GeoInvesting has been trying to protect minority shareholders’ interest for a fairly long time by paying attention to unnoticed events that forecast potential negatives to minority shareholders.

GeoInvesting has been trying to protect minority shareholders’ interest for a fairly long time by paying attention to unnoticed events that forecast potential negatives to minority shareholders.

Today, we want to call attention to developments at NOAH that we believe could pre-date a fall in the company’s share price, which could then be followed by a potential “go private” scenario that common shareholders ultimately may not have a say in, should it come to occur. We believe that control of the company essentially lies in just two powerful shareholders and that the capability of a “take under” happening is very real.

- NOAH is in the business of managing wealth, with their revenue tied closely to the performance of the assets that they manage

- The company has just implemented a new share structure that could allow two shareholders to usurp the interests of all common shareholders very easily.

- The company has exposure to China’s collapsing stock market and we believe it is going to lead to 2016 being a significantly unimpressive year for its legacy businesses.

- The company’s new growth initiative is in the risky “shadow banking” internet banking space; a space that has already produced one $7.6 billion Ponzi scheme in China and several controversial companies in the U.S.

- We believe those that are buying the company here aren’t investing in NOAH, they’re investing in its two controlling shareholders whose last corporate action was to arbitrarily multiply their voting interest 4X.

Along these lines, on January 28, 2016, the result of an extraordinary general meeting held by NOAH caught our attention.

On January 28, 2016 NOAH announced that:

“at the extraordinary general meeting (“EGM”) of shareholders held on January 28, 2016, the Company’s shareholders voted in favor of the proposal to adopt a dual-class share structure (the “Dual-class Share Structure”), pursuant to which the Company’s authorized share capital shall be re-organized and re-designated into Class A ordinary shares and Class B ordinary shares, with each Class A ordinary share being entitled to one (1) vote and each Class B ordinary share being entitled to four (4) votes on all matters subject to vote at general meetings of the Company, as well as the proposal to amend and restate the Company’s memorandum and articles of association to reflect the adoption of the Dual-class Share Structure and other related matters. Ms. Jingbo Wang, Noah’s Founder, Chairman and CEO, and Mr. Zhe Yin, Noah’s Co-founder, Executive Director and CEO of Noah’s subsidiary Gopher Asset Management, will receive Class B ordinary shares and all other shareholders will receive Class A ordinary shares.”

Based on the information provided by NOAH’s most recent 13G/A, before this Dual-class share capital restructure, Ms. Wang and Mr. Yin would have had, collectively, 30.7% voting power. After this restructure, they collectively have about 64% voting power.

This type of dual-class share structure is normally seen in the technology industry when founders of technology companies usually utilize it to control the course of company when they no longer have the majority of outstanding shares.

It is very rare for financial services and/or asset management firms to adopt this type of share structure. What’s even rarer is that based on our research, there is no readily available example of any financial service and/or asset management company changing their shareholder structure from single class to a dual-class after the company’s IPO in the China space. If such a structure is found at these companies, generally it is already in tact prior to the IPO.

NOAH’s change of share structure dramatically dilutes the common shareholder’s voting power and it could be a very negative development for the rest of the company’s minority shareholders.

Why? What’s the catch?

NOAH is incorporated in the Cayman Islands, and based on Cayman Island corporate law, only 2/3 of the voting power is needed to pass significant resolutions for the company, including transactions like going private.

Since Ms. Wang and Mr. Yin now have about 64% of the voting power, they would technically have the ability to call shareholder meetings to pass resolutions that are not be in the best interest of all common shareholders. For example, they can propose a go-private offer at a depressed valuation, and minority shareholders would not be able to protect their interest, as Ms. Wang and Mr. Yin collectively have about 64% of the voting power (they would only need 3% or more to pass whatever theoretical resolution was proposed). We’re willing to bet Wang and Yin could easily come up with the other 3% necessary without much trouble at all.

Interestingly enough, according to the 6K filed on January 27, 2016, one day before the shareholder approval of the dual class share structure, Mr. Neil Nanpeng Shen, the founding and managing partner of Sequoia Capital China, was appointed as a director to NOAH’s Board. According to NOAH’s 2014 20F, Sequoia affiliated funds would have about 7.6% voting power in the company after the approval of the dual class share structure. Now, the company has an independent director that can easily, with Wang and Yin, approve of any corporate initiatives needing shareholder approval.

We believe that this dual class structure directly deprives the voting power of NOAH’s minority shareholders and, up until now, we have not seen any correspondence from NOAH on how they could potentially compensate for this value lost in NOAH shares. We believe that NOAH’s common shares should be appropriately discounted accordingly.

NOAH said in their press release:

“The dual-class share structure is an important part of our long term strategy. We are building our platform for the next decade. This structure will keep our focus on long-term priorities rather than short-term fluctuations and ensure that we keep intact our values and elements of success espoused by our founders”

The company said on their call that the purpose of the structure is for the founders to maintain control of the company and ostensibly prevent it from any hostile takeover.

Yet when the company was asked in its corresponding conference call (“This appears to be a poison pill – what sort of threats are you seeing preventing NOAH from maintaining its culture?”) if they had received hostile takeover interest, the company replied (starts around 5:15 in the call) they have “no active hostile buyer at the moment, so [they’re] not preparing for anything imminent.”

Furthermore, since NOAH’s business in China is highly correlated to the capital market conditions there, if the market were to drag down the share price as a result of continued weakness in China’s A Share market, this could create an opening for a forced takeover by management at a very low price. Whereas normally we’d have to worry about hostile takeovers from activist investors, we believe management could be the real parties to worry about in NOAH’s case.

Recent Example in JMEI Justifies Concern Over Share Structure

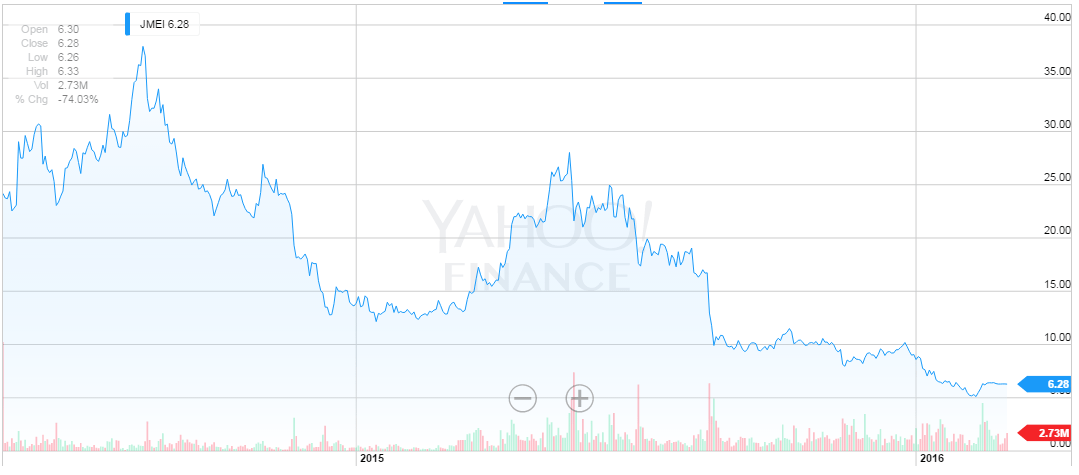

We believe that a recent incident involving Jumei International Holding Ltd (NYSE: JMEI) is a perfect example that should catch NOAH minority shareholders’ attention. On February 17, 2016, JMEI announced that its Board of Directors received a non-binding proposal letter from Mr. Leo Ou Chen, Founder, Chairman and CEO of the company, Mr. Yusen Dai, Co-Founder, Director and Vice President of Products of the company, and the Sequoia Funds (the “Buyer Group”) to acquire all of the outstanding shares that were not owned by the Buyer Group at price of $7.0 in cash per ADS, which represented a 26.6% premium above the average closing price of the company’s ADSs over the past 10 trading days.

A 26.6% premium doesn’t seem to be a bad deal for shareholders, right? True, if you ignore what the stock chart looked like prior to that and after the company’s IPO (chart below shows company’s IPO to present).

All of a sudden, 26.6% doesn’t look so bountiful, does it?

It is quite normal that over the course of time and through different economic cycles or market fluctuations that stock prices tend to ebb and flow. However, over the course of such time as we see above, it’s clear that almost everyone who purchased these shares will be taking a loss if the company is taken private.

We have no knowledge that NOAH’s management will do exactly the same thing as JMEI’s management did. However, we can’t help but notice some similarities between JMEI’s case and NOAH’s current situation:

- Both JMEI and NOAH are incorporated in the Cayman Islands, and only 2/3 voting power is needed to pass significant resolutions, including go-private proposals.

- Both JMEI and now NOAH have dual class share structures: JMEI’s Buyer Group has about 90.1% of the overall voting power, with Mr. Ou Chen and Mr. Yusen Dai having voting power of 75.3% and 11.7%, respectively; and currently NOAH’s two founders have about 64% voting power after switching to the dual-class share structure.

- The Sequoia funds were the only member within the Buyer Group, except for the management, in JMEI’s recently announced non-binding go private transaction; and Mr. Neil Nanpeng Shen, who is the founding and managing partner of Sequoia Capital China, was appointed as a director to NOAH’s Board according to a 6-K filed on January 27, 2016, one day before the shareholder approval of the dual class share structure. Sequoia affiliated funds have about 7.6% voting power after the dual-class share structure change, according to NOAH’s 2014 20F, and if it joins NOAH’s management to form a Buyer Group, then voting power would be above 2/3 of the total voting power necessary.

- The most concerning part is that if our analysis is correct, NOAH may have already entered into a downward business trend and minority shareholders of NOAH might face the same risk as JMEI’s shareholders have faced.

The coincidental timing of NOAH’s changing of its share structure with the downturn in the Chinese marketplace is peculiar to us. Of course, the company could be trying to keep control for good reasons, such as to protect themselves and shareholders, but we have to play the skeptic due to Chinese companies’ past history.

Below, we will show that NOAH’s business lines might be negatively influenced by the correction of China’s capital market and slow down of economy.

Uncertainties Increase for NOAH’s Three Business Segments

The company reports in three segments:

- Wealth management

- Asset management

- Internet finance

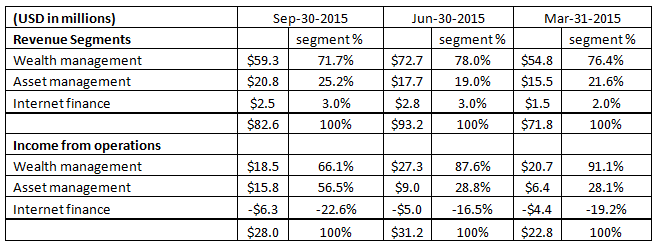

Here is the revenue and income from operations, from the past three quarters:

Wealth Management Segment Showing Sequential Decline

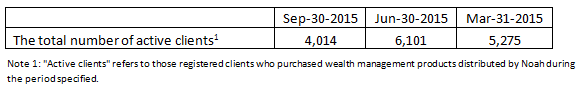

It is shown above that NOAH’s wealth management business contributed 71.7% of the total revenue in Q3 2015, which is sequentially down when compared to revenue in Q2 2015. The sequential drop in revenue should be attributed to the correction of the Chinese stock market and fixed income market, as less wealth management products were distributed by the company and thus less commission is collected. The sequential drop in wealth management revenue is also in lock-step with the total number of active clients, as reported by the company.

As the table shows, the total number of active clients went up from 5,275 in Q1 2015 to the peak of 6,101 in Q2 2015, before then falling back to 4,014 in Q3 2015. This means that from Q2 2015 to Q3 2015, the number of registered clients who purchased wealth management products from NOAH dropped 34%. With the continued correction of China’s capital market, it’s expected that the total number of active clients may continue to decline.

In addition, the correction of China’s capital market also caused quick shrinking in the total size of assets managed by mutual funds. According to this article from Shanghai Securities News, in January 2016, the total size of assets managed by mutual funds decreased from 8.4 Trillion RMB in December 2015 to 7.25 Trillion RMB, a 13.4% month—to-month drop, with an absolute value of 1.1 Trillion RMB. In addition, according to this article published in early March 2016, the size of newly launched private equity fund products have reached a one year low in February of 2016. Since mutual funds and private equity are two asset classes that NOAH distributes to its clients, its wealth management distribution business could be negatively affected.

Asset Management Segment Will Have A Hard Time Continuing as it Has

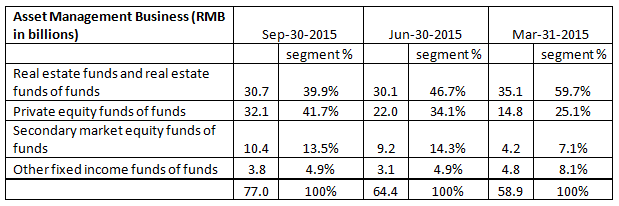

The company collects fees through asset management products, and the asset classes under management over the past three quarters are shown below:

The assets under management by NOAH have four categories:

- Real estate funds and real estate funds of funds

- Private equity funds of funds

- Secondary market equity funds of funds

- Other fixed income funds of funds

It is shown above that total AUM has gradually increased from 58.9 billion RMB to 77.0 billion RMB from Q1 to Q3 2015, and that the investment mix has shifted to some extent: real estate related funds has dropped from 59.6% of the total AUM in Q1 2015 to 39.9% in Q3 2015 private equity funds of funds and secondary market equity funds of funds have increased from 25.1% and 7.2% in Q1 2015 to 41.7% and 13.5% in Q3 2015, respectively.

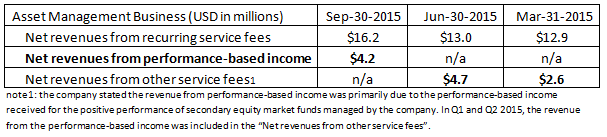

In this Asset Management segment, the company mainly collects management fees (or recurring fees as reported by the company) and performance-related income from the assets it manages. In the past three quarters of 2015, its revenue from its asset management business, dissected into subcategories of ”Net revenues from recurring service fees”, “Net revenues from performance-based income, and “Net revenues from other service fees” that are shown in the table below:

The revenue from management fees collected from the assets under management (recurring services fees) steadily increases in lock-step with the total amount of assets under management, and the revenues from performance-related income are mainly due to the performance of managed funds of China’s secondary equity market funds.

With the continued correction of China’s secondary stock market, it is hard to believe that the company would be able to continuously collect performance related income from the assets it is managing in the coming quarters (i.e. Q4 2015 and Q1 2016). In addition, as the overall capital market and credit markets continue to correct, investors will likely become more cautious of investing in the assets managed by NOAH (or any asset in general),and the increase of NOAH’s AUM should slow down or even decrease (assuming redemptions).

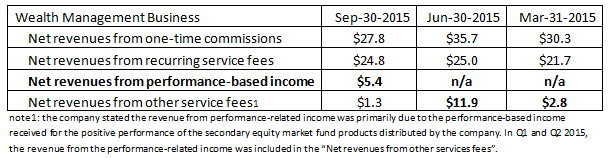

NOAH also receives performance-based income from its wealth management business and the revenue contribution from the past three quarters is as follows:

Since the revenues from performance-based income in both its Wealth Management Business and Asset Management Business are mainly due to the positive performance of the products in the secondary market in China, it’s unlikely that NOAH will be able to collect performance-related income from those products distributed or managed in Q4 2015 and Q1 2016.

Put it this way: no one will be surprised if revenue from performance based income drops significantly as a result of the correction in the Chinese markets.

Further, in real estate, the priority in China is currently to reduce the record amount of inventory buildup and investments in this sector. Common sense tells us that this could have a negative effect on NOAH, as the company may be approached by less developers looking to get projects off the ground.

Moreover, as the company claimed in its annual report,

“During the past two years, the Group has gradually transitioned from a wealth management consulting services provider to an integrated financial group with capabilities in wealth management, asset management and internet finance.”

Obviously the company is trying its best to transition itself from a wealth management consulting firm to a financial group with businesses in wealth management, asset management and internet finance.

Although management had a good track record as a wealth management consulting firm, it is unclear whether the management will be able to successfully transition itself to excel in business areas such as asset management and internet finance. We believe there is a good possibility that the company will not be able to make a smooth transition and its shareholders would then suffer losses from this transitioning difficulty.

Internet Finance Segment Will be Hit by Government Regulation

The internet finance industry in general is consumed in chaos, especially due to the fiasco caused by a peer-to-peer (P2P) lending company called Ezubao (e租å®). It was reported by a New York Times article that this online finance company defrauded more than $7.6 billion from Chinese investors, and that part of the money was spent on luxury gifts and exorbitant employee salaries.

Xinhua [news] quoted a former executive of Ezubao that, “Ezubao is a Ponzi scheme.” Ezubao was reported to have provided fake investment products to its nearly 1 million investors who hail from 31 different provinces, according to the Xinhua news report.

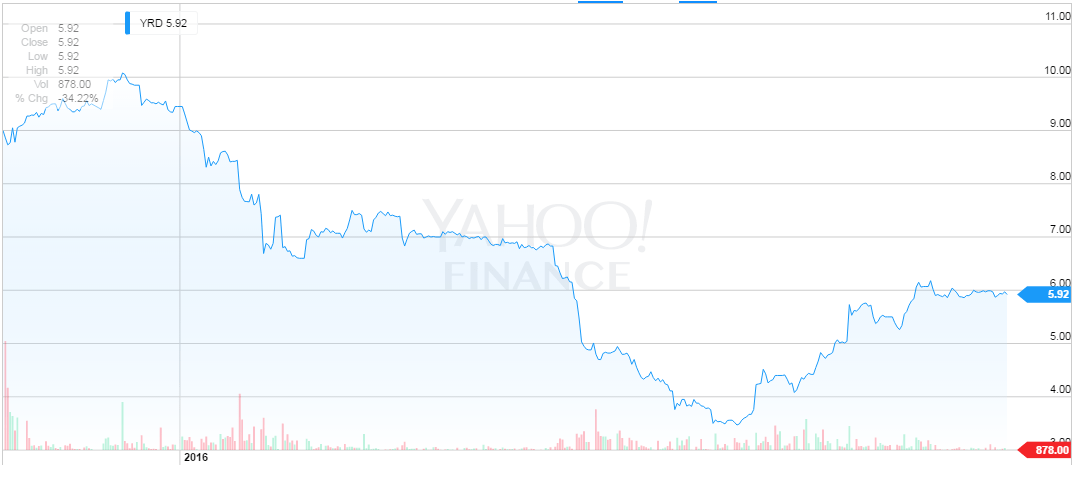

The effect of this industry’s uncertainty is being felt everywhere. Yirendai (YRD) is a Chinese P2P financing company that is down more than 40% from its IPO last month, as a result of the P2P crackdown in China.

In addition to this Chinese company, American Bank of Internet has seen its own controversy, while Lending Club was recently reportedby Bloomberg to see “misfires” in its P2P algorithmic model.

We are not claiming that NOAH’s internet finance business has any relationship with this company or any other companies in this industry, however, we do believe that this nationwide ponzi scheme from Ezubao is drawing huge attention from the government and it is expected to spur much more stringent laws and regulations on this sector going forward.

Internet finance is an area that NOAH is investing heavily in, and the revenue from this segment increased very quickly (with negative income from operations). For example, in Q3 2015 the company reported $2.5 million in revenue from this segment, which is a 304.6% increase from the same quarter in 2014. However, with the expected laws and regulations from the government, the internet finance industry in China will likely cool down, thus causing this segment of NOAH to slow down too. In NOAH’s 2014 20F, it actually listed this regulatory risk:

The laws and regulations governing the internet finance industry in China are developing and evolving and subject to changes.

Due to the relatively short history of the internet finance industry in China, the PRC government has not adopted a clear regulatory framework governing the industry. There are ad hoc laws and regulations applicable to elements of internet finance-related businesses, such as laws and regulations governing online payment and value-added telecommunication services. For example, applicable laws and regulations in the PRC require a payment business license to operate online payment and related services. We are in the process of applying for such payment business license, and intend to engage in providing online payments and related services after we obtain such license; in the meantime, we are cooperating with qualified third-parties to provide such services. There is no guarantee that we will be able to obtain the requisite licenses for all elements of our internet finance business. In addition, according to applicable laws and regulations, we may be required to obtain an internet content provider license, or ICP license, for our internet finance services. We have made efforts to obtain all the applicable licenses and permits that we believe are necessary for the conducting of our internet finance business, including the ICP license, but we cannot guarantee you that we will be able to successfully obtain all such licenses in a timely manner, or at all.

We continually innovate our internet finance products on our internet finance platform, and related regulatory regime applicable to wealth management products and asset management products might be applicable to our internet finance products depending on the product structures. We cannot guarantee you that our internet finance products will comply with the related regulatory regime.

In addition, substantial uncertainties exist regarding the regulatory regime and the interpretation and implementation of current and future laws and regulations applicable to the internet finance services industry in China. As the internet finance business in China is new and rapidly evolving, new laws and regulations may be adopted from time to time and we may be required to obtain additional licenses and permits beyond those we currently hold or are applying for. If new PRC internet finance-related laws and regulations require us to comply with additional requirements in order to continue to conduct any aspect of our business operations, we may not be able to comply with such additional requirements in a timely fashion, or at all. In addition, although we have utilized different measures to reduce such risks, we cannot guarantee that our current practices comply with all the regulations that may be or have been promulgated, and we may be fined or penalized by regulators, required to comply with additional requirements or ordered to cease operations due to any non-compliance in the future. If any of these situations occur, our business, financial condition and prospects would be materially and adversely affected.

It is expected that the government will apply more stringent regulation on the internet finance industry, and the growth prospect of NOAH’s business in this sector just added more clouds.

Valuation

Again, our main concerns with NOAH are as follows:

- The company now has a dual share structure that can easily take power away from common shareholders

- The company is focused on wealth management product distribution and asset management performance tied to China’s stock market, which has collapsed over the last 6 months

- The company’s growth market right now is an extremely controversial “shadow banking” practice of internet banking, already under fire for have creating an Ponzi scheme in China and soon to be under fire in the U.S. due to internet based lenders like BOFI and LC

We believe shareholders, other than the ones with super voting power, need to counter this obvious risk by assigning shares a lower valuation.

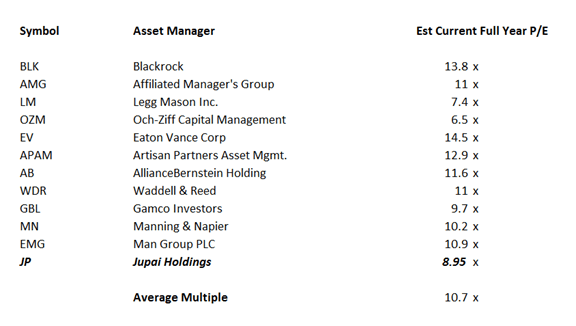

We compared NOAH to Jupai Holdings (JP), a similar company that trades at a multiple of around 9X 2016 forward estimates, without the dual class share structure risk.

Here are how some other U.S. based asset managers fare in terms of their P/E for their respective current fiscal years:

The market has yet to price in what an astute investor probably already knows. Revenue from performance based income should drop significantly as a result of the correction in the Chinese markets for NOAH.

If you believe the company’s best case scenario, NOAH could trade around 10X its extremely optimistic guidance for next year of $1.91, putting a high end for shares around $19.10. Our best case scenario would be closer to the company trading 10X its current year estimates, as we don’t believe the company will come in anywhere near analysts’ $1.91 estimate. We would not be surprised to see these analyst estimates significantly altered to the downside going forward.

The company trading at 10X its estimates for the current year would put its share price closer to $16. Because we don’t know how bad things will get overseas, it’s tough to put a bottom on where we think NOAH could wind up, but handicapping for the new risk of the dual share structure and the potential for a “take under” situation leads us to continue to believe shares have meaningful downside from today’s levels.

The fact is that investors buying NOAH today are not investing in the company, they’re investing in the two shareholders and new Board Member who have controlling interest in all corporate initiatives that the company may put forth. For that reason, we believe the company is simply not investable.

Disclosure: Short NOAH