Maj Soueidan is a full-time investor with over 30 years of experience. He is also the co-founder of Geoinvesting.com, launched in 2007. Since then, he’s led the GeoInvesting team to find overlooked, quality microcap stocks as well as identify red flags in low quality companies. Maj’s all-time favorite investor, Peter Lynch, influenced Maj’s approach to investing. In fact, Maj emulated and even built upon some of the principles and processes implemented by Lynch, who served as the launching pad for Maj to create his own style of research, focusing on both qualitative and quantitative criteria of microcap stocks to root out the gems. The following post goes on to show just how successful he is at it.

- Maj and his team have picked over 550 positions since 2008 among 413 unique stocks.

- Every third stock is now a multi-bagger (defined as having a current return of over 100%).

- More than 10% of all the stocks have been acquired at a premium since Maj’s call. (Defined as having been acquired at a price higher than the previous day’s closing price)

- His overall hit rate is roughly 66%, meaning that two-thirds of all the positions are now above the price of the initial call.

All data is as of 30/03/2021 unless stated otherwise. We will be updating the numbers regularly.

Outperforming SP 500 by 120%

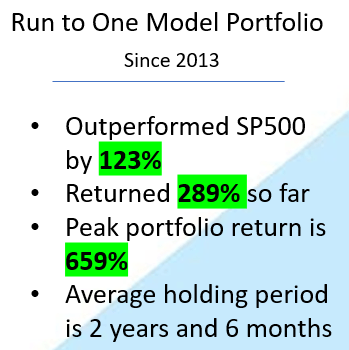

The most exciting statistics come from the high conviction model portfolios visible to GeoInvesting’s premium retail subscribers. The portfolios have consistently outperformed the S&P 500 and racked up impressive gains.

The best portfolio so far has been the “Run to One”. As the name suggests, the portfolio is focused on sub-$1 stocks that can grow based on the underlying fundamentals. Some might think that these penny stocks, as they are usually called, could easily become victims of pump and dump wizards and other scoundrels in the microcap world.

However, GeoInvesting has a long history of engaging with quality companies, learning to steer away from stocks with red flags and only focus on those whose businesses we can understand by interviewing management and noticing favorable trends in the underlying business.

This has worked out well in the Run to One Model Portfolio

As you can see, the portfolio has outperformed the S&P500 by over 120%. Moreover, if you were to take the peak returns of every position (highest share price since the initial call), the portfolio’s return would be 659%.

If you would have invested a mere $10,000 into the portfolio you would have ended up with $38,934. However if you held all the positions and never sold, your gains would skyrocket to $113,998. This is a recurring theme in our research. We sell way too early, which even more so drives home the necessity for discipline and patience to be exercised when investing in quality companies!

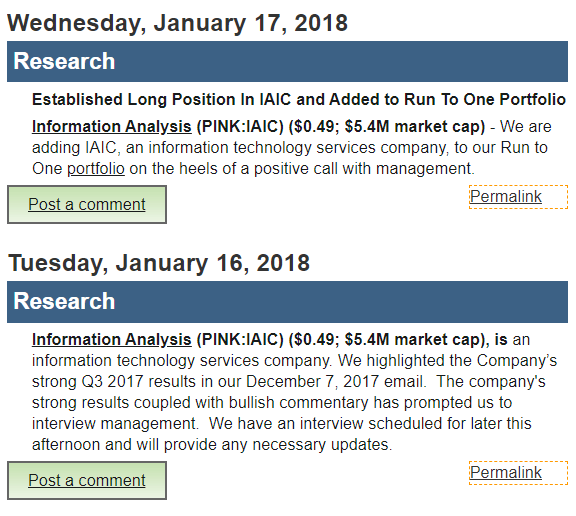

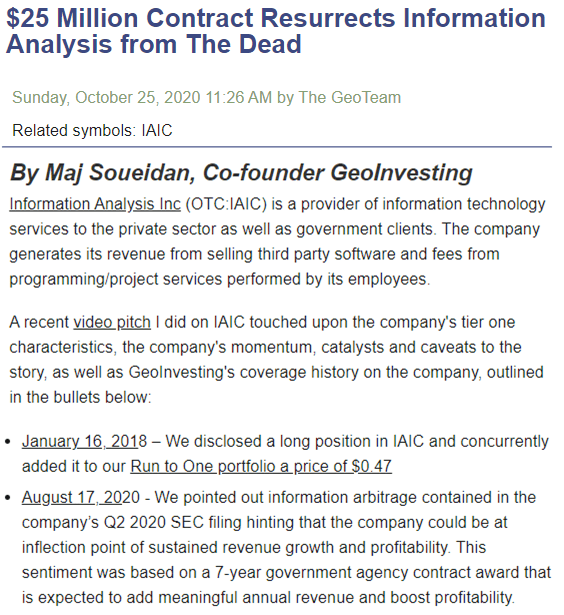

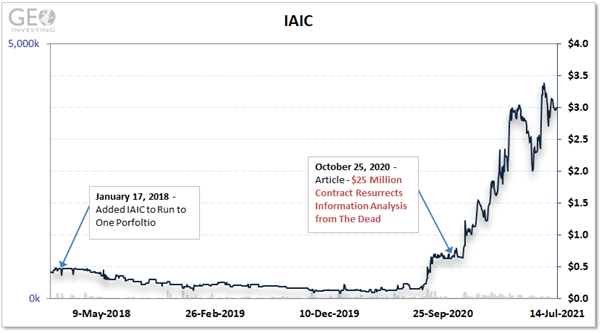

To give you one example from the portfolio, we’ll highlight Information Analysis Inc (OTC:IAIC), a stock we believe can still reach higher levels.

IAIC is an IT services company that specializes in modernizing databases and computer infrastructure for the US government. We knew the stock for a while and at the end of 2017 we noticed their sales started to perk up and the management was bullish about the future. We called up the management team, and shortly after, we decided to add the stock into the Run to One portfolio as we got excited about the prospects of the business.

Related Premium Research Notes

The turnaround to profitability took a bit longer, but last year the company started to generate increased revenue on the back of new contracts. We wrote an in-depth article, when the stock was trading around $0.65, about the situation and explained our thoughts behind the likelihood that the stock would shoot past our initial price target of $1.50 per share if they continued to perform. We became even more bullish on the stock in 2020 when information surfaced in SEC filings about a major contract that SOFO won. Interestingly, this transformative development was not included in any press releases or other sources. We call this strategy information arbitrage, a huge edge that exists in the microcap space that we exploit on a daily basis for our premium members.

This worked out well.

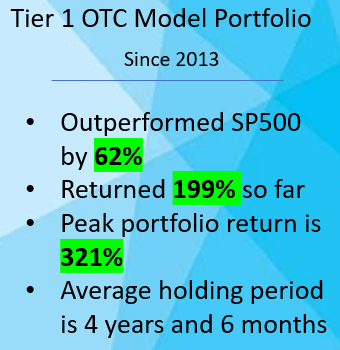

The second-best portfolio in terms of the S&P 500 outperformance is GeoInvesting’s Tier 1 OTC model portfolio. This portfolio focuses on the best-of-breed companies that are trading on the OTC market.

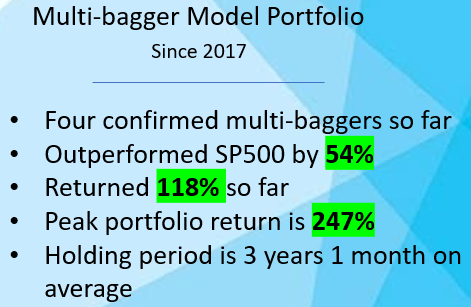

The multi-bagger portfolio that searches for serial compounders has already found four such stocks out of eleven and outperformed the S&P 500 by 54%.

If analyzed by peak return, we already saw seven out of the eleven stocks hitting multibagger returns.

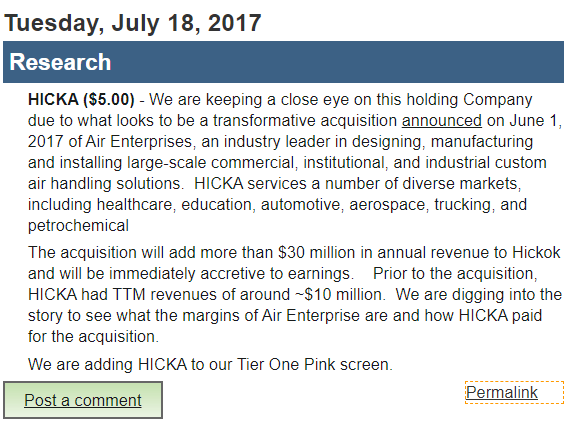

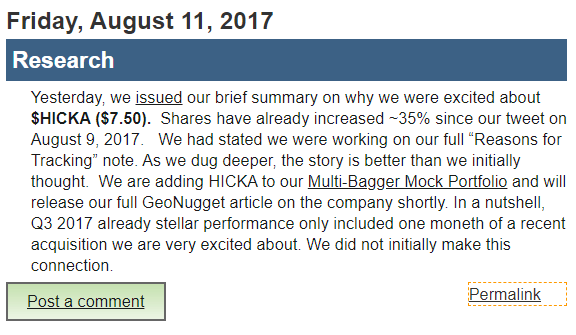

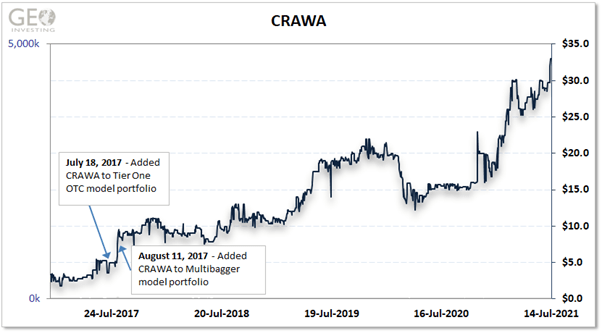

An example of a stock in this portfolio is Crawford United Corp (OOTC:CRAWA) (former symbol HICKA), a holding company which we tracked from the time it traded at just $5 per share (current price is roughly $29 per share). We first noticed the stock after it made what seemed to have been a transformative acquisition, and added it to our Tier One OTC model portfolio.

After more research, we got excited about CRAWA’s prospects and added it to the Multibagger portfolio.

It has been doing well since.

Short-term gains and takeovers

Short-term gains and takeovers

Despite the previous average holding period of the portfolios, Maj and his team are not solely focused on long-term holdings. Short term investment opportunities also arise when a certain catalyst is based on fundamentals.

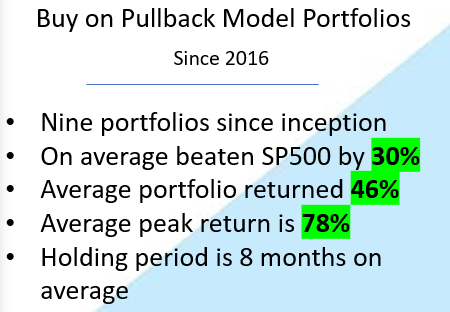

He and his team also created portfolios called ‘Buy on Pullback’ portfolios (also sometimes referred to as Contrarian), which consists of stocks that reacted negatively to or have muted reactions to good news, or when the stock market is correcting or crashing and investors are acting irrationally. The holding period in this portfolio is just eight months on average. They have run nine such portfolios since 2016 and, on average, beaten the S&P 500 by 30% during their time frames. On average, they generated peak returns of 78%.

Here is the aggregate performance of all the Buy on Pullback portfolios.

Through looking at this portfolio, investors can also clearly understand Maj’s focus on information arbitrage. Here is how Maj describes the opportunity.

“Microcaps appeal to me due to the information arbitrage opportunities they provide. An information arbitrage (InfoArb) exists when a disconnect between stock prices and available public information on a company is noticeable, and monetarily worth pursuing. Sometimes, the mispricing of micro-caps can be substantial.

This strategy has “paid dividends” for many investors. Part of the reason that “InfoArb.” opportunities exist because investors often associate microcap stocks with pump & dump companies with no revenues and profits. But there is no better strategy in the stock market than to look for opportunities where others are not looking. There are many good microcap companies with real revenues, some even with blue chip customers.” – taken from GeoInvesting.com

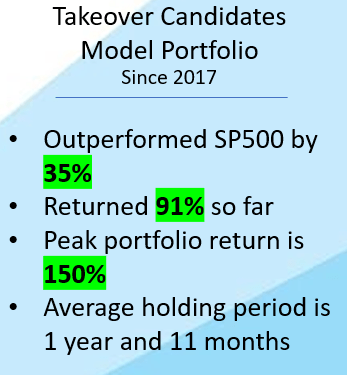

Often, this information arbitrage can also lead to the discovery of stocks that are likely to be acquired, and thus Maj and his team also run a portfolio called ‘Takeover Candidates’. Without too much surprise, the portfolio has beaten the S&P 500 by 35%.

Last but not least, by the looks of the 2020 overall performance of Maj’s picks, it seems the returns are only getting better.

Long side Performance: 2020

- Maj’s long ideas in 2020 delivered outsized returns (average 145%) and a strong hit rate of 91%.

| Date Opened (2020) | Ticker | Current Return |

| March | RVP | 766.67% |

| May | SEED | 638.60% |

| May | INTZ | 573.48% |

| May | CLPT | 564.44% |

| April | MVPT | 410.53% |

| August | FMCIW | 263.25% |

| November | IAIC | 240.48% |

| March | FTDL | 175.86% |

| May | INXSF | 135.71% |

| May | EDUC | 115.87% |

| October | BGFV | 114.48% |

| May | STXS | 107.41% |

| March | HGBL | 75.74% |

| June | OBCI | 69.07% |

| July | LGL | 63.35% |

| May | MHGU | 61.94% |

| June | EFOI | 60.21% |

| July | EML | 56.85% |

| April | MMMB | 55.13% |

| September | ACFN | 50.00% |

| August | ALTO | 49.68% |

| November | MFON | 46.15% |

| April | GLGI | 32.39% |

| March | SOFO | 13.60% |

| July | AIFS | 10.20% |

| November | AERO | 8.16% |

| February | DHX | 5.37% |

| July | NNUP | 2.86% |

| April | MFCO | 1.64% |

| December | KRMD | -18.75% |

| January | KTEL | -44.78% |

| September | HWKE | -64.42% |

The picks beat the S&P 500 by more than 90%.

It should not be too shocking that Maj is already having a great year in 2021. This data is current as of July 5th 2021.

Long Side Performance: 2021

- Maj’s long ideas have already hit great performance this year.

- On average they moved up by 78%. Peak returns were even higher at 85%. This compares well to SP 500.

| Date Opened (2021) | Ticker | Current Return |

| May | TCOR | -3.10% |

| May | CTHR | -20.22% |

| April | SMEYF | 90.83% |

| March | GTBP | 129.95% |

| January | FFHL | 18.10% |

| January | TGEN | 3.30% |

| January | MSLP | 352.08% |

| January | KTEL | 55.96% |

| SPY Comparison | ||

| SPY Return | 16.77% | |

| GeoInvesting Current Return | 78.36% | |

| Outperformance | 61.59% | |

| GeoInvesting Peak Return | 85.58% | |

| Outperformance | 68.81% | |

Short-side experience complements the skillset

Let us not forget Maj and his team’s efforts to bust US-listed China-based stocks and US pump and dumps.

On the Chinese side, 24 stocks were delisted, and 15 stocks reached zero. The research was done through comprehensive due diligence with the help of on-the-ground research. For examples of how Maj and Geo busted the stocks, one can watch the China Hustle documentary and read an article titled The Evolution of U.S. Listed China Based Frauds.

As for the pump and dumps, Maj and his team correctly identified almost all of the 22 stocks we wrote about as fly by night scams. Just a single stock is now above the initial share price. 13 of the pump and dumps fell to zero. Shorting these stocks would have resulted in a return of about 79% by now.

Identifying frauds and pump and dumps made Maj a much more successful investor in vetting all of the potentially “hairy” microcaps he deals with on a daily basis.

If you are not yet a premium subscriber and want to know more about Maj and his investing, email us at support@geoinvesting.com and we’ll be sure to get back to you right away!

Thanks for reading.