This article presents a case study on Evan & Sutherland (OOTC:ESCC), a micro-cap in which information arbitrage has been a recurring theme.

- Information arbitrage (“InfoArb”) is one of the biggest opportunities in the microcap investing space.

- It exists when information that is public is not picked up on by the financial media, analysts, or investors of a specific company.

- ESCC recently landed in our lap and we have many more on tap.

In the microcap investing space, a type of InfoArb exists when public information is not picked up on by the financial media, analysts, or investors of a specific company. InfoArb also occurs when investors misinterpret press release content. We spend most of our time at GeoInvesting looking for and researching these information arbitrage opportunities and delivering them to our premium members. Luckily, another one landed in our lap and we have many more on tap.

You can join GeoInvesting’s premium services here.

Classic Microcap Information Arbitrage Opportunity in ESCC

Evans & Sutherland is a company that we have been long and following since 2014. Technically, ESCC is too small to be considered a microcap. With a market-cap of only $7 million, ESCC is technically a nano-cap,

Evans & Sutherland Computer Corporation (E&S) focuses on the production of visual display systems used primarily in full-dome video projection applications, dome projection screens, dome architectural treatments, and content for planetariums, schools, science centers, other educational institutions and entertainment venues. It operates in the visual simulation market segment. The Company through its subsidiary, Spitz, Inc. (Spitz), is a supplier of planetarium systems, dome projection screens and other dome displays.

We initially targeted a range of $0.40 to $0.80 level for the company if the pension issue became resolved, which it eventually was in April 2016. The stock went on to reach a high of $1.21 before pulling back to the mid $0.70 range on the heels of unexciting Q1 2016 results in May. You can read all of our past ESCC coverage here.

Double Dipping Isn’t Always a Bad Thing

The company released its second quarter 10-Q report on the afternoon of August 4th, 2014 and the stock immediately sold off 30% hitting a low of $0.51. On a precursory glance, the quarterly performance was dismal. Revenues came in at $5.0 million, down almost 50% from the same quarter last year. The company posted a GAAP loss of $0.09, although narrower from the loss of $0.24 they posted in the year prior.

The information arbitrage opportunity is in the management discussion and analysis in the 10-Q, where management made the following comments:

The second quarter of 2016 produced only $5,268,000 of sales. This unusually low sales volume was attributable to the timing of customer deliveries of planetarium systems and a temporary drop in backlog from low sales orders in the first quarter of 2016. The low sales volume resulted in under-absorption of fixed overhead which negatively affected gross profit. Also considerable resources were expended on product demonstrations at a major bi-annual planetarium conference resulting in higher than normal selling expenses. As a result, we reported a net loss of $969,000 in the second quarter of 2016 which offset first quarter net income to produce a net loss of $733,000 for the first half of 2016. This variability in the timing of sales orders and customer deliveries are an element of our business that occasionally affect results in this way.

While the results of operations are disappointing, a healthy volume of new sales orders in the second quarter of 2016 helped the sales backlog rebound almost to the level at the beginning of the year. In addition, significant new orders already booked early in the third quarter of 2016 and several promising prospects attributable to positive reactions to recent product demonstrations are expected to sustain a healthy sales backlog for the remainder of 2016. The sales backlog and customer delivery schedules support our positive outlook for higher sales levels and profitable results for the second half of 2016.

As you can see, despite the terrible-looking revenue numbers, there seems to be a reasonable explanation. Management’s optimism for the future led us to nibble at shares at these depressed prices. It seems that the market has begun to digest this commentary as the stock closed at $0.75 yesterday. We still think ESCC will return to or surpass prior levels. These are chances you normally only get with microcap stocks.

When the company eventually issued a press release, we noticed subtle differences between it and the related 10-Q. Pay particular attention to the bold.

This unusually low sales volume was attributable to the timing of customer deliveries of planetarium systems and a temporary drop in backlog from low sales orders in the first quarter of 2016. The low sales volume resulted in under-absorption of fixed overhead, which negatively affected gross profit. Also, considerable resources were expended on product demonstrations at a major bi-annual planetarium conference, resulting in higher than normal selling expenses. As a result, we reported a net loss of $1.0 million in the second quarter of 2016, which offset first quarter net income to produce a net loss of $0.7 million for the first half of 2016. This variability in the timing of sales orders and customer deliveries are an element of our business that occasionally affect results in this way.

While the results of operations are disappointing, a healthy volume of new sales orders in the second quarter of 2016 helped the sales backlog to rebound almost to the level at the beginning of the year. In addition, significant new sales orders already booked early in the third quarter of 2016 and several promising prospects, attributable to positive reactions of recent product demonstrations, are expected to sustain a healthy sales backlog for the remainder of 2016.

The statement in the 10-Q about getting back to profitability and increased revenue expectations for the remainder of 2016 is not in the press release.

ESCC Valuation

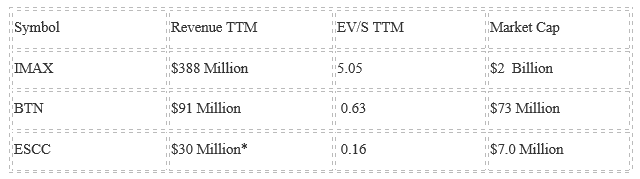

We estimate that ESCC’s baseline annual revenue and EPS can hold around 30 million and $0.10, respectively. In the meantime, as it explores growth opportunities now that the pension issue is behind it, we do not think it’s unreasonable that shares should eventually trade at an EV/S closer to 1.0 or $2.86. Looking at two of the closest publicly traded comps, Ballantyne Strong Inc. Common (AMEX:BTN) and Imax Corporation Common Stock (NYSE:IMAX), supports this opinion.

BTN designs, integrates, and installs technology solutions for the retail, financial, government, and cinema markets worldwide. The company operates in two segments, Cinema and Digital Media.

IMAX operates as an entertainment technology company specializing in motion picture technologies and presentations worldwide.

BTN is the better comparable for ESCC because of its size and the challenges it has faced to profitably grow its business.

* our estimated normalized baseline assumption

As we continue to review ESCC’s results and provide updates in a timely fashion, we’ll also remain committed to be on the lookout for more information arbitrage opportunities in the microcap universe that we can all benefit from. An interview with ESCC management is on our to-do list.