GeoInvesting Presents Additional Evidence to Support Assertions

In this report we will present new evidence to support our belief that AFSI’s reported financial statements are unreliable. AFSI appears to have understated gross adverse development by over $100 million, and therefore gross adverse development appears to be 300% larger than reported in the company’s 10-K. We believe that this is yet another telltale sign that the losses ceded to the company’s Luxembourg captives are not reflected in the 10-K, as covered exhaustively in our first report. Additionally, the 10-K appears to be missing $276.9 million of gross loss reserves confirming our initial report.

Often times, when a company has reported incorrect financial statements, multiple accounts are misstated. For example, in many China fraud cases that we have covered, overstated revenues resulted in false cash balances and uncollectible receivables. In the case of AFSI, we believe that the underreported losses have resulted in understated gross loss reserves in financials reported to the SEC.

Additionally, AFSI conducted a conference call to address some of the issues we raised, and our conviction has not wavered. In this report, we present additional analysis using the information provided in the conference call which we believe bolsters our claim.

We are still short shares of AFSI, and based on the additional evidence and information provided by the company in their conference call, we have revised our fair value estimate to $2.17 – $6.51 per share. Investors who view our target as extreme and rely on continued support by sell side analysts should keep in mind that just prior to TWGP’s 87% collapse, many of the analysts urging investors to buy AFSI today recommended TWGP. In our view, that supports our view that many sector analysts are simply unaware of these issues or are willing to accept simple anecdotal answers from AFSI management as they did with TWGP. Remember, analysts get paid for helping the AFSIs and TWGPs of the world, not investors.

A prime example is Guggenheim, who deemed our report “not worthy of comment” without actually providing an argument to support its view. Just three weeks after issuing this dismissive commentary, AFSI disclosed that Guggenheim advised the company on the acquisition of TWGP.

In this report, we will discuss:

- How AFSI’s 2012 Gross Adverse Development in US statutory filings is over $100 million more than the amount reported in its 2012 10-K. We believe that this is further evidence of the company underreporting losses and violating US GAAP. We note that PricewaterhouseCoopers (PwC) cited Maiden Holdings (MHLD) for deficiencies that included the “failure to give appropriate consideration to US GAAP” while Pipoly (AFSI CFO) was the acting CFO of MHLD.

- AFSI’s “response” regarding Luxembourg’s contribution to profits and why it appears to support our thesis and contradict company disclosures.

- The company’s latest disclosures regarding Phoenix policies now gives investors the ability to separate Phoenix contracts from the rest and facilitates further analysis, which we believe further supports our conclusion that the values are overstated. AFSI appears to value non-Phoenix policies at double the value used by competitors.

Section 1: New Evidence Shows Severe Discrepancies and Supports our Original Thesis

In the section below, we compare gross adverse development and gross loss reserves from AFSI’s statutory filings to the same information in its 10-K and explain why the data further increases our suspicion that AFSI is not properly accounting for the losses ceded to their wholly-owned Luxembourg captives.

A) Gross Adverse Development Discrepancies Between 10-K & Statutory Filings

In the insurance industry, “development” refers to the change in the estimate of claim payments that will ultimately be paid on policies for which the premiums were earned in prior years. Positive development results in reserve releases and adverse development results in reserve charges. Reserve releases (charges) go through the income statement as an offset to (increase in) loss and loss adjustment expenses.

As discussed in our initial report, AFSI’s reported results appeared “too good to be true” as the company grew rapidly without a misstep along the way. We found this hard to believe in the context of a long soft market and noticed other fast-growing peers were struggling with severe adverse development. For example, TWGP announced they would take an additional $75-105 million charge to increase reserves for workers’ compensation and other lines of business in which AFSI is active — just two months after announcing it would take a $365 million charge!

AFSI’s statutory filings make it clear that AFSI is not immune to adverse development. In fact, AFSI’s statutory filings show the company is experiencing substantial gross adverse loss development. This is hardly surprising given the regulated, price-taking nature of commercial insurance. However, the resulting liability present in the statutory filings does not appear to show up in the financials filed with the SEC. We would expect such an anomaly to be very concerning for investors and regulators.

In the next subsection of this report, we show how gross loss and loss adjustment reserves or “loss reserves” (balance sheet liability) in statutory filings exceed those of the 10-K by the amount of cumulative losses ceded to Luxembourg captives. As such, we suspect inter-company reinsurance agreements with Luxembourg captives and the failure to eliminate all inter-company transactions and “give appropriate consideration to US GAAP” (as Pipoly did at MHLD, see Section 1).

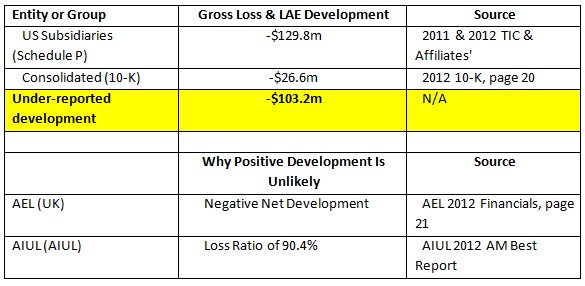

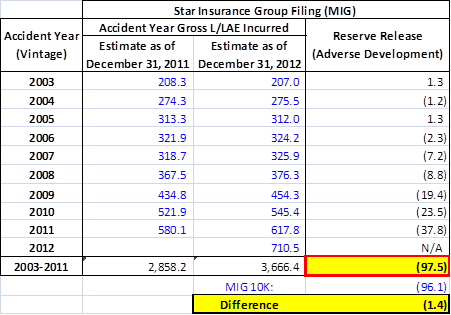

The table below summarizes AFSI’s gross adverse development for 2012 by underwriting group:

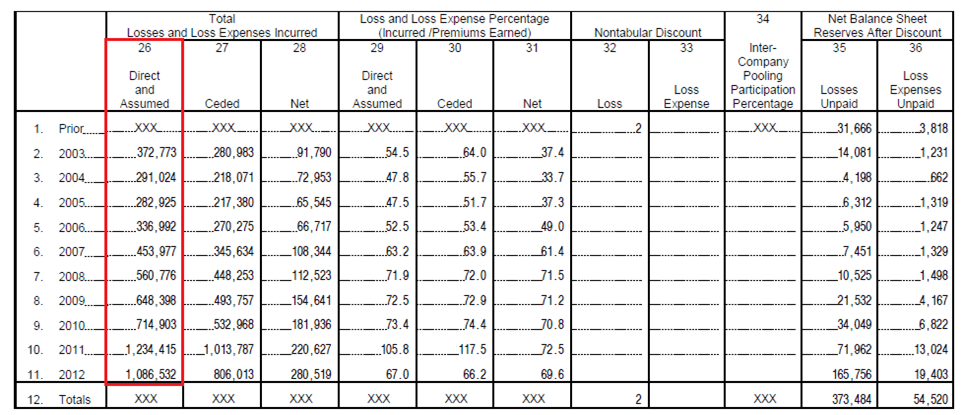

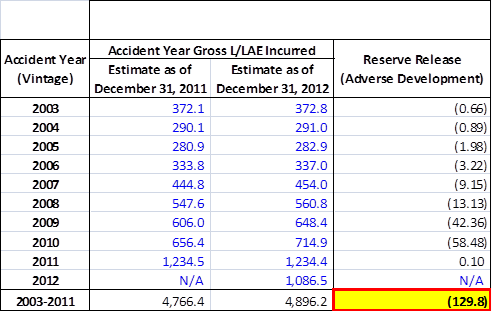

Ultimate Claim Payment Estimates by Accident Year as of December 31, 2011 and December 31, 2012, respectively.

The tables below are from Technology Insurance Company & Affiliates’ (AFSI’s consolidated US statutory subsidiaries) 2011 and 2012 Schedule P, Part 1. The first column shows the estimated “ultimate loss pick” by “accident year”. The “ultimate loss pick” is the company’s estimate of cumulative payments they will make over time for claims on policies that it covered in a given “accident year”. The “accident year” can be thought of as a vintage. It refers to the year in which the premium was earned and an event that resulted in a claim occurred, regardless of when the claim was filed:

Below we compare the change in ultimate loss picks for the two years which shows AFSI’s US subsidiaries had gross adverse development of $129.8 million in 2012.

In addition to the total gross adverse development being substantial, it pervaded almost all accident years (with 2011 still being relatively unseasoned) which indicates systemic under-reserving. This degree of gross adverse development is consistent with the results of other aggressive peers like QBE and MIG, but the uniformly negative development indicates AFSI could have TWGP-like reserve deficiencies.

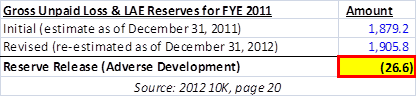

AFSI’s 10-K Shows Meaningfully Less Gross Adverse Development

Despite the $129.8 million of gross adverse development disclosed in statutory filings, AFSI’s 10-K shows only $26.645 million of gross adverse development:

We would have expected to see approximately $130 million of gross adverse development in the 10-K, subject to the development reported by AFSI’s other underwriting subsidiaries because there are only very minor differences between GAAP and SAP when it comes to accounting for loss and loss adjustment expense reserves.

To demonstrate, we also checked Meadowbrook’s (NYSE:MIG) statutory filings, which showed gross adverse development of $97.5 million – only $1.4 million larger than disclosed in its 10-K ($96.1 million).

B) Comparison of 10-K & Statutory Filing Gross Loss & LAE Reserves Corroborates Our View

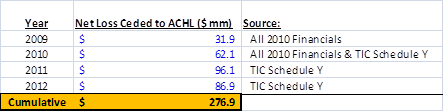

Our original report identified what we believe to be the under-recognition of $276.9 million in net loss & loss adjustment expenses. Now we turn our attention to gross loss and loss adjustment expense (LAE) reserves (balance sheet items).

If AFSI is correctly accounting for its Luxembourg captives by applying US GAAP, then one would expect the gross loss & LAE reserves of AFSI’s direct underwriting subsidiaries (US Subs, AEL, and AIUL) to very closely approximate the gross loss & LAE reserves shown in the 10-K. This is not the case. Instead, we see a discrepancy of $276.7 million — which was our estimated ceded losses to Luxembourg captives.

https://geoinvesting.com/wp-content/uploads/2014/01/07_losses-ceded-to-lux-2012.png

*AII assumes losses from the US Subs, AEL, and AIUL, so including these reserves would be double-counting.

**ACHL assumes losses from AII, so including its gross reserves would be double-counting. If AII and/or ACHL assumed losses from any third parties, the difference would only make the problem worse.

For readers who may not have read our original report, we have reproduced the table where we summed the net losses ceded to Luxembourg seemingly not reflected in the 10-K:

The discrepancy between statutory and GAAP loss reserves strongly suggests AFSI is not appropriately recognizing the gross loss expense incurred (the provision which goes to build the reserve) by Luxembourg captives under US GAAP. We suspect that AFSI is offsetting this expense in Luxembourg by reversing equalization reserve liabilities to smooth losses in Luxembourg captives which, while acceptable under Luxembourg GAAP, is not compliant with US GAAP.

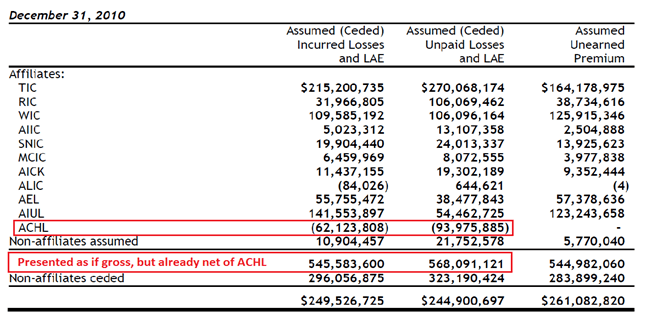

Interestingly, this appears to be how AFSI presented the “gross” loss expense and “gross” unpaid loss and loss adjustment expenses (aka: loss reserves) when preparing its AII-Bermuda financial statements in 2010, as we explain below.

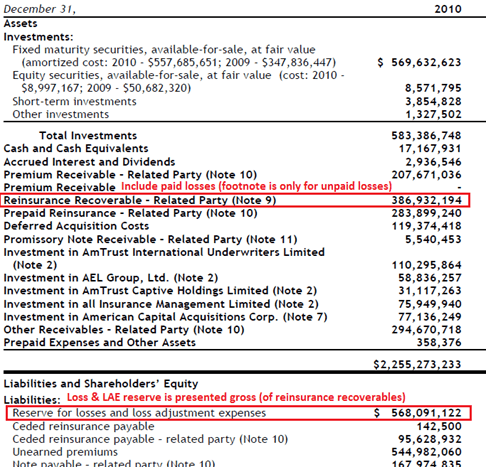

First, note that unpaid losses ceded (a balance sheet liability) to ACHL-Lux are netted out BEFORE arriving at the $568.091 million gross loss & loss adjustment reserve number:

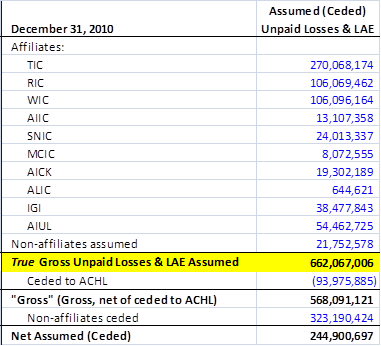

Gross Losses and LAE are comprised of direct (issued to ultimate policyholder) and assumed (acting as a reinsurer) losses and LAE. Net Losses and LAE subtract out the ceded (reinsured) portion. Notice that the sum of assumed (before netting for any ceded) unpaid losses and LAE (the second column above) is $662.067 million, not $568.091 million. We believe $662.067 million is the true gross unpaid losses and LAE. However, AII-Bermuda incorporates the benefit of $93.975 million of reinsurance from ACHL (Luxembourg) before presenting the “gross” reserve. Below we reconfigure the table above to show the true gross loss reserves:

However, we note that $568.1 million (instead of $662.067 million) is presented on the balance sheet as the gross loss and loss adjustment expense reserve:

As discussed in our original report, only after excluding the losses ceded to Luxembourg can we tie out the net loss and loss adjustment expense (income statement expense) between AFSI’s subsidiaries’ AM Best reports and 10-K.

The analysis presented above demonstrates two critical points. First, just like other insurance companies that grew rapidly in the soft market and reported hard-to-believe loss ratios, statutory filings show AFSI is experiencing severe gross adverse development meaning the business is less profitable than the company originally projected. Second, the full extent of AFSI’s gross adverse development does not appear to be reported in AFSI’s SEC filings.

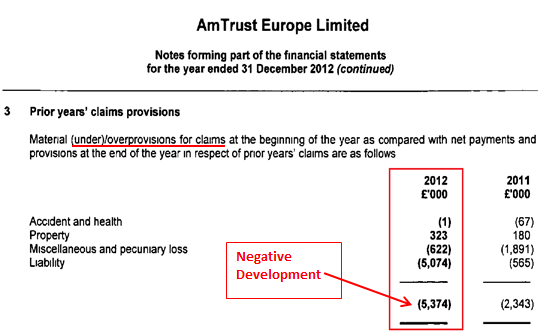

Unfortunately, AFSI’s other entities do not provide the same level of detail as US statutory filings. However, we believe there is sufficient data to rule out the possibility of offsetting positive development. For Amtrust Europe Limited (“AEL”), AFSI’s UK insurance subsidiary, we know net development was negative based on the AEL annual report filed with the registrar Companies House.

Insurance companies that experience negative net development almost always have negative gross development as well. Under proportionate reinsurance, net and gross development is inextricably linked. Under excess of loss reinsurance, the reinsurer does not step in unless losses exceed a certain level. Negative net development indicates that more claims are approaching and/or breaching the level where reinsurers start bearing the risk.

For Amtrust International Underwriters Limited (“AIUL”) we can also rule out the possibility of sufficient positive development to offset the US statutory subsidiaries because AIUL only had $97.4 million of gross loss and loss adjustment expense reserves as of the end of 2011. In other words, the maximum positive gross development AIUL could have had was $97.4 million which still would not be enough to offset the discrepancies. It would require all previously estimated claims to have been zero (and that still wouldn’t be enough!) Further, AIUL’s net loss ratio is 90.4% after benefitting from inter-company reinsurance agreements. Therefore, it’s unlikely that AIUL had anything but meaningfully adverse gross development.

https://geoinvesting.com/wp-content/uploads/2014/01/13_liabilities.png

Source: AIUL’s 2011 AM Best Report

We continue to suspect the difference between loss and loss adjustment expenses and reserves is the result of AFSI’s Luxembourg captives “utilizing” equalization reserves to the tune of $276.9 million. The additional data from primary sources presented above serves to further increase our confidence that the company is sending losses to Luxembourg captives and failing to correctly consolidate the losses when reporting results to investors.

Section 2: Why AFSI’s Conference Call Enhances Our Confidence Regarding Luxembourg

In our view, the press release announcing the call and the call itself were completely devoid of facts to support the “positive outlook” headline of the company-issued press release. In addition, management failed to provide any details to answer the questions we raised about Luxembourg captives, equalization reserves, and AFSI’s apparent failure to consolidate losses ceded to Luxembourg captives. This is in stark contrast to our report which relied on public documents, showed specific data from primary sources, and detailed the methodology so others could verify the approach.

We believe we presented compelling evidence using reports and filings prepared by the company to raise serious questions about AFSI’s accounting for intra-company reinsurance transactions. In our opinion, AFSI is not offering serious answers. We also find it notable that management did not take questions on the call. Further, despite arranging the call specifically to respond, management did not criticize our approach other than by making general statements about unspecified “inaccuracies”.

If our analysis was flawed, why didn’t management take that opportunity to correct the record with specifics? Perhaps it was not as easy to do as they would like to suggest…

We believe AFSI should present actual data from public sources to explain how it accounts for these entities, as we did. The fact that we arrive at such alarming conclusions without having heard a plausible explanation from management is highly disconcerting. After all, the purpose of the company’s financial statements is to present a fair picture of the operations.

AFSI’s disclosure that Luxembourg generated “less than $25 million” of profits actually supports our view

Turning to the conference call, management was adamant that there were no accounting problems related to their Luxembourg reinsurance captives, but chose not to provide any specific details other than saying (emphasis added):

“From January 1, 2009 through the first nine months of 2013, the Company has earned pre-tax profits of approximately $1.1 billion. Less than $25 million of that pre-tax profit, or just under 2.5%, resulted from the Company’s direct operations in Luxembourg.”

Despite AFSI disclosing very little, this meager data point supports our view in light of other AFSI disclosures and management comments.

Consider the only reference we could find in AFSI’s SEC filings regarding the Luxembourg reinsurance captives’ impact on operations, which was in its 2011 10-K (page F-27):

“As a result of these acquisitions (ACHL purchase of reinsurance captives in Luxembourg) in 2011 and 2010, the Company reduced its acquisition costs and other underwriting expenses by approximately $23 million in 2011.”

AFSI’s 2012 10-K (page 68) provides us with an answer which relates to how the company accounts for deferred tax liabilities. AFSI appears to treat the reversal of accrued deferred tax liabilities associated with equalization reserves as a negative operating expense even though it relates to a tax liability!

“Additionally, the use of deferred tax liabilities related to equalization reserves are netted against related amortization expense and recorded as a decrease to other underwriting expense. Otherwise, we include changes in deferred income tax assets and liabilities as a component of income tax expense.”

We were told by readers that SunTrust made comments in a December 18 note defending the company (“Reiterate Buy Rating Following Travel with Management”) that confirm (1) AFSI is ceding more losses (expenses) than premiums to Luxembourg captives “by design” and (2) AFSI records a decline in the DTL as a reduction in operating expenses:

“It is important to know that, by design, the Luxembourg captives should be ceded more losses than premiums in any given period…

AmTrust does benefit from the drop in its deferred tax liability — established as part of the original Luxembourg captive acquisition — that flows through the company’s P&L in the form of an offset to operating expenses (emphasis added)…”

In order for a company’s deferred tax liability to “drop” (ie: reverse the accrued liability), the company has to incur a net loss (incur expenses in excess of revenues). Consider the owner of a stock with unrealized gains. He has a DTL because if he sells the stock, he will have to pay taxes. If he continues to hold it, he is deferring the tax liability. However, if the stock declines, his DTL declines (or goes away) because the taxes he would owe upon selling the stock declined. In other words, for his accrued DTL to reverse without paying taxes, he had to incur a loss.

As noted in prior reports, AFSI subsidiaries’ Schedule Y indicated AFSI’s Luxembourg operations were incurring net losses as a result of inter-company transactions, which is corroborated by AFSI’s disclosed DTL reversals. However, basic accounting tells us that DTL reversals are the result of pre-tax losses, so how does management reconcile DTL reversals and profitable Luxembourg operations?

The combination of disclosures above is, in our view, damning evidence of improper accounting at AFSI.

In summary, management claimed to have reported profits of “less than $25 million” in Luxembourg. Then management seems to have told SunTrust analysts that they intentionally lose money in its wholly-owned Luxembourg captives. So which is it AFSI?

Given the problems AFSI appears to have applying US GAAP, perhaps it shouldn’t be surprising that PricewaterhouseCoopers (subsequently replaced by BDO) noted deficiencies in MHLD’s internal controls for the period that Ron Pipoly (AFSI’s CFO) acted as CFO (MHLD 424B3 filed May 2008, page 10, emphasis added):

“…

In particular, these deficiencies include:

- failure to give appropriate consideration to U.S. GAAP accounting rules or to have documentation of the basis for our opinion and conclusion regarding the application of U.S. GAAP;

- lack of an independent preparer and reviewer for various accounting tasks, including the preparation of the financial statements and disclosures; and

- lack of formality regarding certain controls surrounding the control environment.

…”

Section 3: New Disclosure Supports our View that LSCs are mis-marked

We believe the information management provided on the conference call confirms our view that life settlement contracts (LSCs) are mismarked. In an apparent attempt to discredit our analysis and allay concerns over exposure to Phoenix, management disclosed a new data point on LSCs on the conference call. However, the data actually strengthens our conviction regarding the mismarking of LSCs.

In our first report, we discussed how we believed AFSI was using “egregiously aggressive assumptions relative to peers” despite significant exposure to Phoenix, an issuer shunned by most LSC investors. In other words, we believed AFSI was either (a) not reflecting the severe discount that Phoenix policies receive in the LSC market and/or (b) carrying the non-Phoenix policies at unjustifiable premiums relative to publicly-listed IFT, whose LSCs have similar LEs to AFSI.

During the call, CFO Ron Pipoly said:

“Additionally, there have been comments made regarding the portion of our policies in our life settlement portfolio where Phoenix is the carrier. To be clear, Phoenix policies represent only 15% of the fair value of our portfolio at September 30, 2013. Therefore, our net carrying value exposure to Phoenix policy is approximately $20 million. Thank you.”

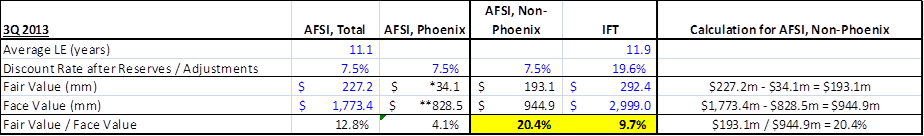

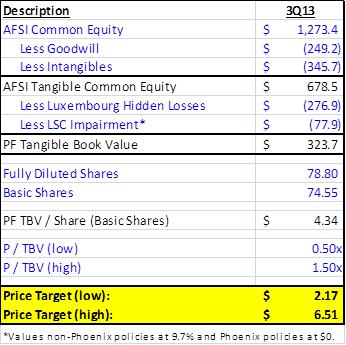

The table below shows that AFSI carries the non-Phoenix policies at approximately 2x the carrying value IFT applies which has similar LEs and does not own any Phoenix policies. Until now, it was not possible to provide a true apples-to-apples comparison with other companies because it was unclear how much value AFSI attributed to the Phoenix policies. Let’s take a look at the implications of this comment:

*Fair Value of $34.1m for Phoenix policies derived from AFSI CFO’s comments (15% of fair value); Net of NCI, AFSI’s Phoenix exposure is approximately $19.7 million

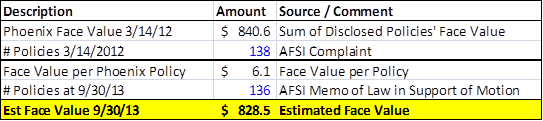

**Face Value of $828.5m for Phoenix policies derived from court documents (see next table)

AFSI LE, Discount rate, Face Value of consolidated LSCs figures from September 30, 2013 10Q

IFT LE, Discount Rate, Fair value, Face value from September 30, 2013 10Q

For the table above, we use the complaint filed by AFSI’s subsidiary in the PHL case, its recent memorandum of law in support of motion for summary judgment (See footnote 1), and assume the face value per Phoenix policy is the same to estimate that the current face value of AFSI’s Phoenix-issued policies is $828.5 million:

Since ALL companies that invest in LSCs make various adjustments (which are essentially in-house estimates) prior to discounting, the simplest way to compare them to each other is by looking at the carrying value versus face value of contracts with similar life expectancy.

As you can see from the table above, AFSI has a carrying value of 20.4% of face value. In comparison, Imperial Holdings (IFT) has a carrying value of 9.7% of face value despite the two companies having similar life expectancies (LEs). In our view, this makes it abundantly clear to us that AFSI uses an inappropriate methodology.

We also question the 4.1% fair value / face value estimate for Phoenix-issued policies. Based on conversations with market participants, long-duration Phoenix policies like the ones AFSI owns are likely worthless. The quote below, from the March 5, 2013 issue of “The Life Settlements Report” demonstrates this well:

“Scott Rose, principal of Tarrytown, N.Y.-based advisory firm Barrett Advisors, urged legislators to expand the bill to include the disclosures required in last year’s bill. The proposal then would have forced carriers to explain why they planned to make the increase, but it was watered down and then died on the Senate floor.

He testified that there is no meaningful market for Phoenix policies currently.”

Debunking the LSC “Reserve” Myth:

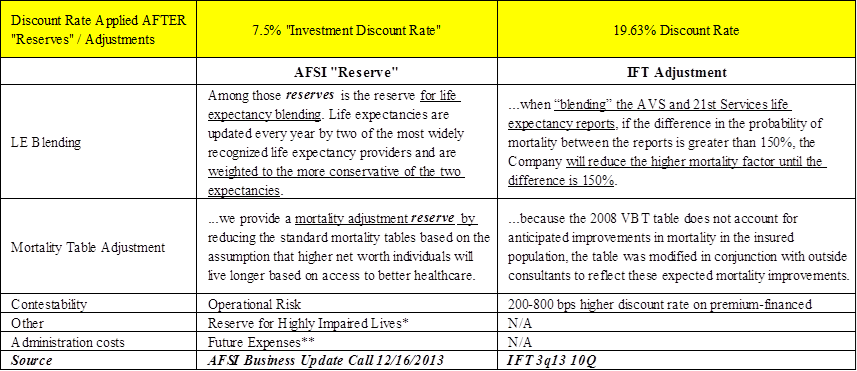

AFSI has put forward an explanation (excerpt below) which we would paraphrase as adding “reserves” to the company’s expected cash flows to adjust for various risks and then using a lower discount rate than others because the riskiness of the investment is already reflected in AFSI’s “reserves”.

Separating the “reserves” from the time value of money would be a reasonable approach, but that does not appear to be what AFSI is doing. Instead, AFSI appears to be calling industry-standard adjustments “reserves”. Below is CFO Ron Pipoly’s comment on the December 16, 2013 conference call (emphasis added):

“Now turning to life settlements. Our effective discount rate of our life settlement portfolio for the third quarter 2013 was 14.2%. The future positive cash flows of our life settlement portfolio are expected to be $779 million. Those cash flows are reduced by additional reserves that we apply.

Among those reserves is the reserve for life expectancy blending. Life expectancies are updated every year by two of the most widely recognized life expectancy providers and are weighted to the more conservative of the two expectancies.

Additionally, we provide a mortality adjustment reserve by reducing the standard mortality tables based on the assumption that higher net worth individuals will live longer based on access to better healthcare. We also provide additional reserves for future expenses, operational risk in reserve for highly impaired lives. We believe that establishing specific reserves and then applying an overall discount rate provides the most accurate valuation for our

portfolio.”

The factors for which AFSI creates so-called “reserves” appear to be adjustments that IFT merely deems prudent and reflect industry standards. Only AFTER these adjustments does IFT apply a 19.63% discount rate.

*AFSI’s reserve for highly impaired lives would seem to be immaterial since only 15 / 272 policies are expected to mature within five years.

**AFSI’s reserve for future expenses is likely quite small because their primary administrator has a profit share tied to the performance of the investments.

Another qualitative hint that AFSI’s explanation is implausible is the lack of detail related to these “reserves”. One would expect a footnote or comment on this $281 million item in AFSI’s SEC filings if it truly was a reserve.

Fair value estimate revised lower: $2.17 – $6.51 per share

Our initial report valued AFSI at $3.87 to $13.00 per share. Given further evidence of over-marked LSC and hidden losses that do not appear to be reflected in SEC filings, we have revised our estimate of fair value to $2.17 – $6.51 per share.

Footnotes:

- Available on www.pacer.gov/findcase.html; Case 1:2012-cv-02939

Disclosure: Short AFSI