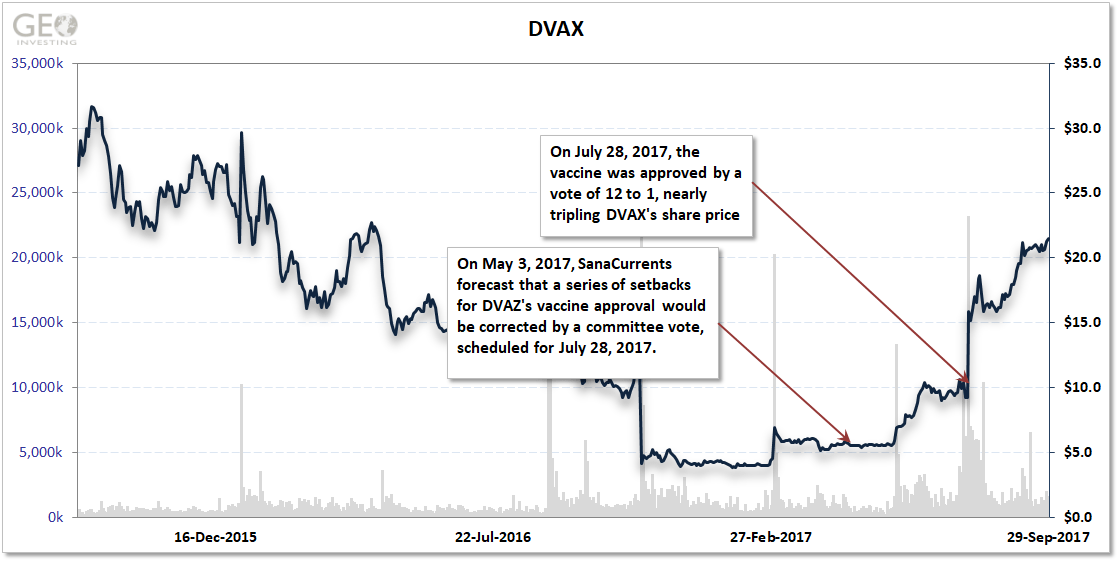

Dynavax’s (NASDAQ:DVAX) BLA application for its Hepatitis B vaccine first received a complete response letter from the FDA in 2013 and then experienced further regulatory delays between 2015-2016. Some of the FDA requests involved the vaccine’s overall immunogenicity data, while others related to how the BLA was filed, not necessarily regarding the effectiveness of the vaccine.

Dynavax’s (NASDAQ:DVAX) BLA application for its Hepatitis B vaccine first received a complete response letter from the FDA in 2013 and then experienced further regulatory delays between 2015-2016. Some of the FDA requests involved the vaccine’s overall immunogenicity data, while others related to how the BLA was filed, not necessarily regarding the effectiveness of the vaccine.

With the setbacks, the stock slid backward for several years as DVAX worked to respond.

SanaCurrents identified on May 3, 2017 that DVAX and the FDA had ironed out their differences and forecast an advisory committee would recommend approval of the vaccine when it voted at a meeting scheduled for July 28, 2017.

DVAX shares traded at $5.50 on May 3. After the 12-1 vote to approve the vaccine, shares climbed to $15.85, a 188% return.

What exactly did this mean for investors in DVAX shares? In 3 months, they netted $18,000 on a $10,000 investment after SanaCurrents’ initial forecast.