Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

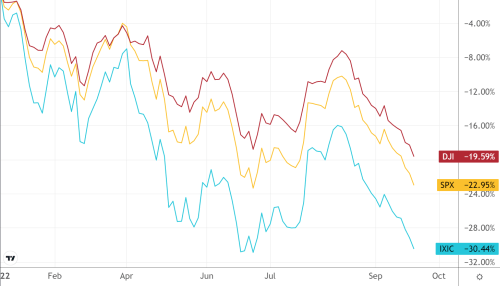

We are once again testing low watermarks on the major market indices, year to date, with the grand prize currently going to the NASDAQ at a 30+ percent decline since January 1, 2022,

Keeping emotions at bay when the market is misbehaving is a theme we’ve visited several times in the past. So, we’ll stay away from that subject matter but at least give you the option to refresh your memory on what we said by going to the following 2 commentaries, one of which features a few PodClips by Maj:

- Evaluate Your Stock Portfolio During Challenging Economic Environments

- Manage Emotion and Behavior in Investing

Anyways, what do we do when market conditions are trending towards bottom side capitulation? Besides the regular practice of maintaining emotional intelligence, we pretty much don’t do anything different than our normal course of business. We research, research, research.

We look for new stock ideas in an attempt to stay ahead of the pack. To do so, we must go through some motions that most assuredly, at some point, will uncover a scenario worth delving into a bit.

A good example of this was at the end of February of 2014, when we found and highlighted Evans & Sutherland (OTC:ESCC) at $0.14. It was a 46 year old company engaged in the production and sale of visual display systems, had Disney as a major customer, and was generating annual revenue of about $30 million. Even though the company was losing money, its financial results indicated that there was some promise that had yet to be realized.

We did end up adding the stock to our Select Longs Model Portfolio the day we highlighted it on our pro portal, but were keenly aware of some overhanging issues the company had to overcome. The most serious one was a pension liability balance sheet item that was depressing the stock by taking away from shareholder equity and reducing net income. It clearly needed to be resolved if the stock were to gain any traction.

This is where the information arbitrage came in. We knew that the resolution of the past due pension liability could be the catalyst that unlocked multibagger potential. What we didn’t know was that ESCC would clearly communicate in SEC filings, and not in press releases, that the pension liability issue would be settled imminently. Amazingly, at one point the SEC filings actually included a date at which the pension liability would be resolved. Pension Benefit Guaranty Corporation, the entity established under the Employee Retirement Income Security Act of 1974 (“ERISA”), agreed to settle the issue and terminate the insurance program that ESCC was beholden to. We’re suckers for immediately comparing rivaling sources of information on companies in our portfolios, and this one paid off for us since we were able to ride the chart.

We initially targeted a range of $0.40 to $0.80 level for the company if the pension issue became resolved, which it eventually was in April 2016. The stock went on to reach a high of $1.21 before pulling back to the $0.75 range on the heels of unexciting Q1 2016 results in May. In February 2020, the company eventually reached a definitive agreement in which they agreed to be acquired for $1.19 per share in cash.

We may have found an information disconnect with another company.

While we pulled the trigger right away with ESCC, it’s not always a given that we will do so with all information arbitrage plays, nor is it a given that we are entirely comfortable with going too gangbusters on our commentary, especially if it’s a company that operates in a field we are not too well versed in.

This is the case with oil field chemical company…

—

Hi, part of this post is for paying subscribers

SUBSCRIBE

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.