GeoWire Monthly, Vol. 4, Issue No. 7, July 2024 Review

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 4, Issue No. 7, July 2024 Review

In This Month’s GeoWire

- Message: Don’t let the Japanese Yen carry trade scare you.

- Complementary video clip from a July skull session CEO conversation .

- GLP-1 Catalyst driven Information Arbitrage stock pitch.

- Premium morning and weekly research coverage summary emails.

- Monthly newsletter archives

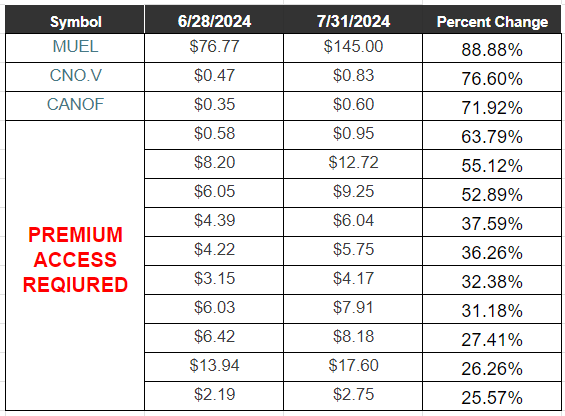

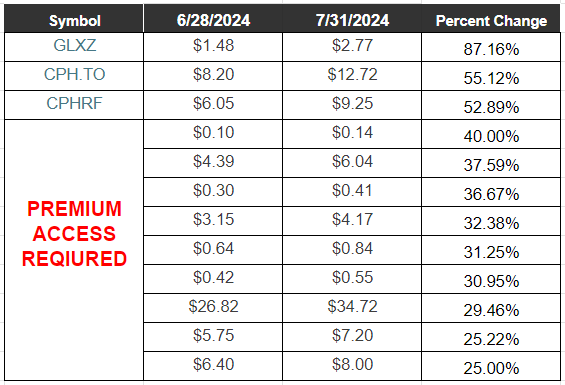

- Best microcap performers in July and other stats.

- GeoInvesting research progress to date.

A brief message from Maj

The second quarter earnings season for microcap stocks has officially been underway for over a week. A few earnings trickled in early last week, but the volume of releases increased last Thursday and Friday.

Yesterday, the bulk of the microcap Q2 releases started to come in. And just like clockwork, they’re arriving right when the market is experiencing volatility and uncertainty. Still, we view that as an opportunity, not as an obstacle.

Having said that, continuing coverage of a stock that is in the very early innings of a rare and long awaited setup that could lead to a huge expansion in valuation multiples at the same time that its earnings growth is accelerating. It’s what fundamental-versed microcap investors live for and where 5 and 10 baggers are born relatively fast, which you can read more about here.

200+ Multibaggers And Counting

The market pullback has triggered the launch of Buy on Pullback Model Portfolio (BOP) #12

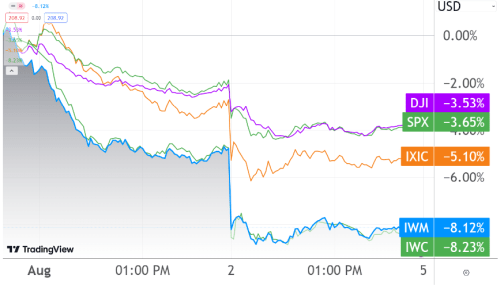

While small caps experienced a significant rally in July, a good amount of those gains have vanished, with a sharp decline accelerating after July 31. Concurrently, large-cap companies have continued substantial drops that began in July as small caps took centerstage for a few seconds.

Recession fears have resurfaced among market commentators, echoing concerns that were prevalent but largely unfounded over the past decade. Despite this, our focus remains steadfast on long-term fundamentals, unaffected by the prevailing market sentiment.

We think this paints a perfect scenario for us. During market downturns or panics, our advantage as fundamental investors is magnified. These periods allow us to identify quality companies with great earnings or high-probability turnaround companies that are overlooked due to their microcap status.

Continue Reading Rest of Commentary Here.

We started building Buy on Pullback Portfolio #12, as we said we would do, here. We just added our first 3 stocks, with 4 more on deck.

Click Here To Gain Access To Our Buy on Pullback Model Portfolio #12.

Complimentary Video Clip

Eric Eyerman, CEO of California Nanotechnologies Cor (OOTC:CANOF) (TSXV:CNO) joined Maj for a Skull Session Fireside Chat where they discussed the company’s financial journey, competitive landscape, and future growth prospects. They also explored the use of advanced materials and manufacturing technologies, including spark plasma centering and cryogenic milling. Eric discussed the company’s partnerships and revenue streams in the machine manufacturing industry, highlighting the benefits of partnering with small businesses and the company’s growth potential in the defense industry. They also discussed Nanotech’s growth strategies in the manufacturing business, including equipment sales and facility expansion, and the latest developments in nanomaterials technology.

In this month’s complimentary clip, Eric discusses the company’s shift towards more consistent revenue streams. Historically, revenue came from stop-and-go projects, typically lasting three to nine months. Despite the lack of long-term visibility, consistent repeat business from aerospace and defense clients has driven growth. Now, as the company moves into commercial manufacturing, longer-term contracts provide better visibility, potentially up to 18 months to two years.

This shift indicates a trend towards stable, recurring revenue, as the industry increasingly adopts scalable technologies. Eyerman notes that engaging with higher-level decision-makers is crucial for transitioning projects from R&D to market-ready products.

If you Are Not a Premium Member, You can Subscribe Here for full access

Must-Read Stock Pitch

Premium Morning and Weekly Emails You May Have Missed in July 2024

Weekly Recaps, July 2024

Morning Emails

Monthly Newsletter Archive

Stat Summarizations

Top Performance Across All GeoInvesting Model Portfolios and Screens (In July 2024)

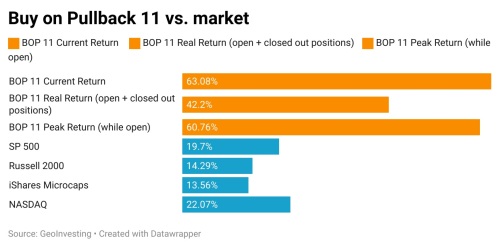

Buy On Pullback 11 Model Portfolio Return Stats as of end of July 2024

Buy on Pullback Model Portfolios are aimed at swiftly capitalizing on mispriced opportunities in the market, identifying stocks experiencing negative or muted reactions to positive news or downside overreactions to negative news that we see as temporary.

Misunderstood company developments, emotions, or negative market sentiment can often be at the core of the mispricing, so the pullbacks often stem from investor overreactions and may not necessarily reflect the underlying fundamentals of the business.

Research Progress, July 2024

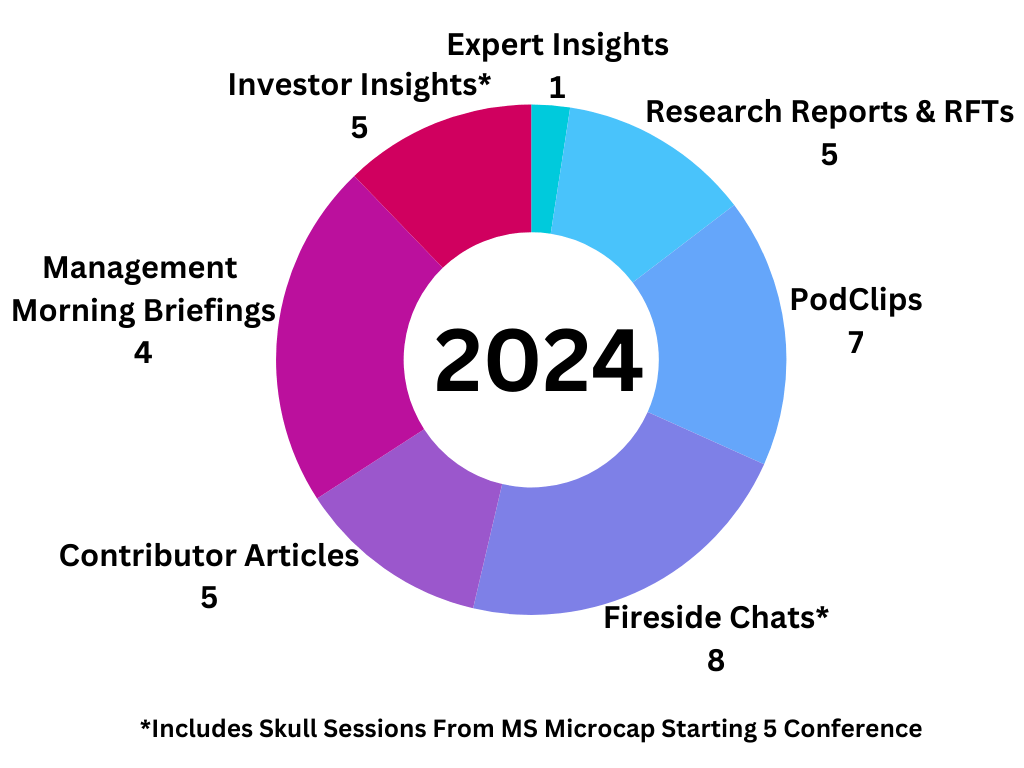

Please also note that year to date, we’ve published 153 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2024,apart from morning emails and weekly GeoWire Content, we have published a combined 189 pieces of Premium content (including video clips) across the segments detailed in the appendix.

As a reminder, in 2023 we published a combined 329 pieces of Premium content across GeoInvesting’s platform.

To see more details on 2023 and 2024 year to date earnings, please go here.

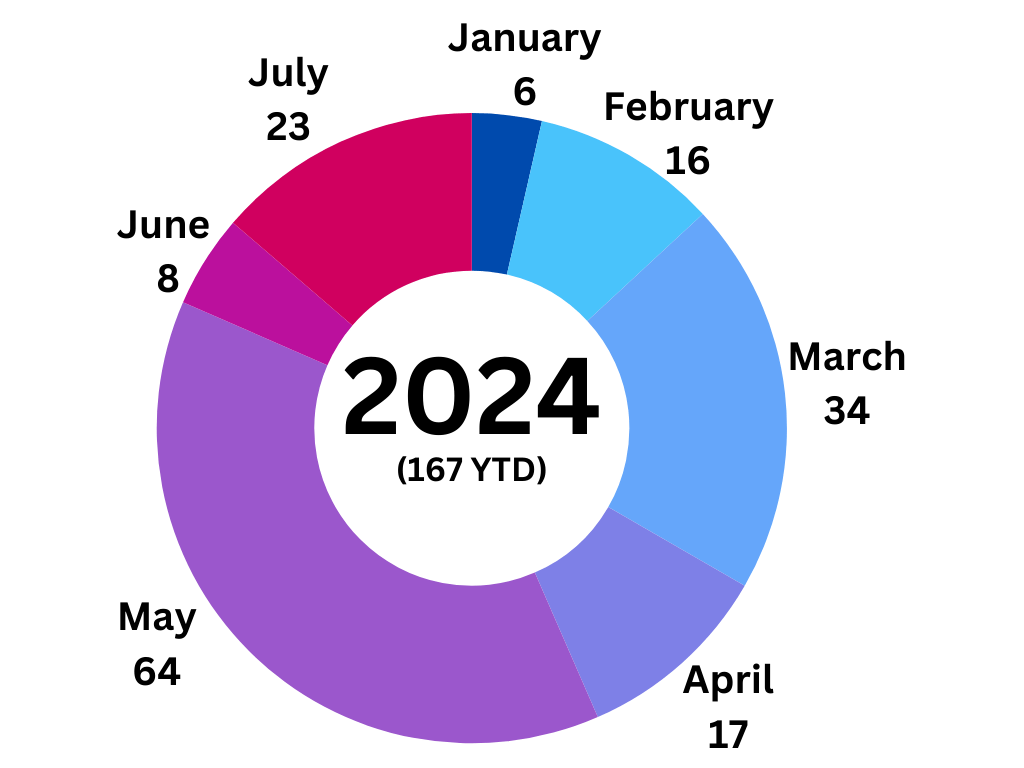

Earnings Processed, July 2024

Earnings picked up this month as Q2 reports started rolling in. We processed 23 reports in July 2024, bringing our full year total to 167.

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- Stock picks from our analyst team, backed by in-depth research

- Model portfolios curated by the GeoInvesting that include timely microcap stocks in “Buy on Pullback” and other themed portfolios and screened lists.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails.

- 16 Years of archived research on over 1500 microcap stocks and counting.

- Stock pitches from our Premium subscriber investor network.

- Live and Archived Video Events:

– CEO Fireside Chats and Briefings.

– Microcap Expert Interviews.

– Monthly Coverage Universe Review. - Week In Review Newsletter, just in case you missed our updates and alerts.

- Multibagger case studies and Investment Process Education.

Appendix

Content Distribution Key

Written

5 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

5 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

7 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

2 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

7 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

5 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

3 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

104 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.

![While Multibagger Turnaround Candidate CAWW And CANOF Performance In Focus, A New Potential Data Center Play Emerges [GeoWire Weekly No. 145]](https://geoinvesting.com/wp-content/uploads/2024/07/Turnaround2-300x296.png)