GeoInvesting Weekly Premium Email and Call To Action Updates (June 1 – June 5)

If you haven’t heard, I was asked to give an investor pitch at the 2020 Virtual Summer Summit that will take place this week, between June 9 and June 12. If you are interested in learning more about the event please go here. I still have not decided which stock idea I will be pitching.

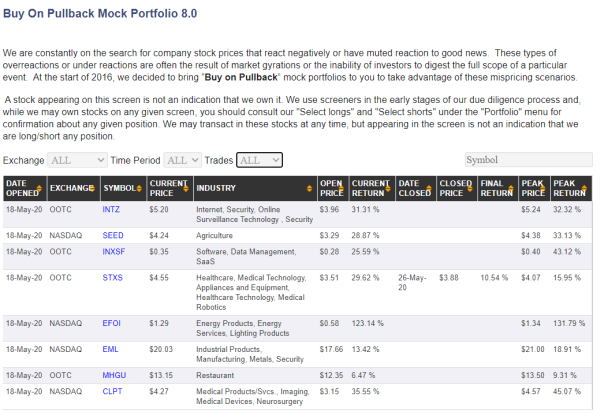

Also…a quick comment on the performance of our latest Buy on Pullback Model Portfolio, launched on May 18, 2020. The portfolio has performed exceptionally and well ahead of the time frame we originally anticipated.

Log in below with your Premium Account or join GeoInvesting and please become an Premium Member to continue.

I am already regretting closing out STXS, just within three weeks of the launch of the portfolio, prompted by the company conducting a small offering after clearly stating that they had no reason to raise capital during the Q1 earnings conference call.. But, that’s life. I need to follow my investing rules. Have a great week! Tier one quality microcaps are heating up again.

Sincerely

Maj Soueidan

Co-founder, GeoInvesting

—

Weekly Wrap Up Summary:

Call To Action Updates

- Intouch Insight Ltd (OOTC:INXSF) – Added to our long position as we feel impact from Covid will be shorter lived than we anticipated. In fact, the company may actually meaningfully benefit from the crisis.

- Eastern Company (the) (NASDAQ:EML) & Meritage Hospitality Group Inc (OOTC:MHGU) – We issued a premium Tweet stating that we added to our long positions, as stocks have barely rebounded from Covid lows.

Notable Email Highlights

- Origin Agritech Limited (NASDAQ:SEED) – Signs continue to point that GMO commercialization is inevitable

- Sonic Foundry Inc (OOTC:SOFO) – published a brief Industry and competitive analysis

Notable Updates

- Biomerica, Inc. (NASDAQ:BMRA) – Mayo Clinic joined BMRA’s InFoods IBS clinical trial.

- Agent Information Software Inc (OOTC:AIFS) – Announced cash dividend of $0.03 and new contract with New Mexico state library.

- Retractable Technologies, Inc. (NYSE:RVP) – Another investor’s bullish take on RVP; see Seeking Alpha article.

- Energy Focus, Inc. (NASDAQ:EFOI) – Published a new article on EFOI to help tie together the research we have issued over the last several months.

- Origin Agritech Limited (NASDAQ:SEED) – Additional materials from Ministry of Agriculture

What To Expect Next

- Look for a talk with a UCaaS industry expert. Bringing it to you this week, and very relevant to ATGN and CXDO.

SanaCurrents – Premium third party biotech analysis (Ask about one month trial for $7.99)

- Coronavirus sparks new direction at Biosig Technologies, Inc. (NASDAQ:BSGM)

Premium Emails Sent During the Week

Premium Emails Sent During the Week

06/01/2020

GMO Commercialization In China Seems Inevitable

We took another look at the industry in which Sonic Foundry Inc (OOTC:SOFO) operates to continue to build a more comprehensive view of the company. We recently took a position in SOFO and wrote a brief RFT (Reasons for Tracking) on the company in late March 2020. This update in particular offers a glance at a few of the company’s competitors and what might give it some advantages over the others, especially given the capabilities of its one of its flagship platforms, Mediasite. An excerpt regarding a key…see more.

06/05/2020

Added To Our Long Position in INXSF; AIFS Dividend and Sees Growth Continuing – 06/05/2020

**Call To Action – Added To Our Long INXSF Position We recently added Intouch Insight Ltd (OTC:INXSF) to our 8th Buy on Pullback Model Portfolio as shares have come down due to business disruptions from Covid-19. Yesterday, we added to our long position as we feel the impact will be temporary and are very bullish on the long term prospects for the Company. We are also adding the stock to our Favorite Model Portfolio. We have been tracking and researching INXSF…see more.

More Notable Updates

More Notable Updates

Stocks Partially discussed or not highlighted during the week

New Article on EFOI

Energy Focus, Inc. (NASDAQ:EFOI) – (LED Lighting Technology Solutions) – While we will certainly remind you tomorrow morning, we just published our latest research article on EFOI. The article follows James Tu’s journey as both a former and current CEO of the company and why, given his vision and experience, his return, coupled with the large addressable market EFOI’s products serve, positions the company for growth,

Please read the article here. Thanks for your patience in receiving this!

—

Origin Agritech Limited (NASDAQ:SEED) (GMO Technology) – More materials from the Ministry of Agriculture and Rural Technology and Education show signs that China is heading towards GMO commercialization

- http://www.moa.gov.cn/ztzl/zjyqwgz/kpxc/202006/t20200603_6345827.htm

- http://www.moa.gov.cn/ztzl/zjyqwgz/kpxc/202006/t20200603_6345826.htm

- http://www.moa.gov.cn/ztzl/zjyqwgz/kpxc/202006/t20200603_6345825.htm

It seems that the gist of these articles is that the PRC government is getting extremely aggressive in promoting the benefits of GMO and that GMO products are safe. We also noticed that domestic production of GMO cotton products have been approved. We think it’s only a matter of time before the approval of GMO food products will start being approved.

What to Expect Next

What to Expect Next

A Focus on UCaaS with an Industry Expert

Because we’ve been invested in Altigen Communications Inc (OOTC:ATGN) and Crexendo Inc (OOTC:CXDO) for a while, Maj, along with Little Grapevine tracked down an expert in the Unified Communication as a Service (UCaaS) industry to pick his brain on the subject. Among other subjects, he talks about:

- How UCaaS solutions expanded to aspects outside a company’s internal needs.

- How UCaaS providers differentiate themselves.

- Consolidation in the UCaaS space and the ideal characteristics of an ideal acquisition target.

- Opportunities for smaller UCaaS firms to help fill the IT support services gaps.

- The overall shift to UCaaS solutions.

- Customer acquisition cost, especially in light of COVID-19.

- What Microsoft Corporation (NASDAQ:MSFT)’s presence in the UCaaS industry means for companies like Slack Technologies, Inc. (NYSE:WORK) and Ringcentral, Inc. (NYSE:RNG)?

- Any red flags investors should watch out for when considering an investment in a UCaaS company.

This conversation will be available shortly. Please stay tuned

In the meantime, if you haven’t already, please take a listen to Jerry Fleming’s (ATGN President and CEO) and Doug Gaylor’s (CXDO President and COO) Little Grapevine presentations to prepare yourself for Maj’s conversation with the UCaaS expert. They are great segues into the segment once we release it.

ATGN:

- Presentation – https://youtu.be/cXIAXits2G4?t=76

- Q&A – https://youtu.be/cXIAXits2G4?t=930

CXDO:

- Presentation – https://youtu.be/lPQi-9YWO04?t=76

- Q&A – https://youtu.be/lPQi-9YWO04?t=1543

![]()

Tracking Biotech Catalysts

Coronavirus sparks new direction at BioSig

Many biotech companies recently have repurposed therapies in development into treatments for Covid-19. Gilead Sciences, Inc. (NASDAQ:GILD) quickly transformed remdesivir, a drug initially designed to treat the Ebola virus, into rapid use to treat Covid-19.

On June 9 at 11 am Eastern time, $BGSM and its subsidiary, ViralClear Pharmaceuticals, will hold a call to discuss the phase II clinical trials of merimepodib, ViralClear’s broad-spectrum oral anti-viral candidate for the treatment of COVID-19 in adult patients. ViralClear said merimepodib will be combined with remdesivir in one trial to be conducted at multiple sites nationwide. Data is expected to be disclosed in the third quarter 2020.

BioSig’s shares traded at $2.56 per share on March 18 before soaring to $10.57 per share at the close on June 5. The climb, during which BioSig shares touched $12.43 per share last month, was driven by the potential success of merimepodib, especially when combined with remdesivir.

Merimepodib previously was tested as a potential hepatitis C and psoriasis treatment by $VRTX before it was transferred to a company called Vicromax. The drug did not advance past early clinical trials. BioSig, which mainly has been developing a cardiac mapping medical device system, acquired Vicromax for an undisclosed sum on March 25. It has since ramped up clinical testing for the drug and brought in a new team around ViralClear.

In spite of BioSig’s and ViralClear’s lack of drug development experience, one phase II trial of merimepodib will be led by Andrew Badley, professor and chair of the department of molecular medicine and the Enterprise Chair of the COVID-19 Task Force at Mayo Clinic. In May, the peer-reviewed journal F1000 Research published pre-clinical results which asserted, “Merimepodib provided in combination with the adenosine analogue remdesivir reduces SARS-CoV-2 replication to undetectable levels in vitro.”

How much higher can BioSig climb? The conference call should be informative.

About SanaCurrents

SanaCurrents is a premium newsletter that has been offering its Premium service to GeoInvesting Members at a special rate. SanaCurrents assigns likelihoods of favorable FDA decisions or data releases (catalysts) surrounding biotech product development initiatives. Biotech expert Bill Langbein, along with his partner Philip Greyling, apply a host of qualitative and quantitative factors to support their rankings and their purchase of shares before dates of when FDA decisions or the release of important data. To date, SanaCurrents has written 71 reports, now archived at geoinvesting.com. You can go here to learn more about Sanacurrents and get access to the service for $7.99 for the first month.