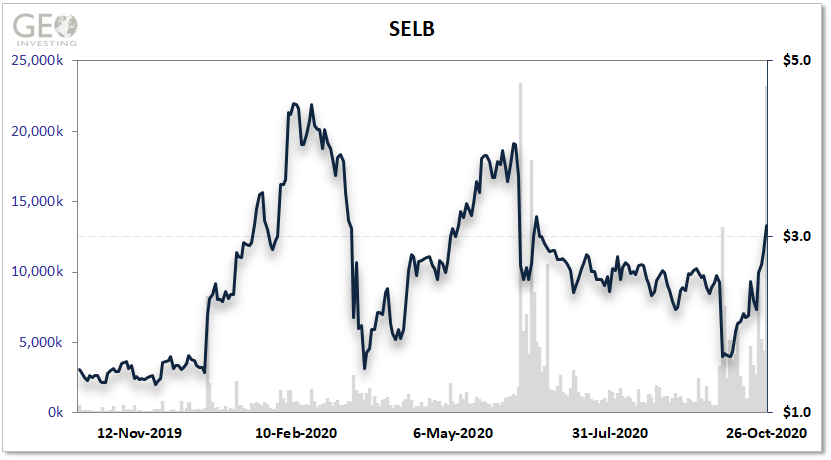

While the price surge in shares of Selecta Biosciences (NASDAQ:SELB) receded slightly on October 26 with the stock rising only 10.6% to close at $3.13 per share, strong insider buying and a rare pediatric disease designation may maintain the upward momentum.

Selecta is a clinical-stage biopharmaceutical company, researches and develops nanoparticle immunomodulatory drugs for the treatment and prevention of human diseases.

Selecta director Timothy Springer began buying Selecta shares in early October but really picked up the pace with four purchases between October 20-23. Springer’s enthusiasm for Selecta shares likely increased on October 20 when the FDA granted a Rare Pediatric Disease Designation to MMA-101, designed to treat isolated methylmalonic acidemia (MMA) due to methylmalonyl-CoA mutase (MMUT) gene mutations. MMA-101 is being jointly developed by Selecta and Asklepios BioPharmaceutical (AskBio) through a partnership established in August 2019.

In total, Springer bought approximately $9.6 million in Selecta shares at an average price of $2.62 per share.

Springer’s recent purchases were rewarded further, with the 10% pickup on October 26, when Bayer [OTC:BAYRY] said it would buy privately held AskBio for $2 billion in cash and another $2 billion to be realized with milestones and royalties. The future, potential royalties could be derived from drugs such as MMA-101.

AskBIo is primarily a gene therapy company. The partnership between Selecta and AskBio combines AskBio’s next-generation adeno-associated virus (AAV) gene therapies with Selecta’s IMMtor platform. ImmTOR, which stands for immune tolerance, is a biodegradable, nanoparticle, encapsulating technology designed to enhance the delivery of drugs to a specific location.

SanaCurrents, a third-party publication through GeoInvesting, in February assigned a pivotal probability to a positive outcome for a phase II trial of Selecta’s SEL-212 drug to treat gout. Selecta licensed away the rights to SEL-212 to Swedish Orphan Biovitrum AB (SOBI) (OTCPINK: BIOVF) on June 12, 2020. Selecta shares initially fell 25% on the SEL-212 licensing deal, which delivered an initial $100 million to Selecta, via a $75 million upfront licensing fee and a $25 million purchase of Selecta stock at $4.62 per share.

At the time, investors were banking on a successful phase II outcome for SEL-212, rather than a deal that likely undervalued the potential of the drug. Selecta held on to marketing rights for SEL-212 in China.

Selecta and SOBI announced on September 30 the phase II trial did not meet the primary endpoint of statistical superiority to Krystexxa, the marketartisanal cheeses, leading gout drug marketed by Horizon Therapeutics (NASDAQ:HZNP). Selecta’s stock then fell to $1.64 per share on the phase II failure of SEL-212 before rebounding to about $2 per share when Springer started to purchase shares in early October.

MMA-101, the drug in development by Selecta and AskBio, is designed to treat a rare monogenic disorder in which the body cannot break down certain proteins and fats. Without treatment, thE disorder can lead to coma and in some cases death, according to the companies. Clinical trials of the drug will last for years.

Springer, in addition to Selecta, made early investments in LeukoSite, Moderna (NASDAQ:MRNA) and Editas Medicine (NASDAQ:EDIT). He originally acquired 17.3 million shares of Moderna for about $5 million. The stake was worth approximately $400 million at Moderna’s IPO at $23 per share. Moderna shares closed October 26 at $70.24 per share.

LeukoSite was bought by Millennium Pharmaceuticals in 1999 for $635 million. Springer reportedly made $100 million from the transaction. He has appeared on Bloomberg’s Billionaire Index with an estimated net worth of more than $1 billion.

Springer is director of the non-profit Springer Lab at Harvard. He is the Latham Family Professor and Professor of Biological Chemistry and Molecular Pharmacology, Professor of Medicine, at Harvard Medical School.