GeoWire Monthly, Vol. 4, Issue No. 3, March 2024

- Home

- GeoWire Monthly

- GeoWire Monthly, Vol. 4, Issue No. 3, March 2024

Latest Pitch You May Have Missed

Premium Emails You May Have Missed in March 2024

Most Qualified to Generate Real AI Stock Ideas

During GeoInvesting’s April 3, 2024 live Open Forum, Maj delved into an artificial intelligence (AI) stock screen to spotlight companies that are engaging with or are significantly impacted by advancements in AI. This screening process is part of GeoInvesting’s attempt to uncover firms positioned to benefit from the “AI revolution”, either through direct application or as beneficiaries of the broader AI trend.

Our Past Helps Us Vett These Companies Out

Due diligence has been our specialty for over 15 years, and it certainly has helped us get through the China fraud and U.S. pump and dump era that pervaded the U.S. markets for several years. Our deep dive research into this subset of companies ultimately made us better investors, helping us to hone our skills when it came to any type of bullish idea generation in the microcap universe. You can read more about how we took a bite out of crime here, which highlights how we were highlighted in a Netflix documentary as protagonists in the success we had in exposing companies with bad intentions. Our take on the entire evolution of this China company fraud can he read about here.

On the AI Screen

Here, Maj provides a glimpse into the diverse applications of AI across different sectors. Each company discussed represents a unique angle on how AI is being harnessed to drive innovation, improve efficiencies, or create new market opportunities, which parlays into an approach to identifying AI-influenced investment prospects.

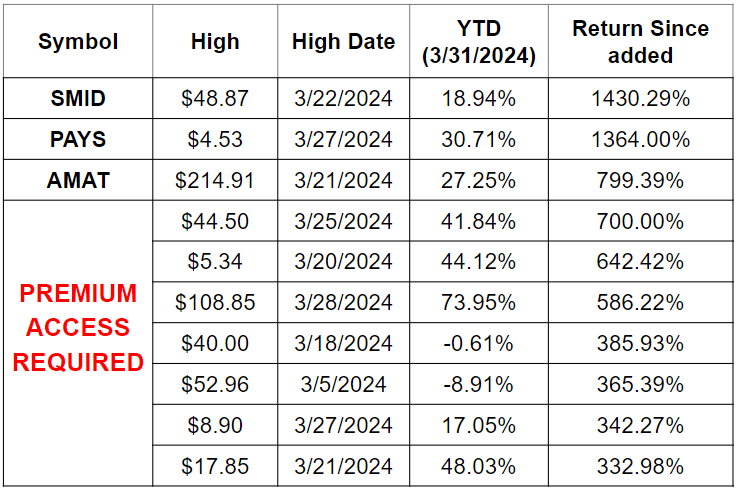

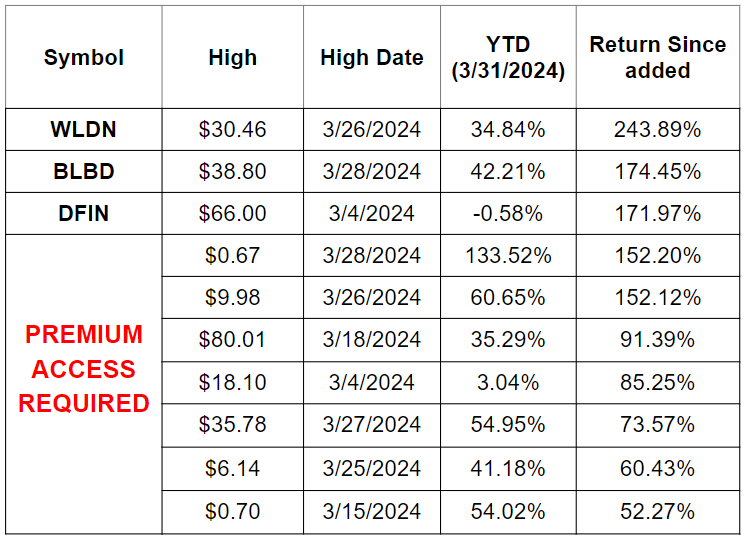

200 Multibaggers And Counting

GeoWire Weekly Recaps, March 2024

February 2024 Newsletter, In Case You Missed It

GeoInvesting Progress and Stat Summarizations, March 2024

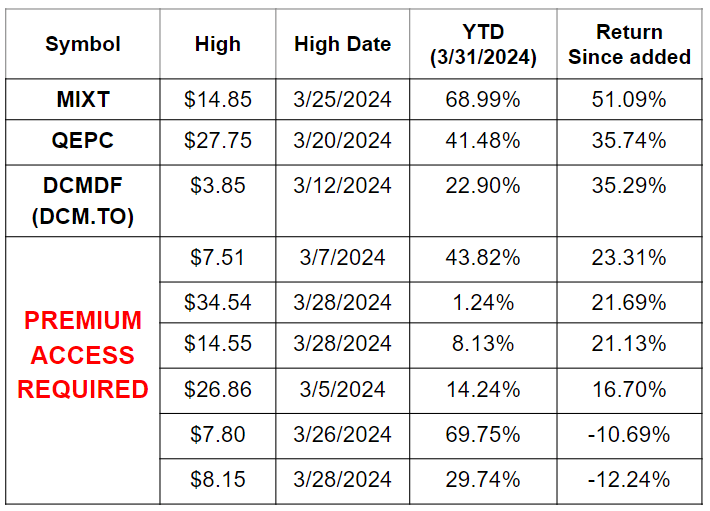

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

GeoInvesting Model Portfolio/Screens* New 52 Week Highs

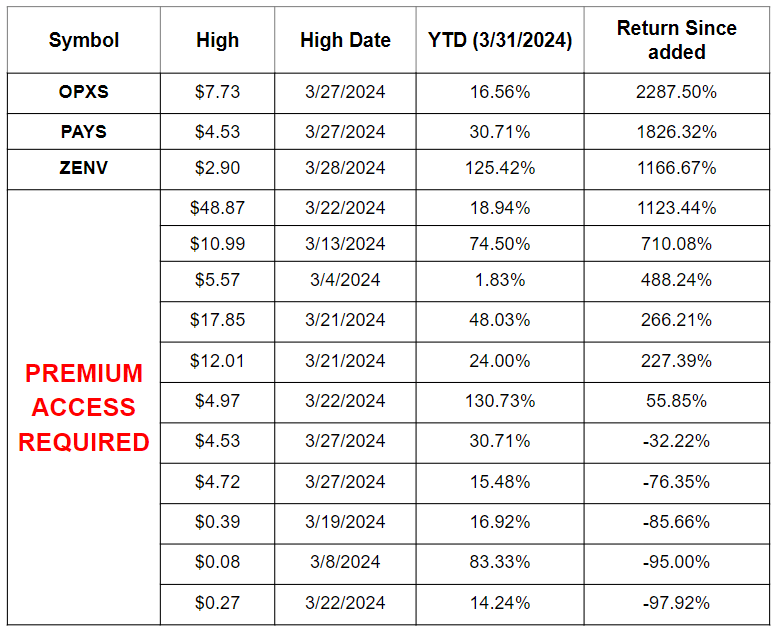

Stocks Rising >25% Across All GeoInvesting Model Portfolios/Screens

Top 10 Best Performers for the Month of Jan 2024 From GeoInvesting Contributor Picks

New 52-wk Highs From GeoInvesting Contributor Stock Picks

Research Progress, March 2023

*Please also note that year to date, we’ve published 48 video clips parsed from Investor Insights, Fireside Chats, Management Morning Briefings and Expert Insights.

So far in 2024,apart from daily emails and weekly GeoWire Content, we have published a combined 59 pieces of Premium content (including video clips) across the segments detailed in the appendix.

As a reminder, in 2023 we published a combined 329 pieces of Premium content across GeoInvesting’s platform.

Earnings Processed, March 2023

During January 2023, we processing 22 Quarterly Earnings Reports, bringing our full year total to 22 so far.

Gain access to all of GeoInvesting’s wide array of services, content and tools that will help you make informed investing decisions.

- Stock picks from our analyst team, backed by in-depth research

- Model portfolios curated by the GeoInvesting that include timely microcap stocks in “Buy on Pullback” and other themed portfolios and screened lists.

- Market moving information that we find well ahead of other investors, giving you a competitive advantage.

- Morning “get your day started” emails.

- 16 Years of archived research on over 1500 microcap stocks and counting.

- Stock pitches from our Premium subscriber investor network.

- Live and Archived Video Events:

– CEO Fireside Chats and Briefings.

– Microcap Expert Interviews.

– Monthly Coverage Universe Review. - Week In Review Newsletter, just in case you missed our updates and alerts.

- Multibagger case studies and Investment Process Education.

Complimentary: Sebastian Krog, Part Time Investor, on How He Decides On The Sizes of His Positions

In this clip from our Skull Session with Sebastian Krog on March 18, 2024, Sebastian talks about bad decisions he took and how he learned from them. Sebastian Krog (@SebKrog) is a microcap investing-focused investor and Substack author of the column Treasure Hunting

He acknowledges past mistakes with averaging down but doesn’t shy away from starting with a large position if the opportunity seems compelling. He stresses the importance of recognizing personal biases, particularly the sunk cost fallacy, which influences his decision-making process. Krog believes it’s crucial to be aware of biases to avoid holding onto stocks for the wrong reasons and emphasizes the need for disciplined selling when necessary, even if it goes against the natural inclination to hold onto investments.

Appendix

Content Distribution Key

Written

3 Research Report & “Reasons For Tracking” (RFT) pieces: Articles are in-depth stock analysis columns focusing on qualitative and quantitative aspects of stocks, while RFTs are shorter, concise research on stock ideas. Learn more about our services.

4 Contributor Articles – Investors we invite to publish their analyses on microcap stocks as well as market forces and industry trends that impact the world of microcap investing.

Audio

5 PodClips – Audio clips consisting of quick “hot take” follow-ups to management interviews, brainstorms on a new stock idea and updates on current ideas.

0 Skull Session Expert Insights (via Twitter Spaces) (NEW) – Recorded and live podcasts that feature conversations with industry experts.

Video

2 Skull Session Fireside Chats – Live/archived video events with management to discuss a company’s entire business plan, growth initiatives and risk factors.

2 Skull Session Management Morning Briefings (MMBs) – Live/archived update video events with management to discuss key developments.

3 Skull Session Investor Insights (picking up the pace here) – Recorded and live podcasts that feature conversations with Investors we invite to provide a look at their stock picking research process, market commentary and their favorite stock pitches.

2 Skull Session Expert Insights (via Video) – Recorded and live podcasts that feature conversations with industry experts.

75 Video Clips across all Live Events (Not represented in Chart) – Catch a quick glimpse of some of the more notable clips/key takeaways that are extracted from our Skull Sessions (Fireside Chats, Management Briefings, Twitter Spaces, Expert & Investor Insights, & Forums), then highlighted on our Weekly/Monthly GeoWire Newsletters. We archive all of this material on the video menu section of our Pro Portal.