By Maj Soueidan, President of GeoInvesting

On August 31, 2010 I published an blog discussing broad aspects of Chinese tax issues and how they relate SAIC filings, stating that further delving into the matter would still be required:

Please note that I am still probing into the Chinese tax system, especially to determine if SAT documents are actually representative of taxes paid.

I touched upon two types of ownership structures:

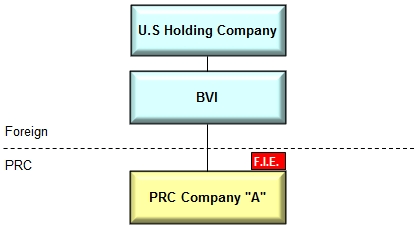

The most important factoid I received was that SAIC documents can be audited. Most supporters, including investment banks, have commented that SAIC filings are not audited or used in the tax system. This is generally true for companies that have a Variable Interest Entity ,or VIE, structure in which the U.S holding company does not have direct ownership in a PRC firm. The flow of funds is set forth by a series of contractual agreements that establishes control without direct ownership.On the other hand, for companies that have direct ownership (FIE, Foreign Invested Enterprises), the SAIC does police the PRC firm and requires AUDITED financial statements, which can be shared by several government authorities. Furthermore, this financial statement is also provided to the SAT. The audit is normally completed by a local auditor. (You will understand why after reading my lawyer’s legal opinion).

Summary of Ownership Structures

Foreign Invested Enterprise, or FIE: Foreign company has a direct ownership in a PRC company. China’s State Administration for Industry & Commerce, or SAIC, requires audited financial documents. An FIE can also be referred to as a wholly owned foreign enterprise, or WOFE.

Example of an FIE is ZST DIGITAL NETWORKS (OOTC:ZSTN), where Zhengzhou Shenyang Technology, Ltd. conducts 100% of operations.

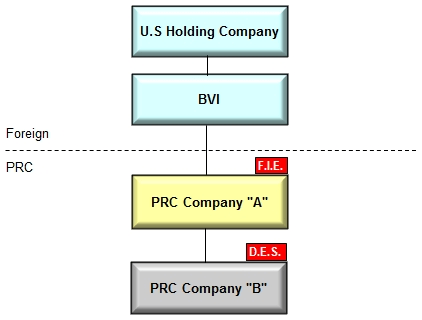

Domestic Owned Enterprise, or DES: A company owned by Chinese individual(s) and/or entity(s). In many cases, the FIE will hold an equity interest in another PRC company.

SAIC does not require audited financial documents for a DES.

Example of a DES is WEIKANG BIO TECH CO (OOTC:WKBT) where the FIE is Weikang Bio-Engineering Co., Ltd. and the DES is Tianfang Pharmaceutical Co., Ltd., which brought in 72% of total sales during 2009.

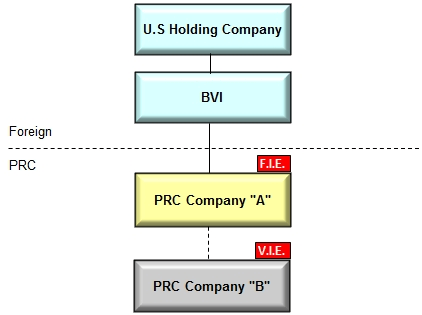

Variable Interest Entity, or VIE: Direct ownership in a PRC firm is not established. The flow of funds is set forth by a series of contractual agreements that establish control without direct ownership. In this structure, an FIE is usually established first. The FIE then procures a contractual arrangement with another PRC company as a VIE relationship . The net income of the VIE flows through the FIE to the foreign holding company (in the U.S.). SAIC does not require audited financial documents for VIE.

Example of a VIE is CHINA MEDIAEXPRESS (OOTC:CCME) where operations are conducted through Fujian Fenzhong.

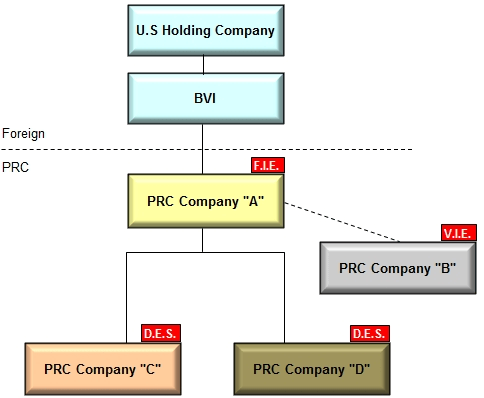

A company can utilize a combination of ownership structures.

An example of a combination structure is VLOV INC (OOTC:VLOV); The FIE is Dong Rong Company (in China) and the VIE is Jinjiang Yinglin Jinduren Fashion which currently conducts all operations. The equity owners of Yinglin Jinduren intend to transfer all of the business operations currently conducted by Yinglin Jinduren to China Dong Rong sometime in 2010). No DES exists in this example.

Those who use SAIC documents to insinuate fraud must have a very good grip on company structure. They must be certain that the SAIC filings of the PRC companies are those of the FIE and represent the majority of business for the holding company. For example, in some cases the FIE has limited operations with most of the revenues derived from companies in which it holds ownership interests as in DES structures or contractual arrangements as in VIE structures.

Please note that Joint Venture relationships can also exist in China.

Sino-Foreign Cooperative Joint Venture, or CJV:

A CJV is a joint venture between a Chinese and a foreign company within the territory of China. The Chinese company usually provides the labour, land use rights and factory buildings, while the foreign company brings in the necessary technology and key equipment, as well as the capital. This joint venture is based on a cooperative joint venture contract in which matters like the terms of cooperation, the division of earnings, the ownership of property upon the termination of the contract term of the CJV, the sharing of risks and losses, etc are laid down.

Sino-Foreign Equity Joint Venture, or EJV:

This type of foreign investment is currently still the most widely used in China, even though Wholly-Foreign Owned Enterprises are developing strongly. It is a limited liability company (This means that the investor or partner is not personally liable for the debts that the company might make in the future) and it has the status of Chinese legal person. This is a crucial difference with a RO because unlike the latter, a Sino-Foreign Equity Joint Venture is capable of buying land, hiring Chinese employees independently, constructing buildings, etc. An EJV is a joint venture between a Chinese and a foreign company within the territory of China. Both companies invest in the joint venture with the foreign company, in general, not investing less than 25% of the total investment.

The SAIC requires audited financial statements for both of these joint venture relationships.