We believe that REPRO MED SYS INC (OOTC:REPR) can more than double from its recent trading price, but there are risks. The Company has been under a cloud since the FDA issued a warning letter concerning the company’s Freedom 60 Syringe and Freedom Edge Infusion Pumps on February 26, 2016. This product suite delivers medication to patients based on a system that does not require batteries or electricity and uses needles that have the advantage of being administered subcutaneously. REPR did not announce receipt of the FDA letter until March 9, 2016, when its shares reacted by plunging 25% from around $0.60 to $0.375, eventually hitting a low of $0.28 in ensuing trading days. Shares are now sitting in the mid-$0.40 range.

We believe that REPRO MED SYS INC (OOTC:REPR) can more than double from its recent trading price, but there are risks. The Company has been under a cloud since the FDA issued a warning letter concerning the company’s Freedom 60 Syringe and Freedom Edge Infusion Pumps on February 26, 2016. This product suite delivers medication to patients based on a system that does not require batteries or electricity and uses needles that have the advantage of being administered subcutaneously. REPR did not announce receipt of the FDA letter until March 9, 2016, when its shares reacted by plunging 25% from around $0.60 to $0.375, eventually hitting a low of $0.28 in ensuing trading days. Shares are now sitting in the mid-$0.40 range.

- Even though we think the stock can more than double from its recent trading price, there are risks.

- Fiscal Q1 2017 (May 2016) results reflect the impact of the FDA warning letter.

- Possible military orders could be a game changer.

We first highlighted REPR at $0.37 in an article we published on October 7, 2014. Before the FDA snafu the thesis was playing out rather nicely. Shares ended 2015 hitting a new 52 high of $0.59.

Since April 6, 2016 we have been updating our premium members on this evolving story.

- The additional purchase of stock by an institutional investor adds a degree of confidence.

- A lax in reporting protocol to the FDA that appeared to play a big role in the issuance of the FDA letter is being addressed.

- We believe that the company is the leader in its field and appears to have much safer and more effective products than its competitors.

- It looks like its most relevant competitor has an inferior product and has not received a warning letter.

- The company is still receiving indications of interest from new customers, such as the Military, who are aware of the FDA warning letter.

Despite the market’s adverse reaction, on March 9, 2016 the company’s newly appointed Chief Medical Officer expressed confidence stating,

“While we anticipate one item taking a bit longer to resolve, the others are merely an exercise in better communicating our thorough processes and premium safety standards to the FDA. As always, we remain committed to uncompromised safety and quality for all of our products.”

Given the sensitivity of the Company’s discussions with the FDA, there have been no status updates on the progress management is making to have the warning letter lifted. We have begun to share management’s confidence though that the matters detailed in the FDA’s letter may be favorably resolved.

Bullish Factor Can’t Be Ignored – Follow the Money Trail

It’s always great to see institutional support come into a microcap stock you own. That happened to REPR when on August 18, 2014 Activist investor, Joseph Manko, Jr., the Senior Principal in Horton Capital Management LLC, disclosed his ownership of 2.9 million shares of REPR and has consistently added to his position. More importantly, in April 2016 he added 85,500 shares to his position post the FDA warning letter at prices between $0.31 and $0.33. Now, just yesterday, on July 5, 2016, he disclosed that he added another 145 thousand shares between $0.41 and $0.45. This is very relevant since Mr. Manko was appointed to the Board of Directors in May 2016. Mr. Manko now owns 4.8 million shares. It is encouraging to see ongoing support from an activist investor who is now a Board Member.

Fiscal Q1 2017 (May 2016) results reflect impact of FDA warning letter

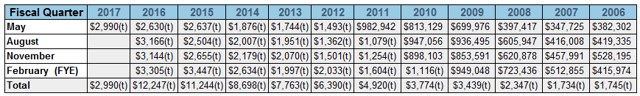

The company reported fiscal Q1 2016 (May 31) results on June 27, 2016. At first blush, revenues were a little lighter than we would have liked having sequentially declined $800,000 or 22% from fiscal Q4 2016 (February). While Q1 is seasonally REPR’s weakest quarter (22% of annual revenue in recent years) and Q4 the strongest (over 30% of annual revenue), we believe some of the sequential decline in revenue can be attributed to the impact of uncertainty caused by the FDA warning letter. We have little doubt that both existing and, especially, potential new customers were at least to some extent dissuaded from making substantial commitments to REPR’s products until the warning letter is lifted. If anything, we are encouraged that the Company was able to generate $3.0 million revenue despite the distraction and headwinds caused by the situation with the FDA. It appears that REPR has reached a new level quarterly revenue run-rate and is in a position to continue to build on its impressive run of consistent year over year and sequential top line quarterly growth, bringing it closer to achieving consistent profitability.

*Number in thousands where indicated

The news in Q1 was not all negative. We are impressed that gross margins improved in Q1 to 64.8% compared to 57.7% in Q1 fiscal 2016. Recently implemented lean manufacturing initiatives to streamline operations, which resulted in increased capacity and decreased direct assembly labor costs, as well as a moratorium on medical device taxes, are driving the improved margins. If and Once the FDA warning letter is resolved and revenue begins growing again, improved gross margins should help drive future profitability and business expansion.

Also encouraging is the company posted non-GAAP net income of $175,000 after adjusting for $618,000 professional fees incurred during Q1 for regulatory and litigation matters. The extraordinary professional fees should drop sharply once the FDA issues are resolved.

FDA challenge has a silver lining

There is no question that the FDA warning letter has been a temporary setback for REPR. There are, however, silver linings that will greatly benefit the company going forward.

- Addition of Chief Medical Officer. REPR did not have the internal resources to effectively deal with the issues raised in the FDA warning letter and brought in a highly qualified Chief Medical Officer, Dr. Fred Ma. Dr. Ma is not only highly qualified and experienced in his own right, but he also has relationships with external FDA consultants and investigators who are helping remedy all issues raised in the FDA warning letter. If the FDA issues are resolved, we anticipate Dr. Ma being a vital resource for the company who will be able to drive new product development and bring products to market. Expanding the product portfolio will not only help grow the business but broaden REPR’s appeal to customers, investors and possible suitors.

- Establishing pumps and related disposables as part of a delivery system, not individual products. REPR’s offers highly sophisticated mechanical pumps that require disposable needles and tubes, all part of a medication delivery system. Given the scope of the FDA warning letter, we believe the company is likely to update all of its filings with the FDA under one comprehensive 510(k) submission. While such an undertaking requires substantial effort and expense, it would bring all product filings current and clearly establish the pumps and related disposables as parts of a system, not individual products. If approved, all of the company’s pumps and disposables will be under one FDA approved umbrella facilitating better understanding of pump systems for the FDA and of reporting and compliance requirements for the company.

- Solidifying relationships with customers. We understand one of REPR’s much smaller competitors has been having a field day trashing REPR by spreading rumors regarding the FDA warning letter and REPR’s status. This has likely given at least some customers pause when considering REPR’s products. The competitor’s strategy, however, could backfire by stimulating a strong customer outreach program by REPR that could not only allay fears and uncertainty concerning the warning letter, but help cement relationships. The fact REPR generated $3.0 million revenue in fiscal Q1 2017 indicates customers are sticking with them, maybe an reflection of the superiority of REPR’s product.

- If the FDA warning letter is lifted, the process will have solidified REPR’s standing and market position. If the warning letter is resolved, REPR will benefit in several ways. First, its products will have withstood the most severe scrutiny lending credibility to both the company and its products. Its filings with the FDA will all be current and in good standing for years to come. Finally, management will have established lasting credibility and relationships with FDA staff. In the end, what doesn’t kill you makes you stronger. REPR will come out the other side of this challenge stronger and its shareholders will benefit.

Possible military orders could be a game changer

REPR gave a business update along with preliminary Q4 revenue results in a March 31, 2016, press release. The release included a very intriguing reference to a possible budding relationship with the DOD/military. The CEO commented,

“The military has expressed interest in our products for utilization in emergency applications as well as use in VA hospitals. We believe that because of our performance standards and the reliability of our products, we will provide them with great value and benefits.”

Management has made no further comments regarding possible orders from the military which makes sense given the backdrop of what would be a time consuming vetting process by the DOD and the ongoing process to clear the issues detailed in the FDA warning letter. Any order from the military could be material to REPR which generated $12.2 million revenue in fiscal 2016. If REPR can secure a foothold in the military, particularly in VA hospitals, it would be a potential game changer for the Company and its shareholders. We think the fact that the military is interested in REPR’s products could imply that decision makers have a high degree of confidence that REPR will resolve its issues with the FDA.

Assessing risk and reward factors for REPR

We see outsized upside potential for REPR from the stock’s current trading price of around $0.45. Catalysts that could abruptly drive the share price higher include successful resolution of the FDA warning letter and a possible military order. Make no mistake, though, a negative outcome with the FDA could very well imperil REPR’s viability. REPR is therefore an all or nothing bet under the circumstances. Our view is that if the FDA letter will be resolved and related uncertainties are removed, the business will resume a solid growth trajectory. Add to that the possibility of DOD orders from the military, growth in Europe and longer term access to the Asian markets, and we can see REPR exceeding $1.00 per share. At $1.00 and assuming the company only maintains its current annual revenue run-rate of $12 million shares would trade at an EV/S of 2.78. If we bump up the revenue run-rate to $15 million shares would trade at an EV/S of 2.22. We think these targets are very reasonable for a company:

- With a recurring revenue model

- That appears to be nearing consistent profitability

- Holds a leading position in the markets it serves

- Diversifying its customer base