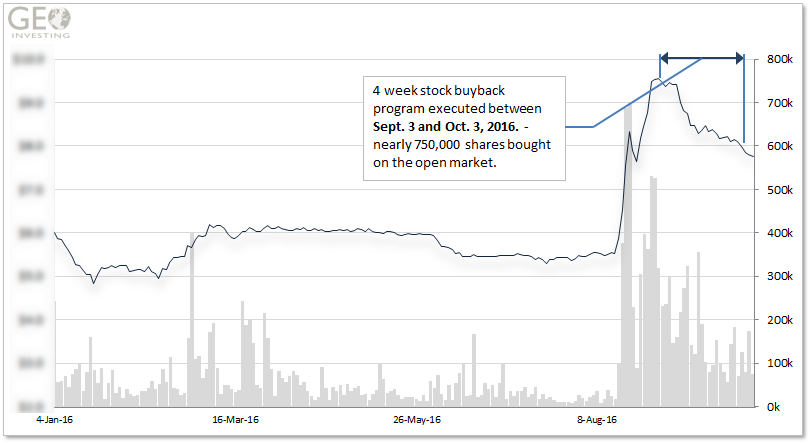

On August 28 and September 6, 2016 I conveyed that two GeoInvesting Contributors saw a certain U.S. listed China-based stock as undervalued – that stock has since had a little pullback. Their bullish theses position the stock to gain more than 100% from current prices. One of the catalysts that added to their optimism was a stock buyback program being undertaken by the company. The program ultimately culminated in the company picking up nearly three quarters of a million shares in the open market by early October 2016, at an average price 15% higher than the stock’s current price!

Consequently, my team was also in the process of conducting some on-the-ground due diligence on the company. We came to the same conclusions that the stock’s upside potential is substantive, and even more so now that the stock has experienced a pullback of 20% from its August high. Our due diligence found that the value of the company’s assets appear to be much higher than what is disclosed in SEC filings.

We are long the stock and will continue to be long and should the stock pullback even more, there is a good chance that we will be adding more. In fact, we have added the stock to another “Buy on Pullback” mock portfolio, our 3rd in a series of portfolios that have returned over 30%.

Potential 100% Stock Returns after Pullback

SYMBOL: Premium Access Required

EXPECTED RETURN: >100%

|

Asset Class — Common Equity, Options |

|

Idea — Special Situation, On-the-ground Due Diligence, Buy on Pullback |

|

Industry — Premium Access Required |

|

Catalyst — Undervalued Assets, Share Buyback Program, Tight Share Structure |

|

Market Cap — Near $300 Million |

Sincerely,

Maj Soueidan