By Maj Soueidan, Co-founder GeoInvesting

Donald Trump’s POTUS election win caught many people with their pants down. They were preparing for a Clinton win, and we have the media and hedge funds to thank for bombarding us with predictions of an immediate crash in the face of a Trump victory. Little thought was given to the possibility that a Trump victory would actually give a boost to the market during the several days that followed.

A Fortune Article explained:

On Tuesday, Bridgewater Associates sent out a note to its clients predicting that the Dow Jones Industrial Average could plunge nearly 2,000 points in one day if Trump is elected president. That would be the biggest one-day slump in stock market history, by more than double, besting the 777-point plunge that happened on October 29, 2008, at the high of the panic surrounding the financial crisis. The drop would translate into a 10.4% dive, and immediately send the stock market into correction territory.

The same page includes a “fear mongering” Video you should watch.

A CNBC Article reads:

The work of two economics professors may provide a glimpse of how the stock market might react if Donald Trump were elected. They studied the predictions market, including PredictIt.org and the reaction in the financial markets to events around the election. One of the economists says their findings point to a sharp immediate sell-off if Trump wins and a slight rally if Clinton wins.

Wrong Again

Well, so far, just like “experts” missed the doomsday mark on Brexit they ended up with egg on their face after the 2016 U.S. Presidential Election.

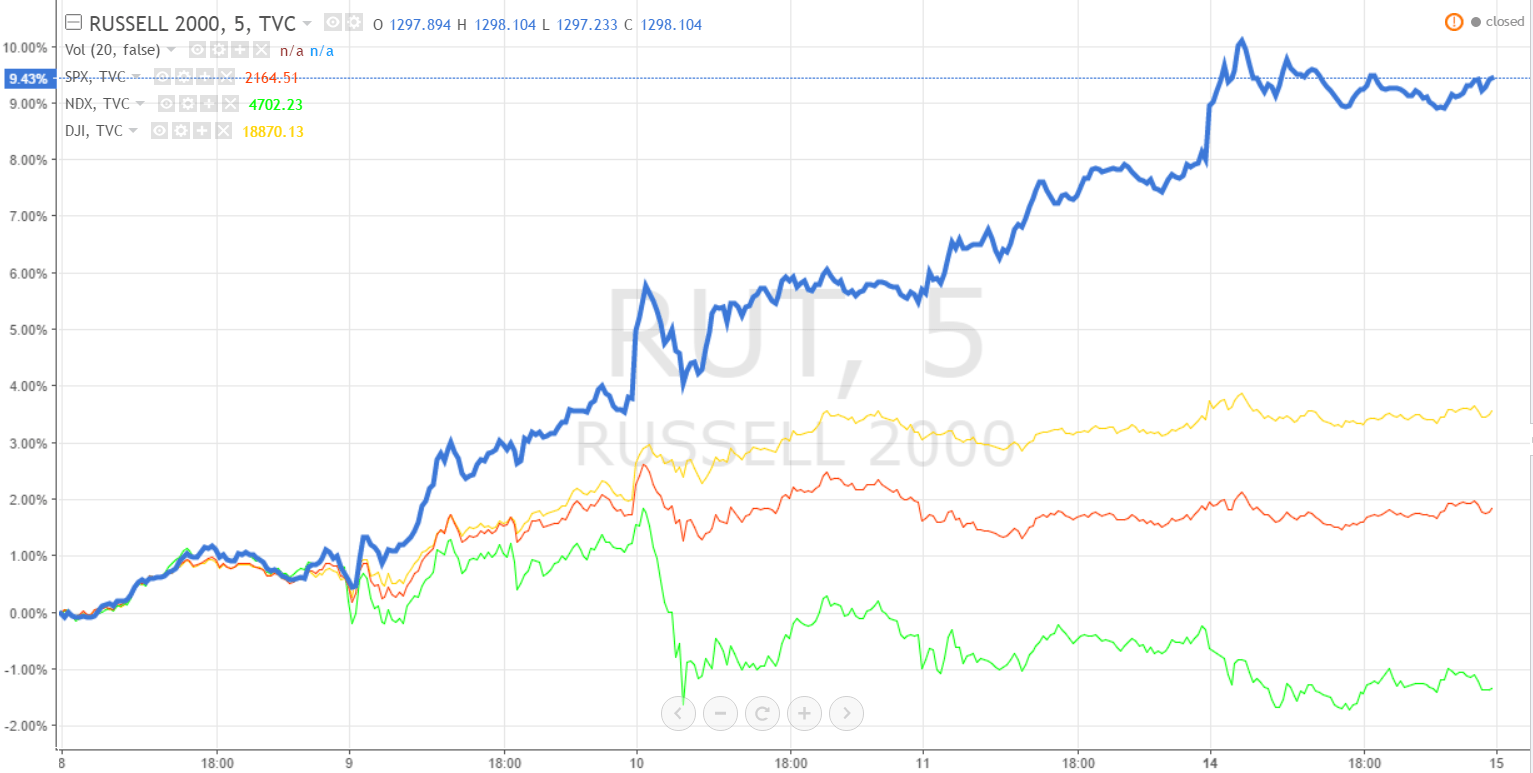

Quite the opposite has occurred. All the major indices skyrocketed. Microcap and small cap stocks led the way with a dramatic 9.5% return in 5 days. As a microcap investor, it was awesome to see small stocks rise last Friday as the major averages remained quiet. If we are lucky, there is an outside chance that a long awaited sustained rally in “The Smalls” could be upon us. Even if you feel left out due to your portfolio’s lack of market exposure, it’s never too late find great microcap companies.

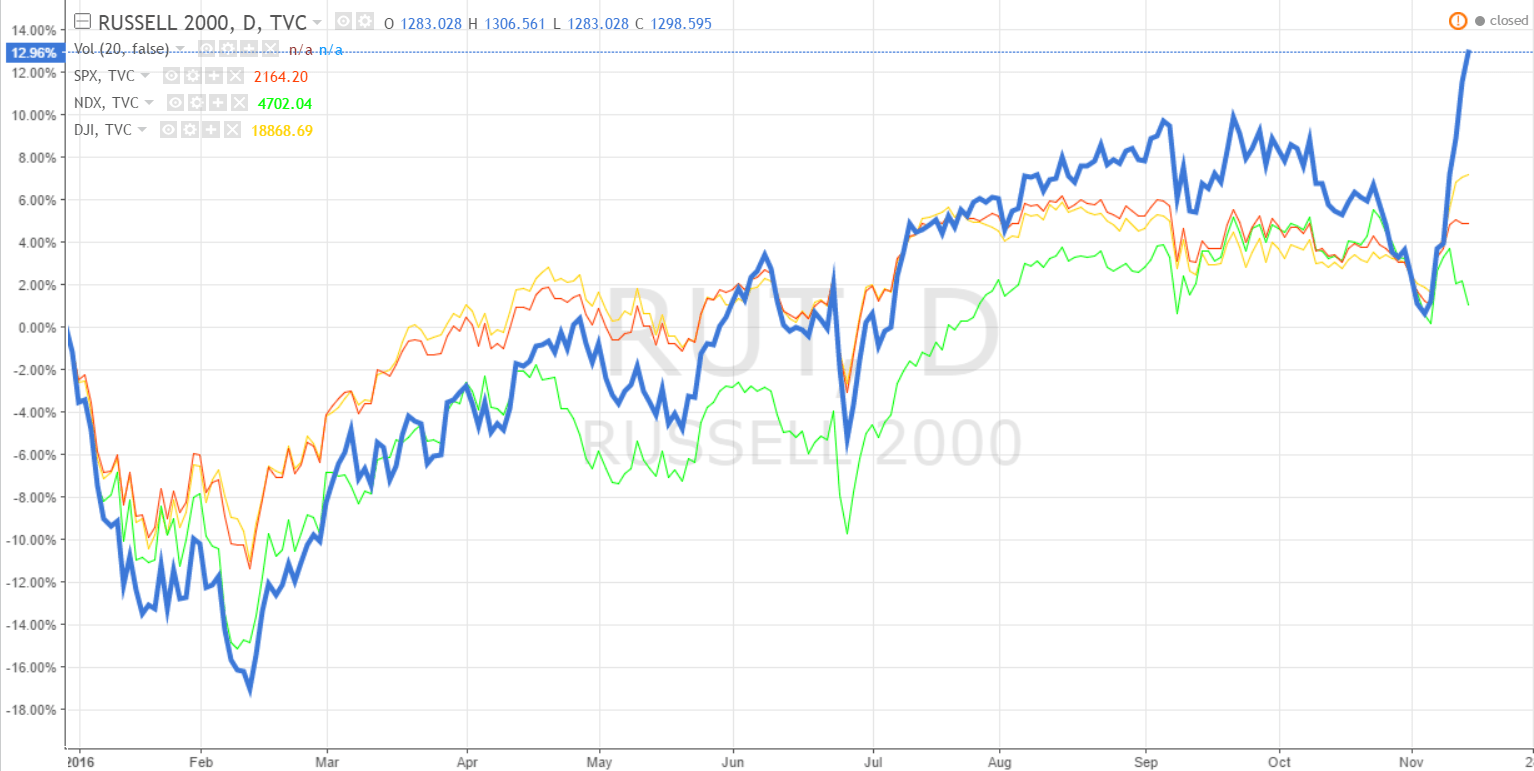

To be fair, after an overall uptrend since February 2016, stocks fell hard for several days prior to the election. Small caps and microcaps were getting demolished.

What It Means for Microcap investors

If you want to see what this means for microcap investors, please continue reading below.

As some of you may know I am co-founder of GeoInvesting.com, a website and morning email service that produces research and content on microcap stocks. I have made a living for about 30 years investing in small companies. From 1989, when I bought my first stock, to 2008, microcap investors carved out a cookie-cutter approach to find double, triple and home run stock picks. It worked consistently, year after year, but 2008 changed everything. Fear, low interest rates, minimal GDP growth, volatility, emergence of ETFs and shorter investor time horizons became kryptonite to microcap stocks. For the most part, the Global Recession and Fat Finger flash crash in May 2010 dried up liquidity in microcaps and pushed investors into larger capitalized “risk off” stocks.

As I’ve touched upon in the past, reversion to the mean always occurs. Eventually, institutional and retail investors are going to find microcap and small cap stocks. Global uncertainty, exchange rate volatility and increasing interest rates are eventually going to force investors to sell bloated big caps and buy smaller capitalized undervalued growth and value stocks. It just makes sense.

Is it possible that Trump is the shot in the arm that under-loved microcaps need to ignite a broad rally in the sector? If anything, the market move last week is an indication that there is an appetite for microcap stocks and that bullish moves can be swift and violent. In theory, trump’s first 100 day plan is bullish for home grown U.S. companies which includes over 10,000 stocks.

Furthermore, now that the GOP controls the White House and U.S. Congress, markets are speculating a wane to the gridlock that plagued the Government for the last eight years. Low interest rates can only stimulate growth to a point. Eventually, fiscal stimulus is needed to kick start a bruised economy. The elements of Donald Trump’s plan from an investor perspective include ambitious goals to boost spending for the U.S Military and “water and environment” infrastructure, while lifting the restrictions on the production American energy reserves.

Back To Reality

Realistically, it is going to take for Trump to unite Congress to put forth elements of his plan. As expected, he is already backing off on some of his 100-day plan promises and meeting some resistance from the GOP Leader Mitch McConnell.

“McConnell also threw some cold water on Trump’s infrastructure plans, calling it not a top priority.”

Personally, I would welcome a pullback in many of the stocks that may have rallied prematurely.

Ironically, Trump’s moderate stance on some spending issues may sit well with liberal-minded individuals, while subjecting the GOP to think twice about “voting against America” by blocking spending measures if it wants to retain its majority during mid-term elections in 2018.

But here is one thing I know for sure. The lack of a broad rally in stocks over the past several years is a “NO” vote by the market that monetary stimulus is the formula to reignite broad economic growth. The stock market’s surprise reaction to the Election results is a “YES” vote that adding fiscal stimulus to a narrow and choppy economic recovery is needed.