GeoWire Monthly, Vol. 4, Issue No. 5, May 2024 Review

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 4, Issue No. 5, May 2024 Review

A brief message from Maj Soueidan, Co-founder, GeoInvesting

May 2024 was another busy month for us – lots of really nice things transpired that are worth pointing out, not only within our model portfolio universe, but also within the universe of stocks pitches that are published on GeoInvesting by our contributors. Our contributors pitch stocks to our network, either through writing articles or videos, usually as part of our subscriber only attended live monthly open forum events or recorded Investor Insight Skull Session podcast events

See list of all contributor research reports here.

Search all GeoInvesting videos archives here.

Our open forums are live events that we hold at the beginning of each month to review the prior month’s news flow in the microcap universe and highlights certain stocks within our 1500+ microcap stock coverage universe that we particularly like. We also bring up improvements we are making to GeoInvesting’s research platform on a monthly basis. If you have not attended live yet, I highly recommend you try to make it once in a while, since we often discuss timely topics and new focus ideas.

The Forum is heavily focused on reviewing the best earnings reports we touched upon during our morning emails throughout the month. We use the monthly forum to expand on the best ones of that bunch.

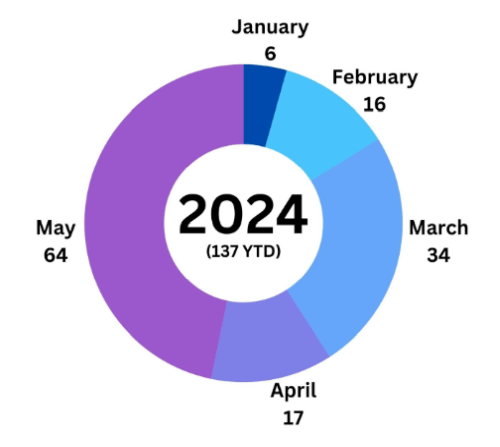

Speaking of which, during our morning emails in May, we highlighted 64 earnings reports within the microcap universe that we want to track.

Now, the tough job is going back and looking at these earnings reports to see which ones are the best, some of which will be covered in an abbreviated session of our monthly forum scheduled to be held on June 12, 2024.

The reason for the abbreviated session is that I am preparing for a special Starting Five Virtual Conference to be held on June 12, 2024.

Learn more about the inaugural Starting Five event by viewing this video. It’s extremely important that you make an attempt to attend the Starting Five event. The more successful the event is, the easier it will be for us to invite great companies to GeoInvesting to share their stories with us.

So far this year, we’ve processed 137 earnings reports, which is ahead of schedule versus last year, where we processed 84 Earnings Reports through the end of May 2023.

We do all this to make your job easier, so you don’t have to hunt through a 10,000-microcap stock universe all by yourself. We love turning over these rocks, so why not just bring the results of that research directly to you.

My 2024 Statistics and Data Points Highlights

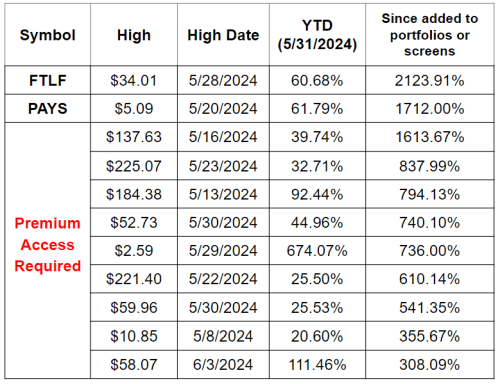

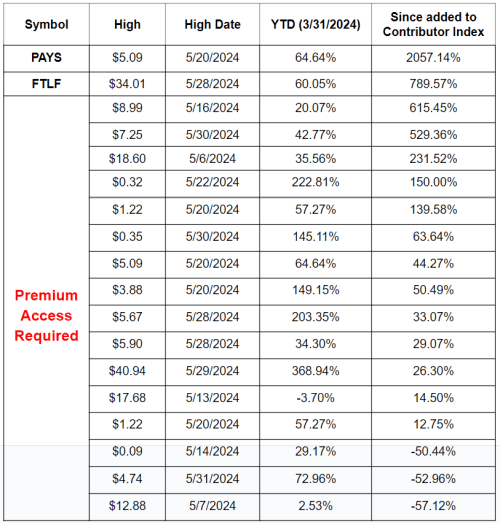

32 stocks across our model portfolios and screens reached 52-week new highs during May.

The best returning stock on that high list so far this year is $FTLF, which is actually up 1,932.91% since we added it to our model portfolio and this year alone, it’s up 60.68%. Additionally, it’s up over 8.5% since we mentioned it as our focus stock in our April 2024 Monthly Forum.

“FitLife Brands is a manufacturer of innovative and proprietary nutritional supplements for health-conscious consumers.”

FTLF returns got a little dinged right at the close on Friday, falling 7.36% after a form 4 was filed, showing that the Chief Retail Officer sold his entire position in FTLF, or 10,544 shares. (All we care about is the CEO in this story).

Regardless, FTLF returns shows that sometimes the best stocks are the ones that you already own. Many people would think we’re crazy for focusing on a stock that’s already up 2,000% since we first wrote about it, but great stocks are like great steaks that you prepare for a barbecue. Sometimes you’ve got to let them marinate to get the best results. By the way, huge shout out to Avram Fisher for his bullish FTLF research report he published on GeoInvesting on FTLF.

Stock Talk

$TSSI

Obviously, the May highlight was TSSI. We’ve been hammering home the bull case on $TSSI for several weeks and that the market was not recognizing TSSI’s participation in elevated data center growth trends.

And all of a sudden, the stock rose 158.02% in May 2024, hitting an all-time high and peak return of 1,195%, since we added it to a GeoInvesting model portfolio.

To get a little more information on the stock and what we were talking about, you can visit last week’s GeoWire Issue #138. We also discussed how you simply could have used a string of past earnings call transcripts to put the pieces of the puzzle together to be able to predict this price performance, to some degree.

$LMB

Finally, another notable stock hitting highs I wanted to mention is $LMB. The stock currently resides on our infrastructure stock screen, which at the end of May was our best performing screen, sprouting an average return of 277.23% over 21 stocks.

See our infrastructure screen here.

Unfortunately, the stock is not one we have in our model portfolios anymore, but it has gone up 541% since we initially added it to our infrastructure screen and is up 30.58% this year. The company experienced a boost in its financial performance and investor interest after the hiring of a new CEO on March 9, 2023.

In retrospect, the CEO change should have been the perfect time for us to revisit the story, since a large reason we removed this company from our radar in the past was due to our dissatisfaction with the prior CEO.

$BLBD

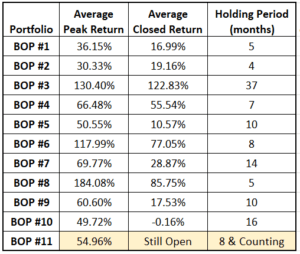

The case of $BLBD shows that investing in stocks is hard. We added it to Buy on Pullback Model Portfolio #11 (BOP) on September 25, 2023. We closed that position out of the seven-stock model portfolio on April 2, 2024, at a return of 98.96%, hitting a peak return of 101.14% during its tenure on BOP #11.

Since we closed the position, it went on to tack on another 100% in gains. We’ve now closed 3 of the 7 positions in the model portfolio, which is now up an average 31.56%.

We are getting ready to construct BOP #12. In case you’re wondering what the stats were for our previous 10 BOP portfolios, here’s a table that shows that.

On the contributor front, there were some notable top performers in the month of May.

We saw $IVFH attain a new high.

“Innovative Food Holdings, Inc., through its subsidiaries, provides origin-specific perishables and specialty food products direct to consumers and establishments.”

IVFH was pitched by Sebastian Krog on March 18, 2024 at a price of $1.02, translating to a current return of 12.74%.

Sticking with contributors, a few stocks that hit highs that are widely followed by investors in the microcap space included:

$FTLF (Nutriceuticals), Pitched by Avram Fisher on July 29, 2016, up 709.56%

$MAMA (Italian food)- Pitched by Michael Liu on July 20, 2017, up 529.23%

$PAYS (Payment Solutions) – Pitched by Quim Abril on August 29, 2022, up 29.61% and W. Xion on January 29, 2016 up 1838.09%.

$MAMA, under a new CEO, has been able to drive earnings per share growth, something the old team was not able to accomplish, even though they were able to increase revenue.

It’s worth noting that Micheal Liu also pitched $OPXS, a company that manufactures optical sightings for military use, on July 13, 2018, up 600.90%. It looks like July is Michael Liu’s Lucky month!

As a final reminder, an abbreviated session of our monthly forum is slated to be held June 12, 2024. If you’re not a member of GeoInvesting and want to attend, you can sign up for a premium membership here.

Please keep on reading to see more of our stats, past GeoWire issues, as well as a glimpse of emails we sent out last month.

~Maj Soueidan

200 Multibaggers And Counting

Retrospectives on TSSI and More...

Premium Emails You May Have Missed in May 2024

GeoWire Weekly Recaps, May 2024

April 2024 Review, In Case You Missed It

GeoInvesting Progress and Stat Summarizations

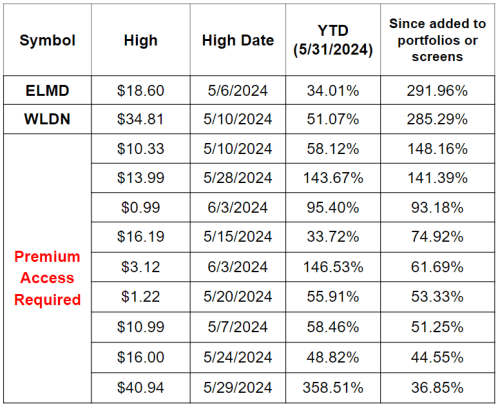

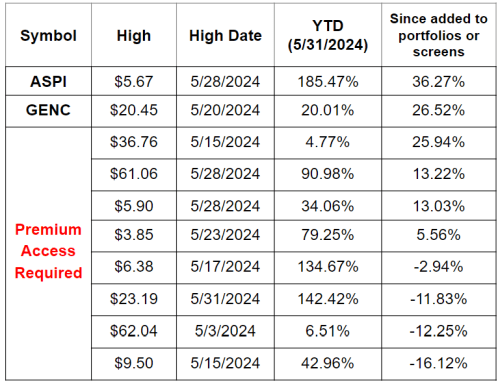

New 52-Week Highs Across All GeoInvesting Model Portfolios and Screens (In May 2024)

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

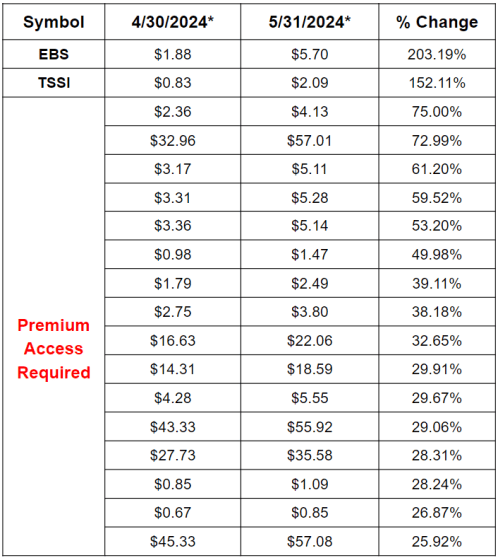

Stocks Rising >25% Across All GeoInvesting Model Portfolios/Screens

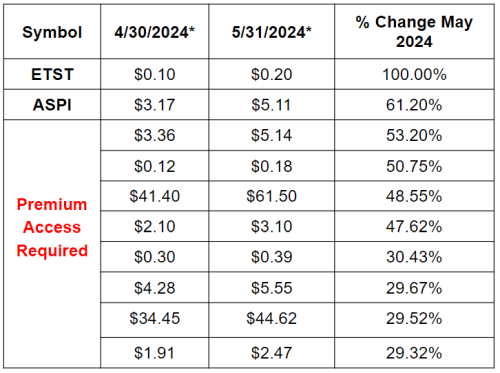

Top 10 Best Performers for GeoInvesting Contributor Picks

New 52-wk Highs From GeoInvesting Contributor Stock Picks

Research Progress, May 2023

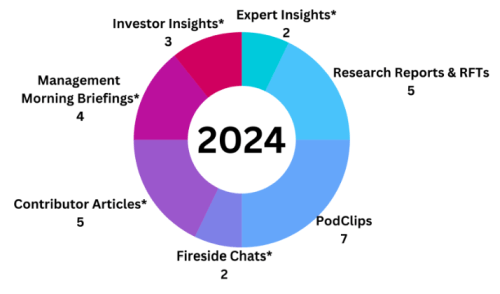

*Please also note that year to date, we’ve published 125 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2024,apart from daily emails and weekly GeoWire Content, we have published a combined 159 pieces of Premium content (including video clips) across the segments detailed in the appendix.

As a reminder, in 2023 we published a combined 329 pieces of Premium content across GeoInvesting’s platform.

See Appendix For Content Descriptions And YTD Totals

Earnings Processed, May 2023

Q1 earnings reports were in full swing last month. We processed 64 reports in May 2024, bringing our full year total to 137.

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- Stock picks from our analyst team, backed by in-depth research

- Model portfolios curated by the GeoInvesting that include timely microcap stocks in “Buy on Pullback” and other themed portfolios and screened lists.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails.

- 16 Years of archived research on over 1500 microcap stocks and counting.

- Stock pitches from our Premium subscriber investor network.

- Live and Archived Video Events:

– CEO Fireside Chats and Briefings.

– Microcap Expert Interviews.

– Monthly Coverage Universe Review. - Week In Review Newsletter, just in case you missed our updates and alerts.

- Multibagger case studies and Investment Process Education.

Complimentary: Ryan Telford on the Mindset of GUTS Methodology for Microcaps

Ryan Telford and Maj Soueidan discuss the GUTS Method, which uses a quantitative strategy and requires a strong investing mindset. Telford emphasizes that success in investing requires a balance of intelligence (IQ), emotional intelligence (EQ), and the “guts” mindset (GQ). GQ represents the courage to take action, deal with volatility, manage emotions, and navigate uncertainty. The conversation touches on the challenges of investing, including the need for confidence, the dynamic nature of markets, the importance of timing and humility, and the significance of trusting one’s strategy. They also discuss the influence of social media and distractions on investor behavior, highlighting the importance of staying the course and building stamina to endure market fluctuations, particularly in the context of nano cap stocks.

Appendix

Content Distribution Key

Written

5 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

5 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

7 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

2 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

2 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

4 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

3 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

159 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.