLH/year. The Form 20-F states:

“Currently, the Company’s production capacity is 1,500 grams per year. The Company currently has live M. crenulata inventory sufficient to increase KLH production volume by approximately 3,000 grams per year. The Company anticipates scaling up its production through the addition of the required equipment and personnel as demand warrants using funds received from the September 2013 private placement.”

Yet, what we found in the company’s last annual report is that for 2011, 2012 and 2013 the amount of KLH grams produced seems to have been a small percentage of capacity – and has declined year over year. The 2013 20-F (source 3) reads:

“The quantity of KLH pharmaceutical intermediate produced in fiscal 2013 was approximately 46 grams for product development and research. The Company sold approximately 0.34 grams of KLH in various formulations from prior years’ production. The quantity produced in 2012 was 161 grams for commercial sales, contract obligations, product development and research and 20.5 grams of KLH in various formulations were sold, including a portion from prior years’ production. The quantity produced in 2011 was approximately 340 grams for commercial sales, contract obligations, product development and research. The Company sold 0.76 grams of KLH in various formulations in that fiscal year.”

From this, we can project what capacity SBOTF has been operating at over the last three years:

| FY | KLH Produced+Sold (Grams) | % of 1,500g Capacity Used |

| 2011 | 340.76 | 22.71% |

| 2012 | 181.5 | 12.1% |

| 2013 | 46.34 | 3.09% |

We asked the company about the amount of grams produced in 2014, but we were told we would have to wait for the coming 10-K.

This data seems to suggest to us an astonishing figure: SBOTF only produced at 3.09% of its potential production capacity in 2013. In addition, the percentage of capacity seems to have dropped significantly since 2011.

Puzzling about these figures is that the company seems to be pushing the possibility of ramping up production.

In the MD&A (Exhibit 99.2) for the nine months ended May 31, 2014, the company wrote the following:

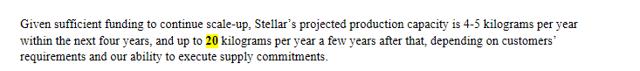

Then we have this mystical paragraph buried in the company’s 2013 Form 20-F (source 3):

We have to ask how much business the company actually expects to do in the coming years that they would need to expand production by 1200% when they’re currently only using under 4% of their 1,500g capacity and openly admit in their own filings that they don’t know if it’s economical to manufacture?

Finally, SBOTF does not, by any means, have a monopoly on the KLH niche as the promotion was suggesting. Biosyn Corporation has been the market leader in KLH for the past couple of decades (source 26) and they’ve been in business since 1984. We reached out to BioSyn’s president, Shammana Muddukrishna, who was nice enough to speak with us via phone. When I asked whether or not Stellar had a monopoly on KLH, he laughed. From our conversation with Mr. Muddukrishna, we were told the following items that should alarm SBOTF shareholders:

- BioSyn got their first approval in 1997 to use KLH to treat bladder cancer, “which Stellar is trying to mimic now”

- They have supplied KLH for “almost 90% of the clinical trials that have taken place to date and the ones that are continuing now”

- If “all of the clinical trials going on now are approved, [BioSyn] will have more than necessary to supply”

- [BioSyn] has “interacted with almost all of the major pharmaceutical companies working with KLH and they continue to use our KLH”.

To add insult to injury, when told that Stellar has the capabilities to produce 1,500 grams/year, BioSyn’s President said, “We already produce much more than that.”

Summary and Investment Thesis

What we have here is the case of a yet another company with a “good story”, but a company that’s also significantly overvalued, in our opinion. Like any other speculative company in the biotech sector, this is a case where there’s the prospect of a win in the distant future, but we believe SBOTF to be years from tangible results and steady fundamentals. Until they reach that point, dilution is likely going to be a reality as the company fights to fund itself, like any other speculative biotech.

We were pleased that VP Mark McPartland took time out of his day to have a call with us, and we in no way believe that he was being anything but honest and realistic to us when we spoke to him. He came off as extremely knowledgeable and passionate about what the company is trying to do, and he invited us out to visit the company – an offer that we may take him up on in the future. He seemed to know exactly what we were talking about when we questioned him about the promotions and when we suggested that the stock price may have gotten away from being realistic, he didn’t come out and disagree with us.

The unfortunate circumstance that this company has found itself in, however, is one where the stock has been pushed up to an unrealistic valuation, and the company has made the mistake of not aggressively going after the parties involved in the false and misleading promotion.

We believe SBOTF to be far overvalued and we place a value on the company near what the company placed upon itself during its September 2013 PIPE – somewhere around $0.35 – $0.50.

Now that the promotion is wearing off and the true “niche” of SBOTF’s business is exposed as one that has substantial competition with far more production capability, we believe SBOTF will resume its pre-promotion decline, eventually making its way back to $0.70 and resuming its downward move from there.

We expect the descent to be further catalyzed by continued dilution from the company in coming months, as well as by lack of intrinsic fundamentals to hold the company afloat. The company, as of its last quarterly report, has $11.2 million in shareholders’ equity, which equates to roughly $0.15 per share in equity.

So far, SBOTF has failed to achieve any substantial revenue and is currently trading at a price to sales ratio of 178.25. If “grant revenues” are excluded from total revenues, we are left with an astounding price to sales ratio of 403.88. Assigning a generous multiple to these intrinsic values, we believe a $0.35 – $0.50 price target to be a reasonable and fair measure to value the company’s future prospects at this point.

Investors buying at these levels should assume caution; with Stellar Biotechnologies, we believe we’ve seen the pump, and are now as is often the case, just waiting on the inevitable dump.

Sources:

Sources:

- Pumpregister.com via Google Cache

- Google Cache

- SEC.gov

- Stock Gumshoe

- Pumpregister.com

- Pumpregister.com via Google Cache

- NASDAQ.com

- Dream Team Group

- Seeking Alpha

- Value Walk

- Seeking Alpha

- Investor s Hub

- MissionIR

- Small Cap Network

- Dream Team Network

- MarketWatch.com

- Guerilla Stock Trading

- Seeking Alpha

- Stellar Biotechnologies Website

- StockPR.com

- MarketWired.com

- Stellar Biotechnologies Website

- Biosyncorp.com

- SEC.gov

- SEC.gov

- OTCMarkets.com

Disclosure: Short SBOTF

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.