We Warned NOAH Was Uninvestable

We Warned NOAH Was Uninvestable

On March 8, 2016, we released an article stating that Noah Holdings Limited (NYSE:NOAH) was uninvestable based on the company’s new dual class share structure and what we felt to be a limited chance that the company meets analyst expectations this year.

Yesterday, the company reported poor 2015 earnings and missed on both its top line and bottom line for 2015. We think the company only got as close as it did to meeting estimates by an abnormally lower effective tax rate and abnormally high investment income.

Yesterday’s Earnings Get Uglier the Deeper You Look

We continue to believe the company’s chances of meeting its guidance for the coming year remain very slim. The company’s full press release from earnings can be viewed here. Our key points from the call and the release are as follows:

- NOAH missed both top line and bottom line for full year 2015. The company reported 2015 full year revenue of $327.3 million, which was under the analyst estimate of $335.97 million for 2015. Non-GAAP EPS for full year 2015 was $1.59, which is under the analyst estimate of $1.64.

- Revenue was slightly up sequentially, but operating income and margin were much lower. For the fourth quarter 2015, revenue increased from $82.6 million in Q3 2015 to $88.6 million in Q4 2015, yet income from operations dropped from $28.0 million in Q3 2015 to $7.3 million in Q4 2015, a sequential decrease of 74% and also a year-over-year decrease of 57%. Operating margin dropped from 33.9% in Q3 2015 (33.5% in Q2 2015) to 8.2% in Q4 2015. The major reason behind this drastic operating income decline was 1) the decrease of income from operations from both wealth management and asset management business segments and 2) the increased quarter-over-quarter operating loss from its internet finance business (loss of $4.4 million, $5.1 million, $6.3 million and 8.6 million from Q1 to Q4 2015). What’s worth noting is that even though the internet finance business is considered as one of NOAH’s fastest growing businesses, revenue from this segment was sequentially down from $2.8 million in Q2 2015 to $2.5 million in Q3 2015, and then to $2.3 million in Q4 2015.

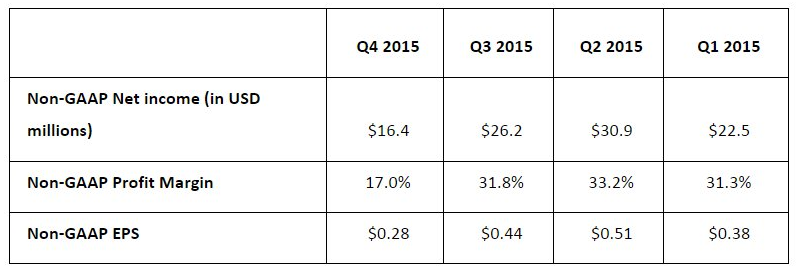

- Non-GAAP net income, profit margin, and EPS were all sequentially lower.

- Q4 2015 Non-GAAP profit and EPS were helped immensely with a questionably low effective tax rate and relatively high investment income in Q4 2015. The effective tax rate for Q4 2015 was 8.9%, which is much lower than the average effective tax rate of 25.9% in the past three years. Had the income before taxes of been taxed at 25.9%, diluted GAAP EPS would be $0.18, instead of $0.21, and diluted Non-GAAP EPS would be $0.24, instead of $0.28. Non-GAAP EPS in Q4 2014 was $0.27.

- In addition, the company recorded investment income of $3.8 million this quarter which is very large compared to numbers it has posted in previous quarters. For example, investment income for Q3, Q2 and Q1 2015 were 1.0 million, 2.0 million, and 1.4 million, respectively. On a year over year comparison, investment income for Q4 2014 was only 0.8 million, as compared to $3.8 million in Q4 2015.