Polydex Pharmaceuticals Limited, through its subsidiaries, engages in the development, manufacture, and marketing of biotechnology-based products for the human pharmaceutical market. It is also involved with manufacture of bulk pharmaceutical intermediates for the veterinary pharmaceutical industry worldwide. It primarily offers Dextran and Dextran derivative products.

Polydex Pharmaceuticals Limited, through its subsidiaries, engages in the development, manufacture, and marketing of biotechnology-based products for the human pharmaceutical market. It is also involved with manufacture of bulk pharmaceutical intermediates for the veterinary pharmaceutical industry worldwide. It primarily offers Dextran and Dextran derivative products.

(This is somewhat of a high risk play. The company’s recent turn in fortune has been driven by market/industry dynamics. At this point, we are not totally convinced management’s moves have had a big impact on the turnaround. Only time will tell.)

On The Cusp of a New Period of Growth

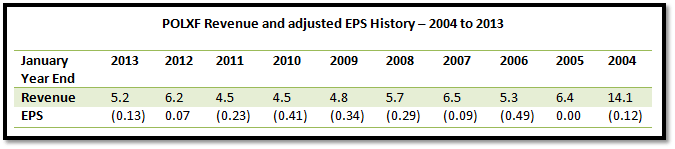

Shares of POLXF have risen sharply in recent weeks. In early June 2013 shares were trading around $0.30. Today shares are trading at around $0.80. The answer to what fueled this sharp rise in share price is simple. After several years of lackluster bottom-line growth on a quarterly and annual basis, the company posted substantial EPS growth during its fiscal 2014 first quarter.

POLXF Revenue and adjusted EPS History — 2004 to 2013

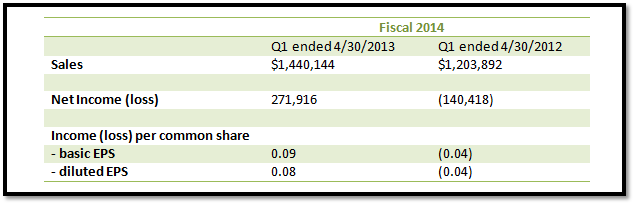

POLXF Sales, Income and adjusted EPS — First Quarter Fiscal 2014 vs. 2013 (Year Ends January 31)

Was the first quarter performance an aberration or a sign that the company is about to enter a period of sustained growth? We believe that several factors support a scenario that put the company in a position to achieve substantial bottom-line growth over the next several quarters.

The following management commentary from recent press releases sums up the POLXF story:

“The company’s reputation for producing high quality, unique Dextran products continues to grow throughout the world. New customer audits of the company’s facilities and practices has led to an expanding client base, along with the return of customers who temporarily sourced less expensive but inconsistent Dextran products from China. The company received a number of urgent requests for product and has responded to the best of its ability.”

“President and CEO George Usher is encouraged that the economy appears to be stabilizing, and more specifically that the global hog market appears to be rebounding, therefore increasing demand for iron Dextran. We are experiencing a dramatic increase in orders and customer audits of our facilities and manufacturing practices. These audits help assure our customers that they can rely on us for a consistent supply of the highest grade product available, reflected in the increased demand across our product portfolio, with interest in the liquid and the higher margin powdered products.”

“Demand for product is steady and our order book is full for many months to come” said George Usher, President and CEO. The Company has also been developing new formulations of product for potential new market opportunities.”

Understanding Dextran

POLXF manufactures and supplies Dextran and Dextran derivatives. Without getting too technical we learned that Dextran is a molecule with various properties that make it ideal for a variety of uses. Specifically, Dextran can be used as an adjuvant, an emulsifier and as a drug delivery agent.

- Adjuvants (Vaccine production). Dextran is used as a food source for bacteria in vaccine production.

- Emulsifier/ Binding Agent. Thickening agent when used with other matter, such as in making ice cream, or the manufacturing of cosmetic lotions.

- Delivery Agent (making a chemical, mineral, etc. biologically available). In this case, when matter such as Iron is added to Dextran the compound helps the body absorb the intended matter. An example of this would be in addressing the anemic conditions of newborn swine with an Iron/Dextran compound.

Dextran can also be used as a standalone substance in certain instances, such as a blood plasma volume expander or a moisture retaining ingredient in cosmetic applications. Dextran is very safe and is made from sugar. When it is not used as a standalone, a particular compound is referred to as a Dextran derivative.

From one of the company’s two websites:

“Inert Dextran and its derivatives are widely used in biological and biochemical research. Dextran has been described for use in the production of foodstuffs. Its value lies in its capacity to prevent crystallization, improve moisture retention, improve body and maintain flavour and appearance. Dextran is an excellent ingredient in cosmetic preparations, such as conditioning, due to its moisture retaining properties in creams, foams and gels, for example, and in the manufacture of shaving cream.”

Brief Background:

Prior to 2004 the company operated 2 divisions:

- Manufacturing Dextran-based materials to supply to the veterinary and human pharmaceutical arena. Customers would then incorporate into finished products.

- Manufacturing finished dosage form veterinary products for the U.S. Market.

The company sold its veterinary finished product division in March of 2004…

“Management considered the finished goods veterinary pharmaceuticals industry to be a highly competitive, mature industry, and believed that meaningful growth in this industry would require significant investment in new product development. Management believed that the Company could expect to obtain a higher return on investment by focusing on its current Dextran Products business and on human pharmaceutical research and development projects.”

…and currently operates three product divisions from its manufacturing plant in Toronto:

- Iron Dextran derivative ((liquid form).)- Addresses iron deficiency in the swine market.

- Diethylaminoethyl Dextran (DEAE) and Dextran Sulfate derivatives (both powdered form)- Used for a variety of Pharmaceutical and Biotechnology purposes including the production of Vaccines. ( acts as a vaccine production stimulator)

- Bulk Dextran/pure form (powder form)- Pharmaceutical/Biotechnology Sold in powder form

Due to reasons we will explain later, the company was unable to grow its business post 2004 as it had hoped, and was eventually delisted to the Pink Sheets in 2010. POLXF shares actually rose from $5.00 in July 2005 to a high of around $10.50 in April 2006 when revenues were approximately $6.0 million, even though the company was losing money on an adjusted basis. The rise in shares occurred over excitement of the potential use of one of its research projects (Cellulose Sulphate). The company had been conducting clinical trials for a birth control gel product to prevent pregnancy and HIV prevention. Birth control trials completed phase 2 with favorable results. However, the HIV trials were halted by its research partner.

Reference from January 31, 2007 10-K:

“The Independent Review Board in conjunction with CONRAD, WHO, FHI and Polydex announced the halting of Two Phase III clinical trials to assess the effect of Ushercell on vaginal HIV acquisition which had been started in six clinical trial sites located in India and Africa. The trials were halted due to a possible higher than expected incidence of HIV. An investigation is now underway to determine the cause, with a report due towards the end of fiscal year 2009.

Funding stopped for both projects. Accordingly, shares dropped sharply and continued to decline over time. However, the current irony is that shares are well below its 2006 highs even though the company looks to be poised to achieve significant EPS gains in its current fiscal year 2014 and 2015. An article was later published in the New England Journal of Medicine showing that the initial findings were not nearly as negative as first assumed.

Five Reasons for Optimism

- Improving Competitive Landscape. According to the company, certain negative market trends have already reversed or are currently reversing. For several years, competition from large and small suppliers/manufacturers had put pressure on pricing and margins. But two things happened.First, a very large competitor out of Demark (Pharmacosmos) made a strategic decision to stop supplying Iron Dextran and solely used its supply to manufacture its own finished products. Second, the 2008 global recession eliminated many of POLXF’s competitors. Conversely, the global recession had a negative effect on many of POLXF’s customers who abandoned the company and looked to China for their Dextran supplies. Ultimately, many of these customers have returned to the company due to quality issues of the Dextran supply coming out of China.

- New Market Opportunities. Currently, 60% of the company’s revenues are derived from its Dextran derivative iron product. 20% of revenues come from derivative Dextran products like Dextran sulfate and DEAE Dextran. The remainder comes from bulk/pure Dextran.The company has opportunities to meaningfully expand its market reach. For example, it can develop additional derivatives of Dextran and has an opportunity to increase the sale of bulk dextran. There are also significant opportunities to use Dextran in the cosmetic and food industries where the company does not have a big market presence.The reduction in the amount of competition has provided the company with an opportunity to pick up new customers who need new sources of supply.Regarding other products, although not worth getting excited about yet, at some point in the future the company could readdress the potential for its Cellulose Sulphate birth control product. And we do not believe the company will revisit its HIV project. We were surprised to learn that over $80 million from 3rd parties (Including the Gates foundation, World Health Organization, Family Health International, and a partner conducting the clinical trials) had been devoted to this cellulose sulfate project.

- Expanding Margins. Certain factors should lead to expanding margins. The company is placing increased focus on targeting customers that require the company’s higher margin products such as, bulk powdered Dextran product and powdered Dextran derivatives. The company is also seeing higher demand for its powder product from the reduction of the number of competitors supplying Dextran.Furthermore, in 2012 (FY2012) the company encountered an efficiency problem with its manufacturing capabilities due to a faulty piece of equipment. The company set out to upgrade/improve its production equipment/process. The plan to address this problem did not go as smoothly as the company had hoped which is why the company reported a loss in FY2013 after reaching profitability in FY2012 for the first time since the company sold its veterinary division in 2004. This issue has been resolved.

- Earnings. The culmination of the first 3 reasons for optimism should begin to lead to improvements in sales and earnings. The company’s FY2014 first quarter results are an indication that its efforts to improve margins are working.

- Sales increased 20% to $1.44 million.

- Net income turned positive, increasing from a loss of $140,418 to a gain of $271,916.

- Diluted EPS increased to $0.08, reversing a prior year loss of $0.04. This is significant because the company has had a history of reporting quarterly losses and has not reported EPS greater than $0.04 on a quarterly basis in recent history.

- EBITDA increased to $313,779 compared to negative EBITDA of $65,228 in the prior year period.

Although quarterly sales are still within the company’s post-2004 historical range, enhanced production efficiencies and management’s focus to increase revenue contribution from higher margin products have dramatically helped to improve the bottom line. Ultimately, the company will have to expand its manufacturing capacity and/or outsource its production in order for it to begin realizing substantial revenue growth; a situation we feel will gradually begin to occur toward the end of 2013.

- Tier One Pink. Many investors ignore companies that trade on the Pink Sheets. However, some of our best multi-baggers have arisen from investments made in what we like to call Tier One Pinks (“TOP”). Of the several criteria we set to qualify a Pink Sheet stock as a TOP candidate, two are often essential:

- The company must be a revenue generating enterprise.

- The company must maintain financial transparency and communicate with its shareholders.

POLXF passes both of these litmus tests. The company is already a revenue generating enterprise. Furthermore, it is beginning to step up its efforts to communicate with shareholders. On June 25, 2013 the company announced that it…

“…has updated the company website at http://www.Polydex.com with an aim to provide greater transparency and other helpful information to shareholders, investors and interested parties alike. The company’s new website includes greater access to financial reports, recent news releases and company information as it becomes available, and includes links to current stock quotes and charts. Shareholders and visitors can also subscribe to receive News Releases directly from the Company website.”

An in-depth review of the company’s product line can be viewed at http://www.Dextran.ca. It is also worth noting that the POLXF’s CEO and external investor relations contact are easily reachable.

- Investors who buy shares of POLXF will have to ignore the company’s negative equity and large accumulated deficit. This circumstance was the result of prior management (pre-1989) spending large amounts of capital on research and development with little emphasis on marketing initiatives to drive sales. The new management team goal to increase top line growth was then challenged for many years due to competitive pressures that are finally beginning to abate.

- Is there a chance that the Denmark company decides to become a supplier of bulk Iron Dextran once again?

- It is essential that the company expands its production capacity to increase sales to current and new customers and push out new products.

- Dilutive funding to expand production capacity. In the end, we believe that spending capital, through internal or external sources, could lead to a significant return on investment.

- Management’s goal to increase sales of powder Dextran and powdered Dextran derivatives may not occur as fast as the company would like or at an amount to consistently benefit margins.

- China could address its Dextran quality issues.

- The company may be unable to maintain a level of EPS near its first quarter 2014 performance.

- The company’s recent turn in fortune has been driven by market/industry dynamics. At this point, we are not totally convinced management’s moves have had a big impact on the turnaround. Only time will tell.

The near-term goal is for the company to continue to achieve quarterly EPS numbers at a level higher than its depressed historical performance while maintaining current or slightly higher revenue levels. In a nutshell, we think the POLXF’s fiscal 2014 (ending in January) will be a year of moderate revenue growth and significant EPS growth, and that FY2015 will be a year when the company begins to experience an uptick in revenue growth as a result of increases in production capacity to meet the needs of its current and new customers. FY2016 should be a year when the company begins to introduce new products. We think the company has a good chance of achieving EPS north of 0.20 for FY2014 (fully taxed).

We see little reason for the stock not to be trading at a PE between 10-15 on this estimate, leading to a near-term price target of $2.00-$3.00. As a first step, the market may soon be able to assign shares an EV to Sales multiple closer to 1.0 if the company proves it can consistently grow sales and earnings. This would lead to a stock price of around $1.50.

Caveats:

Disclosure: Long POLXF

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control