About Fullshare Holdings Ltd (607:Hong Kong)

Contributed by FG Alpha Management

Summary

- Newly acquired British Virgin Island (“BVI”) regulatory documents contradict statements made in Fullshare Holdings Ltd (607:Hong Kong) 2016 annual report

- In light of this new evidence, we question whether Fullshare received any cash consideration from the sale of assets to a BVI entity called “Sun Field Holdings, Ltd.”

Introduction

Today we will further our research into a transaction that we first called into question in our initial report on Fullshare, published May 4, 2017.

In our original report, we detailed a transaction between Zall Group, a mysterious BVI company named Sun Field Holdings Ltd. (“Sun Field”) and Fullshare. Sun Field reportedly purchased two companies (Zall Xiongan and Zall Shenyang) from Fullshare in late 2015 and, at the time, pledged these assets back to Fullshare as collateral until it could make the corresponding payments. Fullshare claimed in its 2016 annual report that all payments related to this transaction had been paid in full.

Despite Fullshare claiming that it has received payment for this sale, the share pledge made as collateral has not, as of May 2017, been released according to newly discovered BVI documentation. The non-released pledge leaves us no choice but to doubt that payment for this already questionable transaction was ever made.

In 2015, Fullshare had already issued the shares necessary to Zall Group in order to consummate the purchase of Zall Xiaongan and Zall Shenyang. As of today, however, the answer to the question of whether or not Fullshare received the corresponding cash consideration from Sun Field, as claimed by Fullshare, is now in dispute.

Sun Field: Further Down the Rabbit Hole

In our original report, we raised questions about a purported transaction involving Zall Group, a mysterious BVI company and Fullshare:

“We believe transactions involving Zall Group, Fullshare and a mysterious BVI company may have been a front for the purpose of Fullshare issuing shares to Zall Group via an arm’s length transaction between Zall Group and Fullshare.”

In June of 2015, Fullshare bought a 90% equity interest in Zall Xiaogan and Zall Shenyang for a total consideration of RMB 736M by way of issuing 681,480,000 shares. Five months later, Fullshare turned around and entered into two agreements to sell Zall Shenyang (“Active Mind Group”) and Zall Xiaogan (“Advance Goal Group”) to Sun Field Property Holdings Limited, a BVI company that lacks a disclosed beneficial owner. We visited both Zall Xiaogan and Zall Shenyang. It was reported to us by employees of Zall that both Zall Xiaogan and Zall Shenyang are still managed and controlled by Zall Group, rather than by Fullshare or any other third party, such as Sun Field.

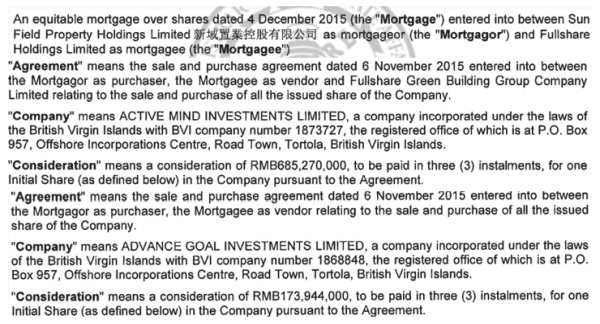

On November 6, 2015, Fullshare entered into two sales and purchase agreements with Sun Field Property Holdings Ltd., an alleged “independent” third party, for the disposal of its entire equity interests in Active Mind Group (“Zall Shenyang”) and Advance Goal Group (“Zall Xiaogan”) for a cash consideration of RMB 685,270,000 and RMB 173,944,000, respectively. This deal closed on December 4, 2015, according to Fullshare’s disclosure.

We noticed in the SAIC database that Active Mind and Advance Goal only became shareholders of Zall Shenyang and Zall Xiaogan on Nov. 3 2015 and Nov. 5 2015 — between 1 and 3 days before Fullshare sold them to Sun Field, the mystery BVI company.

This is the SAIC data showing the origination of Active Mind and Advance Goal as shareholders of Zall Shenyang and Zall Xiogan that we included in our first report:

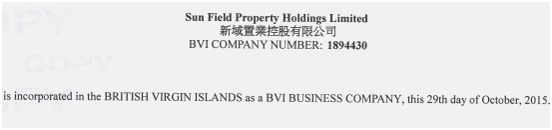

Suspecting that Sun Field may also wind up being a related party of Zall Group or Fullshare, we wanted to take a deeper dive into the company’s history. We combed through the BVI corporate registry and found out that Sun Field was established less than two years ago, on October 29, 2015.

This establishment date was only a week before the announced acquisition of Zall Shenyang and Zall Xiaogan by Sun Field, from Fullshare.

Because the date Sun Field was established was literally just days prior to the acquisition of Zall Shenyang and Zall Xiaogan, we’re left with little choice but to conclude that Sun Field is an entity that was set up by related parties, solely for the purpose of this transaction.

When the sale to Sun Field closed on December 4, 2015, Sun Field didn’t pay Fullshare up front, but rather pledged the Zall Xiaogan and Zall Shenyang projects back to Fullshare as collateral for its future payment.

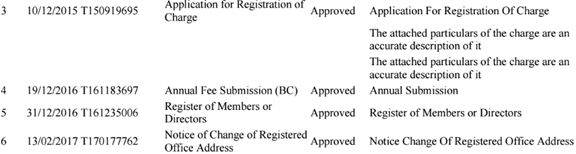

In its 2015 financial report, Fullshare disclosed Sun Field’s share pledge, alongside of accounts receivable from Sun Field. We searched Sun Field’s BVI corporate registry and found the disclosure and terms of the share pledge:

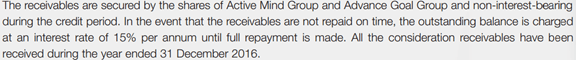

In its 2016 annual report, Fullshare disclosed that Sun Field had paid for the transaction in full.

The next logical step after receiving payment would be for Fullshare to release its collateral (the share pledge). However, when we searched Sun Field’s BVI registry, there’s no evidence that the corresponding share pledge had been released as of December 2016.

Since Sun Field’s share pledge has not been released, we question whether Sun Field ever actually paid Fullshare. If Sun Field did not pay Fullshare, it theoretically means that Fullshare issued shares to Zall Group for free.

As we stated in our first report we visited Zall Xiaogan to try and understand its business. We found out that the entire real estate construction project had been idled. Local employees told us that Zall Xiaogan is owned and operated by Zall Group, which would indicate that the transaction may have never actually taken place. Here are some pictures of Zall Xiaogan:

On April 5, 2016, a half year after Fullshare’s alleged sale of these assets to Sun Field, the local government issued an online response regarding the lack of progress at the project. The local government stated that Zall Group was still the owner and operator of the project rather than Sun Field or Fullshare. We find it even more suspicious that Fullshare, based on SAIC records, acquired this project one to three days prior to selling it to Sun Field.

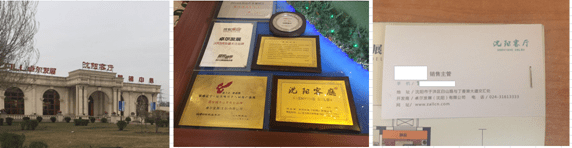

We also visited the Zall Shenyang project which, based on our on the ground research, is still wholly managed by Zall Group. We were unable to find any signs that Fullshare and/or any third party was/is the owner of Zall Shenyang. Here are our pictures of Zall Shenyang:

We think this entire group of transactions is a sham simply for the purpose of Fullshare issuing more shares to Zall Group via an arm’s length transaction between the two. We still suspect that the final beneficial owner of Sun Field, the unknown BVI company, is a person or persons close to Zall Group or Fullshare.

The most important revelation is that without the pledge release, Sun Field appears to have not paid Fullshare as of the date of May 2017, despite the claim in Fullshare’s 2016 financial statements that they were, in fact, paid as of December 31, 2016.

A Second Transaction for Fullshare to Acquire Zall Group’s Shares?

On October 13 2015, Fullshare entered into an agreement with its Chairman, Mr. Ji Changqun, to acquire the entire equity interest of a company called “Rich Unicorn” by issuing 937.91 million shares. Fullshare’s Chairman, Mr. Ji Changqun, is the sole shareholder and Director of Rich Unicorn. At that time the transaction was completed, the primary asset base of Rich Unicorn consisted only of 289.71 million shares of Zall Group.

Zall Group did not put out any press releases regarding Rich Unicorn, but according to a disclosure made through the Hong Kong exchange, Rich Unicorn became a shareholder of Zall Group, with 288.9 million shares at an average price of HK $2.70 (equivalent to HK $0.9 after 3:1 post-split in October 2015. Currently, the stock trades at 4.28) on April 20, 2015.

Rich Unicorn acquired its Zall Group shares from Zall Development Investment Company Limited (“ZDI”). ZDI is a company 100% owned by Mr. Yan Zhi, the chairman of Zall Group. This simply appears to be a transaction between the two chairmen. We do not know whether there was any additional “backdoor” component to this deal involving the share transfer.

Rich Unicorn also pledged its assets, essentially all of its holding in Zall Group, to UBS AG and CCB International Securities Limited on June 17, 2016 and August 30, 2016. As of May 5, 2017, Rich Unicorn has been released from the CCB International Securities Limited pledge and we were unable to find a release on the UBS AG pledge.

We believe that this transaction could have also simply been a sham in order for Fullshare to gain control of Zall Group shares, using Rich Unicorn as a vehicle to do so.

Conclusion

We believe that Zall Group and Fullshare exchanged shares using two transactions: the Zall Xiaogan and Zall Shenyang (Sun Field) transaction and the Rich Unicorn transaction. As we have stated before, we strongly suggest auditors and regulators review these two transactions.

After the critical reports detailing Fullshare’s transactions, we believe Zall Group had little choice but to continue to support Fullshare. Now we understand better why Zall continues to defend Fullshare.

一è£ä¿±è£ï¼Œä¸€æŸä¿±æŸ.

Disclosure: Short 607.HK

Disclaimer

You agree that you shall not republish or redistribute in any medium any information contained in this report without our express written authorization. You acknowledge that GeoInvesting nor FG Alpha are registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting nor FG Alpha have provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, FG Alpha, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, FG Alpha, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, FG Alpha, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, FG Alpha, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting nor FG Alpha shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

The research contained herein expresses opinions which have been based upon generally available information, field research, inferences and deductions through due diligence and our analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here –https://geoinvesting.com/terms-conditions-privacy-policy/