We all like to think big — big investment ideas and big returns but you don’t have to invest in big companies to achieve those goals. Big returns can be found in high growth micro-cap ($50 to $300 million market cap) value stocks that most investors overlook.

Focus on Micro-cap Growth Opportunities

Our primary investment strategy is to focus on growth opportunities in the micro-cap space but those opportunities come in different forms. We find attractive opportunities in value companies that offer steady but historically uninspiring growth and some that even pay dividends but there is little, at least on the surface, to excite investors. The key is to identify the catalysts that will take some of these value plays to the next level with accelerated growth.

There are benefits to investing in value plays that are about to enter a new growth phase that other investments do not offer. Value stocks tend to have a built in safety net as the shares offer a price cushion supported by incremental revenue and earnings growth, a sustainable dividend, and eventual capital gains as the market periodically adjusts to the company’s underlying value. The alpha comes into play when the catalysts that will spur accelerated growth kick into gear. If you are early to the party, you will be benefit from a stable share price, dividend and modest price appreciation while you wait.

Investors considering growth and value stocks in the micro-cap space should be aware that patience will likely be required. The reason many of these stocks are undervalued is that they fly under the radar with little or no analyst coverage and, typically, very low trading volume. The lack of liquidity is a risk if you prematurely liquidate your position. For that reason, such stocks are probably not good trading vehicles but are best suited to a buy and hold strategy at least for the intermediate term.

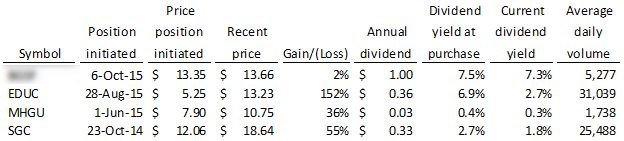

Following are four value and growth plays the GeoTeam has identified in the past year, three of which that have played out well for our Premium members, and one yet to catalyze.

Catalysts for accelerated growth

- The first stock that has yet to perform is an IT staffing company that pays a generous dividend of around 7% and is in the midst of a strong growth phase. The company is growing revenues both organically and through acquisitions. The recent acquisition of technology services company is expected to add $30 million annual revenue and $3.9 million EBITDA.

Our premium members have access to the above stock on our exclusive portal.

- EDUC is a trade publisher of educational children’s book in the U.S. An aggressive expansion of the company’s multi-level marketing operations is driving rapid sales growth and margin expansion. EDUC is benefiting from the rapidly growing number and new generation of sales reps in the multi-level channel that are adept at the use of social media as a means of driving sales. We first published our reasons for optimism on 8/26/15 when the stock was trading at $4.94. We alerted premium members that we had established a long position at $5.25 and published a call to action on 8/28/15. We followed up with our research report on 9/8/15.

- MHGU operates 162 Wendy’s quick-service restaurants under franchise agreements with The Wendy’s Company and five casual dining restaurants. The net addition of 23 Wendy’s restaurants in 2014 and 25 in 2015 is driving revenue growth. Year over year same store sales are also growing at a solid 3.5%. Finally, the new Wendy’s standard design termed “image activation” is producing record restaurant-level sales increases in both new and renovated restaurants. We initiated a long position 6/1/15 when the MHGU was trading at $7.90. We published our research report on 7/15/15. The company has since reported strong Q3 2015 operating results and increased its special dividend.

- SGC is a leading provider of uniforms and image apparel established in 1920. SGC has embarked on a period of accelerated growth and profitability. Management is growing the business organically and through carefully targeted acquisitions. Operations have been organized as two diverse businesses, uniform and related products and remote staffing solutions that leverage the company’s efficient cost structure and healthy margins. Also, the company no longer sells into unprofitable markets and exited operations that did not meet management’s performance criteria. We established our long position 10/30/14 when the shares were trading at a split adjusted $12.06 and published a research report on 1/22/15.