President Trump’s promises of tax reform, business deregulation and infrastructure spending are not the only catalysts driving micro-cap

President Trump’s promises of tax reform, business deregulation and infrastructure spending are not the only catalysts driving micro-cap

and small-cap stocks. The current micro-cap environment is ripe for shareholder activism and can help expand the valuation of quality “growth + value” micro-cap stocks. After seeing our calls to action (“CTA”) rise an average of 32% in 2016, our micro-cap performance through the first quarter of 2017, 23.75%, is setting the tone for a great year.

Media Creates Inefficiencies You Can Exploit

The lack of broad and consistent participation of micro-caps during this 7+ year bull market has led to inconsistent returns in the micro-cap space, frustrated investors and depressed valuations in the stocks of many quality companies. Stock picking is being portrayed as a lost art. The media keeps pouring cold water on the dreams of stock pickers and young fund managers by talking about the rise of mindless ETFs and at times questioning short-term under-performances by iconic value investors such as Warren Buffett. C’mon, man!

The severity of the 2008 global recession was second only to the 1929 Great Depression. With an event that devastating, it could take years to repair the damage inflicted upon old investors and invite a new army of young investors to the “game”. I look at this as a half glass full point of view in that we have a long run way ahead of us.

I’m sorry, Mr. CNBC, nothing has the potential to last forever except for regret and ignorance. The more negative rhetoric you spread, the more inefficiency you will create, which benefits good stock pickers when the pendulum swings.

The Micro-Cap Problem – Environment Became Messy

The aftermath of the 2008 global recession and 2010 Flash Crash (“fat finger”) events removed critical pieces of the puzzle that had historically expedited value creation in micro-caps. The Flash Crash was like a nail in the coffin, because up until that point, I was observing a return to market normalcy. No one really talks about it, but I really point my finger at the Fat Finger dip as a huge reason why many retail investors remained and returned to the sideline.

The number of retail investors allocating capital to micro-caps has clearly been diminished since 2008. This has taken away “the first move” phase in micro-cap stock price appreciation, where retail investors push up shares to prices and market caps that would attract institutions who could not invest at certain price levels and market caps. This is even more critical now, because funds that once were potentially able to buy micro-caps now have steeper market value restrictions. Additionally, brokerage firms now make it more difficult for investors to buy micro-caps or over the counter (OTC) stocks. Sometimes, you even need to phone in a micro-cap buy order if you have accounts with discount brokerage firms like E-Trade and TDAmeritrade. Come on guys, it’s 2017: we need to make microcap investing accessible to everyone.

When you add the fact that pooled investments now represent 2/3 of trading volume vs. as low as 1/3 of the volume prior to 2008, you simply have a case where less money is chasing individual equities, which can prolong value creation in your stock picks.

This is not to say that all micro-caps have been shunned by investors. Great stock pickers will probably always be great at their craft. After 2008, however, a new breed of investment success arose. Investors didn’t want long-term exposure to the market. For example, I was listening to an NPR program a few months ago where a stat was given that illustrates this point: the holding period for a stock for the average retail investor has fallen from a few years to just a few months. Ironically, this leads to investors craving quick hit highly speculative stocks in lieu of higher quality “growth + value” stocks.

It’s a simple conclusion to draw: lack of interest in quality micro-caps, which reduced liquidity in an already illiquid space, depressed valuations of many quality firms.

The Pendulum Is Swinging – The Trump Effect

Value still matters at some point, but I am by no way a market timer. But, I have been often commenting that micro-caps were starting to look healthier. But it was not until late 2016 that micro-caps started attracting “sticky” capital.

Putting political affiliation aside, the Trump effect has started to bring some long needed consistent participation into the micro-cap space.

At some point during my interview process with management teams I always make it a point to ask them how business has fared since the election. The answer has been fairly consistent: almost immediately, they stress that optimism and spending increased on the business level. I got the feeling that businesses were just not confident to let loose under Obama.

Here are a few trends that I am observing that are helping micro-caps

- More appetite from old school retail investors

- Younger investors starting to toy with investing longer term

- Micro-caps stocks finding strong bids when they pull back (instead of just falling asleep)

- Quicker expansion of valuation multiples in undervalued names

- More investors beginning to inquire about launching micro-cap funds

Shareholder Activism – Walking Down The Food Chain

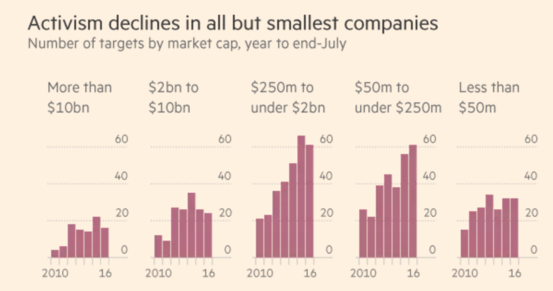

If the typical market forces won’t naturally take care of the micro-cap valuation gap, activists and M&A will. Like hedge fund manager Jeff Gramm wrote in his book, Dear Chairman, “today no public company is too big to be confronted.” Unique corporate governance issues exist in the micro-cap space which are ideal for activists. The role of shareholder activism is a trend I have seen picking up and a trend that I think will eventually help restore balance to the micro-cap space.

Remember this: private equity firms and hedge funds are greedy

The smart ones know that you make money from exploiting inefficiencies in the market. With big cap valuations being stretched over the 7+ year bull market, and their bloated balance sheets, activists are beginning to see more favorable risk reward profiles that investing in smaller capitalized firms can bring. This is great news for micro-cap investors waiting for institutional capital to catalyze their bets. It will also motivate management teams (especially older teams) to put greater emphasis on maximizing shareholder value so not to attract to activists.

2017 is already starting to see some micro-caps getting share boosts from shareholder activism involvement.

Sevcon (NYSE:SEV) is a 30 year old designer and seller of motor controllers with 276 employees and a current annual revenue run rate of about $40 million with a market cap $76 million. The company has been struggling to profitability grow its business for several years. Activists stepped in, calling on management to find new areas of growth for its legacy product offerings/technology. Earlier this year, shares briefly doubled to $17.54 in two days, after the company issued a press release discussing contract wins related to some of its product reinvention activities.

Likewise, The Eastern Company (NASDAQ:EML), a ~160 year old industrial product company with a market cap of $160 million, is beginning to see the benefits of new growth initiatives put in place by activists. The stock has already increased 27% from when we brought this developing story to the GeoInvesting community on March 28, 2017.

Just a few days ago, shares of micro-cap Sito Mobile (NASDAQ:SITO) and small cap Rent A Centers of America (NASDAQ:RCII) saw shares rise sharply on the heels of shareholder activism.

Here is a quote from a 2016 Financial Times article that talks about the trend of activists moving down the food chain:

“And because the companies are less well researched by analysts, have access to fewer corporate advisers, and are less likely to follow corporate governance best practices, the potential for unlocking big share price gains may be greater than at larger groups, hedge fund managers say.

Activist funds which have targeted micro-caps for decades are being joined by newcomers inspired by the famous players but without their financial firepower, and even some of the big names are moving down the market cap scale. “

The right activist campaign can ensure that management will not abuse valuation disconnects, where instead of enriching shareholders, they go the route of trying to enrich themselves; For example, management led buyouts where management attempts to “steal” the company at a depressed valuation.

On the flip side, minority investors should be prepared to fight situations where “greedy” activists try to “steal” companies sitting at already low valuations – as we did in the recent case of micro-cap Blue Bird Corp. (NASDAQ:BLBD). The stock just hit a new high of $18.55 is up 33% since we published an in-depth analysis on why the Board of Directors should reject a private equity firm’s low bid offer (which they eventually did) to buy the company. Our analysis was subsequently profiled and featured in Barron’s which helped disseminate the thesis to the public. We are optimistic that microcap coverage will gradually attract the attention of the mainstream media.

As for risks to investors that want to turn activists, many micro-caps have emotional management teams with high insider ownership that are resistant to change. This can lead to costly proxy battles. Although not a micro-cap, “Dear Chairman” points out that General Motors (NYSE:GM) spent three quarters of a billion dollars to oust Ross Perot from the Board where he championed an activist role.

In sum, as liquidity makes its way back into the micro-cap space and investors realize opportunities they can take advantage of due to depressed valuations, I continue to firmly believe the health of space will continue to improve. Keeping track of 13D filings is a great way to monitor shareholder activism and buy and sell decisions in target companies. On a final note, shareholder activism is not the only market balancing act that will lift micro-cap valuations. We believe increased M&A activity in the space will also help lift prices.

This post written by By Maj Soueidan, Co-founder GeoInvesting