Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

Since 2010, there’s really been this disconnect in the market. A lot of high flying stocks, with high growth rates and revenue with perhaps little earnings per share growth or maybe even negative cash flow, had risen to nosebleed valuations in terms of prices to sales and enterprise value to sales ratios. You can’t value them on other metrics, really. Some of them might have weak balance sheets, using debt and leverage to grow their revenue.

It’s been tough to watch. The first 20 years of my career was all based on looking at stocks that were growing and making money, then valuing the stocks on their P/E ratios. It was a pretty simple approach I used based on what I learned from Peter Lynch. I never really looked at the price of sales, or EV to sales type of valuation too much.

I wasn’t even a big fan of EBITDA. I would use a P/E ratio, adjusting the earnings for non recurring items and non cash items to get our pure non-GAAP adjusted P/E ratio. It worked really well. But, then I learned to go outside that box a little bit.

I learned that if you can find these companies trading around breakeven, not really burning a lot of cash, but growing revenue nicely, and continuing operations without having to raise money in the market, that I could kind of get into that game of playing the price of sales valuation scenario.

We’ve written about that a lot, especially when we’re looking at recurring and sticky revenue models as you would see in SaaS companies, or medical device companies. For us, that’s been an interesting dynamic to watch over the last several years.

And as an investor with roots in valuing a company in terms of just the earnings and cash flow, it was really tough for me to apply that strategy, but it worked well.

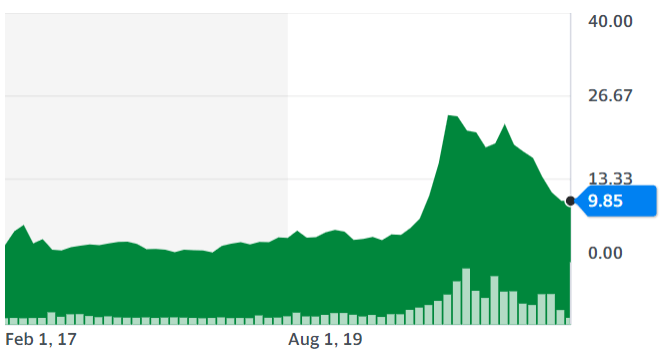

We knew that one day, the pendulum was going to swing where earnings, valuation and P/Es mattered. I don’t know if we’re there yet, but as the overall markets are near their highs, we’ve seen incredible blood underneath high tech names like RingCentral, Everbridge, and other software companies. This is also the case for medical device companies, like Clearpoint. CLPT, a company we found at Geo that ran from $4 to the 30s. Now, it’s back to $10.

We knew when we were buying CLPT that they weren’t making any money. But at that time, the market was placing a premium for high growth and revenue, so we saw nosebleed valuations.

Now they’re all coming back to Earth, and some of them even after losing 50% of their value, are still selling at price to sales ratios of 10 and 15 – And still not making any money. It’s not clear if this trend is going to continue. I believe that it may, especially in the smaller capitalized, nano cap area. So, that’s kind of what’s going on now.

In the end, I’m not a market timer, and I don’t know if that’s going to continue. But what we are starting to see happening here, at least in the short run, is the market beginning to place premiums on traditional value stocks that are selling at crazy low P/Es. They might not even be growing their revenue or earnings per share, but they are very cheap with respect to P/Es, and might even have some high dividend yields.

But if that turn happens, it can happen really, really fast. And it might not even matter if the company isn’t growing, as long as they’re just staying stable and there’s just a revaluation to a PE range of 5 to 15. So, we’re keeping an eye on that

For those of you that are into deep-dive research and you want to validate your own ideas, GeoInvesting is a great spot for that because we help you with this too. We have hundreds of research notes on companies serving as a guide to how we approach our idea discovery.

Continue to the PodClip where I go through a list of stocks on the Selected Long Disclosures related to the theme above.

Best Regards

~Maj Soueidan

–

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Recommended Reading From Around The Web

In the PoClip referenced in this week’s intro, Maj addressed ClearPoint Neuro (CLPT) as one of those stocks that outperformed on the basis of growth, and not so much valuation, during GeoInvesting’s coverage of the company. CLPT is a medical device company that develops and commercializes platforms for performing minimally invasive surgical procedures in the brain and heart. Between December 27, 2019 and Jan 19, 2021, the duration of our holding, the stock rose from $4.80 to $19.95, a 315.66% final return, and reached a high of $20.50 before retracing to current levels of around $10 per share.

A Seeking Alpha contributor, Superstocks Seekers, strives to continue the narrative of growth, putting an emphasis on the company’s enterprise value, and ignores the company’s failure to report a positive bottom line. Therein is a perfect example of the growth vs. value debate.

ClearPoint Neuro: Underlying Growth Potential Concealed By COVID, By Superstocks Seekers

Summary

- Even though elective procedures are returning to the pre-pandemic level, the rise of the Omicron variant resurgence may continue to impact the case volume in the upcoming quarters.

- ClearPoint Neuro is working with 40 biology partners as of Q3 ’21, and with 100 potential partners in the intracranial and spine segment, this increases the odds of multiple commercialization.

- ClearPoint Neuro’s portfolio of product development is on track to be fully launched by 2023, which puts the company in a position to grow even faster.

Notable Tweets

If you are feeling frustrated with the market, you may find this article helpful and encouraging.

The Three P’s of Investinghttps://t.co/5qT6I62eeK

— Stock Trader (@MikeDDKing) January 8, 2022

Why This is Our Favorite Kind of Market to Operate In:A Microcap Stock Picker’s Market https://t.co/YfoyMzJ01X

— Level3Trading (@Level3Trading) January 11, 2022

Invest in companies, not stock prices.

Hold long-term.

Look after your family.

Life CAN be simple

— Dividend Logan💰 (@DividendLogan) January 10, 2022

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.