Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here.

Topics Include 2023 Guidance, Order Backlog, and Other Markets to Tap Into

On October 20, 2023, we conducted a Skull Session Management Briefing with Nathan Mazurek, the CEO of Pioneer Power Solutions, Inc. (NASDAQ:PPSI). This company specializes in the manufacture, sale, and servicing of electrical transmission, distribution, and on-site power generation equipment. We started following the company back in 2016, and our first Fireside Chat with them took place on April 4, 2023. In a previous article, we took a deep dive into the company’s operations, which you can find linked here.

One of the things that we find interesting in the company is its implementation of the E-bloc system, an all-in-one transfer switch, protection, and control system for users that have more than one power source which, as of 2022, generated 75% of the company’s revenue.

Nathan graciously agreed to a follow-up Skull Session Management Briefing, providing us with insights into the company’s recent developments and performance since our last conversation in April.

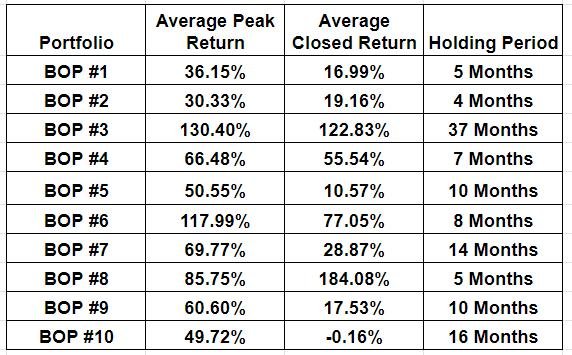

In this series of 6 clips (2 of which are complimentary for non-premium members), we present key highlights from the Skull Session. Our main goal right now is to determine if the pullback in the stock (after its recent quick runup) would be a reason to consider it as an addition to our Buy on Pullback Portfolio #11, launched September 25, 2023, which currently sports an average return of 6.05% and an average peak return of 15.42% across the 4 stocks initially included.

As a reminder, we are in the process of vetting 6 other stocks aside from PPSI to occupy the potential remaining 3 spots.

Our first 10 BOP Portfolios resulted in the following returns:

–

Nathan Mazurek Discusses His Journey and PPSI’s Evolution

Nathan Mazurek provides an overview of his background and the evolution of Pioneer Power Solutions, Inc. (NASDAQ:PPSI)’s business. He mentions being in the electrical industry for 30 years and having experience in various aspects of the industry, including distribution equipment, engineered products, switchgears, metering, load centers, and transformers. He talks about merging a transformer business into his company, selling it in 2019, and using the proceeds to pay off debt and issue dividends.

Nathan explains that he had two remaining businesses, a switchgear business in Los Angeles and an engine generator service business in Minneapolis, both generating around $8 million in revenue annually. He discusses their strategic decision to focus on the switchgear business, which they rebranded as E-bloc. This product is designed for users looking to use multiple sources of power in parallel, either to supplement the grid or save money. It integrates automatic transfer switches, circuit protection, and controls.

The E-bloc has seen significant success, with substantial revenue growth, and the company has secured large orders from diverse customers, including its first application in a data center and water utilities. Nathan also mentions their other product, E-boost, which is a mobile propane generator-based system with a high-capacity DC fast charger. This product has gained traction with prominent customers like GM Cruise and the Port Authorities of New York and New Jersey.

–

Nathan Mazurek Discusses Other Potential Markets for PPSI

Nathan responds to a question I posed regarding the potential for remote monitoring solutions in the E-bloc business. He explains that for the E-bloc, remote monitoring is not what they focus on, but customers can integrate their own remote monitoring solutions into the existing system. However, he mentions that they do offer remote monitoring for E-boost, a mobile solution, which is particularly important for users of this product. E-boost’s remote monitoring provides some additional revenue, but is not the primary focus.

The conversation then shifts to some of E-boost’s primary customers, Sequoia’s electric truck, and bus manufacturers who are transitioning from traditional diesel vehicles to electric ones. Nathan highlights that these manufacturers sometimes try to add solutions themselves to save money, believing they have expertise in certain areas, which can lead to them not opting for all of PPSI’s services..

I brought up Blue Bird Corporation (NASDAQ:BLBD), a manufacturer of school buses, and how it’s a stock GeoInvesting has been following for some time. The discussion touches on other players in the market, such as Navistar (former symbol NAV), a company that recently merged with the Munich, Germany-based Traton Group (trading on various international stock exchanges under the symbol 8TRA and on the U.S OTC market as TRATF), and Thomas Built (Private), who also have significant market shares in the school bus sector, and the emergence of new entrants in the electric vehicle market.

–

—

By Maj Soueidan, Co-founder, GeoInvesting

If you are a premium subscriber and not currently logged in, you can log in here to view all the premium content associated with this research update. Just click the back arrow on your browser to return to this page after you log in.

If you are not a premium subscribe, please JOIN HERE.

—

Tweets and Reposts From Maj’s Feed

An advantage of the smaller cap reset, where POS cash burning story stocks will slowly go to zero, is that investment banking chop shops with biz plans of financing these Cos. & pimping toxic capital raising deals to retail investors may slowly go out of biz.🤞

— Maj Soueidan (@majgeoinvesting) October 17, 2023

Interacting with Mgmt. gives you a large investing edge, especially with microcaps. But proceed with caution. Getting too close can lead to “drinking the Kool-Aid” when you shouldn’t. It’s a bias successful quant investors eliminate – just listen to the numbers. @RTelford_invest

— Maj Soueidan (@majgeoinvesting) October 20, 2023

A lesson learned early in my full-time investing journey is that, sure, free resources to help you become a better investor exist – but stubbornly holding on to a principle of “never” paying for services is shortsighted. Small pieces of alpha add up over time. Don’t be piggy.

— Maj Soueidan (@majgeoinvesting) October 21, 2023

Warren Buffett on inflation in 2022… er, I mean 1977 🤔 pic.twitter.com/uPapAka9Na

— Simon Handrahan | MOS Capital (@MoS_Investing) May 22, 2022